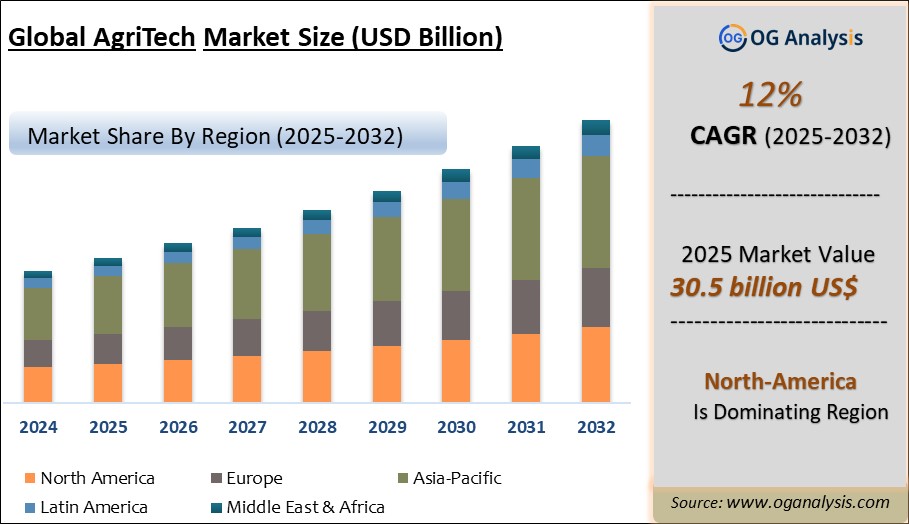

"Global Agritech Market is valued at USD 30.5 billion in 2025. Further, the market is expected to grow at a CAGR of 12% to reach USD 84.2 billion by 2034."

The Agritech Market is undergoing rapid transformation as the agriculture industry adopts advanced technologies to improve productivity, sustainability, and profitability. Agritech—short for agricultural technology—encompasses a broad range of innovations including precision farming, IoT sensors, AI-driven analytics, drones, robotics, smart irrigation, and digital supply chains. The sector is responding to global challenges such as climate change, resource scarcity, and rising food demand, pushing farmers and agribusinesses to modernize operations. Increased investments, supportive government policies, and growing startup ecosystems are accelerating the adoption of digital tools and data-driven solutions. Agritech is empowering both smallholders and large-scale producers to maximize yields, optimize resource use, and reduce environmental impact, reshaping how food is grown, managed, and distributed.

As the market expands, companies are focusing on interoperability, connectivity, and user-friendly platforms to drive greater farmer participation. The integration of cloud computing, big data, and artificial intelligence is enabling real-time monitoring, predictive modeling, and precise decision-making at every stage of the crop cycle. Agritech is also fostering financial inclusion through agri-fintech solutions, expanding access to credit and insurance. Startups are leveraging remote sensing and automation to tackle labor shortages and increase operational efficiency. While adoption varies by region, the ongoing digital transformation is creating new revenue streams and business models, positioning agritech as a key enabler of food security and sustainable development for future generations.

Big data and analytics is the fastest-growing segment in the agritech market, driven by the need for actionable insights to enhance farm productivity, resource allocation, and risk management. The ability to collect, process, and analyze vast amounts of agricultural data empowers growers to make data-driven decisions, optimize yields, and adapt quickly to changing environmental and market conditions.

Production and maintenance is the largest application segment, as most agritech adoption focuses on improving crop management, machinery performance, and overall farm operations. Technologies that streamline planting, fertilization, pest control, and equipment upkeep deliver immediate value, making them essential for both smallholders and large-scale commercial farms seeking efficiency and profitability.

Agritech market- Key Insights

-

Precision agriculture and data-driven decision-making are at the core of agritech, enabling farmers to optimize planting, irrigation, and fertilization, which leads to higher yields, reduced input costs, and more efficient use of land and resources.

-

IoT sensors, drones, and satellite imagery provide real-time monitoring of crops, soil health, and weather patterns, empowering growers to detect problems early and respond proactively to environmental and pest threats.

-

Artificial intelligence and machine learning are increasingly used in crop modeling, yield forecasting, and automated farm management, driving predictive analytics and smarter allocation of resources.

-

The adoption of robotics and automation—such as autonomous tractors and harvesters—is reducing labor dependency and boosting efficiency, particularly in regions facing workforce shortages.

-

Smart irrigation and water management systems are gaining traction, helping farmers conserve water, reduce energy costs, and adapt to climate variability by delivering precise amounts of water based on actual plant needs.

-

Digital marketplaces and supply chain platforms are connecting producers with buyers, streamlining logistics, and providing greater price transparency, which benefits smallholders and enhances market access.

