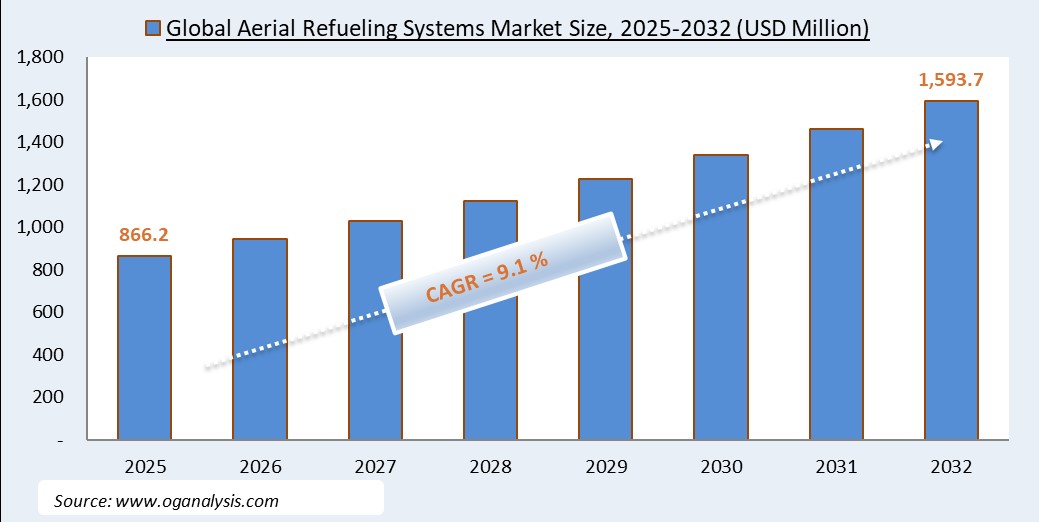

"The Global Aerial Refueling Systems Market is valued at USD 866.25 Million in 2025. Worldwide sales of Aerial Refueling Systems Market are expected to grow at a significant CAGR of 9.1%, reaching USD 1593.74 Million by the end of the forecast period in 2032."

Aerial Refueling Systems Market Overview

The aerial refueling systems market plays a crucial role in modern military and defense operations, enabling extended flight endurance and operational range for aircraft. Aerial refueling, also known as air-to-air refueling (AAR), is a critical capability for air forces worldwide, allowing aircraft to stay airborne longer, conduct extended missions, and reduce the need for ground refueling stops. The market encompasses various refueling systems, including probe-and-drogue, boom refueling, and autonomous refueling technologies. As geopolitical tensions rise and defense budgets increase, countries are investing heavily in upgrading their aerial refueling capabilities to enhance their air force’s operational readiness. The demand for tanker aircraft, advanced refueling pods, and automated refueling systems has surged, particularly in the U.S., Europe, and Asia-Pacific. Technological advancements, such as smart refueling systems with real-time data integration and enhanced fuel efficiency, are also shaping the market landscape. Furthermore, commercial applications, including aerial refueling for unmanned aerial vehicles (UAVs), are gaining traction, expanding the scope of the market beyond military operations.

In 2024, the aerial refueling systems market has witnessed significant developments driven by increased defense spending and modernization programs across major military forces. Several countries have ramped up procurement of next-generation tanker aircraft, with a focus on enhancing fuel transfer efficiency and operational flexibility. The integration of advanced automation technologies, such as AI-driven fuel management and automated refueling booms, has improved safety and precision in refueling operations. Additionally, multinational defense collaborations have fueled market expansion, with joint development programs and strategic alliances driving innovation. The growing demand for multi-role tanker transport aircraft, which offer both refueling and cargo transport capabilities, has further shaped industry trends. In the commercial aviation sector, interest in UAV refueling systems has intensified, with research initiatives exploring autonomous aerial refueling for long-endurance drones. However, supply chain constraints and regulatory challenges have posed hurdles, affecting the timely delivery of new tanker aircraft and refueling components. Despite these challenges, the market remains resilient, with strong demand from both established and emerging military forces.

Looking ahead to 2025 and beyond, the aerial refueling systems market is expected to undergo rapid evolution with the introduction of next-generation autonomous refueling technologies. AI-powered refueling drones, enhanced sensor integration, and real-time communication networks will transform how aerial refueling operations are conducted. The development of fully autonomous refueling pods, capable of adjusting fuel transfer rates dynamically based on aircraft needs, is anticipated to enhance operational efficiency. Furthermore, hybrid-electric and sustainable aviation fuel (SAF) initiatives will influence the market as governments push for greener defense solutions. The growing role of space-based surveillance and long-range strike capabilities will drive further investments in aerial refueling infrastructure to support extended missions. In addition, regional defense partnerships in Asia-Pacific, the Middle East, and NATO countries will boost the market as nations collaborate on shared tanker programs. The industry is also expected to see advancements in 3D printing and lightweight materials for refueling components, reducing operational costs and improving performance. With continued technological advancements and strategic investments, the aerial refueling systems market is poised for sustained growth, shaping the future of air combat and strategic mobility.

Market Segmentation

- By Refueling System Type:

- Probe-and-Drogue

- Flying Boom

- Autonomous Refueling

- By Component:

- Refueling Pods

- Fuel Tanks

- Hoses

- Booms

- Valves

- Nozzles

- By Aircraft Type:

- Tanker Aircraft

- Receiver Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Combat Aircraft

- Transport Aircraft

- By End-User:

- Military

- Commercial Aviation

- Unmanned Systems

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of Asia-Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (GCC, South Africa, Rest of MEA)

Major Players in the Aerial Refueling Systems Market

- Boeing

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Corporation

- Embraer S.A.

