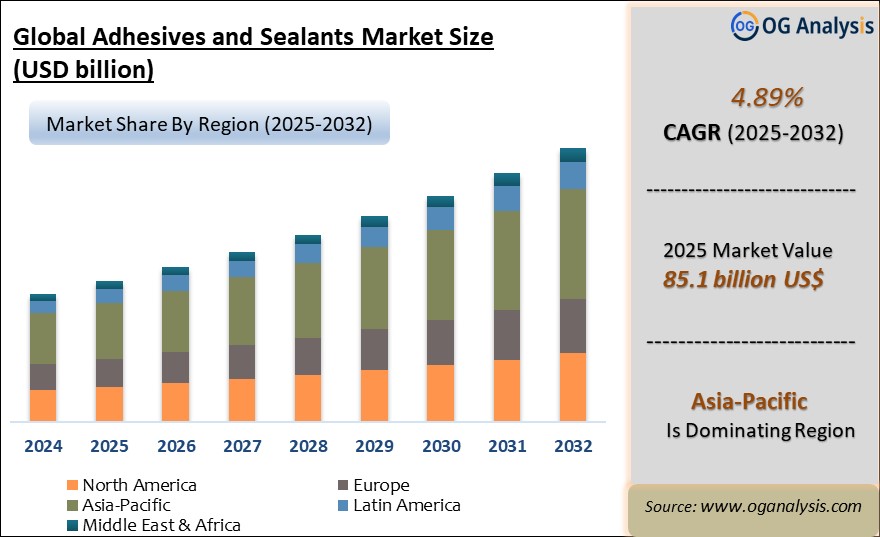

"The Global Adhesives and Sealants Market valued at USD 81.2 billion in 2024, is expected to grow by 4.89% CAGR to reach market size worth USD 133.7 billion by 2034."

The adhesives and sealants market is a critical component of various industries, providing essential solutions for bonding, sealing, and protecting materials across diverse applications. Adhesives and sealants are used to assemble, secure, and protect a wide range of products, from consumer goods and automotive components to construction materials and aerospace structures. The market has witnessed consistent growth over the years, driven by factors like technological advancements, increasing demand for durable and reliable bonding solutions, and growing focus on sustainability. In 2024, the adhesives and sealants market saw a surge in the development of innovative products with enhanced performance characteristics, including improved adhesion, faster curing times, and enhanced resistance to environmental factors. Furthermore, the industry saw a significant shift towards more sustainable and environmentally friendly adhesives and sealants, driven by a growing concern for reducing the environmental footprint of manufacturing and construction processes.

Looking ahead to 2025, the adhesives and sealants market is expected to continue its robust growth trajectory, fueled by the expanding global economy, increasing urbanization, and the growing demand for advanced materials and technologies. The automotive, construction, and aerospace industries are anticipated to remain key drivers, fueled by factors like technological advancements, infrastructure development, and a growing middle class in developing economies. Furthermore, the development of new and innovative adhesives and sealants, particularly those with improved performance, sustainability, and ease of use, is expected to drive market growth. The market is likely to witness intensified competition among existing players and new entrants, with a focus on innovation, cost optimization, and sustainability. The adhesives and sealants market is thus positioned for a period of robust growth, offering compelling opportunities for manufacturers and suppliers.

The Global Adhesives and Sealants Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

Asia-Pacific is the leading region in the adhesives and sealants market, powered by rapid industrialization, robust growth in the construction and automotive sectors, and increasing demand for packaging and electronics applications across emerging economies.

