Adaptive Learning Software Market 2024–2034: personalization at scale

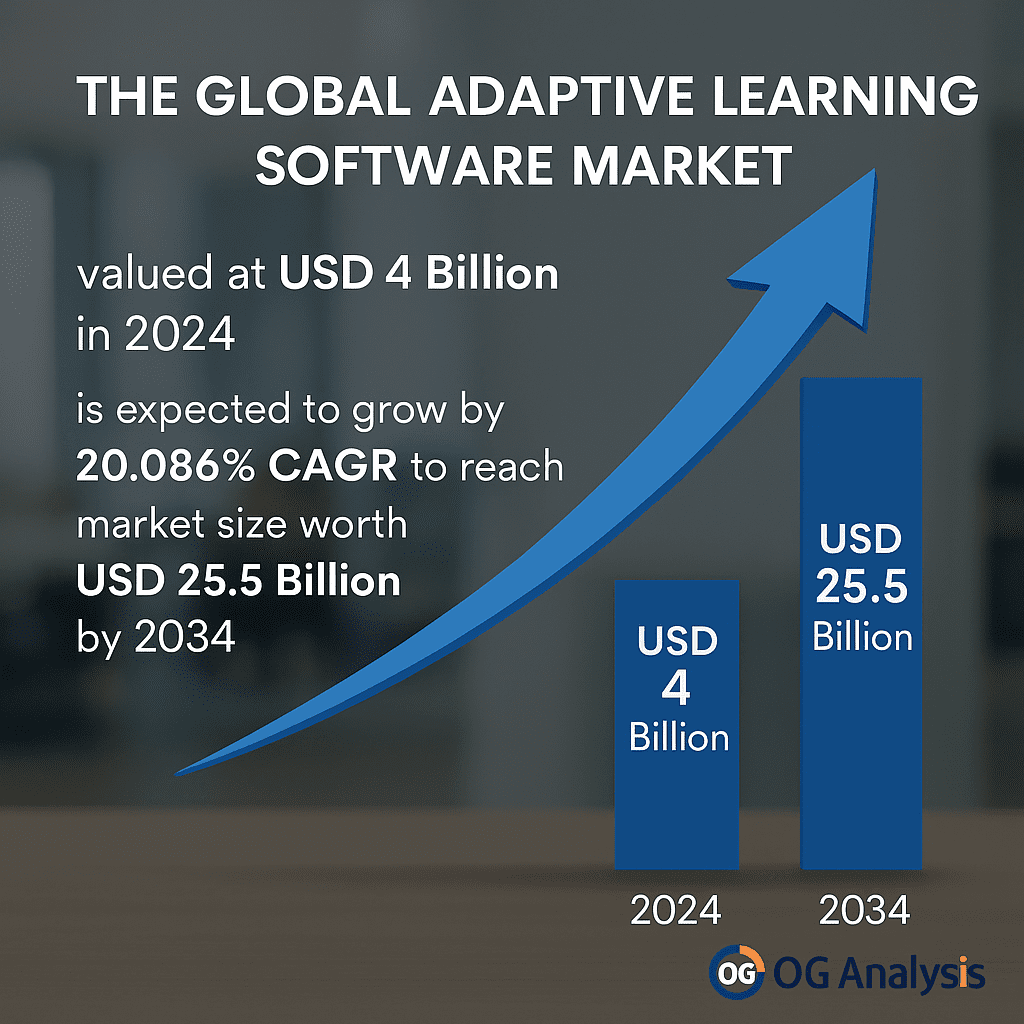

The Adaptive Learning Software Market, valued at USD 4.0 billion in 2024, is on a steep growth path to USD 25.5 billion by 2034, advancing at a 20.086% CAGR. This surge mirrors a structural shift in how schools, universities, and enterprises deliver instruction—moving from static courses to AI-guided experiences that adjust content, difficulty, pacing, and assessment to each learner.

Momentum is strongest where cloud delivery, rich analytics, and integrated LMS workflows meet high-stakes outcomes: K-12 learning recovery, university retention, and corporate reskilling. Still, buyers are scrutinizing proof of ROI, data privacy, interoperability, and content quality—pressing vendors to pair cutting-edge models with transparent pedagogy and measurable results.

1) Will AI agents become every learner’s “co-pilot,” or will human-in-the-loop remain the gold standard?

Vendors are piloting AI tutors that nudge, quiz, and remediate in real time. The core question is how far autonomy can go before efficacy, safety, and pedagogy demand explicit educator oversight and policy guardrails.

2) Cloud vs. on-premise: where will regulated institutions draw the line?

Cloud unlocks faster deployments and model updates, yet districts and universities with strict compliance regimes still favor on-prem or private cloud. Expect hybrid patterns that segment sensitive PII while keeping AI inference in elastic environments.

3) Can analytics move beyond dashboards to provable learning impact?

Leaders are tying item-level mastery to course outcomes, retention, and job readiness. The market will reward platforms that link adaptive pathways to statistically significant gains—and make those gains auditable.

Click Here for the Full Market Report

4) Micro-credentials and skills graphs: hype or the backbone of corporate reskilling?

Enterprises want adaptive paths mapped to granular skills and verifiable badges. The winners will align content to standardized competency frameworks and feed HRIS/LXP systems with trustworthy skills data.

5) How quickly will content pipelines adapt to AI-native authoring?

From item generation to distractor quality and bias checks, AI can compress course build cycles. The tension: speed vs. academic rigor, accessibility, and copyright compliance at scale.

Click Here for the Full Market Report

6) Interoperability first: will LTI/xAPI/SCORM compliance decide buying cycles?

Districts and CLOs want plug-and-play with existing LMS, proctoring, and SSO. Vendors that ship robust APIs, data export, and standards compliance will shorten pilots and reduce switching risk.

7) Who captures the adoption curve—K-12 and higher-ed incumbents or agile corporate-first platforms?

K-12/Higher-Ed players boast distribution and trust; corporate platforms iterate faster on skills, analytics, and ROI. Watch for cross-over: edu incumbents chasing workforce learning and enterprise vendors moving upstream with educator-centric features.

Segmentation at a glance

By Component: Software; Services

By Deployment Mode: On-premise; Cloud

By Application: Student Collaboration; Analytics & Insights; E-learning Authority; Integrated LMS; Others

By End User: K-12; Higher Education; Corporate

By Geography:

-

North America (USA, Canada, Mexico)

-

Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

-

Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

-

Middle East & Africa (Middle East, Africa)

-

South & Central America (Brazil, Argentina, Rest of SCA)

Representative companies

Cerego; Curriculum Associates, LLC; D2L Corporation; Docebo; DREAMBOX LEARNING; Fishtree; Houghton Mifflin Harcourt; Imagine Learning; Kidaptive; Knewton, Inc.; Macmillan; McGraw Hill; New Leaf Technologies; Paradiso; Pearson; Realizeit; SAS; Scootpad; Smart Sparrow, Pty Ltd; Fuel Education LLC; EdSurge Inc.; Wiley; aNewSpring; Intetics Inc.; HCL Technologies Limited; intellAdapt; Domoscio; GradeSlam.

Explore More Industry Insights:

Life Sciences Bpo Market Analysis and Outlook Report: Industry Size, Share, Growth Trends, and Forecast (2025-2034)

Healthcare Finance Solutions Market Analysis and Outlook Report: Industry Size, Share, Growth Trends, and Forecast (2025-2034)

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.