"The Automotive Heat Shield Market was valued at $ 13.93 billion in 2025 and is projected to reach $ 24.4 billion by 2034, growing at a CAGR of 6.43%."

The automotive heat shield market is witnessing steady growth driven by the rising need for thermal management solutions in modern vehicles. Heat shields are critical components designed to protect vehicle parts from excessive heat generated by internal combustion engines, exhaust systems, turbochargers, and other high-temperature sources. With the growing adoption of downsized engines, turbocharging, and emission-reduction technologies, managing under-hood temperatures has become increasingly important. Heat shields not only improve passenger comfort and safety but also contribute to the durability and efficiency of vehicle systems by preventing heat-reated wear and thermal deformation. Manufacturers are leveraging lightweight materials such as aluminum, composites, and multilayer insulations to develop high-performance, cost-effective shielding solutions tailored to various vehicle applications.

The market is also being influenced by the rapid growth of electric and hybrid vehicles, which require innovative thermal insulation around battery packs, electric motors, and power electronics to maintain optimal performance and safety. Advancements in heat shield designs such as flexible, form-fitted, and acoustically optimized variants are expanding use cases across luxury, commercial, and performance vehicles. Regulatory pressure for noise, vibration, and harshness (NVH) control is further encouraging OEMs to integrate multifunctional heat shields that combine thermal, acoustic, and lightweighting capabilities. As vehicle architectures evolve to accommodate electrification and connectivity, the demand for compact, modular, and environmentally compliant heat shielding solutions is expected to shape the future of the market.

Key Market Insights

-

Automotive heat shields are becoming essential across all vehicle classes as OEMs adopt high-performance engines, turbochargers, and exhaust gas recirculation systems, leading to elevated under-hood temperatures that must be effectively managed to prevent component failure.

-

The transition to lightweight vehicles is pushing manufacturers to develop heat shields using aluminum, composite materials, and advanced laminates that offer thermal resistance without adding significant mass, supporting both fuel efficiency and emission reduction goals.

-

Electric and hybrid vehicles present new thermal challenges, requiring heat shielding around battery packs, inverters, and charging systems. Customized shielding solutions are being designed to manage localized heating and ensure thermal stability of sensitive components.

-

Flexible and formable heat shields are gaining popularity in complex engine configurations, allowing engineers to wrap components with precision and optimize space utilization without compromising thermal protection or mechanical integrity.

-

OEMs are increasingly favoring multifunctional heat shields that also offer acoustic damping and vibration isolation, helping to meet NVH performance standards and enhance passenger comfort in both ICE and electric vehicle platforms.

-

Asia Pacific is emerging as a leading production hub for heat shield systems due to the region’s dominance in vehicle manufacturing, strong demand for compact vehicles, and rapid electrification initiatives in markets like China, India, and Japan.

-

Regulatory mandates for emission reduction and noise control in North America and Europe are prompting automakers to adopt advanced heat shielding technologies in exhaust manifolds, catalytic converters, and particulate filters for improved thermal efficiency.

-

Tier 1 suppliers are investing in simulation-driven design and high-precision forming technologies to produce custom-fit shields that meet specific thermal and dimensional requirements, improving installation efficiency and overall system reliability.

-

In commercial vehicles, heat shields play a vital role in protecting sensitive components in close proximity to high-output diesel engines and aftertreatment systems, reducing the risk of heat-induced breakdowns in long-haul and off-road applications.

-

The growing use of heat shields in interior cabin components such as floor pans, firewalls, and center consoles is improving thermal insulation and heat soak management, particularly in performance and luxury vehicles with high power outputs.

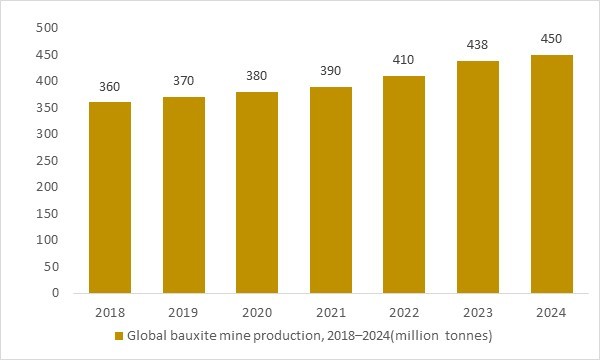

Global bauxite mine production, 2018–2024(million tonnes)

Figure: Global bauxite mine production has risen steadily from the late 2010s through 2023, with 2024 output expected to remain at historically high levels. This expanding ore supply underpins primary aluminium availability for lightweight metallic heat shields used in exhaust systems, engine bays and increasingly in battery and power-electronics enclosures. OG Analysis estimates, based on international bauxite mining statistics, highlight how upstream raw-material trends support long-term capacity for aluminium-intensive heat shield solutions in the global automotive heat shield market.

