"The Global Automotive Infotainment Market was valued at $ 19.45 billion in 2025 and is projected to reach $ 33.76 billion by 2034, growing at a CAGR of 6.32%."

The automotive infotainment market is a rapidly expanding segment within the global automotive industry, driven by the increasing demand for advanced in-car entertainment, connectivity, and navigation systems. Automotive infotainment systems integrate multimedia capabilities, including audio, video, voice recognition, GPS navigation, and internet connectivity, creating a seamless and engaging experience for drivers and passengers. These systems enable hands-free communication, real-time traffic updates, music streaming, and access to various apps, contributing to the convenience, comfort, and entertainment of modern vehicles. Market growth is driven by advancements in connectivity technologies, such as 5G, Wi-Fi, and Bluetooth, as well as the increasing preference for user-centric, customizable in-car experiences.

North America and Europe dominate the automotive infotainment market, driven by high consumer demand for luxury and premium vehicles equipped with advanced infotainment systems, along with strict regulatory standards for safety and connectivity. Asia-Pacific is witnessing significant growth, supported by a booming automotive market, rising disposable incomes, and the increasing adoption of connected vehicle technologies in countries such as China, Japan, and India. Key trends include the integration of voice assistants like Amazon Alexa and Google Assistant, enhanced display technologies such as OLED and touchscreens, and the development of over-the-air (OTA) software updates for infotainment systems. However, challenges such as high system costs, data privacy concerns, and the complexity of integrating new technologies into legacy vehicles may hinder market growth. Despite these challenges, the automotive infotainment market is poised for continued expansion as consumers increasingly demand seamless, connected experiences both on the road and in the car.

Trade Intelligence automotive infotainment market

| Global Vehicle radio receivers with sound recording/reproducing, requiring external power , Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 4,841 | 4,816 | 5,194 | 5,412 | 5,089 |

| United States of America | 2,059 | 2,196 | 2,424 | 2,516 | 2,883 |

| Mexico | 243 | 231 | 297 | 403 | 391 |

| Brazil | 131 | 214 | 250 | 241 | 235 |

| Japan | 264 | 242 | 279 | 272 | 165 |

| Canada | 163 | 128 | 151 | 185 | 122 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- United States of America , Mexico , Brazil , Japan and Canada are the top five countries importing 74.6% of global Vehicle radio receivers with sound recording/reproducing, requiring external power in 2024

- Global Vehicle radio receivers with sound recording/reproducing, requiring external power Imports increased by 5.1% between 2020 and 2024

- United States of America accounts for 56.7% of global Vehicle radio receivers with sound recording/reproducing, requiring external power trade in 2024

- Mexico accounts for 7.7% of global Vehicle radio receivers with sound recording/reproducing, requiring external power trade in 2024

- Brazil accounts for 4.6% of global Vehicle radio receivers with sound recording/reproducing, requiring external power trade in 2024

| Global Vehicle radio receivers with sound recording/reproducing, requiring external power Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis, International Trade Centre (ITC) |

Key Market Insights

-

North America and Europe lead the market, driven by high demand for advanced in-car entertainment systems in luxury and premium vehicles.

-

Asia-Pacific is the fastest-growing region due to rising consumer demand for connected and feature-rich vehicles, particularly in China and Japan.

- Automotive infotainment systems integrate multimedia, navigation, voice recognition, and internet connectivity for a seamless in-car experience.

- Voice assistants like Amazon Alexa, Google Assistant, and Apple Siri are increasingly integrated into infotainment systems for hands-free control.

- OLED and touchscreen displays are gaining popularity due to their superior image quality and user-friendly interfaces.

- 5G and Wi-Fi technologies are enhancing connectivity, enabling real-time traffic updates, streaming, and cloud-based applications.

- Over-the-air (OTA) software updates are becoming a key feature, enabling manufacturers to remotely update infotainment systems and improve functionality.

- Connected vehicle technologies are improving the in-car experience, allowing passengers to sync their devices and access a wide range of services.

- Data privacy concerns and regulatory compliance related to data security are major challenges for automakers offering connected infotainment systems.

- Cost pressures and the complexity of integrating advanced technologies into legacy vehicles could limit adoption in budget-friendly segments.

