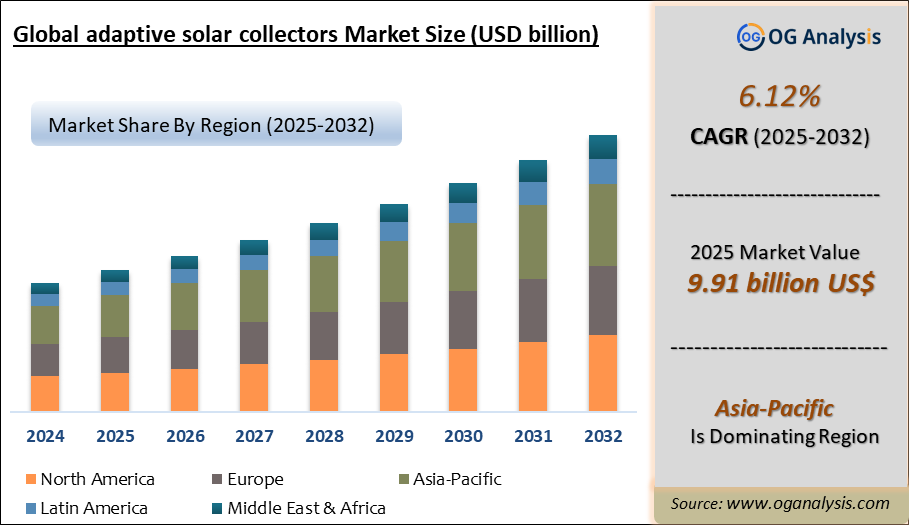

"The Global Adaptive Solar Collectors Market is valued at USD 9.91 Billion in 2025. Worldwide sales of Adaptive Solar Collectors Market are expected to grow at a significant CAGR of 6.12%, reaching USD 15.02 Billion by the end of the forecast period in 2032."

The Adaptive Solar Collectors Market refers to solar thermal systems equipped with dynamic features that adjust the absorber’s orientation, concentration, or flow rate to optimize solar energy capture under varying environmental conditions. These systems—ranging from sun-tracking parabolic collectors to variable-flow flat-plate arrays—enhance efficiency by aligning with the sun’s position, modulating fluid flow based on temperature, or adjusting the mirror focus. Increasing demand for renewable heat in residential, commercial, and industrial applications—such as water heating, HVAC preheating, and process steam—coupled with global decarbonization efforts, is driving market expansion. Improvements in sensor technology, IoT integration, and affordable actuators are enabling more precise control and scalable deployment, while financial incentives and carbon pricing are boosting adoption in regions targeting greenhouse gas reductions.

Regionally, Europe leads due to supportive policies, solar mandates, and mature solar-thermal infrastructure. North America is experiencing growth driven by commercial and agricultural heating needs and state-level incentives. Asia-Pacific is the fastest-growing region, with China, India, and Southeast Asia deploying adaptive solar collectors for district heating, industrial processes, and off-grid systems. Technological advancements in dual-axis tracking, variable-flow heat exchange, and predictive solar modeling are increasing annual energy yields by 20–40% over static collectors. However, challenges include higher upfront costs, maintenance of moving parts, and site-specific performance optimization. Forecasts suggest that as economies of scale, digital automation, and long-term energy savings improve ROI, adaptive solar systems will gain broader application across residential, industrial, and utility-scale solar thermal deployments.

The photovoltaic (PV) systems segment is the largest in the adaptive solar collectors market due to their high efficiency, declining installation costs, and ease of integration across varied scales. PV systems are widely adopted in both grid-connected and off-grid applications, making them the most commercially viable technology type.

The industrial segment is the fastest-growing application area, driven by rising energy demands, decarbonization goals, and the need to reduce operational energy costs. Adaptive solar solutions are increasingly used in manufacturing, mining, and processing sectors to supplement traditional energy sources with renewable alternatives.

