"Global Protein Ingredients In Infant Nutrition Market is valued at USD 11.8 billion in 2025. Further, the market is expected to grow at a CAGR of 7.8% to reach USD 23.1 billion by 2034."

Protein Ingredients in Infant Nutrition Market Overview

The Protein Ingredients in Infant Nutrition Market is evolving rapidly as manufacturers seek high-quality, digestible, and allergen-friendly protein sources tailored for infant formulas and baby foods. This sector emphasizes the importance of mimicking breast milk’s nutritional profile, focusing on proteins like whey, casein, and plant-derived isolates. Advanced processing methods—such as enzymatic hydrolysis and microfiltration—are enhancing protein purity and functionality while reducing allergenic potential. This trend underscores the shift toward premium ingredients that support healthy infant development, immune function, and digestive tolerance. With growing interest in clean-label formulations, the market is also responding with non-GMO, minimally processed, and lactose-reduced protein options. Moreover, strategic collaborations between ingredient suppliers, formula producers, and research institutions are accelerating innovation and product differentiation in this competitive space.

Emerging regional preferences and regulatory frameworks are shaping demand and ingredients. While formula consumption remains high in urban and emerging markets, mature regions prioritize label transparency, clinical validation, and protein fortification. Plant-based proteins like pea, soy, and chickpea are gaining traction due to interest in sustainable, hypoallergenic alternatives. Suppliers are developing multifunctional proteins that contribute to texture, stability, and nutritional adequacy. Challenges persist, including cost optimization, clean-label certification and sourcing traceability. However, consumer awareness around infant nutrition is driving growth in premium protein inclusions, such as human milk–like peptides and bioactive fractions. In response, manufacturers are expanding product portfolios with tailored blends for age-specific needs, including early infancy, weaning, and toddler nutrition, supporting a holistic approach to child development.

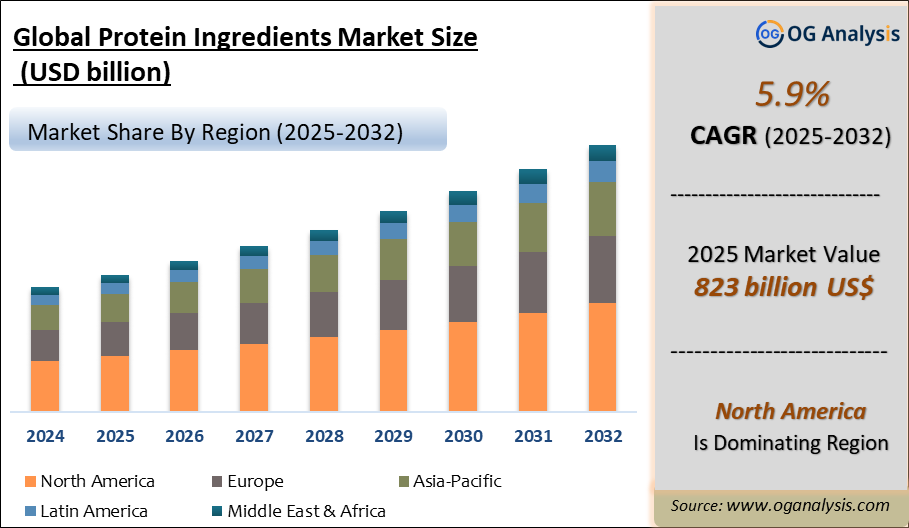

Global Protein Ingredients Market Analysis 2025-2032: Industry Size, Share, Growth Trends, Competition and Forecast Report

Key Takeaways

-

Whey protein concentrates and isolates remain foundational due to their high digestibility and amino acid profile that closely resemble breast milk, making them the preferred base in many infant formula formulations.

-

Enzymatic hydrolysates and partially hydrolyzed proteins are increasingly used to reduce allergenicity and improve tolerance, aiding infants with sensitive digestion or cow‑milk protein intolerance without compromising nutritional value.

-

Plant-based proteins like pea and soy are growing in prominence, offering sustainable, non-allergenic alternatives; their functionality is improved via processing methods, but achieving comparability to dairy remains a formulation challenge.

-

Bioactive protein fractions—such as lactoferrin, immunoglobulins, and growth factors—are being incorporated to support immune health, gut development, and microbial balance, appealing to caregivers seeking added health benefits.

-

Clean-label attributes—non‑GMO, minimal processing, verified sourcing—are becoming key differentiators as parents demand transparency, purity, and safety in infant nutrition, influencing ingredient selection and supplier practices.

-

Manufacturers are investing in tailored protein blends that address age-specific nutritional needs—for example, early infancy, weaning, and toddler stages—ensuring optimized amino acid ratios and functional benefits.

-

Collaboration between ingredient producers, formula manufacturers, and clinical researchers is enhancing validation efforts, resulting in evidence‑based formulations that build trust and market credibility.

-

Regulatory standards and label guidelines in major markets are shaping the market landscape; compliance with nutritional, safety, and allergen disclosure requirements is driving ingredient innovation and documentation practices.

-

Traceability and sustainable sourcing are gaining attention, prompting manufacturers to adopt transparent supply chains, eco‑certifications, and sustainability reporting to meet ESG expectations and consumer demands.

-

Functional improvements—such as enhancing solubility, emulsification, and stability—are enabling the inclusion of high‑protein formulations in ready‑to‑feed liquid products and nutrient-dense snacks for older infants.

