"The Automotive Adaptive Cruise Control Market was valued at $22.54 billion in 2025 and is projected to reach $62.88 billion by 2034, growing at a CAGR of 12.08%."

The automotive adaptive cruise control (ACC) market is witnessing strong growth globally, driven by rising demand for advanced driver assistance systems (ADAS), increased vehicle safety awareness, and regulatory support for collision avoidance technologies. Adaptive cruise control is an intelligent driving system that automatically adjusts a vehicle's speed to maintain a safe following distance from vehicles ahead, utilizing sensors, radar, cameras, and onboard processors. Unlike conventional cruise control systems, ACC actively responds to changing traffic conditions by accelerating or braking as needed, enhancing comfort and reducing driver fatigue. Initially introduced in high-end vehicles, the technology is now being increasingly adopted in mid-range and even entry-level vehicles due to the falling costs of sensors and rising consumer expectations for safety and convenience features.

Market dynamics are also being shaped by the accelerating development of semi-autonomous and autonomous driving technologies, where ACC forms a foundational component of traffic-aware automation. Integration with systems like lane-keeping assist, automatic emergency braking, and traffic jam assist is expanding the functional capabilities of ACC modules across varied driving environments. Europe and North America have led early adoption, while Asia Pacific is emerging as a key growth region due to the surge in connected vehicle production and supportive safety mandates. As global OEMs and Tier 1 suppliers invest in radar miniaturization, AI-based control algorithms, and V2X communication, the adaptive cruise control market is set to evolve into an essential layer of next-generation intelligent mobility solutions.

Trade Intelligence automotive adaptive cruise control (ACC) market

| Global Radar apparatus , Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 5,131 | 6,028 | 6,579 | 7,553 | 7,699 |

| United States of America | 1,037 | 1,065 | 1,151 | 1,344 | 1,377 |

| Germany | 375 | 462 | 575 | 715 | 838 |

| Japan | 574 | 549 | 550 | 660 | 646 |

| United Kingdom | 187 | 286 | 425 | 623 | 617 |

| China | 277 | 453 | 429 | 387 | 528 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- United States of America , Germany , Japan , United Kingdom and China are the top five countries importing 52% of global Radar apparatus in 2024

- Global Radar apparatus Imports increased by 50.1% between 2020 and 2024

- United States of America accounts for 17.9% of global Radar apparatus trade in 2024

- Germany accounts for 10.9% of global Radar apparatus trade in 2024

- Japan accounts for 8.4% of global Radar apparatus trade in 2024

| Global Radar apparatus Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis, International Trade Centre (ITC) |

Key Market Insights

-

Adaptive cruise control systems are becoming a standard feature in modern vehicles, offering real-time speed and distance regulation by detecting surrounding traffic through radar, LiDAR, or camera-based sensors. This enhances highway safety and reduces driver fatigue on long journeys.

-

The integration of adaptive cruise control with other ADAS technologies such as lane centering, traffic jam assist, and collision avoidance is creating a comprehensive semi-autonomous driving experience, especially in congested urban and highway environments.

-

OEMs are rapidly expanding the inclusion of ACC in mid-segment vehicles, aided by the declining costs of radar sensors and advancements in embedded software. This democratization is driving broader market adoption across global passenger car fleets.

-

AI and machine learning are playing an increasing role in enhancing ACC functionality, enabling predictive behavior analysis and more accurate responses to complex traffic scenarios such as cut-ins, merging traffic, and stop-and-go conditions.

-

Asia Pacific is experiencing significant growth in ACC adoption, driven by strong automotive production, increasing safety regulations, and consumer demand for comfort and driver-assist technologies in new vehicle models across China, Japan, and South Korea.

-

Adaptive cruise control is being adapted for electric and hybrid vehicles, where smooth acceleration and deceleration patterns improve energy efficiency and regenerative braking performance supporting overall range optimization in electrified platforms.

-

Leading Tier 1 suppliers are developing compact, integrated radar modules that can be embedded behind body panels, improving vehicle aesthetics and reducing system complexity while supporting short-to-long-range detection capabilities for ACC systems.

-

Regulatory authorities in North America and Europe are increasingly promoting ACC as part of vehicle safety assessments, encouraging manufacturers to include such systems to meet evolving crash prevention and safety compliance standards.

-

ACC is evolving toward full traffic-aware cruise control with stop-and-go functionality, which allows vehicles to automatically come to a halt and resume movement in heavy traffic minimizing driver intervention and enhancing convenience in urban commuting.

-

Future developments in V2X (vehicle-to-everything) communication are expected to enhance adaptive cruise control systems by allowing vehicles to anticipate traffic behavior, adjust proactively, and coordinate with infrastructure to optimize flow and safety.

