Racks, Regions, and Rising Demand: Inside the Global Data Center Colocation Market

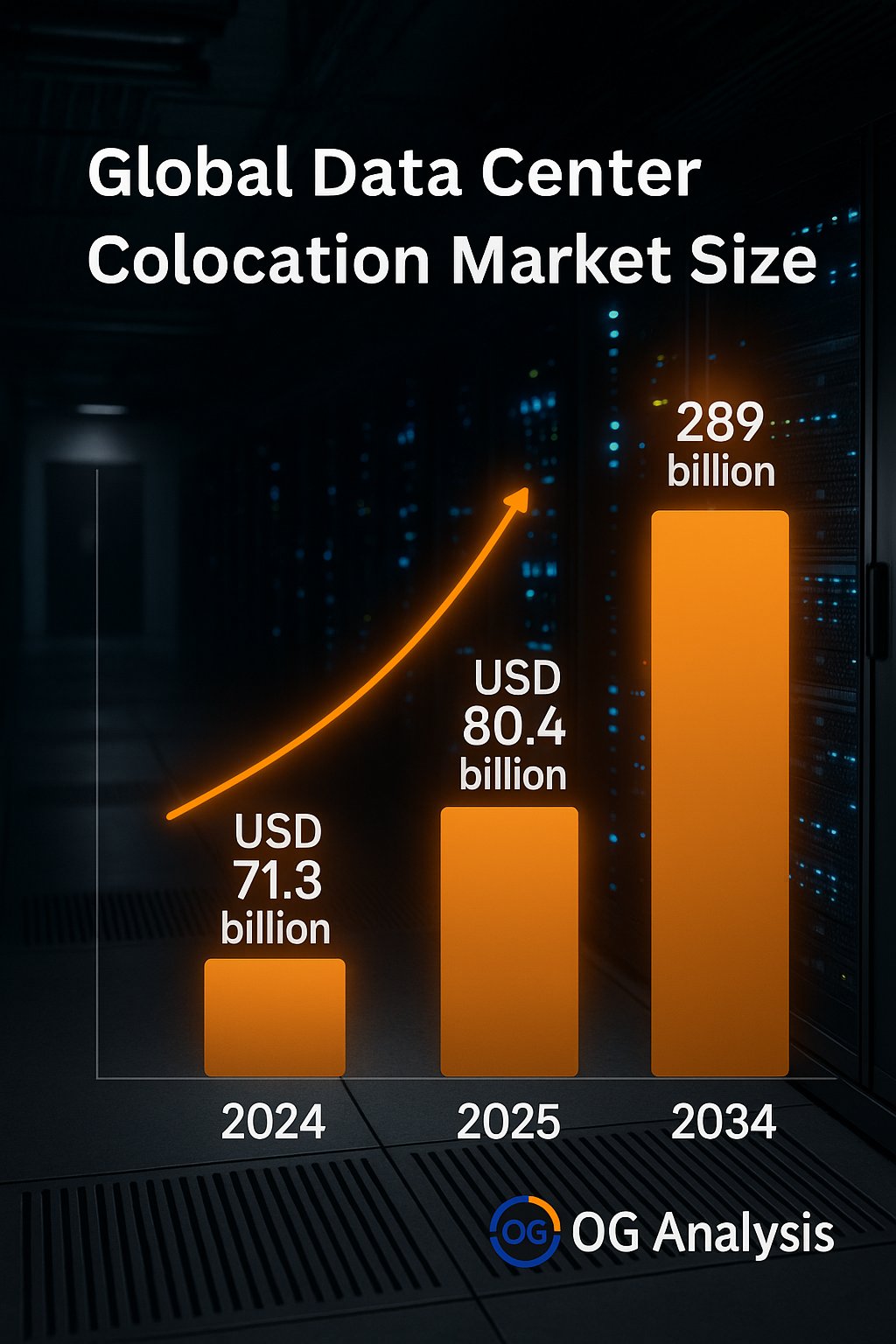

Valued at USD 71.3 billion in 2024 and forecast to hit USD 80.4 billion in 2025, the global data center colocation market is scaling at a rapid 14.9 % CAGR, on track for USD 289 billion by 2034. Surging AI workloads, edge-computing rollouts, and sustainability mandates are all propelling enterprises toward third-party facilities instead of building their own. Below are seven punchy questions—and answers—that spotlight the hottest trends, key opportunities, and regional dynamics redefining colocation today.