Trade Intelligence for Adhesives and Sealants Market

| Global Glaziers putty, resin cements, caulking compounds, mastics Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 6,288 | 7,692 | 8,242 | 8,269 | 8,534 |

| Germany | 437 | 525 | 533 | 561 | 572 |

| China | 509 | 618 | 578 | 517 | 561 |

| United States of America | 319 | 395 | 516 | 459 | 501 |

| France | 237 | 325 | 360 | 398 | 413 |

| Canada | 261 | 314 | 377 | 384 | 371 |

| Source: OGAnalysis | |||||

- Germany, United States of America, Belgium, China and France are the top five countries importing 51.6% of global Glaziers putty, resin cements, caulking compounds, mastics in 2024

- Global Glaziers putty, resin cements, caulking compounds, mastics Imports increased by 34.3% between 2020 and 2024

- Germany accounts for 20.7% of global Glaziers putty, resin cements, caulking compounds, mastics trade in 2024

- United States of America accounts for 10.8% of global Glaziers putty, resin cements, caulking compounds, mastics trade in 2024

- Belgium accounts for 9.4% of global Glaziers putty, resin cements, caulking compounds, mastics trade in 2024

| Global Glaziers putty, resin cements, caulking compounds, mastics Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Key Insights

- Adhesives and sealants historically gained share by enabling design freedom and weight reduction compared with mechanical joining, particularly in transportation and consumer goods. This legacy continues as engineers seek to join dissimilar materials and optimize structures for performance and aesthetics.

- Construction and infrastructure remain foundational end-use sectors, where sealants and construction adhesives support weatherproofing, structural glazing, flooring, roofing, and façade systems. Rising expectations for energy-efficient, airtight buildings keep demand resilient throughout both new-build and renovation cycles.

- Automotive and transportation markets rely on structural adhesives, body-in-white bonding, glass bonding, and seam sealants to improve crash performance, reduce noise, and lower weight. The transition toward electrified and connected vehicles further expands use in battery systems, electronics encapsulation, and thermal management assemblies.

- Packaging applications, especially in flexible packaging and labelling, remain a key volume driver for adhesives. Hot melts, water-based systems, and specialty laminating adhesives enable lightweight, high-speed packaging formats while supporting requirements for shelf life, printability, and consumer convenience.

- Electronics and electrical applications are growing in importance, with adhesives and sealants increasingly used for die attach, underfill, potting, conformal coating, and thermal interface management. These materials protect sensitive components from moisture, vibration, and thermal stress in compact, densely packed devices.

- Technology trends favour reactive and hybrid chemistries such as polyurethane, silyl-modified polymers, and epoxy-based systems that deliver strong bonds, flexibility, and improved durability. These formulations often replace solvent-based products and offer better balance between mechanical performance, processability, and environmental profile.

- Sustainability and regulatory pressures are accelerating the shift toward low-VOC, solvent-free, and reduced-hazard products. Producers are reformulating portfolios with water-based systems, higher solids, and alternative raw materials, while also supporting customers in meeting evolving building, automotive, and environmental standards.

- Process integration and automation are critical differentiators, as manufacturers look to shorten cycle times and improve consistency. Adhesive and sealant suppliers increasingly provide rheology-tailored products, cure-on-demand technologies, and application know-how that align with robotic dispensing, high-speed lines, and digital quality control.

- Specialty and niche applications, such as medical devices, aerospace, renewable energy, and high-performance sports equipment, are expanding the value mix of the market. These segments demand highly engineered formulations with specific biocompatibility, flame-retardancy, or extreme-environment performance attributes.

- Looking ahead, the adhesives and sealants market is expected to benefit from megatrends such as urbanization, lightweighting, electrification, modular construction, and circular design. Companies that combine broad chemistry capabilities with strong application support, regulatory expertise, and sustainability roadmaps will be best positioned to capture long-term growth opportunities.

Global cement production (million tonnes), 2018–2024

Figure: Global cement production (million tonnes), 2018–2024e, indicating sustained construction and infrastructure activity that underpins demand for construction adhesives and sealants.

- Global cement production remained above 4 billion tonnes through 2018–2024e, reflecting sustained construction and infrastructure activity worldwide—the largest demand center for structural adhesives, construction sealants, waterproofing systems and glazing compounds. This steady upstream indicator highlights the strong substrate base of concrete, masonry and prefabricated elements that rely on high-performance bonding and sealing solutions, reinforcing the robust long-term growth outlook for the Adhesives and Sealants Market.

