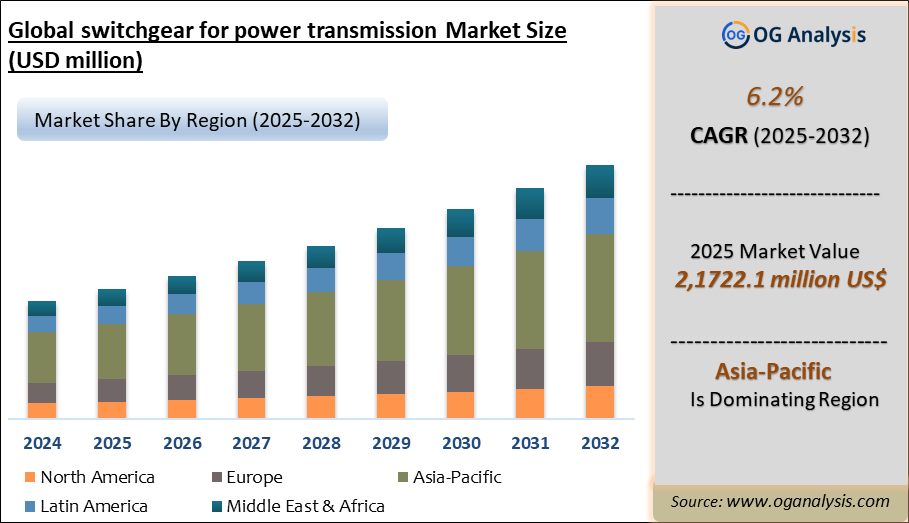

The Switchgear for Power Transmission Market is estimated at USD 19,364 million in 2023. Further, the market is expected to grow from USD 2,0454 million in 2024 to USD 3,1290 million in 2031 at a CAGR of 6.2%.

Switchgear for Power Transmission Market Overview

Switchgear is the main device used for common needs such as controlling, protecting, and isolating power systems. They are also used for de-energizing equipment for safe testing, maintenance, and fault clearing. The types of switchgear include air-insulated switchgear, gas-insulated switchgear, and hybrid switchgear. There are three primary types of switchgear based on voltage: Low voltage (less than 1 kV), Medium voltage (up to 36 kV), and High voltage (above 36 kV).

Examples of switchgear include switching devices (Switches, Fuses, Circuit breakers), measuring devices (Current and Voltage Transformers), and protection & control devices (Relays, Lightning arresters). Since the global electricity market adopted an alternating current system rather than a direct current system for power transmission and distribution, switchgear has been the backbone of electricity grids. Switchgear is critical in ensuring electrical power systems' safe, reliable, and efficient operation. In situations of a power supply shortage or overloading, switchgear can be used to shed non-essential loads or transfer loads to alternate sources, helping to maintain the system's stability and prevent blackouts. In substations, switchgear controls the flow of electricity from higher voltage transmission lines to lower voltage distribution lines. They help manage the distribution of power to various consumers.

Asia-Pacific is the leading region in the switchgear for power transmission market, propelled by rapid urbanization, large-scale investments in smart grid infrastructure, and expanding electricity demand across emerging economies like China and India. High-voltage switchgear is the dominating segment in the market, fueled by the increasing deployment of high-capacity transmission lines, renewable energy integration, and growing need for grid reliability and efficiency.

Switchgear for Power Transmission Market Latest - Trends, Drivers, Challenges

Development of Intelligent, Eco-Efficient, Digital, Vacuum, Hybrid, and SF6 Free Switchgears:

Many businesses attempt to revolutionize the industry by providing next-generation switchgear technologies and solutions. Vacuum switchgear, hybrid switchgear, and intelligent switchgear are examples of recent switchgear innovations. Vacuum switching, commonly utilized in medium-voltage applications, is now a viable option in high-voltage applications. Hybrid switchgear combines air-insulated and high-voltage gas-insulated switchgear.

Smart switchgear has grown increasingly common as the smart grid has evolved. It can also handle more fluctuating renewable energy integration into the grid. Due to a growing focus on saving correctly and providing uninterrupted power, power companies concentrate on substation and switchgear technologies that use less space and lower outages. With the rapid pace of activities to establish a smart grid, alternative types of switchgear that are more compact, dependable, environmentally friendly, and need little installation and commissioning time are needed. As the requisition of renewable energy integration accelerates, utilities will be needed to ramp up the deployment of intelligent switchgear. There is a growing shift toward SF6-free switchgear, specifically in European countries.

