"The Global Aquafeed Additives Market was valued at USD 2.33 billion in 2025 and is projected to reach USD 4.64 billion by 2034, growing at a CAGR of 7.96%."

The Aquafeed Additives Market is witnessing notable growth due to the rapid expansion of global aquaculture activities and the increasing demand for nutritionally balanced and sustainable aquatic feeds. These additives, which include amino acids, vitamins, enzymes, probiotics, and minerals, are vital in enhancing feed efficiency, boosting growth rates, and improving the immunity of aquatic species. Rising concerns over disease outbreaks, fluctuating raw material quality, and environmental sustainability have accelerated the shift toward functional and health-oriented aquafeed formulations. Governments and industry players are also advocating for reduced reliance on antibiotics, further driving the adoption of bioactive and natural feed additives in aquaculture systems worldwide.

Innovations in feed technology, including microencapsulation, slow-release delivery, and tailored additive blends for species-specific needs, are enhancing the efficiency and precision of additive usage. Producers are increasingly focusing on additives that not only improve animal performance but also contribute to water quality management and environmental protection. Asia-Pacific remains the dominant market, supported by large-scale fish farming operations, while Europe and North America are characterized by demand for premium and traceable feed products. The market outlook remains strong, with aquafeed additives poised to play a strategic role in meeting the nutritional needs of aquaculture and addressing global food security challenges.

Key Market Insights

- The increasing intensification of aquaculture production is driving demand for functional feed additives that promote health, enhance feed conversion, and improve growth performance. Additives such as enzymes, probiotics, and organic acids are being widely integrated into modern feed formulations to meet efficiency targets.

- Rising disease outbreaks in farmed fish and shrimp have led to heightened interest in immunostimulant additives. These include prebiotics, phytogenics, and nucleotides, which are being used to boost resistance to pathogens without relying on antibiotics, aligning with global regulatory and consumer expectations.

- Probiotics are witnessing widespread adoption in freshwater and marine aquaculture for their role in improving gut microbiota, nutrient absorption, and stress resistance. Their compatibility with sustainable farming practices is strengthening their market position globally.

- Enzymes, particularly phytase and protease, are gaining traction as they enable improved nutrient digestibility and reduce the environmental footprint by minimizing waste output. These benefits are crucial for farms targeting sustainable certification and eco-labels.

- Trace minerals and vitamins continue to be fundamental components of additive mixes, offering metabolic support and reproductive benefits. Innovations in chelated minerals and coated vitamin formulations are enhancing bioavailability and stability in aquatic environments.

- Asia-Pacific remains the largest regional consumer of aquafeed additives due to high aquaculture output in China, Vietnam, and India. Growth is fueled by both volume-based expansion and an increasing shift toward higher-quality, functional feeds.

- Europe is focusing on high-specification additive solutions tailored for salmonids and other cold-water species, with emphasis on feed efficiency, pigment enhancement, and disease control in controlled farming systems.

- North America is advancing in R&D-driven product development, particularly for additive applications in recirculating aquaculture systems (RAS) and sustainable offshore farming technologies. The region also shows strong demand for non-GMO and organic-certified additives.

- Companies are investing in encapsulation technologies to improve the delivery and stability of sensitive additives like essential oils and enzymes. This innovation is reducing losses during feed processing and ensuring targeted action post-ingestion.

- Stringent regulatory frameworks are pushing manufacturers toward cleaner, traceable, and standardized additive compositions. Transparency in feed labeling, sustainability certifications, and additive sourcing is becoming a competitive differentiator among global suppliers.

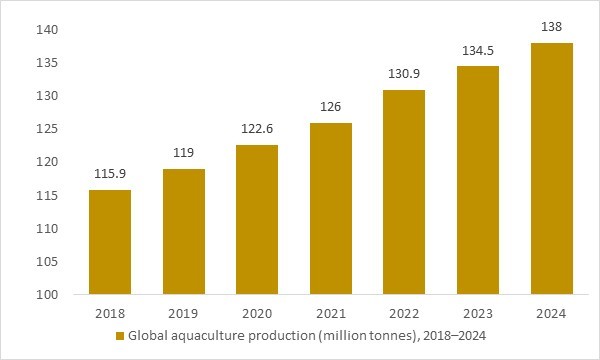

Global aquaculture production (million tonnes), 2018–2024

Figure: Global aquaculture production increased steadily between 2018 and 2024, adding millions of tonnes of farmed fish and shrimp. As producers intensify stocking densities and rely more on formulated compound feeds, this rising aquaculture base directly underpins demand for aquafeed additives, including enzymes, probiotics, pigments, organic acids and immune-supporting ingredients. OG Analysis estimates, derived from FAO and industry sources, highlight how sustained growth in aquaculture output supports the long-term expansion of the aquafeed additives market.

