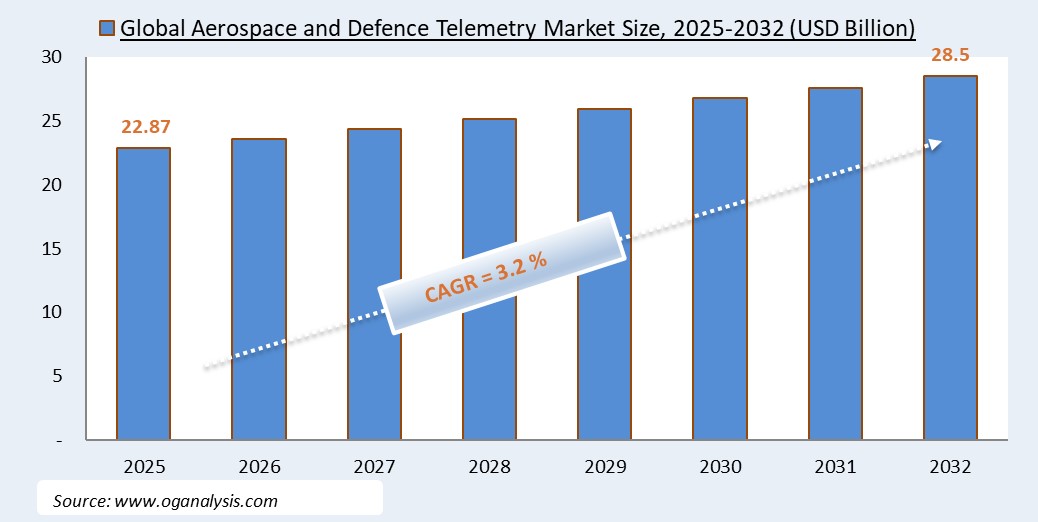

"The Global Aerospace and Defence Telemetry Market is valued at USD 22.87 Billion in 2025. Worldwide sales of Aerospace and Defence Telemetry Market are expected to grow at a significant CAGR of 3.2%, reaching USD 28.51 Billion by the end of the forecast period in 2032."

The Aerospace and Defence Telemetry Market is experiencing significant expansion as the demand for real-time data acquisition and analysis continues to grow across military, space, and aviation sectors. Telemetry systems collect, transmit, and analyze vital information from airborne, ground, and naval platforms to monitor performance, environmental parameters, and system health. This data is critical during missile tests, live-fly exercises, spacecraft launches, and fighter jet operations to ensure mission success and safety. Market drivers include increased defense budgets, advancements in satellite and UAV technologies, integration of IoT and AI in aerospace systems, and the shift towards digital twin models in aircraft development. Telemetry enhances situational awareness, predictive maintenance, and in-flight diagnostics, empowering operators with actionable insights and improving mission reliability, operational readiness, and cost-efficiency.

Major aerospace and defense contractors, telemetry equipment manufacturers, and system integrators are investing in high-bandwidth RF, satellite communication, software-defined radios, secure data links, and cloud-based ground stations. North America leads due to substantial defense R&D spending and space exploration initiatives, while Asia Pacific is witnessing rapid growth owing to new satellite programmes, military modernisation, and UAV deployments. The competitive landscape features partnerships between technology providers and government agencies to develop encrypted, IP-based telemetry systems with enhanced data security and bandwidth. However, challenges include spectrum congestion, cybersecurity threats, and high deployment costs. Looking ahead, market growth is projected through miniaturisation of telemetry units, adoption of advanced modulation techniques, integration with AI analytics, and expansion of satellite-based telemetry services for global low-latency coverage.

By Technology, the largest segment is Wireless Telemetry. This is because wireless telemetry offers flexible, real-time data transmission from airborne, naval, and ground-based platforms without the limitations of physical cabling, enabling its widespread adoption in aircraft flight tests, UAV operations, and missile telemetry for reliable, high-speed data acquisition.

By Application, the fastest-growing segment is Unmanned Aerial Vehicles (UAVs). The rapid growth is driven by increasing military and commercial UAV deployments globally, requiring advanced telemetry systems for real-time flight control, payload data transmission, surveillance, and mission-critical diagnostics to ensure safe and efficient operations.

