"The Air Cargo Market was valued at $ 64.98 billion in 2025 and is projected to reach $ 106.17 billion by 2034, growing at a CAGR of 5.61%."

The air cargo market plays a vital role in global trade by facilitating the rapid transportation of goods across continents. It is a crucial enabler of international supply chains, supporting industries such as electronics, pharmaceuticals, automotive, perishables, and e-commerce. Air cargo offers unmatched speed and reliability compared to other transportation modes, making it the preferred choice for high-value and time-sensitive shipments. The sector benefits from continuous advancements in aircraft capacity, logistics infrastructure, and digital solutions, which are streamlining operations and enhancing efficiency. With globalization and growing cross-border commerce, air freight remains a cornerstone of international trade and a key contributor to economic development.

The market is undergoing significant transformation driven by digitalization, sustainability initiatives, and evolving customer expectations. Airlines and logistics companies are increasingly investing in green technologies, fuel-efficient aircraft, and smart cargo handling systems to meet regulatory requirements and reduce carbon footprints. Additionally, the rising prominence of e-commerce and express delivery services is pushing operators to expand capacity and adopt automation for faster and more secure cargo movement. Regional hubs are strengthening their infrastructure to serve as gateways for trade flows, while alliances and strategic partnerships are reshaping competitive dynamics. This evolving landscape positions the air cargo market for sustained growth while addressing challenges of cost optimization, regulatory compliance, and technological adaptation.

Trade Intelligence air cargo market

| Global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) , Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 66,239 | 65,280 | 75,113 | 99,233 | 1,01,324 |

| Ireland | 15,331 | 16,966 | 17,340 | 20,437 | 17,760 |

| United States of America | 10,227 | 8,990 | 8,067 | 8,977 | 12,523 |

| India | 1,114 | 396 | 2,725 | 10,522 | 11,351 |

| China | 6,731 | 9,936 | 8,151 | 8,051 | 8,871 |

| United Kingdom | 3,784 | 1,663 | 2,539 | 7,415 | 6,581 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- Ireland , United States of America , India , China and United Kingdom are the top five countries importing 56.3% of global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) in 2024

- Global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) Imports increased by 53% between 2020 and 2024

- Ireland accounts for 17.5% of global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) trade in 2024

- United States of America accounts for 12.4% of global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) trade in 2024

- India accounts for 11.2% of global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) trade in 2024

| Global Large powered aircraft >15,000 kg (excl. helicopters, dirigibles & drones) Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis, International Trade Centre (ITC) |

Key Market Insights

-

The air cargo market has become a central pillar of international trade, supporting fast and reliable transportation of high-value and time-sensitive goods. It facilitates the smooth flow of supply chains across industries such as pharmaceuticals, electronics, automotive, and fresh produce, ensuring global commerce remains uninterrupted.

-

E-commerce growth has emerged as one of the strongest drivers of air cargo demand, with retailers and logistics firms increasingly relying on air freight for last-mile delivery and cross-border shipments. This trend is pushing companies to enhance automation, digitization, and capacity expansion strategies.

-

Pharmaceutical and healthcare sectors represent a significant opportunity, especially for temperature-sensitive and time-critical goods like vaccines and biologics. Specialized air cargo solutions such as cold chain logistics are witnessing increased investment to maintain quality and compliance standards.

-

Sustainability is reshaping the industry, with airlines and logistics providers investing in fuel-efficient aircraft, biofuels, and carbon offset programs. Green initiatives are not only meeting regulatory mandates but also appealing to eco-conscious customers, strengthening the market’s long-term growth potential.

-

Technological innovations such as blockchain, AI-driven route optimization, and cargo tracking systems are improving transparency, reducing operational costs, and enhancing customer experience. Real-time data and predictive analytics are now integral to cargo operations and supply chain resilience.

-

Strategic alliances and partnerships between airlines, logistics companies, and e-commerce platforms are shaping the competitive landscape. Collaborative models help optimize capacity utilization, expand global reach, and deliver integrated services, creating synergies across value chains.