Key Insights

- Solar collectors with dual-axis tracking are being deployed in industrial process-energy and district-heating systems to maximize solar exposure throughout the day, boosting thermal yield significantly over static arrays.

- Variable-flow adaptive collectors modulate fluid circulation based on real-time temperature and solar irradiance data, improving system responsiveness and reducing heat loss during low-sun periods.

- IoT and predictive control integration allows adaptive solar systems to adjust parameters based on weather forecasts and system performance, increasing efficiency and minimizing manual intervention.

- Commercial and agricultural sectors—such as food processing, washdown systems, and greenhouse heating—are adopting adaptive collectors to lower fossil-fuel dependence and reduce thermal energy costs.

- Residential adaptive collector solutions, including hinged and tiltable flat-plate panels, are entering niche markets in remote and mountainous areas where orientation variability is critical.

- Smart sensors and actuators with enhanced durability and low power consumption are reducing maintenance risks and improving the longevity of tracking mechanisms in harsh climates.

- Large-scale deployment is being piloted in solar district-heating networks, demonstrating that adaptive systems can provide 25–35% higher heat output compared to conventional solar thermal collectors.

- Hybrid systems combining adaptive solar collectors with heat pumps and thermal storage are emerging, leveraging synergies to enable year-round heat supply and grid electrification.

- Ongoing R&D focuses on advanced coatings, mirror materials, and self-powered actuation systems that reduce friction and operational energy use in adaptive collectors.

- Utility and project developers are evaluating adaptive solar collectors in EPC tender bids for industrial energy and district heating contracts, indicating growing market acceptance.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application, By End User, By Technology, By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

What You Receive

• Global Adaptive Solar Collectors market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Adaptive Solar Collectors.

• Adaptive Solar Collectors market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Adaptive Solar Collectors market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Adaptive Solar Collectors market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Adaptive Solar Collectors market, Adaptive Solar Collectors supply chain analysis.

• Adaptive Solar Collectors trade analysis, Adaptive Solar Collectors market price analysis, Adaptive Solar Collectors Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Adaptive Solar Collectors market news and developments.

The Adaptive Solar Collectors Market international scenario is well established in the report with separate chapters on North America Adaptive Solar Collectors Market, Europe Adaptive Solar Collectors Market, Asia-Pacific Adaptive Solar Collectors Market, Middle East and Africa Adaptive Solar Collectors Market, and South and Central America Adaptive Solar Collectors Markets. These sections further fragment the regional Adaptive Solar Collectors market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Adaptive Solar Collectors market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Adaptive Solar Collectors market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Adaptive Solar Collectors market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Adaptive Solar Collectors business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Adaptive Solar Collectors Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Adaptive Solar Collectors Pricing and Margins Across the Supply Chain, Adaptive Solar Collectors Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Adaptive Solar Collectors market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Adaptive Solar Collectors Market Latest Trends, Drivers and Challenges, 2024 - 2032

2.1 Adaptive Solar Collectors Market Overview

2.2 Market Strategies of Leading Adaptive Solar Collectors Companies

2.3 Adaptive Solar Collectors Market Insights, 2024 - 2032

2.3.1 Leading Adaptive Solar Collectors Types, 2024 - 2032

2.3.2 Leading Adaptive Solar Collectors End-User industries, 2024 - 2032

2.3.3 Fast-Growing countries for Adaptive Solar Collectors sales, 2024 - 2032

2.4 Adaptive Solar Collectors Market Drivers and Restraints

2.4.1 Adaptive Solar Collectors Demand Drivers to 2032

2.4.2 Adaptive Solar Collectors Challenges to 2032

2.5 Adaptive Solar Collectors Market- Five Forces Analysis

2.5.1 Adaptive Solar Collectors Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Adaptive Solar Collectors Market Value, Market Share, and Forecast to 2032