-

Agri-fintech solutions, including digital credit, insurance, and payment platforms, are promoting financial inclusion for rural communities and enabling investment in new technologies and inputs.

-

Vertical farming and controlled environment agriculture are emerging as high-growth segments, allowing food production in urban settings, reducing transportation costs, and improving year-round availability of fresh produce.

-

Government support through grants, subsidies, and regulatory reforms is accelerating agritech adoption, especially in regions aiming to improve food security and sustainable rural development.

-

Sustainability concerns and consumer demand for traceability are driving the use of blockchain and data platforms to ensure food safety, certification, and transparency from farm to table.

Report Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application and By Sector |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Big Data And Analytics

- Biotechnology And Biochemical

- Mobility

- Sensors And Connected Devices

- Other Types

By Application

- Production And Maintenance

- Irrigation

- Supply Chain

- Marketplace

- Other Applications

By Sector

- Precision Farming

- Agriculture

- Agrochemicals

- Smart Agriculture

- Biotechnology

- Indoor Farming

- Other Sectors

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- BASF SE

- Wilmar International Limited

- Bunge Limited

- Dow AgroSciences LLC

- Bayer Crop Science AG

- Deere & Company

- Nutrien Ltd.

- Syngenta Group AG

- Olam International Limited

- Yara International ASA

- CNH Industrial NV

- Sumitomo Chemical Company Limited

- Kubota Corporation

- The Mosaic Company

- Corteva Agriscience Inc.

- The Andersons Inc.

- Land O'Lakes Inc.

- Tractor Supply Company

- Ball Corporation

- Tetra Pak Group

- AGCO Corporation

- Darling Ingredients Inc.

- Calavo Growers Inc.

Recent Developments

In June 2025, a leading global agritech company launched a new AI-powered platform integrating satellite imagery, IoT sensors, and real-time analytics to help farmers optimize crop management and resource use across large-scale operations.

In May 2025, a major biotechnology firm introduced a next-generation bio-stimulant for crop yield enhancement, designed to improve resilience against drought and pests, with successful pilot programs in North America and Europe.

Earlier this year, a prominent agri-fintech startup secured substantial funding to expand its digital credit and insurance solutions for smallholder farmers, aiming to increase technology adoption and financial inclusion in emerging markets.

Recently, an international consortium of agritech firms and food retailers began a blockchain-powered supply chain project to ensure full traceability and transparency of produce from farm to supermarket shelves.

RR1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Agritech Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Agritech Market Overview

2.2 Agritech Market Developments

2.2.1 Agritech Market -Supply Chain Disruptions

2.2.2 Agritech Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Agritech Market -Price Development

2.2.4 Agritech Market -Regulatory and Compliance Management

2.2.5 Agritech Market -Consumer Expectations and Trends

2.2.6 Agritech Market -Market Structure and Competition

2.2.7 Agritech Market -Technological Adaptation

2.2.8 Agritech Market -Changing Retail Dynamics

2.3 Agritech Market Insights, 2025- 2034

2.3.1 Prominent Agritech Market product types, 2025- 2034

2.3.2 Leading Agritech Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Agritech Market sales, 2025- 2034

2.4 Agritech Market Drivers and Restraints

2.4.1 Agritech Market Demand Drivers to 2034

2.4.2 Agritech Market Challenges to 2034

2.5 Agritech Market- Five Forces Analysis

2.5.1 Agritech Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Agritech Market Value, Market Share, and outlook to 2034

3.1 Global Agritech Market Overview, 2025

3.2 Global Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Agritech Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Agritech Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Agritech Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Agritech Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Agritech Market Overview, 2025

4.2 Asia Pacific Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Agritech Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Agritech Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Agritech Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Agritech Market

5. Europe Agritech Market Value, Market Share, and Forecast to 2034

5.1 Europe Agritech Market Overview, 2025

5.2 Europe Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Agritech Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Agritech Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Agritech Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Agritech Market

6. North America Agritech Market Value, Market Share, and Forecast to 2034

6.1 North America Agritech Market Overview, 2025

6.2 North America Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Agritech Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Agritech Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Agritech Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Agritech Market

7. South and Central America Agritech Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Agritech Market Overview, 2025

7.2 South and Central America Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Agritech Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Agritech Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Agritech Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Agritech Market

8. Middle East Africa Agritech Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Agritech Market Overview, 2025

8.2 Middle East and Africa Agritech Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Agritech Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Agritech Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Agritech Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Agritech Market

9. Agritech Market Players Analysis

9.1 Agritech Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Agritech Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Agritech Market is estimated to reach USD 84.2 billion by 2034.

The Global Agritech Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12% during the forecast period from 2025 to 2034.

The Global Agritech Market is estimated to generate USD 30.5 billion in revenue in 2025.

$2900- 20%

$4350- 25%

$5800- 30%

$2150- 10%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!