Regional Insights

North America Adhesives and Sealants Market Analysis

The North America Adhesives and Sealants market demonstrated robust growth in 2024, driven by advancements in eco-friendly materials, regulatory shifts favoring sustainable production, and increased investments in R&D. Chemicals and Materials markets such as bio-based polymers, adhesives and sealants, and paints and coatings additives saw significant traction, spurred by strong demand from construction, automotive, and packaging sectors. The anticipated Adhesives and Sealants industry growth in 2025 is underpinned by heightened focus on green building materials, innovative self-healing materials, and expansion of end-user industries such as electronics and aerospace. Competitive dynamics reflect increasing collaboration between key players and technology providers, with a focus on sustainable innovation and scaling advanced manufacturing technologies. Major players are leveraging partnerships and acquisitions to address regulatory standards and expand their market presence, creating an intensely competitive landscape.

Europe Adhesives and Sealants Market Outlook

The European Adhesives and Sealants market maintained a steady growth trajectory in 2024, bolstered by stringent environmental regulations and the growing adoption of circular economy principles. High demand for specialty chemicals and bio-based polymers was observed due to infrastructure projects and the push for green building initiatives. From 2025 onward, growth is expected to accelerate with innovations in materials catering to advanced applications in pharmaceuticals, cosmetics, and industrial coatings. The region’s leadership in sustainable technologies and commitment to reducing carbon footprints are key driving factors. The competitive landscape is characterized by well-established global leaders and emerging regional players focusing on localized manufacturing and energy-efficient solutions, creating a diverse and evolving market.

Asia-Pacific Adhesives and Sealants Market Forecast

Asia-Pacific’s Adhesives and Sealants market experienced dynamic growth in 2024, fueled by industrialization, urbanization, and increasing investments in construction, automotive, and consumer goods. Overall, the chemicals and Materials segment saw exponential demand due to infrastructure projects and expanding manufacturing bases. Anticipated growth from 2025 is supported by government initiatives promoting domestic production and green manufacturing. Its competitive production costs and technological advancements drive the region's dominance in key end-use markets. The competitive landscape is highly fragmented, with local manufacturers scaling operations to meet global export demands while international players continue to expand their footprints through joint ventures and acquisitions.

Middle East, Africa, Latin America Adhesives and Sealants Market Overview

The Adhesives and Sealants market across the Rest of the World, encompassing Latin America, the Middle East, and Africa, showed promising growth in 2024. This growth was supported by rising investments in the construction and energy sectors, driven by increasing oil and gas exploration and infrastructure development. From 2025, anticipated growth will stem from industrial diversification efforts, especially in GCC countries, and the adoption of high-performance materials like potassium sorbate and self-healing materials in emerging industries. The competitive landscape is evolving as regional players strengthen production capabilities and international players capitalize on untapped markets through strategic partnerships.

Adhesives and Sealants Market Dynamics and Future Analytics

The research analyses the Adhesives and Sealants parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Adhesives and Sealants market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Adhesives and Sealants market projections.

Recent deals and developments are considered for their potential impact on Adhesives and Sealants's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Adhesives and Sealants market.

Adhesives and Sealants trade and price analysis helps comprehend Adhesives and Sealants's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Adhesives and Sealants price trends and patterns, and exploring new Adhesives and Sealants sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Adhesives and Sealants market.

Adhesives and Sealants Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Adhesives and Sealants market and players serving the Adhesives and Sealants value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Adhesives and Sealants market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Adhesives and Sealants products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Adhesives and Sealants market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Adhesives and Sealants market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Adhesives and Sealants Market Research Scope

• Global Adhesives and Sealants market size and growth projections (CAGR), 2024- 2034

• Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Adhesives and Sealants Trade and Supply-chain

• Adhesives and Sealants market size, share, and outlook across 5 regions and 27 countries, 2023- 2034

• Adhesives and Sealants market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023- 2034

• Short and long-term Adhesives and Sealants market trends, drivers, restraints, and opportunities

• Porter’s Five Forces analysis, Technological developments in the Adhesives and Sealants market, Adhesives and Sealants supply chain analysis

• Adhesives and Sealants trade analysis, Adhesives and Sealants market price analysis, Adhesives and Sealants supply/demand

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

• Latest Adhesives and Sealants market news and developments

The Adhesives and Sealants Market international scenario is well established in the report with separate chapters on North America Adhesives and Sealants Market, Europe Adhesives and Sealants Market, Asia-Pacific Adhesives and Sealants Market, Middle East and Africa Adhesives and Sealants Market, and South and Central America Adhesives and Sealants Markets. These sections further fragment the regional Adhesives and Sealants market by type, application, end-user, and country.