Rapid Urbanization & Industrialization Across the Globe:

By 2050 more than two-thirds of the world’s population is estimated to live in urban areas. Africa’s urban population is estimated to rise from 40% to 56% by 2050, and Asia’s from 48% to 64%. Global demand for switchgear is rising due to the urban population in emerging economies. As cities expand and industries grow, the demand for reliable and efficient electrical distribution systems escalates. This rise in electricity consumption has increased the need for sophisticated power distribution equipment to ensure the smooth operation of various industrial processes and residential utilities. Moreover, as industrial activities have become more complex and diverse, the requirement for safety measures against electrical faults, short circuits, and overloads has increased, which, in turn, further necessitates the usage of switchgear.

Environmental Concerns & Regulations Restricting SF6 Gas Emissions:

In our energy-intensive world, electrical infrastructure is important for maintaining uninterrupted power networks. However, the widespread use of Sulphur hexafluoride (SF6) gas in switchgear poses an environmental challenge. Some traditional switchgear technologies use insulating gases that have a high global warming potential. Strict environmental regulations and the need to reduce greenhouse gas emissions push the industry to develop more environmentally friendly alternatives.

In the T&D (Transmission and Distribution) of electricity, SF6 is widely used worldwide as an insulating gas in medium and high-voltage equipment. As the electricity demand grows, the chance of SF6 leaks from additional switches and circuit breakers also grows. Many communities are taking steps to upgrade their equipment and transition to SF6-free alternatives. While the European Community has taken significant strides in phasing out SF6 gas, the United Kingdom is yet to adopt similar legislation.

Companies Mentioned

- ABB Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Eaton Corporation plc

- Toshiba Energy Systems & Solutions Corporation

- Hitachi, Ltd.

- Schneider Electric

- General Electric

- Chint Group

- Weidmüller

- Arteche

- Ingeteam

- Hyundai Heavy Industries

- LG CNS

- Fuji Electric

*The companies above are listed in no particular order.

Market Scope

|

Parameter |

Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD million |

|

Market Splits Covered |

By Product, By Voltage |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

Switchgear for Power Transmission Market, By Product Type

- Air-insulated

- Gas-insulated

- Other Types

Switchgear for Power Transmission Market, By Voltage

- Upto 110kV

- 111-220kV

- 221-420kV

- > 420kV

Switchgear for Power Transmission Market, by Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

TABLE OF CONTENTS

1. GLOBAL SWITCHGEAR FOR POWER TRANSMISSION INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. GLOBAL SWITCHGEAR FOR POWER TRANSMISSION, MARKET SUMMARY, 2023

2.1. Switchgear for Power Transmission Market Latest Trends

2.1.1. Development of Intelligent, Eco-Efficient, Digital, Vacuum, Hybrid, and SF6 Free Switchgears:

2.1.2. Technological Advancements, Growing Digitalization and Smart Switchgears Demand:

2.1.3. Upgradation of Aging Power Infrastructure & Smart Grid Deployments:

2.1.4. Increase in Renewable Energy-Based Projects & Capacities, Government Initiatives:

2.1.5. Rise of Gas-Insulated Switchgear (GIS) Demand:

3. SWITCHGEAR FOR POWER TRANSMISSION, MARKET ANALYTICS

3.1. Switchgear for Power Transmission Market Insights, 2023-2031

3.1.1. Leading Switchgear for Power Transmission Types, 2023-2031

3.1.2. Dominant Switchgear for Power Transmission Voltage, 2023-2031

3.1.3. Fast-Growing Geographies for Switchgear for Power Transmission, 2023-2031

3.2. Switchgear for Power Transmission Demand Drivers to 2031

3.2.1. Rapid Urbanization & Industrialization Across the Globe:

3.2.2. Increasing Demand for Electricity:

3.2.3. Decentralizing Activities in the Administration of Buildings & Services:

3.2.4. Increased Investment in Industrial Production & Infrastructure:

3.2.5. Growing Usage of HVDC Systems:

3.3. Switchgear for Power Transmission Challenges to 2031

3.3.1. Environmental Concerns & Regulations Restricting SF6 Gas Emissions:

3.3.2. High Cost & Maintenance of Switchgears:

3.3.3. Technical Limitations of Switchgears & Functional Disadvantages:

3.4. Switchgear for Power Transmission Market-Five Forces Analysis

4. GLOBAL SWITCHGEAR FOR POWER TRANSMISSION, MARKET STATISTICS - INDUSTRY REVENUE, MARKET SHARE, GROWTH TRENDS AND FORECAST BY SEGMENTS, TO 2031