- Global aquaculture production rose consistently from 2018 to 2024, reflecting increasing volumes of farmed fish and shrimp entering the food supply chain. As aquaculture intensifies with higher stocking densities and greater reliance on formulated feeds, demand for functional aquafeed additives such as enzymes, probiotics, pigments and immune-supporting ingredients continues to accelerate, reinforcing long-term growth opportunities in the aquafeed additives market.

Regional Insights

North America Aquafeed Additives Market

North America’s aquafeed additives market is shaped by advanced aquaculture systems, strong regulatory frameworks, and rising demand for premium fish and shrimp products. Producers in the region are increasingly adopting feed additives that support sustainability, health, and traceability. Functional additives like enzymes, probiotics, and organic acids are widely incorporated to enhance growth rates and disease resistance in high-value species such as salmon and trout. There is a growing trend toward customized additive blends for specific farming environments, including recirculating aquaculture systems. Industry players are investing in R&D to develop clean-label and antibiotic-free additives, in line with evolving consumer preferences and animal welfare standards.

Asia-Pacific Aquafeed Additives Market

Asia-Pacific leads global aquafeed additive consumption due to the vast scale of aquaculture operations across countries like China, India, Vietnam, and Indonesia. The market is characterized by high-volume production and increasing focus on improving feed quality and efficiency. Additives such as phytogenics, enzymes, and vitamins are being utilized to support rapid growth, immunity, and stress management in diverse aquatic species. The region offers lucrative opportunities for additive manufacturers through expansion into rural markets, partnerships with local feed mills, and regulatory support for sustainable farming practices. Innovations in feed formulations and low-cost solutions tailored to regional farming systems are driving continuous market expansion.

Europe Aquafeed Additives Market

Europe’s aquafeed additives market reflects a mature and highly regulated environment focused on sustainability, efficiency, and traceability. Countries like Norway, Scotland, and Spain are emphasizing the use of precision nutrition and functional feed additives to improve fish health and reduce environmental impact. There is strong demand for organic-certified, non-GMO, and environmentally friendly additives, particularly in the salmon farming sector. The market is witnessing growth in encapsulated delivery systems and bioactive compounds that enhance gut health and nutrient utilization. Strategic collaborations between aquaculture companies and biotech firms are facilitating innovation in next-generation additives, positioning Europe as a leader in premium aquafeed solutions.

Report Scope

| Parameter | Aquafeed additives Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Aquafeed Additives Market Segments Covered In The Report

By Source

- Animal

- Microorganisms

- Plant

By Ingredient

- Anti-Parasitic

- Feed Acidifiers

- Prebiotics

- Essential Oils And Natural Extracts

- Palatants

- Other Ingredients

By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Grouper

- Other Application

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Aker Biomarine, Alltech, Biorigin, Kemin Industries Inc., Norel SA, BioMar Group A/S, Cargill Inc., DuPont de Nemours Inc., Nutreco NV, Nutriad Ltd., Calanus AS, Olmix Group, Lallemand Inc., Nouryon B. V., Delacon Biotech Nik Ges. m. b. H., Camlin Fine Sciences Ltd., Diana S. A. S., Aller Aqua A/S, Archer Daniels Midland Company, Ridley Corporation Ltd., Thai Union, Inve Aquaculture Inc., Growel Feeds Pvt. Ltd., BASF SE, Bluestar Adisseo Company, Wilbur-Ellis Nutrition LLC, Purina Animal Nutrition LLC, Koninklijke DSM N. V., Skretting, Clextral S. A. S., Trouw Nutrition LLC, Balchem Corporation, AquaBounty Technologies, Scoular, Nutra Blend LLC

Recent Industry Developments

- June 2025: MIAVIT GmbH and Arctic Feed Ingredients AS entered into a strategic partnership to launch the new Marfeed brand, offering scientifically developed, high-quality feed additives tailored for aquaculture needs.