-

Regional hubs in Asia, Europe, and North America are strengthening their air cargo infrastructure, with airports investing in automation, digital cargo handling, and dedicated cargo terminals. These hubs act as gateways for growing international trade flows.

-

Geopolitical uncertainties, trade policy shifts, and fuel price volatility remain challenges influencing air cargo profitability and operational planning. Companies are adopting flexible business models and diversified trade routes to mitigate risks and ensure continuity.

-

Express and courier services are expanding as demand for same-day and next-day deliveries continues to rise. The market for express cargo is experiencing heightened competition, with players investing in technology and infrastructure to meet rising customer expectations.

-

The future outlook for the air cargo market is highly promising, with sustained growth driven by globalization, cross-border trade, and technology adoption. Despite challenges, ongoing investments in infrastructure, sustainability, and innovation ensure long-term resilience and profitability.

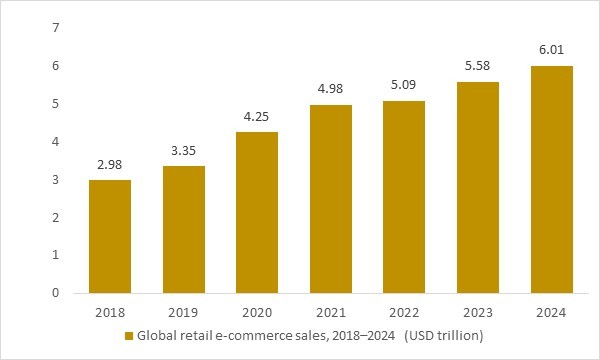

Global retail e-commerce sales, 2018–2024 (USD trillion)

Figure: Global retail e-commerce sales have roughly doubled between 2018 and 2024, reflecting the structural shift toward online retail and cross-border parcel flows. OG Analysis estimates, compiled from leading global e-commerce benchmarks, underline how sustained growth in high-value, time-sensitive online orders supports international air freight volumes, integrator networks and belly-hold capacity in the global air cargo market.

- From an air cargo market perspective, global retail e-commerce sales rising from about USD 2.98 trillion in 2018 to roughly USD 6.01 trillion in 2024 highlight a structural shift toward frequent, smaller, higher-value shipments that favour air over sea for long-haul and cross-border deliveries. This doubling of online spending has expanded integrator and postal parcel networks, driving demand for belly-hold capacity on passenger aircraft and dedicated freighters on key trade lanes. Even as e-commerce growth moderates post-pandemic, the elevated sales baseline underpins a stable base load of time-sensitive B2C and B2B flows that support air cargo yields. As a result, airlines, express carriers and cargo airports align their fleet, hub capacity and digital tracking investments closely with multi-year e-commerce growth expectations.

Report Scope

| Parameter | air cargo market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion/Million |

| Market Splits Covered | By Type ,By Service ,By Destination ,By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Air Cargo Market Segments Covered In The Report

By Type

- Air Mail

- Air Freight

By Service

- Express

- Regular

By Destination

- Domestic

- International

By End-User

- Consumer Electronics

- Retail

- Third Party Logistics

- Food And Beverages

- Pharmaceuticals And Healthcare

- Other End Users

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

Amazon.com Inc., China Railway Corporation, UPS Airlines, United Parcel Service Inc., Deutsche Post AG, FedEx Corporation, A.P. Møller-Mærsk A/S, United States Postal Service, American Airlines, Delta Airlines, United Airlines, Kuehne + Nagel International AG, The Emirates Group, Indian Railways, JSC Russian Railways, International Consolidated Airlines Group SA, Qatar Airways Company QCSC, LATAM Airlines, Japan Airlines Co. Ltd., Cathay Pacific Airways Limited, Cargolux Airlines International SA, China Airlines Ltd., Cargill Incorporated, Aeromexico Cargo, Gol Airlines, Azul Airlines, Magma Aviation Limited, China Airlines Cargo, South African Airways Cargo, Thai Airways Cargo

Recent Industry Developments

- August 2025 – Aerospace startup Grid Aero debuted the Lifter-Lite cargo drone, designed to fly thousands of miles with substantial payload capacity—offering a solution for remote or contested logistics and backed by a U.S. Air Force contract.