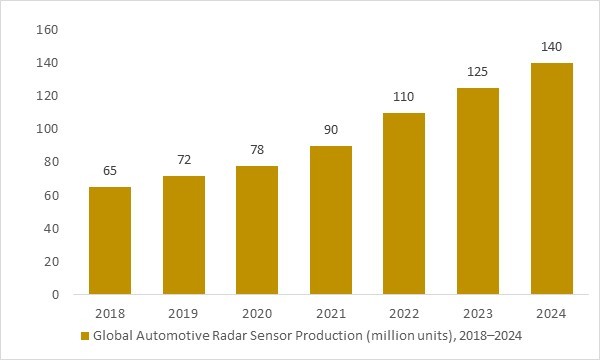

Global Automotive Radar Sensor Production (million units), 2018–2024

Figure:Global automotive radar sensor production has increased from about 65 million units in 2018 to an estimated 140 million units in 2024, underpinning wider deployment of adaptive cruise control and other ADAS features. OG Analysis estimates based on international automotive electronics sources.

- Global automotive radar sensor production has risen steadily from around 65 million units in 2018 to an estimated 140 million units in 2024, reflecting the rapid scale-up of core ADAS hardware across mainstream vehicle platforms. As radar serves as the foundational sensing layer for adaptive cruise control, this expansion in upstream component availability strengthens OEM capacity to standardize ACC across mid-segment models, enhances cost efficiencies, and underpins the long-term growth outlook for the Automotive Adaptive Cruise Control Market.

Regional Insights

North America Automotive Adaptive Cruise Control Market

North America remains a key market for automotive adaptive cruise control (ACC), supported by stringent safety regulations and strong consumer demand for driver assistance technologies. The region benefits from advanced automotive infrastructure, a high penetration of connected vehicles, and a mature ecosystem of ADAS-equipped car models. Companies offering AI-enhanced sensor fusion and integrated e-drive systems have fertile ground for innovation and market expansion. Growth is further propelled by demand in both passenger and commercial fleets seeking improved safety, fuel efficiency, and semi-autonomous capabilities.

Asia Pacific Automotive Adaptive Cruise Control Market

Asia Pacific is the fastest-growing region in the ACC space, driven by rapid urbanization, rising disposable income, and expansion of EV and connected car segments. Markets like China, Japan, South Korea, and India are seeing widespread adoption of ACC in both high-end and mass-market vehicles. Local manufacturers and suppliers investing in scalable, cost-effective ACC solutions especially radar- and camera-based systems are well-positioned to capitalize on the region’s booming vehicle production and increasing demand for safety and comfort.

Europe Automotive Adaptive Cruise Control Market

Europe presents a mature and innovation-rich environment for the ACC market, with strong regulatory support encouraging widespread adoption of advanced safety systems. Countries like Germany, France, and Italy lead in deploying AI-powered ACC features as part of comprehensive ADAS platforms. Suppliers offering cutting-edge technologies such as long-range radar, high-resolution cameras, and sensor fusion solutions aligned with evolving standards are poised to benefit. Ongoing investments in smart infrastructure and semi-autonomous capabilities continue to open opportunities for collaboration with OEMs and tech partners in the region.

Report Scope

| Parameter | automotive adaptive cruise control (ACC) market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Component ,By Technology ,By Mode Of Operation ,By Vehicle ,By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Automotive Adaptive Cruise Control Market Segments Covered In The Report

By Component

- LIN

- CAN

- ECU

- MCU

- Wire harness

By Technology

- RADAR Sensor

- LIDAR Sensor

By Mode Of Operation

- Normal Adaptive Cruise Control System

- Connected Adaptive Cruise Control System

By Vehicle

- Passenger Vehicle

- Commercial Vehicle

By Distribution Channel

- OEM

- Aftermarket

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Dow Chemical Company, 3M Acoustic Solutions, BASF SE, Covestro AG, Henkel Adhesives Technologies India Private Limited, LyondellBasell Industries Holdings B.V., Sumitomo Riko Co. Ltd., Sika AG, Rockwool A/S, Huntsman International LLC, Johns Manville, Saint-Gobain Ecophon AB, Harman International, Thomas Publishing Company, UFP Technologies Inc., Nihon Tokushu Toryo Co. Ltd., Knauf Insulation Ltd., Owens Corning, DuPont Automotive, ThyssenKrupp Automotive AG, Bridgestone Americas Inc., Metaldyne LLC, Detroit Diesel Corp., Alps Automotive Inc., American Showa Inc., Electrolux AB, LG Electroncis Inc., Miele & Cie. KG, Samsung Electronics Co. Ltd., Panasonic Corporation, Koninklijke Philips N.V., Shanghai Energy New Materials Technology Co. Ltd., Sinoma Science & Technology Co. Ltd., Cangzhou Mingzhu Plastic Co., Teijin Limited, Nitto Denko Corporation

Recent Industry Developments

-

February 2025: General Motors completed its full acquisition of Cruise, merging autonomous driving technology into its Super Cruise platform to expand hands‑off driving across over 750,000 miles of mapped roads, aiming to scale autonomy into urban environments.