3.1 Global Adaptive Solar Collectors Market Overview, 2024

3.2 Global Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

3.3 Global Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

3.3.1 Single-Axis Adaptive Solar Collectors

3.3.2 Dual-Axis Adaptive Solar Collectors

3.4 Global Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

3.4.1 Flat Plate Collectors

3.4.2 Evacuated Tube Collectors

3.4.3 Parabolic Trough Collectors

3.4.4 Fresnel Reflectors

3.5 Global Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

3.5.1 Residential

3.5.2 Commercial

3.5.3 Industrial

3.5.4 District Heating

3.5.5 Off-Grid Solutions

3.6 Global Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

3.6.1 Water Heating

3.6.2 Space Heating

3.6.3 Process Heating

3.6.4 Hybrid Solar Energy Systems

3.7 Global Adaptive Solar Collectors Market Size and Share Outlook by Region, 2024 - 2032

4. Asia Pacific Adaptive Solar Collectors Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Adaptive Solar Collectors Market Overview, 2024

4.2 Asia Pacific Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

4.3 Asia Pacific Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

4.4 Asia Pacific Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

4.5 Asia Pacific Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

4.6 Asia Pacific Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

4.7 Asia Pacific Adaptive Solar Collectors Market Size and Share Outlook by Country, 2024 - 2032

4.8 Key Companies in Asia Pacific Adaptive Solar Collectors Market

5. Europe Adaptive Solar Collectors Market Value, Market Share, and Forecast to 2032

5.1 Europe Adaptive Solar Collectors Market Overview, 2024

5.2 Europe Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

5.3 Europe Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

5.4 Europe Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

5.5 Europe Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

5.6 Europe Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

5.7 Europe Adaptive Solar Collectors Market Size and Share Outlook by Country, 2024 - 2032

5.8 Key Companies in Europe Adaptive Solar Collectors Market

6. North America Adaptive Solar Collectors Market Value, Market Share and Forecast to 2032

6.1 North America Adaptive Solar Collectors Market Overview, 2024

6.2 North America Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

6.3 North America Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

6.4 North America Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

6.5 North America Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

6.6 North America Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

6.7 North America Adaptive Solar Collectors Market Size and Share Outlook by Country, 2024 - 2032

6.8 Key Companies in North America Adaptive Solar Collectors Market

7. South and Central America Adaptive Solar Collectors Market Value, Market Share and Forecast to 2032

7.1 South and Central America Adaptive Solar Collectors Market Overview, 2024

7.2 South and Central America Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

7.3 South and Central America Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

7.4 South and Central America Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

7.5 South and Central America Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

7.6 South and Central America Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

7.7 South and Central America Adaptive Solar Collectors Market Size and Share Outlook by Country, 2024 - 2032

7.8 Key Companies in South and Central America Adaptive Solar Collectors Market

8. Middle East Africa Adaptive Solar Collectors Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Adaptive Solar Collectors Market Overview, 2024

8.2 Middle East and Africa Adaptive Solar Collectors Market Revenue and Forecast, 2024 - 2032 (US$ Million)

8.3 Middle East Africa Adaptive Solar Collectors Market Size and Share Outlook By Type, 2024 - 2032

8.4 Middle East Africa Adaptive Solar Collectors Market Size and Share Outlook By Collector Type, 2024 - 2032

8.5 Middle East Africa Adaptive Solar Collectors Market Size and Share Outlook By Application, 2024 - 2032

8.6 Middle East Africa Adaptive Solar Collectors Market Size and Share Outlook By End-Use Sector, 2024 - 2032

8.7 Middle East Africa Adaptive Solar Collectors Market Size and Share Outlook by Country, 2024 - 2032

8.8 Key Companies in Middle East Africa Adaptive Solar Collectors Market

9. Adaptive Solar Collectors Market Structure

9.1 Key Players

9.2 Adaptive Solar Collectors Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Adaptive Solar Collectors Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

By 2032, the Adaptive Solar Collectors Market is estimated to account for USD 15.02 Billion.

The Global Adaptive Solar Collectors Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.12% during the forecast period from 2025 to 2032.

The Global Adaptive Solar Collectors Market is estimated to generate USD 9.91 Billion revenue in 2025.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!