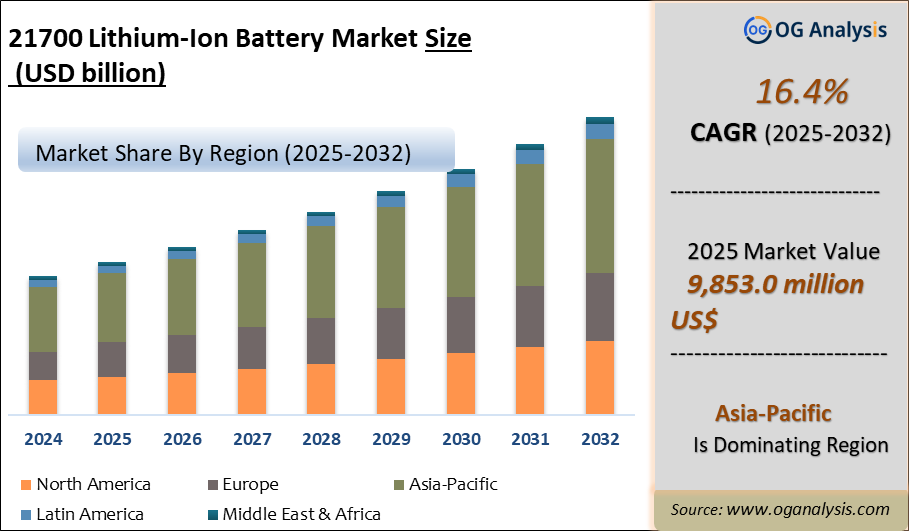

The 21700 Lithium-Ion Battery Market is estimated at USD 6,495 million in MV 2022. Further, the market is expected to grow from USD 7,272 million in 2023 to USD 21,064 Million in 2030 at a CAGR of 16.4%.

21700 Lithium-Ion Battery Market Overview

The 21700 Lithium-Ion (Li-Ion) battery market is a sub-segment of the Li-Ion battery market and refers to cylindrical batteries with a diameter of 21mm and a length of 70mm. Li-ion batteries are rechargeable batteries in which the Li-ion acts as the cathode and the carbon acts as the anode. Li-ion batteries with good electrochemical performance and low resistance induce good thermal stability, higher current density, and longer shelf life as compared with other types of batteries available in the market. The 21700 battery is larger than other commonly used Li-Ion battery types, as the 18650 offers a higher energy density and capacity.

21700 battery is available in both protected and unprotected forms. Most protected 21700 batteries include PCB and overheat protection, which avoids the battery from overcharging or overheating. Unprotected batteries are more dangerous as they do not have this preventative protection.

Spurred by increasing concern for environmental sustainability and ambitious targets to encourage and enforce clean energy, demand for 21700 Lithium-ion batteries is growing at a rapid pace. Owing to its sophisticated characteristics, the 21700 Li-ion battery is finding applications across a wide range of end-user segments. Electric vehicles, flashlights, consumer electronics, and high-power applications such as power tools, energy storage and medical devices are the major industries stimulating the growth of the Lithium-ion battery market.

Global Lithium-Ion Battery Market Analysis 2025-2032: Industry Size, Share, Growth Trends, Competition and Forecast Report

Latest Trends in 21700 Lithium-Ion Battery Market

Demand for Clean Energy Sources

The automotive industry is rapidly embracing electric vehicle technology with increasing emphasis on lower emissions of SOx, NOx, particulate matter, carbon monoxide, and other volatile organic compounds. Increasing government focus on reducing GHG emissions from the automotive industry coupled with technological advancements in the battery industry are fueling the shift towards cleaner fuels.

Demand for electric vehicles is forecast at 19.7% CAGR over the forecast period to 2026, with strong sales volume in developing countries. The US, China, Japan, India, and other countries present a strong potential for growth in batteries. The demand for Lithium-ion batteries is expected to remain robust in the automotive sector as they emit no harmful compounds, provide cheaper alternatives and reduce oil dependency. The demand for both EV and PHEV sales remains a major driving factor for lithium-ion batteries.