-

Global bauxite production—the upstream raw material base for aluminium used in automotive heat shields—has steadily expanded from around 350–360 million tonnes in 2018 to 438 million tonnes in 2023, with 2024 output estimated between 421 and 450 million tonnes. This sustained growth in ore availability strengthens aluminium sheet and foil supply, enabling OEMs to meet rising thermal protection requirements in exhaust systems, turbochargers, engine bays and EV battery enclosures. As vehicles incorporate higher power densities and lightweighting targets, the need for advanced aluminium-based heat shields increases across ICE, hybrid and electric platforms. The consistent upward trend in bauxite supply therefore underpins long-term manufacturing capacity and supports market stability for global automotive heat shield producers.

Regional Insights

North America Automotive Heat Shield Market

The North American automotive heat shield market is being propelled by stringent emission standards and rising demand for engine efficiency and thermal safety. Manufacturers are balancing the need for effective thermal protection with weight reduction, leading to broader adoption of lightweight aluminum and laminate-based heat shields. Additionally, the increasing integration of turbocharged powertrains and hybrid systems has created a heightened need to manage high under-hood temperatures and ensure system reliability. Stakeholders can capitalize on growing demand in both OEM and retrofit segments by offering tailor-made, multifunctional heat shield solutions that address thermal, acoustic, and durability requirements in contemporary vehicle designs.

Asia Pacific Automotive Heat Shield Market

Asia Pacific is a key growth region in the automotive heat shield market, driven by rapid automotive production and demand for compact, electrified, and affordable vehicles. In markets like China, India, and Southeast Asia, automakers are adopting advanced heat shielding that accommodates cost-sensitive production methods while ensuring thermal protection for components in tight packaging configurations. Electric vehicles in the region also require shields for battery enclosures and power electronics. Suppliers offering low-cost, scalable, and easy-to-install heat shield systems are well-positioned to meet the requirements of high-volume manufacturing and the evolving thermal management needs of diverse vehicle platforms.

Europe Automotive Heat Shield Market

Europe presents a mature and innovation-led landscape for heat shield technologies, driven by the region’s rigorous emission control policies and continuous transition to electrification. Automotive manufacturers are deploying advanced, multi-layered heat shields that combine thermal insulation with sound-deadening properties to meet NVH performance and regulatory compliance. The demand for compact protection in electric and hybrid powertrains is fostering development of form-fitted and acoustically optimized heat shields. There is a strong opening for suppliers capable of delivering sustainable materials, integrated design services, and compliance-ready solutions that can adapt to rapidly evolving vehicle architectures across luxury, performance, and mass-market segments.

Report Scope

| Parameter | Automotive Heat Shield Market Scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Automotive Heat Shield Market Segments Covered In The Report

By Material Type

- Metallic

- Non-metallic

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Product Type

- Single Shell

- Double Shell

- Sandwich

By Application

- Exhaust System Heat Shield

- Turbocharger Heat Shield

- Under Bonnet Heat Shield

- Engine Compartment Heat Shield

- Under Chassis

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Autoneum Nittoku Pvt. Ltd., Carcoustics, Dana Incorporated, ElringKlinger AG, Lydall Inc., Morgan Advanced Materials plc, Tenneco Inc., UGN Inc., Covpress Ltd, DuPont de Nemours, Inc., Happich GmbH, Sumitomo riko Co. Ltd., Talbros Automotive Components Ltd., Ningbo Tuopu Group, Zhuzhou Times New Material Technology Co., Ltd., Zircotec Ltd., NICHIAS Corporation, Adient PLC, Aisin Corporation, BorgWarner Inc., Continental AG, Denso Corporation, Hitachi Astemo, Ltd., JTEKT Corporation, Parker Hannifin Corporation, Robert Bosch GmbH, Compagnie de Saint-Gobain S. A, Schaeffler Technologies AG & Co. KG, Siemens AG, Sogefi Group

Recent Industry Developments

-

June 2025: Aegis FibreTech unveiled an ultra-lightweight heat-shield insulation material that is 10× less thermally conductive and 100× less dense than conventional ceramic fire blankets, offering effective protection up to 1000 °C in automotive and motorsport applications.