Key Insights

- The aerospace and defence telemetry market is expanding due to growing demand for real-time data from flight tests, UAVs, missile systems, and space missions, enabling monitoring of critical parameters like engine performance, structural integrity, and environmental conditions.

- High-data-rate RF and IP-based telemetry systems dominate segment share by offering secure, low-latency, and reliable links for transmitting video, sensor, and diagnostic data from high-altitude and supersonic platforms.

- Satellite telemetry services are gaining momentum, especially in space launches and UAS beyond line-of-sight missions, to ensure continuous, global data connectivity across vast and remote operational areas.

- North America leads due to substantial defense R&D, private space projects, and established aerospace infrastructure, while Asia Pacific shows fastest growth driven by new satellite launches, UAV modernisation, and regional defence upgrades.

- Telemetry unit miniaturisation and weight reduction are key trends, facilitating integration in small UAVs, microsatellites, and guided munitions without compromising data throughput or mission flexibility.

- AI-driven analytics and predictive diagnostics are enabling telemetry systems to process complex datasets onboard or at ground stations, delivering actionable insights such as failure prediction and performance optimisation.

- Defense modernization programs are driving demand for secure, encrypted telemetry solutions that ensure data integrity and protection from cyber threats during live exercises and operational missions.

- Software-defined radios and agile SDR-based telemetry platforms are being adopted for frequency flexibility and interoperability across global military and commercial aerospace systems.

- Collaborations between telemetry OEMs, space agencies, and integrators are increasing, fostering joint development of next-gen systems supporting multi-mission flexibility, satellite control, and UAV swarm telemetry.

- Future market growth is expected through deployment of multi-band, high-throughput telemetry links, enhanced AI-based onboard processing, and satellite telemetry expansion to meet global low-latency communication needs.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Component, By Technology, By Application, By End User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

What You Receive

• Global Aerospace And Defence Telemetry market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Aerospace And Defence Telemetry.

• Aerospace And Defence Telemetry market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Aerospace And Defence Telemetry market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Aerospace And Defence Telemetry market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Aerospace And Defence Telemetry market, Aerospace And Defence Telemetry supply chain analysis.

• Aerospace And Defence Telemetry trade analysis, Aerospace And Defence Telemetry market price analysis, Aerospace And Defence Telemetry Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Aerospace And Defence Telemetry market news and developments.

The Aerospace And Defence Telemetry Market international scenario is well established in the report with separate chapters on North America Aerospace And Defence Telemetry Market, Europe Aerospace And Defence Telemetry Market, Asia-Pacific Aerospace And Defence Telemetry Market, Middle East and Africa Aerospace And Defence Telemetry Market, and South and Central America Aerospace And Defence Telemetry Markets. These sections further fragment the regional Aerospace And Defence Telemetry market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Aerospace And Defence Telemetry market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Aerospace And Defence Telemetry market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Aerospace And Defence Telemetry market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Aerospace And Defence Telemetry business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Aerospace And Defence Telemetry Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Aerospace And Defence Telemetry Pricing and Margins Across the Supply Chain, Aerospace And Defence Telemetry Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Aerospace And Defence Telemetry market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Aerospace and Defence Telemetry Market Latest Trends, Drivers and Challenges, 2024 - 2032

2.1 Aerospace and Defence Telemetry Market Overview

2.2 Market Strategies of Leading Aerospace and Defence Telemetry Companies

2.3 Aerospace and Defence Telemetry Market Insights, 2024 - 2032

2.3.1 Leading Aerospace and Defence Telemetry Types, 2024 - 2032

2.3.2 Leading Aerospace and Defence Telemetry End-User industries, 2024 - 2032

2.3.3 Fast-Growing countries for Aerospace and Defence Telemetry sales, 2024 - 2032

2.4 Aerospace and Defence Telemetry Market Drivers and Restraints

2.4.1 Aerospace and Defence Telemetry Demand Drivers to 2032

2.4.2 Aerospace and Defence Telemetry Challenges to 2032

2.5 Aerospace and Defence Telemetry Market- Five Forces Analysis

2.5.1 Aerospace and Defence Telemetry Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Aerospace and Defence Telemetry Market Value, Market Share, and Forecast to 2032