1. Why is colocation booming while hyperscale cloud keeps expanding?

Enterprises want cloud-like agility and hardware control. Colocation offers a “best of both worlds” model: deploy your own racks in a highly connected, carrier-dense site, then cross-connect to hyperscale clouds for burst capacity and specialized services. As hybrid- and multi-cloud strategies mature, colocation becomes the physical backbone that ties everything together.

2. How are AI and high-density computing reshaping facility design?

Generative-AI training clusters can draw 40 kW—or more—per rack. Operators are racing to retrofit with liquid-cooling loops, rear-door heat exchangers, and direct-to-chip solutions. Sites able to guarantee 300 W/ft² (or higher) while keeping power-usage effectiveness (PUE) <1.25 are commanding premium rates and long-term contracts.

3. What new revenue streams are emerging beyond basic floor space?

Think “colocation-plus.” Leading providers bundle edge nodes, managed interconnection fabrics, on-prem cloud hardware, sustainability reporting dashboards, and sovereign-cloud zones for regulated data. These add-ons can lift average revenue per cabinet by 20-30 % versus plain-vanilla space-and-power deals.

Click Here for the Full Market Report:

4. Which regions are set for the fastest expansion through 2034?

-

Asia-Pacific – Mega-metros like Tokyo, Singapore, Mumbai, and Sydney see double-digit MW pipelines, fueled by fintech and gaming demand.

-

North America – Secondary markets (Phoenix, Hillsboro, Montréal) are booming thanks to tax incentives and renewable-energy access.

-

Europe – Frankfurt, London, Amsterdam, Paris, and Dublin (FLAP-D) remain core hubs, but Madrid, Warsaw, and Milan are the new edge frontiers.

-

Latin America & MEA – Subsea-cable landings and 5G rollouts are catalyzing first-wave hyperscale and wholesale projects in Santiago, São Paulo, Johannesburg, and Riyadh.

5. How big is the sustainability “green premium” in colocation deals?

Up to 15 % higher pricing for sites guaranteed to source 100 % renewable energy, provide granular carbon-intensity dashboards, and participate in demand-response programs. ESG-driven enterprises—particularly in Europe—are willing to pay for verifiable green credentials.

6. What opportunities exist for SMEs in a market dominated by hyperscalers?

Retail colocation suites (¼-rack to 10 racks) remain the entry point for SMEs needing predictable OPEX and compliant environments. Providers now court these clients with turnkey “IT room in a box” bundles pre-cabled racks, firewalls, SD-WAN, even remote-hands vouchers—eliminating large up-front capex.

7. Will edge colocation eclipse core facilities by 2034?

Not eclipse—but complement. Edge sites (1–5 MW) near population centers will proliferate for latency-sensitive workloads (autonomous vehicles, VR streaming). Yet core campuses (50 MW+) will still house bulk storage, AI training, and hyperscale cloud zones. Expect a hub-and-spoke topology where regional mega-data centers interlink with dozens of micro-edge nodes.

Click Here for the Full Market Report:

Market Segmentation Snapshot: Key Categories and Regional Insights:

By Type

-

Retail Colocation

-

Wholesale Colocation

By Enterprise Size

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

By End User

-

BFSI

-

IT & Telecommunications

-

Healthcare

-

Government & Public Sector

-

Retail

-

Energy

-

Others

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Key Companies Shaping the Market:

-

Equinix, Inc.

-

Digital Realty Trust, Inc.

-

CyrusOne Inc.

-

Global Switch

-

China Telecom Corporation Limited

-

NTT Communications Corporation

-

KDDI Corporation

-

Interxion Holding N.V.

-

Telehouse

-

Cyxtera Technologies, Inc.

-

QTS Realty Trust, Inc.

-

CoreSite Realty Corporation

-

Iron Mountain Incorporated

-

ST Telemedia Global Data Centres (STT GDC)

-

Flexential Corp.

Click Here for the Full Market Report:

Explore More Industry Insights:

Global Data Centre Market Outlook Report

Global Data Backup and Recovery Market Outlook Report

Connect with us on:

Phone: +91 888 64 99099

Email: mailto:sales@oganalysis.com

Learn More about OG Analysis

OG Analysis, established in 2009 has 14+ years of experience and served 1800+ clients from 980+ companies operating in 54+ countries. OG Analysis is a leading provider of market research reports in Chemicals, Energy, Oil & Gas, Food & Beverage, Electronics & Semiconductors, Automotive, Telecommunication, Healthcare and Other industries.