- July 2025 – China's regulator granted conditional approval for ANA Holdings to acquire Nippon Cargo Airlines, with safeguards to maintain competitive cargo ground handling at Tokyo-Narita and Osaka-Kansai airports, paving the way for expanded international operations.

- June 2025 – Delta Air Lines expanded its cargo strategy with "DeliverDirect," using unused belly space on passenger flights to offer tech-integrated, door-to-door e-commerce delivery via its SmartKargo platform, achieving lower-cost and high punctuality performance.

- June 2025 – AirZeta (formerly Air Incheon) took over Asiana Cargo operations, rebranding and absorbing a large freighter fleet to expand its international cargo network across Asia.

Available Customizations

The standard syndicate report is designed to serve the common interests of Air Cargo Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Air Cargo Pricing and Margins Across the Supply Chain, Air Cargo Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Air Cargo market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Air Cargo Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Air Cargo Market Overview

2.2 Market Strategies of Leading Air Cargo Companies

2.3 Air Cargo Market Insights, 2024 - 2034

2.3.1 Leading Air Cargo Types, 2024 - 2034

2.3.2 Leading Air Cargo End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Air Cargo sales, 2024 - 2034

2.4 Air Cargo Market Drivers and Restraints

2.4.1 Air Cargo Demand Drivers to 2034

2.4.2 Air Cargo Challenges to 2034

2.5 Air Cargo Market- Five Forces Analysis

2.5.1 Air Cargo Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Air Cargo Market Value, Market Share, and Forecast to 2034

3.1 Global Air Cargo Market Overview, 2024

3.2 Global Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

3.4 Global Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

3.5 Global Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

3.6 Global Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

3.7 Global Air Cargo Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Air Cargo Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Air Cargo Market Overview, 2024

4.2 Asia Pacific Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

4.4 Asia Pacific Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

4.5 Asia Pacific Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

4.6 Asia Pacific Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

4.7 Asia Pacific Air Cargo Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Air Cargo Market Value, Market Share, and Forecast to 2034

5.1 Europe Air Cargo Market Overview, 2024

5.2 Europe Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

5.4 Europe Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

5.5 Europe Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

5.6 Europe Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

5.7 Europe Air Cargo Market Size and Share Outlook by Country, 2024 - 2034

6. North America Air Cargo Market Value, Market Share and Forecast to 2034

6.1 North America Air Cargo Market Overview, 2024

6.2 North America Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

6.4 North America Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

6.5 North America Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

6.6 North America Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

6.7 North America Air Cargo Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Air Cargo Market Value, Market Share and Forecast to 2034

7.1 South and Central America Air Cargo Market Overview, 2024

7.2 South and Central America Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

7.4 South and Central America Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

7.5 South and Central America Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

7.6 South and Central America Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

7.7 South and Central America Air Cargo Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Air Cargo Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Air Cargo Market Overview, 2024

8.2 Middle East and Africa Air Cargo Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Air Cargo Market Size and Share Outlook By Type, 2024 - 2034

8.4 Middle East Africa Air Cargo Market Size and Share Outlook By Service, 2024 - 2034

8.5 Middle East Africa Air Cargo Market Size and Share Outlook By Destination, 2024 – 2034

8.6 Middle East Africa Air Cargo Market Size and Share Outlook By End-User, 2024 - 2034

8.7 Middle East Africa Air Cargo Market Size and Share Outlook by Country, 2024 - 2034

9. Air Cargo Market Structure

9.1 Key Players

9.2 Air Cargo Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Air Cargo Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Air Cargo Market is estimated to generate USD 64.98 billion in revenue in 2025.

The Global Air Cargo Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.61% during the forecast period from 2025 to 2034.

The Air Cargo Market is estimated to reach USD 106.17 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!