4.1. Global Switchgear for Power Transmission Market Overview, 2023

4.2. Global Switchgear for Power Transmission Market Size and Share Outlook, By Type, 2023-2031

4.2.1. Air-insulated

4.2.2. Gas-insulated

4.2.3. Other Types

4.3. Global Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

4.3.1. Upto 110kV

4.3.2. 111-220kV

4.3.3. 221-420kV

4.3.4. > 420kV

4.4. Global Switchgear for Power Transmission Market Size and Share Outlook by Region, 2023-2031

5. GLOBAL SWITCHGEAR FOR POWER TRANSMISSION MARKET VOLUME, MARKET SHARE, AND FORECAST TO 2031

5.1. Global Switchgear for Power Transmission Market Volume Overview, 2023

5.2. Global Switchgear for Power Transmission Market Size and Share Outlook, By Type, # Units, 2023-2031

5.2.1. Air-insulated

5.2.2. Gas-insulated

5.2.3. Other Types

5.3. Global Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

5.3.1. Upto 110kV

5.3.2. 111-220kV

5.3.3. 221-420kV

5.3.4. > 420kV

5.4. Global Switchgear for Power Transmission Market Size and Share Outlook by Region, 2023-2031

6. NORTH AMERICA SWITCHGEAR FOR POWER TRANSMISSION MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

6.1. North America Switchgear for Power Transmission Market Overview, 2023

6.2. North America Switchgear for Power Transmission Market Size and Share Outlook By Type, 2023-2031

6.3. North America Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

6.4. North America Switchgear for Power Transmission Market Size and Share Outlook by Country, 2023-2031

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. EUROPE SWITCHGEAR FOR POWER TRANSMISSION MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

7.1. Europe Switchgear for Power Transmission Market Overview, 2023

7.2. Europe Switchgear for Power Transmission Market Size and Share Outlook By Type, 2023-2031

7.3. Europe Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

7.4. Europe Switchgear for Power Transmission Market Size and Share Outlook by Country, 2023-2031

7.4.1. Germany

7.4.2. France

7.4.3. UK

7.4.4. Italy

7.4.5. Spain

7.4.6. Rest of Europe

8. ASIA PACIFIC SWITCHGEAR FOR POWER TRANSMISSION MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Asia Pacific Switchgear for Power Transmission Market Overview, 2023

8.2. Asia Pacific Switchgear for Power Transmission Market Size and Share Outlook By Type, 2023-2031

8.3. Asia Pacific Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

8.4. Asia Pacific Switchgear for Power Transmission Market Size and Share Outlook by Country, 2023-2031

8.4.1. China

8.4.2. Australia

8.4.3. South Korea

8.4.4. India

8.4.5. Rest of Asia Pacific

9. SOUTH AND CENTRAL AMERICA SWITCHGEAR FOR POWER TRANSMISSION MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

9.1. South and Central America Switchgear for Power Transmission Market Overview, 2023

9.2. South and Central America Switchgear for Power Transmission Market Size and Share Outlook By Type, 2023-2031

9.3. South and Central America Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

9.4. South and Central America Switchgear for Power Transmission Market Size and Share Outlook by Country, 2023-2031

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest of South and Central America

10. MIDDLE EAST AFRICA SWITCHGEAR FOR POWER TRANSMISSION MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

10.1. Middle East Africa Switchgear for Power Transmission Market Overview, 2023

10.2. Middle East Africa Switchgear for Power Transmission Market Size and Share Outlook By Type, 2023-2031

10.3. Middle East Africa Switchgear for Power Transmission Market Size and Share Outlook, By Voltage, 2023-2031

10.4. Middle East Africa Switchgear for Power Transmission Market Size and Share Outlook by Country, 2023-2031

10.4.1. Middle East

10.4.2. Africa

11. SWITCHGEAR FOR POWER TRANSMISSION MARKET STRUCTURE

11.1. General Electric Company

11.2. Mitsubishi Heavy Industries, Ltd.

11.3. ABB Ltd

12. APPENDIX

12.1. About Us

12.2. Sources

12.3. Research Methodology

12.4. Research Process

12.5. Research Execution

12.6. Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

High initial costs of advanced switchgear

Supply chain disruptions

Integration complexity in older infrastructure

Rising demand for reliable grid infrastructure

Urbanization and industrial expansion

Integration of renewable energy

Aging transmission networks needing upgrades

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

- ABB Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Eaton Corporation plc

- Toshiba Energy Systems & Solutions Corporation

- Hitachi, Ltd.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!