- General Dynamics Corporation

- Draken International

- Eaton Corporation

- GE Aviation

- Cobham Limited

- BAE Systems plc

- Parker Hannifin Corporation

- Marshall Aerospace and Defence Group

- Safran S.A.

- L3Harris Technologies, Inc.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Aerial Refueling Systems Market Latest Trends, Drivers and Challenges, 2024 - 2032

2.1 Aerial Refueling Systems Market Overview

2.2 Market Strategies of Leading Aerial Refueling Systems Companies

2.3 Aerial Refueling Systems Market Insights, 2024 - 2032

2.3.1 Leading Aerial Refueling Systems Types, 2024 - 2032

2.3.2 Leading Aerial Refueling Systems End-User industries, 2024 - 2032

2.3.3 Fast-Growing countries for Aerial Refueling Systems sales, 2024 - 2032

2.4 Aerial Refueling Systems Market Drivers and Restraints

2.4.1 Aerial Refueling Systems Demand Drivers to 2032

2.4.2 Aerial Refueling Systems Challenges to 2032

2.5 Aerial Refueling Systems Market- Five Forces Analysis

2.5.1 Aerial Refueling Systems Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Aerial Refueling Systems Market Value, Market Share, and Forecast to 2032

3.1 Global Aerial Refueling Systems Market Overview, 2024

3.2 Global Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

3.3 Global Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

3.3.1 Probe-and-Drogue

3.3.2 Flying Boom

3.3.3 Autonomous Refueling

3.4 Global Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

3.4.1 Refueling Pods

3.4.2 Fuel Tanks

3.4.3 Hoses

3.4.4 Booms

3.4.5 Valves

3.4.6 Nozzles

3.5 Global Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

3.5.1 Tanker Aircraft

3.5.2 Receiver Aircraft

3.5.3 Unmanned Aerial Vehicles (UAVs)

3.5.4 Combat Aircraft

3.5.5 Transport Aircraft

3.6 Global Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

3.6.1 Military

3.6.2 Commercial Aviation

3.6.3 Unmanned Systems

3.7 Global Aerial Refueling Systems Market Size and Share Outlook by Region, 2024 - 2032

4. Asia Pacific Aerial Refueling Systems Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Aerial Refueling Systems Market Overview, 2024

4.2 Asia Pacific Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

4.3 Asia Pacific Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

4.4 Asia Pacific Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

4.5 Asia Pacific Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

4.6 Asia Pacific Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

4.7 Asia Pacific Aerial Refueling Systems Market Size and Share Outlook by Country, 2024 - 2032

4.8 Key Companies in Asia Pacific Aerial Refueling Systems Market

5. Europe Aerial Refueling Systems Market Value, Market Share, and Forecast to 2032

5.1 Europe Aerial Refueling Systems Market Overview, 2024

5.2 Europe Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

5.3 Europe Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

5.4 Europe Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

5.5 Europe Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

5.6 Europe Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

5.7 Europe Aerial Refueling Systems Market Size and Share Outlook by Country, 2024 - 2032

5.8 Key Companies in Europe Aerial Refueling Systems Market

6. North America Aerial Refueling Systems Market Value, Market Share and Forecast to 2032

6.1 North America Aerial Refueling Systems Market Overview, 2024

6.2 North America Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

6.3 North America Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

6.4 North America Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

6.5 North America Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

6.6 North America Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

6.7 North America Aerial Refueling Systems Market Size and Share Outlook by Country, 2024 - 2032

6.8 Key Companies in North America Aerial Refueling Systems Market

7. South and Central America Aerial Refueling Systems Market Value, Market Share and Forecast to 2032

7.1 South and Central America Aerial Refueling Systems Market Overview, 2024

7.2 South and Central America Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

7.3 South and Central America Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

7.4 South and Central America Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

7.5 South and Central America Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

7.6 South and Central America Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

7.7 South and Central America Aerial Refueling Systems Market Size and Share Outlook by Country, 2024 - 2032

7.8 Key Companies in South and Central America Aerial Refueling Systems Market

8. Middle East Africa Aerial Refueling Systems Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Aerial Refueling Systems Market Overview, 2024

8.2 Middle East and Africa Aerial Refueling Systems Market Revenue and Forecast, 2024 - 2032 (US$ Million)

8.3 Middle East Africa Aerial Refueling Systems Market Size and Share Outlook By Refueling System Type, 2024 - 2032

8.4 Middle East Africa Aerial Refueling Systems Market Size and Share Outlook By Component, 2024 - 2032

8.5 Middle East Africa Aerial Refueling Systems Market Size and Share Outlook By Aircraft Type, 2024 - 2032

8.6 Middle East Africa Aerial Refueling Systems Market Size and Share Outlook By End-User, 2024 - 2032

8.7 Middle East Africa Aerial Refueling Systems Market Size and Share Outlook by Country, 2024 - 2032

8.8 Key Companies in Middle East Africa Aerial Refueling Systems Market

9. Aerial Refueling Systems Market Structure

9.1 Key Players

9.2 Aerial Refueling Systems Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Aerial Refueling Systems Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Aerial Refueling Systems Market is estimated to generate USD 866.25 Million revenue in 2025.

The Global Aerial Refueling Systems Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% during the forecast period from 2025 to 2032.

By 2032, the Aerial Refueling Systems Market is estimated to account for USD 1593.74 Million.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!