-

March 2025: Dana Limited launched a new lightweight aluminum heat shield line aimed at improving thermal management in electric vehicles, enhancing performance and range while aligning with sustainability objectives.

-

April 2025: ElringKlinger showcased its ElroSeal™‑G rotary shaft seal at Auto Shanghai—a lightweight sealing solution designed for high-speed electric drivetrains, underscoring innovation in thermal and sealing technologies.

-

April 2025: Alpha Engineered Composites introduced next‑generation thin‑profile textile composite heat shields with enhanced thermo‑oxidative resistance, capable of withstanding rising engine compartment temperatures driven by modern combustion technologies.

-

November 2024: Autoneum inaugurated a new Research & Technology Center in Shanghai focused on next‑gen mobility thermal shielding, including solutions to enhance battery case protection and thermal propagation resistance.

Available Customizations

The standard syndicate report is designed to serve the common interests of Automotive Heat Shield Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Automotive Heat Shield Pricing and Margins Across the Supply Chain, Automotive Heat Shield Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Automotive Heat Shield market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Automotive Heat Shield Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Automotive Heat Shield Market Overview

2.2 Market Strategies of Leading Automotive Heat Shield Companies

2.3 Automotive Heat Shield Market Insights, 2024 - 2034

2.3.1 Leading Automotive Heat Shield Types, 2024 - 2034

2.3.2 Leading Automotive Heat Shield End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Automotive Heat Shield sales, 2024 - 2034

2.4 Automotive Heat Shield Market Drivers and Restraints

2.4.1 Automotive Heat Shield Demand Drivers to 2034

2.4.2 Automotive Heat Shield Challenges to 2034

2.5 Automotive Heat Shield Market- Five Forces Analysis

2.5.1 Automotive Heat Shield Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Automotive Heat Shield Market Value, Market Share, and Forecast to 2034

3.1 Global Automotive Heat Shield Market Overview, 2024

3.2 Global Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

3.4 Global Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

3.5 Global Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

3.6 Global Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

3.7 Global Automotive Heat Shield Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Automotive Heat Shield Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Automotive Heat Shield Market Overview, 2024

4.2 Asia Pacific Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

4.4 Asia Pacific Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

4.5 Asia Pacific Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

4.6 Asia Pacific Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

4.7 Asia Pacific Automotive Heat Shield Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Automotive Heat Shield Market Value, Market Share, and Forecast to 2034

5.1 Europe Automotive Heat Shield Market Overview, 2024

5.2 Europe Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

5.4 Europe Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

5.5 Europe Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

5.6 Europe Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

5.7 Europe Automotive Heat Shield Market Size and Share Outlook by Country, 2024 - 2034

6. North America Automotive Heat Shield Market Value, Market Share and Forecast to 2034

6.1 North America Automotive Heat Shield Market Overview, 2024

6.2 North America Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

6.4 North America Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

6.5 North America Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

6.6 North America Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

6.7 North America Automotive Heat Shield Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Automotive Heat Shield Market Value, Market Share and Forecast to 2034

7.1 South and Central America Automotive Heat Shield Market Overview, 2024

7.2 South and Central America Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

7.4 South and Central America Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

7.5 South and Central America Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

7.6 South and Central America Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

7.7 South and Central America Automotive Heat Shield Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Automotive Heat Shield Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Automotive Heat Shield Market Overview, 2024

8.2 Middle East and Africa Automotive Heat Shield Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Automotive Heat Shield Market Size and Share Outlook By Material Type, 2024 - 2034

8.4 Middle East Africa Automotive Heat Shield Market Size and Share Outlook By Vehicle Type, 2024 - 2034

8.5 Middle East Africa Automotive Heat Shield Market Size and Share Outlook By Product Type, 2024 – 2034

8.6 Middle East Africa Automotive Heat Shield Market Size and Share Outlook By Application, 2024 - 2034

8.7 Middle East Africa Automotive Heat Shield Market Size and Share Outlook by Country, 2024 - 2034

9. Automotive Heat Shield Market Structure

9.1 Key Players

9.2 Automotive Heat Shield Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Automotive Heat Shield Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Automotive Heat Shield Market is estimated to generate USD 13.93 billion in revenue in 2025.

The Global Automotive Heat Shield Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.43% during the forecast period from 2025 to 2034.

The Automotive Heat Shield Market is estimated to reach USD 24.4 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!