"Alfalfa Market is valued at $25.3 billion in 2025. Further, the market is expected to grow at a CAGR of 6.9% to reach $46.1 billion by 2034."

The Alfalfa Market is a significant sector within the agricultural industry, focusing on the production and distribution of alfalfa, a perennial flowering plant widely used as forage for livestock. This market encompasses a range of alfalfa products, including hay, pellets, and silage, each tailored to specific livestock feeding requirements and agricultural practices. The demand for high-quality alfalfa is driven by the increasing livestock production, the growing awareness of animal nutrition, and the need for sustainable agricultural practices. The market is characterized by diverse growing conditions, fluctuating weather patterns, and competitive pricing strategies. The focus is on delivering reliable, high-quality, and cost-effective alfalfa products that meet the demanding requirements of livestock producers. The integration of precision agriculture, sustainable farming practices, and improved forage processing technologies is transforming the alfalfa market.

In 2024, the Alfalfa Market witnessed a significant push towards precision agriculture and sustainable farming practices. There was a noticeable increase in the adoption of GPS-guided equipment and sensor-based monitoring, improving the efficiency and accuracy of alfalfa cultivation. Farmers focused on developing sustainable farming practices, reducing water consumption and soil erosion. The integration of improved forage processing technologies, enhancing the nutritional value and digestibility of alfalfa, improved the quality of livestock feed. Furthermore, there was a growing emphasis on developing drought-resistant alfalfa varieties, adapting to changing climate conditions. The development of customized alfalfa products, tailored to specific livestock feeding requirements and nutritional needs, also saw increased investment. The use of data analytics platforms, enabling real-time monitoring and performance optimization, improved the efficiency of alfalfa production.

Looking ahead to 2025 and beyond, the Alfalfa Market is expected to experience continued growth and innovation, driven by the increasing demand for sustainable and high-quality livestock feed. We anticipate further advancements in AI-powered crop management, optimizing irrigation and fertilization practices. The integration of biotechnology techniques will enable the development of improved alfalfa varieties, with enhanced nutritional content and disease resistance. There will be a greater focus on developing alfalfa products compatible with future livestock feeding systems, including precision feeding and automated feeding. The adoption of advanced sensor networks and data analytics will enable real-time monitoring and optimization of alfalfa production. Furthermore, the market will see increased collaboration between alfalfa producers, agricultural technology providers, and livestock farmers to develop integrated and optimized forage solutions. The integration of circular economy principles, focusing on waste reduction and resource recovery, will also become more prevalent, aligning with the industry's sustainability goals.

Key Insights

- Robust demand from dairy, beef, sheep, and equine sectors continues to anchor alfalfa consumption, as nutritionists value its high protein, fiber, and digestibility profile in total mixed rations. The shift from smallholder to commercial, large-scale livestock operations is reinforcing standardized use of dehydrated bales, pellets, and cubes. This structural linkage to animal protein and dairy demand makes alfalfa closely tied to long-term growth in food and nutrition needs.

- Water availability, climate variability, and competition with other irrigated crops are key historic and future constraints shaping alfalfa acreage. Recurring drought episodes and stricter water regulations in major producing regions are pushing producers toward higher-efficiency irrigation systems and more precise agronomy. These pressures are accelerating a move from low-value bulk hay to premium, higher-priced quality grades.

- International trade has become a central growth driver, with surplus-producing regions supplying alfalfa to countries facing forage deficits and land constraints. Long-term contracts between exporters and large commercial dairies or feedlot operators are increasingly common as buyers seek supply security. Trade policies, logistics capacity, and currency movements therefore play an outsized role in market development and pricing trends.

- Technological advances in seed genetics, including improved alfalfa varieties with higher yield potential, better stand persistence, and enhanced disease resistance, are reshaping production economics. Adoption of such varieties helps growers stabilize output under challenging climatic conditions and optimize quality traits like protein content and fiber digestibility. These innovations support more consistent quality for both domestic feed use and export markets.

- Growing emphasis on forage quality and ration optimization is driving demand for premium alfalfa segments, including dehydrated pellets, cubes, and high-grade hay with defined nutritional specifications. Feed mills and integrators increasingly require consistent analysis and traceability to support precision feeding programmes. This trend favors organized growers and processors who can standardize cutting schedules, curing, and storage practices.

- Sustainability, soil health, and regenerative agriculture narratives are elevating alfalfa’s role in crop rotations as a nitrogen-fixing legume. Integrating alfalfa into rotations can reduce synthetic fertilizer needs, improve soil structure, and support biodiversity, aligning with environmental and policy priorities. Over time, this positioning may secure policy incentives and enhance the crop’s attractiveness beyond purely feed economics.

- Diversification into value-added applications such as alfalfa-based protein concentrates, specialty feeds for pets and small animals, and niche organic segments is widening the market’s opportunity set. These emerging applications typically demand stricter quality controls and may carry higher margins than bulk commodity hay. As consumer interest in natural and plant-derived ingredients grows, alfalfa’s role in these specialty value chains is likely to expand.