-

February 2025: Stellantis introduced its STLA AutoDrive system, offering Level 2 (hands-on) and Level 2+ (hands-off, eyes-on) adaptive cruise control with seamless lane centering and smooth integration for elevated driver convenience.

-

May 2025: Cadillac’s new Optiq EV now includes advanced Super Cruise adaptive cruise control that can perform automatic lane changes and provide tactile alerts through seat bolsters for a more intuitive and immersive driving experience.

-

August 2025: Apple debuted CarPlay Ultra in partnership with Aston Martin, highlighting a future where adaptive cruise control systems can receive anticipatory speed guidance via Apple Maps, reducing driver interaction through dynamic visual cues.

-

January 2025: Rivian announced plans to launch an advanced hands-free driver assistance system in 2025, evolving toward an "eyes-off" system by 2026—positioning adaptive cruise control as a central feature in its autonomy roadmap.

Available Customizations

The standard syndicate report is designed to serve the common interests of Automotive Adaptive Cruise Control Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Automotive Adaptive Cruise Control Pricing and Margins Across the Supply Chain, Automotive Adaptive Cruise Control Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Automotive Adaptive Cruise Control market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Automotive Adaptive Cruise Control Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Automotive Adaptive Cruise Control Market Overview

2.2 Market Strategies of Leading Automotive Adaptive Cruise Control Companies

2.3 Automotive Adaptive Cruise Control Market Insights, 2024 - 2034

2.3.1 Leading Automotive Adaptive Cruise Control Types, 2024 - 2034

2.3.2 Leading Automotive Adaptive Cruise Control End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Automotive Adaptive Cruise Control sales, 2024 - 2034

2.4 Automotive Adaptive Cruise Control Market Drivers and Restraints

2.4.1 Automotive Adaptive Cruise Control Demand Drivers to 2034

2.4.2 Automotive Adaptive Cruise Control Challenges to 2034

2.5 Automotive Adaptive Cruise Control Market- Five Forces Analysis

2.5.1 Automotive Adaptive Cruise Control Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Automotive Adaptive Cruise Control Market Value, Market Share, and Forecast to 2034

3.1 Global Automotive Adaptive Cruise Control Market Overview, 2024

3.2 Global Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

3.4 Global Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

3.5 Global Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

3.6 Global Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

3.7 Global Automotive Adaptive Cruise Control Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Automotive Adaptive Cruise Control Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Automotive Adaptive Cruise Control Market Overview, 2024

4.2 Asia Pacific Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

4.4 Asia Pacific Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

4.5 Asia Pacific Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

4.6 Asia Pacific Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

4.7 Asia Pacific Automotive Adaptive Cruise Control Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Automotive Adaptive Cruise Control Market Value, Market Share, and Forecast to 2034

5.1 Europe Automotive Adaptive Cruise Control Market Overview, 2024

5.2 Europe Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

5.4 Europe Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

5.5 Europe Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

5.6 Europe Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

5.7 Europe Automotive Adaptive Cruise Control Market Size and Share Outlook by Country, 2024 - 2034

6. North America Automotive Adaptive Cruise Control Market Value, Market Share and Forecast to 2034

6.1 North America Automotive Adaptive Cruise Control Market Overview, 2024

6.2 North America Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

6.4 North America Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

6.5 North America Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

6.6 North America Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

6.7 North America Automotive Adaptive Cruise Control Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Automotive Adaptive Cruise Control Market Value, Market Share and Forecast to 2034

7.1 South and Central America Automotive Adaptive Cruise Control Market Overview, 2024

7.2 South and Central America Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

7.4 South and Central America Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

7.5 South and Central America Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

7.6 South and Central America Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

7.7 South and Central America Automotive Adaptive Cruise Control Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Automotive Adaptive Cruise Control Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Automotive Adaptive Cruise Control Market Overview, 2024

8.2 Middle East and Africa Automotive Adaptive Cruise Control Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Automotive Adaptive Cruise Control Market Size and Share Outlook By Component, 2024 - 2034

8.4 Middle East Africa Automotive Adaptive Cruise Control Market Size and Share Outlook By Technology, 2024 - 2034

8.5 Middle East Africa Automotive Adaptive Cruise Control Market Size and Share Outlook By Mode Of Operation, 2024 – 2034

8.6 Middle East Africa Automotive Adaptive Cruise Control Market Size and Share Outlook By Vehicle, 2024 - 2034

8.7 Middle East Africa Automotive Adaptive Cruise Control Market Size and Share Outlook by Country, 2024 - 2034

9. Automotive Adaptive Cruise Control Market Structure

9.1 Key Players

9.2 Automotive Adaptive Cruise Control Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Automotive Adaptive Cruise Control Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Automotive Adaptive Cruise Control Market is estimated to generate USD 22.54 billion in revenue in 2025.

The Global Automotive Adaptive Cruise Control Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.08% during the forecast period from 2025 to 2034.

The Automotive Adaptive Cruise Control Market is estimated to reach USD 62.88 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!