Report Scope

| Parameter | Adhesives and Sealants Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Regional Insights

North America Adhesives and Sealants market data and outlook to 2034

United States

Canada

Mexico

Europe Adhesives and Sealants market data and outlook to 2034

Germany

United Kingdom

France

Italy

Spain

BeNeLux

Russia

Asia-Pacific Adhesives and Sealants market data and outlook to 2034

China

Japan

India

South Korea

Australia

Indonesia

Malaysia

Vietnam

Middle East and Africa Adhesives and Sealants market data and outlook to 2034

Saudi Arabia

South Africa

Iran

UAE

Egypt

South and Central America Adhesives and Sealants market data and outlook to 2034

Brazil

Argentina

Chile

Peru

* We can include data and analysis of additional coutries on demand

Available Customizations

The standard syndicate report is designed to serve the common interests of Adhesives and Sealants Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below –

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Adhesives and Sealants Pricing and Margins Across the Supply Chain, Adhesives and Sealants Price Analysis / International Trade Data / Import-Export Analysis,

Supply Chain Analysis, Supply – Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Adhesives and Sealants market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days

Segmentation

By Technology

- Water Based

- Solvent Based

- Hot Melt

- Reactive

- Others

By Product

- Acrylic

- PVA

- Polyurethanes

- Styrenic block

- Epoxy

- EVA

- Others

By Application

- Paper & packaging

- Consumer & DIY

- Building & construction

- Furniture & woodworking

- Footwear & leather

- Automotive & transportation

- Medical

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

3M Company

-

Ashland Inc.

-

Avery Denison Corporation

-

H B Fuller

-

Henkel AG

-

Sika AG

-

Pidilite Industries

-

Huntsman

-

Wacker Chemie AG

-

RPM International Inc.

-

Dow

-

Kuraray Co., Ltd.

Key Recent Developments

- Sonoco is investing about USD 30 million to expand its adhesives & sealants production capacity, adding new production lines and increasing output by roughly 100 million units/year to meet rising demand.

- Avery Dennison is acquiring the flooring adhesives business of Meridian Adhesives Group, strengthening its product portfolio and footprint in the flooring segment.

- Covestro is expanding its specialty isocyanate capacity through acquisitions, boosting its ability to support advanced adhesive and sealant formulations, particularly for durable and high-performance applications.

- Henkel has introduced a new solvent-free adhesive line designed for high-thermal stress situations, offering aliphatic (non-aromatic), more stable chemistry for demanding sealant/adhesive use.

- MÜNZING expanded its North American production headquarters, increasing infrastructure and scalability for liquid emulsion polymers used in adhesive and sealant applications.

- Arkema earned ISCC PLUS certification for several of its acrylic, alkyd resin, and polyester products, enhancing sustainability credentials relevant to adhesives/sealants producers.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Adhesives and Sealants Market Review, 2024

2.1 Adhesives and Sealants Industry Overview

2.2 Research Methodology

3. Adhesives and Sealants Market Insights

3.1 Adhesives and Sealants Market Trends to 2034

3.2 Future Opportunities in Adhesives and Sealants Market

3.3 Dominant Applications of Adhesives and Sealants, 2024 Vs 2034

3.4 Key Types of Adhesives and Sealants, 2024 Vs 2034

3.5 Leading End Uses of Adhesives and Sealants Market, 2024 Vs 2034

3.6 High Prospect Countries for Adhesives and Sealants Market, 2024 Vs 2034

4. Adhesives and Sealants Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Adhesives and Sealants Market

4.2 Key Factors Driving the Adhesives and Sealants Market Growth

4.2 Major Challenges to the Adhesives and Sealants industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Adhesives and Sealants supply chain