Driving Factors

The shift in the global energy mix

To reduce oil dependency on fossil fuels and to shift towards reliable energy sources for the growing population and economic development, the shift in the global primary energy mix is being observed worldwide. Power generation through solar, wind and other renewable sources remain major users of lithium-ion batteries, which will support the market growth. In particular, the shift in European countries is rapid, which will fuel the market growth of batteries and power storage systems.

An increased share of renewable fuels in the energy mix will support the development of flexible power generation and transmission systems. Lucrative policies to support the growth of alternative power generation through incentives and tax rebates are encouraging investments in power generation, which will fuel the lithium-ion battery market growth over the medium to long term future.

Market Challenges

Environmental concerns

The traction to Lithium-ion batteries for electric vehicles and other clean energy solutions is due to the increasing shift of people and governments to cleaner and environmentally friendly fuels and processes. Batteries evolving and continuously improving their shelf life and safety have not yet attained an effective and economic recycling process. OEMs collecting batteries that ends earlier than the stipulated battery life can be reused by installing them in another appliance.

However, there are very limited options to recover materials or reuse components once the battery life attains completion. These batteries creating highly hazardous e-waste piles is a direct threat to the environment, questioning the very first initiative of battery vehicles and other products.

Further, the existing expensive recycling processes using brine-based processes discourage companies from these attempts. These factors increase the difficulty of recycling lithium despite it being 100 percent recyclable. This is one of the major challenges for the global lithium battery market. The lack of recycling infrastructure also hinders the recycling of the batteries.

However, the technology companies are confident of developing an economically feasible solution with maximum re-use once the number of used batteries received is of significant quantity to implement the process.

Companies Mentioned

CATL

LG Energy Solution Ltd.

Samsung SDI Co., Ltd.

BYD Co., Ltd.

Panasonic Holdings Corp.

|

Parameter |

Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By Application, By Type, By Capacity |

|

Countries Covered |

North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Datafile |

Market Segmentation

21700 Lithium-Ion Battery Market, by Application

Consumer Electronics

Automotive

Flashlights

Others

21700 Lithium-Ion Battery Market, by Type

Lithium Cobalt Oxide (LCO)

Lithium Iron Phosphate (LFP)

Lithium Nickel Manganese Cobalt (LI-NMC)

Lithium Manganese Oxide (LMO)

Lithium Titanate Oxide (LTO)

Lithium Nickel Cobalt Aluminum Oxide (NCA)

21700 Lithium-Ion Battery Market, By Capacity

Up to 4000 mAh

4100-4800 mAh

4800 mAh+

21700 Lithium-Ion Battery Market, by Geography

North America

Europe

Asia-Pacific

Middle East and Africa

South and Central America

TABLE OF CONTENTS

1. GLOBAL 21700 LITHIUM-ION BATTERY INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. 21700 LITHIUM-ION BATTERY MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2022-2030