Report Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product Type , By Form |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analysed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type

- Animal

- Plant

By Form

- Isolate

- Concentrate

- Other Forms

By Source

- Cow Milk

- Soy

- Protein Hydrolysates

- Other Sources

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Abbott Laboratories

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Incorporated

- Danone SA

- DuPont de Nemours Inc.

- Fonterra Cooperative Group Ltd.

- Nestle SA

- Perrigo Company plc

- Reckitt Benckiser India Ltd.

- The Kraft Heinz Company

- Inner Mongolia Yili Industrial Group Company Limited

- Royal Friesland Campina NV

- Kerry Group plc

- Omega Protein Corporation

- FrieslandCampina NV

- Mead Johnson Nutrition Company

- Kewpie Corporation

- Solae LLC

- Axiom Food Inc.

- Davisco Foods International Inc.

- ZuChem Inc.

- Beingmate Baby & Child Food Co. Ltd.

- Meiji Holdings Co. Ltd.

- Synutra International Inc.

- Ausnutria Dairy Corporation Ltd.

- China Feihe Limited

- Arla Foods Ingredients Group P/S

- Erie Foods International Inc.

- Grande Custom Ingredients Group

- Idaho Milk Products Inc.

- .

Recent Developments

-

January 2025 – Axiom Foods launched Oryzatein 2.0, a next‑generation white, grit‑free rice protein for infant formulas, uniquely engineered for ultra-low heavy metals and better texture.

-

January 2025 – FrieslandCampina Ingredients achieved U.S. GRAS status for Vivinal® Lactoferrin, enabling its use in cow’s milk‑based infant and toddler formulas to support immune and digestive health.

-

February 2025 – Axiom Foods released validated test results showing Oryzatein 2.0 has no detectable lead, reinforcing its safety credentials ahead of its market launch.

-

Early 2025 – FrieslandCampina extended its infant‑nutrition portfolio with complementary high‑purity ingredients like MFGM and GOS, reinforcing its integrated protein and prebiotic platform.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Protein Ingredients In Infant Nutrition Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Protein Ingredients In Infant Nutrition Market Overview

2.2 Protein Ingredients In Infant Nutrition Market Developments

2.2.1 Protein Ingredients In Infant Nutrition Market -Supply Chain Disruptions

2.2.2 Protein Ingredients In Infant Nutrition Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Protein Ingredients In Infant Nutrition Market -Price Development

2.2.4 Protein Ingredients In Infant Nutrition Market -Regulatory and Compliance Management

2.2.5 Protein Ingredients In Infant Nutrition Market -Consumer Expectations and Trends

2.2.6 Protein Ingredients In Infant Nutrition Market -Market Structure and Competition

2.2.7 Protein Ingredients In Infant Nutrition Market -Technological Adaptation

2.2.8 Protein Ingredients In Infant Nutrition Market -Changing Retail Dynamics

2.3 Protein Ingredients In Infant Nutrition Market Insights, 2025- 2034

2.3.1 Prominent Protein Ingredients In Infant Nutrition Market product types, 2025- 2034

2.3.2 Leading Protein Ingredients In Infant Nutrition Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Protein Ingredients In Infant Nutrition Market sales, 2025- 2034

2.4 Protein Ingredients In Infant Nutrition Market Drivers and Restraints

2.4.1 Protein Ingredients In Infant Nutrition Market Demand Drivers to 2034

2.4.2 Protein Ingredients In Infant Nutrition Market Challenges to 2034

2.5 Protein Ingredients In Infant Nutrition Market- Five Forces Analysis

2.5.1 Protein Ingredients In Infant Nutrition Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Protein Ingredients In Infant Nutrition Market Value, Market Share, and outlook to 2034

3.1 Global Protein Ingredients In Infant Nutrition Market Overview, 2025

3.2 Global Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Protein Ingredients In Infant Nutrition Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Protein Ingredients In Infant Nutrition Market Overview, 2025

4.2 Asia Pacific Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Protein Ingredients In Infant Nutrition Market

5. Europe Protein Ingredients In Infant Nutrition Market Value, Market Share, and Forecast to 2034

5.1 Europe Protein Ingredients In Infant Nutrition Market Overview, 2025

5.2 Europe Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Protein Ingredients In Infant Nutrition Market

6. North America Protein Ingredients In Infant Nutrition Market Value, Market Share, and Forecast to 2034

6.1 North America Protein Ingredients In Infant Nutrition Market Overview, 2025

6.2 North America Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Protein Ingredients In Infant Nutrition Market

7. South and Central America Protein Ingredients In Infant Nutrition Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Protein Ingredients In Infant Nutrition Market Overview, 2025

7.2 South and Central America Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Protein Ingredients In Infant Nutrition Market

8. Middle East Africa Protein Ingredients In Infant Nutrition Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Protein Ingredients In Infant Nutrition Market Overview, 2025

8.2 Middle East and Africa Protein Ingredients In Infant Nutrition Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Protein Ingredients In Infant Nutrition Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Protein Ingredients In Infant Nutrition Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Protein Ingredients In Infant Nutrition Market

9. Protein Ingredients In Infant Nutrition Market Players Analysis

9.1 Protein Ingredients In Infant Nutrition Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Protein Ingredients In Infant Nutrition Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Protein Ingredients In Infant Nutrition Market is estimated to reach USD 23.1 billion by 2034.

The Global Protein Ingredients In Infant Nutrition Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period from 2025 to 2034.

The Global Protein Ingredients In Infant Nutrition Market is estimated to generate USD 11.8 billion in revenue in 2025.

$2900- 5%

$4350- 10%

$5800- 15%

$2150- 5%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!