- Logistics and storage infrastructure, including modern baling, compaction, warehousing, and port handling facilities, are critical enablers of cross-border alfalfa trade. Investments that improve loading efficiency and reduce spoilage help exporters maintain quality over long distances. As importing regions tighten quality standards, superior supply-chain capabilities become a key competitive advantage for major suppliers.

- Policy frameworks related to agricultural support, export facilitation, and environmental regulation significantly influence the economics of alfalfa production and trade. Subsidies or incentives for forage production, infrastructure, and water-efficient technologies can stimulate acreage and modernization. Conversely, tightening environmental or water-use rules can constrain expansion and push producers toward more intensive, higher-value production models.

- Digitalization and data-driven farm management are gradually entering alfalfa value chains through precision farming tools, remote sensing, and yield mapping. These technologies allow producers to monitor crop health, optimize cutting schedules, and better match supply to quality requirements of different customer segments. Over the longer term, integration of digital platforms between growers, traders, and feed users could enhance transparency, forecastability, and risk management across the alfalfa market.

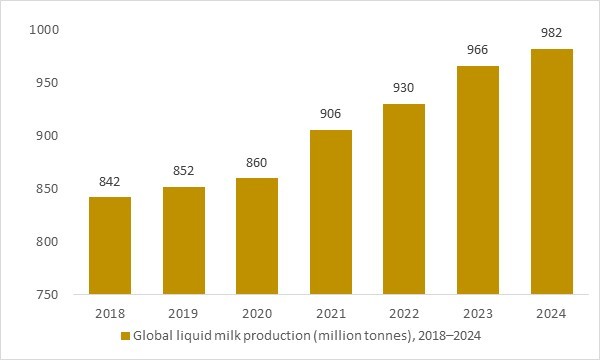

Global liquid milk production (million tonnes), 2018–2024

Figure: Global liquid milk production increased from around 840 million tonnes in 2018 to nearly 1 billion tonnes in 2024. As dairy herds expand and production systems intensify, this rising milk output directly underpins demand for high-quality alfalfa hay, pellets and cubes, reinforcing the long-term growth fundamentals of the alfalfa market.

- Global milk production rose steadily from 2018 to 2024, reflecting the expansion of dairy herds and intensive feeding practices worldwide. As high-yield dairy systems increasingly rely on protein-rich forages, this upward trend directly strengthens demand for alfalfa hay, pellets and cubes, underscoring its essential role in maintaining milk quality, animal health and sustainable productivity in the global alfalfa market.

Regional Insights

North America Alfalfa market

North America is the core production and export hub for the alfalfa market, driven by large-scale dairy, beef, and equine industries in the United States and Canada. Extensive irrigated acreage, mechanized harvesting, and well-developed dehydration and baling infrastructure support consistent volumes and a wide range of grades for domestic and export use. The region supplies significant alfalfa hay and cubes to key importers in Asia, helping stabilize prices and improve capacity utilization for major growers and exporters. At the same time, recurring droughts, competition for irrigation water, and rising input costs are pushing producers toward more efficient irrigation systems, precision agriculture, and higher-value premium grades. Policy support for forage exports, logistics investments in ports and rail, and a strong network of cooperatives and merchant exporters underpin North America’s continued leadership in the global alfalfa trade.

Asia-Pacific Alfalfa market

Asia-Pacific is the fastest-growing consumer region for alfalfa, propelled by rapid expansion of commercial dairy, feedlot, and high-value livestock operations in China, Japan, South Korea, and parts of Southeast Asia. Limited local forage availability in several markets, combined with land and water constraints, makes the region heavily dependent on imported alfalfa hay and pellets from North America, Europe, and Australia. Rising demand for high-quality milk, meat, and premium animal products is pushing large farms and integrators to standardize rations using alfalfa as a key protein and fiber component. Governments in some countries are promoting domestic forage production and improved pasture management, but structural deficits in quality roughage continue to support steady import growth. Investments in port handling, inland logistics, and feed-milling capacity, alongside long-term supply contracts with global exporters, are reinforcing Asia-Pacific’s role as a strategic demand center for the alfalfa market.

Europe Alfalfa market

In Europe, the alfalfa market is closely linked to intensive dairy, beef, and small ruminant production, with Mediterranean countries such as Spain, Italy, and France playing a prominent role in cultivation and dehydration. Dehydrated alfalfa pellets and bales are widely used in compound feed and total mixed rations, benefiting from consistent nutritional profiles and year-round availability. Environmental regulations, Common Agricultural Policy reforms, and stricter water-use rules are reshaping cropping decisions, encouraging more efficient irrigation and crop rotations that integrate alfalfa as a soil-improving legume. European producers increasingly target both regional feed manufacturers and export markets in North Africa and the Middle East, leveraging proximity and established trade relationships. Sustainability certifications, traceability, and a focus on high-fiber, high-protein forage products are becoming key differentiators for European alfalfa suppliers.