3.1 Global Aerospace and Defence Telemetry Market Overview, 2024

3.2 Global Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

3.3 Global Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

3.3.1 Telemetry Transmitters

3.3.2 Receivers

3.3.3 Antennas

3.3.4 Sensors

3.3.5 Data Acquisition Systems

3.4 Global Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

3.4.1 Wired Telemetry

3.4.2 Wireless Telemetry

3.4.3 Satellite Telemetry

3.5 Global Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

3.5.1 Missile Guidance and Testing

3.5.2 Flight Testing

3.5.3 Space Exploration

3.5.4 Unmanned Aerial Vehicles (UAVs)

3.5.5 Military and Defense Operations

3.6 Global Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

3.6.1 Defense Agencies

3.6.2 Space Agencies

3.6.3 Aerospace Manufacturers

3.6.4 Commercial Airlines

3.6.5 Research Institutions

3.7 Global Aerospace and Defence Telemetry Market Size and Share Outlook by Region, 2024 - 2032

4. Asia Pacific Aerospace and Defence Telemetry Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Aerospace and Defence Telemetry Market Overview, 2024

4.2 Asia Pacific Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

4.3 Asia Pacific Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

4.4 Asia Pacific Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

4.5 Asia Pacific Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

4.6 Asia Pacific Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

4.7 Asia Pacific Aerospace and Defence Telemetry Market Size and Share Outlook by Country, 2024 - 2032

4.8 Key Companies in Asia Pacific Aerospace and Defence Telemetry Market

5. Europe Aerospace and Defence Telemetry Market Value, Market Share, and Forecast to 2032

5.1 Europe Aerospace and Defence Telemetry Market Overview, 2024

5.2 Europe Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

5.3 Europe Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

5.4 Europe Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

5.5 Europe Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

5.6 Europe Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

5.7 Europe Aerospace and Defence Telemetry Market Size and Share Outlook by Country, 2024 - 2032

5.8 Key Companies in Europe Aerospace and Defence Telemetry Market

6. North America Aerospace and Defence Telemetry Market Value, Market Share and Forecast to 2032

6.1 North America Aerospace and Defence Telemetry Market Overview, 2024

6.2 North America Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

6.3 North America Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

6.4 North America Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

6.5 North America Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

6.6 North America Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

6.7 North America Aerospace and Defence Telemetry Market Size and Share Outlook by Country, 2024 - 2032

6.8 Key Companies in North America Aerospace and Defence Telemetry Market

7. South and Central America Aerospace and Defence Telemetry Market Value, Market Share and Forecast to 2032

7.1 South and Central America Aerospace and Defence Telemetry Market Overview, 2024

7.2 South and Central America Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

7.3 South and Central America Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

7.4 South and Central America Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

7.5 South and Central America Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

7.6 South and Central America Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

7.7 South and Central America Aerospace and Defence Telemetry Market Size and Share Outlook by Country, 2024 - 2032

7.8 Key Companies in South and Central America Aerospace and Defence Telemetry Market

8. Middle East Africa Aerospace and Defence Telemetry Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Aerospace and Defence Telemetry Market Overview, 2024

8.2 Middle East and Africa Aerospace and Defence Telemetry Market Revenue and Forecast, 2024 - 2032 (US$ Million)

8.3 Middle East Africa Aerospace and Defence Telemetry Market Size and Share Outlook By Component, 2024 - 2032

8.4 Middle East Africa Aerospace and Defence Telemetry Market Size and Share Outlook By Technology, 2024 - 2032

8.5 Middle East Africa Aerospace and Defence Telemetry Market Size and Share Outlook By Application, 2024 - 2032

8.6 Middle East Africa Aerospace and Defence Telemetry Market Size and Share Outlook By End-User, 2024 - 2032

8.7 Middle East Africa Aerospace and Defence Telemetry Market Size and Share Outlook by Country, 2024 - 2032

8.8 Key Companies in Middle East Africa Aerospace and Defence Telemetry Market

9. Aerospace and Defence Telemetry Market Structure

9.1 Key Players

9.2 Aerospace and Defence Telemetry Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Aerospace and Defence Telemetry Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Aerospace and Defence Telemetry Market is estimated to generate USD 22.87 Billion revenue in 2025.

The Global Aerospace and Defence Telemetry Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period from 2025 to 2032.

By 2032, the Aerospace and Defence Telemetry Market is estimated to account for USD 28.51 Billion.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!