2.1. Development of 4680 and Potential Replacement of 2170 Li-ion battery

2.2. 21700 Lithium-Ion Battery Market Latest Trends

2.2.1. Demand for Clean Energy Sources

2.2.2. The shift of global EV OEMs towards 21700 batteries

2.2.3. Gigantic Battery Manufacturing Plants Planned in South East Asia and Europe

2.2.4. Declining Li-ion battery prices

2.3. 21700 Lithium-Ion Battery Market Insights, 2022-2030

2.3.1. Leading 21700 Lithium-Ion Battery Application, 2022-2030

2.3.2. Leading 21700 Lithium-Ion Battery Type, 2022-2030

2.3.3. Dominant 21700 Lithium-Ion Battery Capacity, 2022-2030

2.3.4. Fast-Growing Geographies for 21700 Lithium-Ion Battery, 2022-2030

2.4. 21700 Lithium-Ion Battery Market Drivers to 2030

2.4.1. The shift in the global energy mix

2.4.2. Increased demand for Electric Vehicles

2.4.3. Increasing power consumption from renewable sources and distributed energy storage

2.4.4. Strong demand from the consumer electronic market

2.4.5. Smart electricity market

2.4.6. Higher efficiency and lower cost of 21700 batteries

2.5. 21700 Lithium-Ion Battery Market Restraints to 2030

2.5.1. Environmental concerns

2.5.2. Lithium supply-demand challenges cause price fluctuations

2.5.3. Competition from alternative technologies

2.6. 21700 Lithium-Ion Battery Market-Five Forces Analysis

3. GLOBAL 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

3.1. Global 21700 Lithium-Ion Battery Market Overview, 2021

3.2. Global 21700 Lithium-Ion Battery Market Size and Share Outlook, By Application, 2022-2030

3.2.1. Consumer Electronics

3.2.2. Automotive

3.2.3. Flashlights

3.2.4. Other Application

3.3. Global 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

3.3.1. Lithium Cobalt Oxide (LCO)

3.3.2. Lithium Iron Phosphate (LFP)

3.3.3. Lithium Nickel Manganese Cobalt (LI-NMC)

3.3.4. Lithium Manganese Oxide (LMO)

3.3.5. Lithium Titanate Oxide (LTO)

3.3.6. Lithium Nickel Cobalt Aluminum Oxide (NCA)

3.4. Global 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

3.4.1. Up to 4000 mAh

3.4.2. 4100-4800 mAh

3.4.3. 4800 mAh+

3.5. Global 21700 Lithium-Ion Battery Market Size and Share Outlook by Region, 2022-2030

4. NORTH AMERICA 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

4.1. North America 21700 Lithium-Ion Battery Market Overview, 2021

4.2. North America 21700 Lithium-Ion Battery Market Size and Share Outlook by Application, 2022-2030

4.3. North America 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

4.4. North America 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

4.5. North America 21700 Lithium-Ion Battery Market Size and Share Outlook by Country, 2022-2030

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. EUROPE 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

5.1. Europe 21700 Lithium-Ion Battery Market Overview, 2021

5.2. Europe 21700 Lithium-Ion Battery Market Size and Share Outlook by Application, 2022-2030

5.3. Europe 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

5.4. Europe 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

5.5. Europe 21700 Lithium-Ion Battery Market Size and Share Outlook by Country, 2022-2030

5.5.1. Germany

5.5.2. UK

5.5.3. Italy

5.5.4. France

5.5.5. Spain

5.5.6. Rest of Europe

6. ASIA PACIFIC 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

6.1. Asia Pacific 21700 Lithium-Ion Battery Market Overview, 2021

6.2. Asia Pacific 21700 Lithium-Ion Battery Market Size and Share Outlook by Application, 2022-2030

6.3. Asia Pacific 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

6.4. Asia Pacific 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

6.5. Asia Pacific 21700 Lithium-Ion Battery Market Size and Share Outlook by Country, 2022-2030

6.5.1. China

6.5.2. Japan

6.5.3. India

6.5.4. South Korea

6.5.5. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

7.1. South and Central America 21700 Lithium-Ion Battery Market Overview, 2021

7.2. South and Central America 21700 Lithium-Ion Battery Market Size and Share Outlook by Application, 2022-2030

7.3. South and Central America 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

7.4. South and Central America 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

7.5. South and Central America 21700 Lithium-Ion Battery Market Size and Share Outlook by Country, 2022-2030

7.5.1. Brazil

7.5.2. Argentina

7.5.3. Rest of South and Central America

8. MIDDLE EAST AFRICA 21700 LITHIUM-ION BATTERY MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

8.1. Middle East Africa 21700 Lithium-Ion Battery Market Overview, 2021

8.2. Middle East Africa 21700 Lithium-Ion Battery Market Size and Share Outlook by Application, 2022-2030

8.3. Middle East Africa 21700 Lithium-Ion Battery Market Size and Share Outlook, By Type, 2022-2030

8.4. Middle East Africa 21700 Lithium-Ion Battery Market Size and Share Outlook, By Capacity, 2022-2030

8.5. Middle East Africa 21700 Lithium-Ion Battery Market Size and Share Outlook by Country, 2022-2030

8.5.1. Middle East

8.5.2. Africa

9. 21700 LITHIUM-ION BATTERY MARKET STRUCTURE

9.1. CATL

9.2. LG Energy Solution Ltd.

9.3. Samsung SDI Co., Ltd.

9.4. BYD Co., Ltd.

9.5. Panasonic Holdings Corp.

10. ABOUT US

10.1. Sources

10.1. Research Methodology

10.2. Research Process

10.3. Research Execution

10.4. Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!