- February 2025: Wittaya and Maverick Innovation formed a collaboration to support the commercialization and evaluation of innovative feed ingredients aimed at both aquaculture and poultry sectors, enhancing development pathways for novel additive technologies.

- February 2024: Innovafeed unveiled its new Hilucia™ brand, introducing insect-sourced protein and oil solutions specifically for aquaculture, reinforcing its leadership in sustainable and circular feed ingredient innovation.

- April 2023: Kemin AquaScience™ launched Pathorol™, a phytogenic feed additive designed to improve shrimp health, digestion, and hepatopancreas function in multiple Asian aquaculture markets.

- May 2024: Bluejais B.V. expanded into the aquaculture sector, unveiling in-feed and water treatment solutions designed to enhance shrimp and fish farm productivity while promoting sustainable pond management.

What You Receive

• Global Aquafeed Additives market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Aquafeed Additives.

• Aquafeed Additives market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Aquafeed Additives market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Aquafeed Additives market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Aquafeed Additives market, Aquafeed Additives supply chain analysis.

• Aquafeed Additives trade analysis, Aquafeed Additives market price analysis, Aquafeed Additives Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Aquafeed Additives market news and developments.

The Aquafeed Additives Market international scenario is well established in the report with separate chapters on North America Aquafeed Additives Market, Europe Aquafeed Additives Market, Asia-Pacific Aquafeed Additives Market, Middle East and Africa Aquafeed Additives Market, and South and Central America Aquafeed Additives Markets. These sections further fragment the regional Aquafeed Additives market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Aquafeed Additives Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Aquafeed Additives Market Overview

2.2 Market Strategies of Leading Aquafeed Additives Companies

2.3 Aquafeed Additives Market Insights, 2024 - 2034

2.3.1 Leading Aquafeed Additives Types, 2024 - 2034

2.3.2 Leading Aquafeed Additives End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Aquafeed Additives sales, 2024 - 2034

2.4 Aquafeed Additives Market Drivers and Restraints

2.4.1 Aquafeed Additives Demand Drivers to 2034

2.4.2 Aquafeed Additives Challenges to 2034

2.5 Aquafeed Additives Market- Five Forces Analysis

2.5.1 Aquafeed Additives Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Aquafeed Additives Market Value, Market Share, and Forecast to 2034

3.1 Global Aquafeed Additives Market Overview, 2024

3.2 Global Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

3.4 Global Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

3.5 Global Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

3.6 Global Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Aquafeed Additives Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Aquafeed Additives Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Aquafeed Additives Market Overview, 2024

4.2 Asia Pacific Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

4.4 Asia Pacific Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

4.5 Asia Pacific Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

4.6 Asia Pacific Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Aquafeed Additives Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Aquafeed Additives Market Value, Market Share, and Forecast to 2034

5.1 Europe Aquafeed Additives Market Overview, 2024

5.2 Europe Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

5.4 Europe Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

5.5 Europe Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

5.6 Europe Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Aquafeed Additives Market Size and Share Outlook by Country, 2024 - 2034

6. North America Aquafeed Additives Market Value, Market Share and Forecast to 2034

6.1 North America Aquafeed Additives Market Overview, 2024

6.2 North America Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

6.4 North America Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

6.5 North America Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

6.6 North America Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Aquafeed Additives Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Aquafeed Additives Market Value, Market Share and Forecast to 2034

7.1 South and Central America Aquafeed Additives Market Overview, 2024

7.2 South and Central America Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

7.4 South and Central America Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

7.5 South and Central America Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

7.6 South and Central America Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Aquafeed Additives Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Aquafeed Additives Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Aquafeed Additives Market Overview, 2024

8.2 Middle East and Africa Aquafeed Additives Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Aquafeed Additives Market Size and Share Outlook By Source, 2024 - 2034

8.4 Middle East Africa Aquafeed Additives Market Size and Share Outlook By Ingredient, 2024 - 2034

8.5 Middle East Africa Aquafeed Additives Market Size and Share Outlook By Application, 2024 – 2034

8.6 Middle East Africa Aquafeed Additives Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Aquafeed Additives Market Size and Share Outlook by Country, 2024 - 2034

9. Aquafeed Additives Market Structure

9.1 Key Players

9.2 Aquafeed Additives Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Aquafeed Additives Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Aquafeed Additives Market is estimated to generate USD 2.33 billion in revenue in 2025.

The Global Aquafeed Additives Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.96% during the forecast period from 2025 to 2034.

The Aquafeed Additives Market is estimated to reach USD 4.64 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!