5 Five Forces Analysis for Global Adhesives and Sealants Market

5.1 Adhesives and Sealants Industry Attractiveness Index, 2024

5.2 Adhesives and Sealants Market Threat of New Entrants

5.3 Adhesives and Sealants Market Bargaining Power of Suppliers

5.4 Adhesives and Sealants Market Bargaining Power of Buyers

5.5 Adhesives and Sealants Market Intensity of Competitive Rivalry

5.6 Adhesives and Sealants Market Threat of Substitutes

6. Global Adhesives and Sealants Market Data – Industry Size, Share, and Outlook

6.1 Adhesives and Sealants Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Adhesives and Sealants Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Adhesives and Sealants Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Adhesives and Sealants Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Adhesives and Sealants Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Adhesives and Sealants Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Adhesives and Sealants Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Adhesives and Sealants Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Adhesives and Sealants Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Adhesives and Sealants Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Adhesives and Sealants Analysis and Forecast to 2034

7.5.2 Japan Adhesives and Sealants Analysis and Forecast to 2034

7.5.3 India Adhesives and Sealants Analysis and Forecast to 2034

7.5.4 South Korea Adhesives and Sealants Analysis and Forecast to 2034

7.5.5 Australia Adhesives and Sealants Analysis and Forecast to 2034

7.5.6 Indonesia Adhesives and Sealants Analysis and Forecast to 2034

7.5.7 Malaysia Adhesives and Sealants Analysis and Forecast to 2034

7.5.8 Vietnam Adhesives and Sealants Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Adhesives and Sealants Industry

8. Europe Adhesives and Sealants Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Adhesives and Sealants Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Adhesives and Sealants Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Adhesives and Sealants Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Adhesives and Sealants Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Adhesives and Sealants Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Adhesives and Sealants Market Size and Outlook to 2034

8.5.3 2024 France Adhesives and Sealants Market Size and Outlook to 2034

8.5.4 2024 Italy Adhesives and Sealants Market Size and Outlook to 2034

8.5.5 2024 Spain Adhesives and Sealants Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Adhesives and Sealants Market Size and Outlook to 2034

8.5.7 2024 Russia Adhesives and Sealants Market Size and Outlook to 2034

8.6 Leading Companies in Europe Adhesives and Sealants Industry

9. North America Adhesives and Sealants Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Adhesives and Sealants Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Adhesives and Sealants Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Adhesives and Sealants Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Adhesives and Sealants Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Adhesives and Sealants Market Analysis and Outlook

9.5.2 Canada Adhesives and Sealants Market Analysis and Outlook

9.5.3 Mexico Adhesives and Sealants Market Analysis and Outlook

9.6 Leading Companies in North America Adhesives and Sealants Business

10. Latin America Adhesives and Sealants Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Adhesives and Sealants Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Adhesives and Sealants Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Adhesives and Sealants Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Adhesives and Sealants Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Adhesives and Sealants Market Analysis and Outlook to 2034

10.5.2 Argentina Adhesives and Sealants Market Analysis and Outlook to 2034

10.5.3 Chile Adhesives and Sealants Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Adhesives and Sealants Industry

11. Middle East Africa Adhesives and Sealants Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Adhesives and Sealants Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Adhesives and Sealants Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Adhesives and Sealants Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Adhesives and Sealants Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Adhesives and Sealants Market Outlook

11.5.2 Egypt Adhesives and Sealants Market Outlook

11.5.3 Saudi Arabia Adhesives and Sealants Market Outlook

11.5.4 Iran Adhesives and Sealants Market Outlook

11.5.5 UAE Adhesives and Sealants Market Outlook

11.6 Leading Companies in Middle East Africa Adhesives and Sealants Business

12. Adhesives and Sealants Market Structure and Competitive Landscape

12.1 Key Companies in Adhesives and Sealants Business

12.2 Adhesives and Sealants Key Player Benchmarking

12.3 Adhesives and Sealants Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Adhesives and Sealants Market

14.1 Adhesives and Sealants trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Adhesives and Sealants Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Adhesives and Sealants Market is estimated to generate USD 84.3 billion in revenue in 2025

The Global Adhesives and Sealants Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.89% during the forecast period from 2025 to 2034.

The Adhesives and Sealants Market is estimated to reach USD 133.7 billion by 2034.

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!