Report Scope

| Parameter | Alfalfa Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type

- Pellets

- Hay

- Cubes

- Other Product Type

By Animal Type

- Cattle

- Horses

- Other Animal Type

By Application

- Animal Feed

- Forage

- Biofuel

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Alfalfa Monegros SL

- Anderson Hay & Grain Co Inc.

- Standlee Premium Products LLC

- Green Prairie International Inc.

- SL Follen Company

- Bailey Farms Inc.

- HayKingdom Inc.

- Cubeit Hay Company

- McCracken Hay Company

- Border Valley

- Carli Group

- M&C Hay

- Al Dahra ACX Global Inc.

- La Crosse Forage And Turf Seeds

- Limagrain Holdings SAS

- Monsanto Company

- Syngenta AG

- CHS Inc.

- Riverina Pty. Ltd.

- Standlee Hay Company

- Dairyland Seed Co. Inc.

- Allied Seed LLC

- Ampac Seed Company

- Bayer AG

- Corteva Inc.

- DLF Seeds A/S

- KWS SAAT SE & Co. KGaA

- Land O'Lakes Inc.

- NAFOSA

- California Alfalfa Products Inc.

Recent Industry Developments

-

Dec 2025 – DLF North America: Launched the “We Love Alfalfa” campaign and an education-focused microsite to promote alfalfa’s value in livestock nutrition and sustainability. The initiative also spotlights DLF’s investment in alfalfa genetics and grower support.

-

Sep 2025 – Fondomonte (Argentina): Announced plans to build a second alfalfa dehydration and pressing plant in Córdoba (Tránsito), expanding capacity for export-grade dehydrated alfalfa. The investment supports higher-quality output and more consistent supply for international buyers.

-

Aug 2025 – Salar Farm LLP (Kazakhstan): Announced a new alfalfa processing plant covering artificial drying, baling, and pelletizing, designed to scale granulated alfalfa production for export markets. The project targets start-up in 2026 as Kazakhstan strengthens forage exports.

-

Apr 2025 – Al Dahra (UAE/Global forage producer): Joined the World Business Council for Sustainable Development (WBCSD), reinforcing its sustainability roadmap across forage crops (including alfalfa). The move aligns with broader efforts to improve climate-resilient sourcing and responsible production practices.

-

Sep 2024 – Millborn Seeds / Renovo Seed: Announced its 2025 elite alfalfa lineup, expanding offerings of trial-backed varieties and alfalfa–grass mixes. The release targets higher yield stability and better fit across diverse forage and livestock systems.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Alfalfa Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Alfalfa Market Overview

2.2 Alfalfa Market Developments

2.2.1 Alfalfa Market -Supply Chain Disruptions

2.2.2 Alfalfa Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Alfalfa Market -Price Development

2.2.4 Alfalfa Market -Regulatory and Compliance Management

2.2.5 Alfalfa Market -Consumer Expectations and Trends

2.2.6 Alfalfa Market -Market Structure and Competition

2.2.7 Alfalfa Market -Technological Adaptation

2.2.8 Alfalfa Market -Changing Retail Dynamics

2.3 Alfalfa Market Insights, 2025- 2034

2.3.1 Prominent Alfalfa Market product types, 2025- 2034

2.3.2 Leading Alfalfa Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Alfalfa Market sales, 2025- 2034

2.4 Alfalfa Market Drivers and Restraints

2.4.1 Alfalfa Market Demand Drivers to 2034

2.4.2 Alfalfa Market Challenges to 2034

2.5 Alfalfa Market- Five Forces Analysis

2.5.1 Alfalfa Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Alfalfa Market Value, Market Share, and outlook to 2034

3.1 Global Alfalfa Market Overview, 2025

3.2 Global Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Alfalfa Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Alfalfa Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Alfalfa Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Alfalfa Market Overview, 2025

4.2 Asia Pacific Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Alfalfa Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Alfalfa Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Alfalfa Market

5. Europe Alfalfa Market Value, Market Share, and Forecast to 2034

5.1 Europe Alfalfa Market Overview, 2025

5.2 Europe Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Alfalfa Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Alfalfa Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Alfalfa Market

6. North America Alfalfa Market Value, Market Share, and Forecast to 2034

6.1 North America Alfalfa Market Overview, 2025

6.2 North America Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Alfalfa Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Alfalfa Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Alfalfa Market

7. South and Central America Alfalfa Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Alfalfa Market Overview, 2025

7.2 South and Central America Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Alfalfa Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Alfalfa Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Alfalfa Market

8. Middle East Africa Alfalfa Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Alfalfa Market Overview, 2025

8.2 Middle East and Africa Alfalfa Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Alfalfa Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Alfalfa Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Alfalfa Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Alfalfa Market

9. Alfalfa Market Players Analysis

9.1 Alfalfa Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Alfalfa Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Alfalfa Market is estimated to generate USD 25.3 billion in revenue in 2025.

The Global Alfalfa Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period from 2025 to 2034.

The Alfalfa Market is estimated to reach USD 46.1 billion by 2034.

$2900- 30%

$4350- 40%

$5800- 50%

$2150- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!