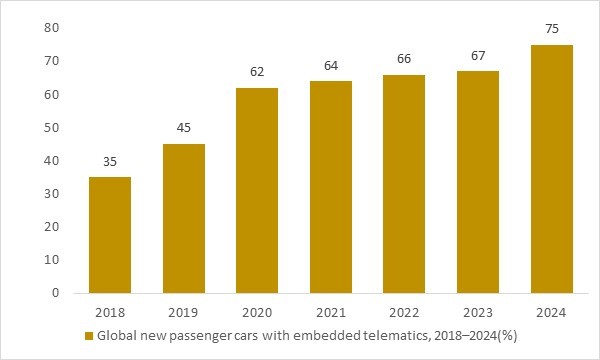

Global new passenger cars with embedded telematics , 2018–2024(%)

Figure: The share of new passenger cars equipped with embedded telematics and cellular connectivity increased from around 35% in 2018 to nearly 75% by 2024, reflecting the rapid shift toward fully connected vehicles. This expanding connectivity base enables OEMs to integrate richer infotainment experiences—spanning real-time navigation, streaming, voice assistants, OTA updates and in-car app ecosystems—directly into factory-installed head units. OG Analysis estimates, calibrated using global automotive connectivity benchmarks, underscore how rising embedded connectivity penetration directly supports the technology adoption curve and long-term growth outlook of the global automotive infotainment market.

- The steady rise in embedded telematics and cellular connectivity adoption—from 35% in 2018 to 75% in 2024—highlights the rapid shift toward fully connected vehicles, a core enabler of modern automotive infotainment systems. As more new cars integrate real-time communication, OEMs can deliver advanced navigation, streaming, voice assistance, and OTA services directly through the head unit, significantly strengthening the global automotive infotainment market’s growth outlook.

Report Scope

| Parameter | automotive infotainment market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion/Million |

| Market Splits Covered | By Operating System ,By Form ,By Vehicle Type |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Automotive Infotainment Market Segments Covered In The Report

By Operating System

- QNX

- Microsoft

- Linux

By Form

- Embedded

- Tethered

- Integrated

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Robert Bosch GmbH, HARMAN International, Mitsubishi Electric Corporation, DENSO CORPORATION, Visteon Corporation, Kenwood Corporation, Continental AG, Pioneer Corporation, Panasonic Corporation, Alpine Electronics, Delphi Automotive PLC, ALLGo Embedded Systems Pvt. Ltd., Aptiv PLC, Clarion Co. Ltd., Aisin Seiki Co. Ltd., Garmin Ltd., Pacific Industrial Co. Ltd., Fujitsu Ten Limited, Magnetic Marelli SpA, General Motors Company, Tesla Inc., Hyundai Mobis Co. Ltd., TomTom International BV, Sony Corporation, LG Electronics Inc., Blaupunkt GmbH, Qualcomm Incorporated, NXP Semiconductors N. V., Infineon Technologies AG, JVC Kenwood Corporation, Bose Corporation

Recent Industry Developments

Ford has introduced the "Ford Digital Experience," an infotainment system based on Android Automotive, featuring both Apple CarPlay and Android Auto compatibility, marking a significant shift from its previous SYNC system.

Qualcomm plans to localize automotive module production in India, aiming to double its automotive revenue by 2029, enhancing supply chain efficiency and collaboration with Indian industry partners.

Panasonic Automotive Systems and Qualcomm have expanded their collaboration to deliver cloud-connected infotainment solutions powered by Snapdragon Cockpit Elite, integrating AI, gaming, and 3D graphics.

Spark Minda has partnered with Qualcomm Technologies to develop advanced cockpit solutions for the Indian automotive market, incorporating AI-driven user interfaces and next-generation infotainment systems.

SoundHound has introduced brand personalities for its Chat AI automotive voice assistant, allowing car manufacturers to create unique voice identities for their vehicles, enhancing user interaction.

Apple has launched CarPlay Ultra, an advanced infotainment system debuting in the Aston Martin DBX 707, offering deeper integration with vehicle functions and a more immersive user experience.

BMW has announced it will not adopt Apple CarPlay Ultra, opting instead to continue developing its proprietary iDrive system to maintain brand identity and control over in-car experiences.

Available Customizations

The standard syndicate report is designed to serve the common interests of Automotive Infotainment Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Automotive Infotainment Pricing and Margins Across the Supply Chain, Automotive Infotainment Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Automotive Infotainment market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Automotive Infotainment Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Automotive Infotainment Market Overview

2.2 Market Strategies of Leading Automotive Infotainment Companies

2.3 Automotive Infotainment Market Insights, 2024 - 2034

2.3.1 Leading Automotive Infotainment Types, 2024 - 2034

2.3.2 Leading Automotive Infotainment End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Automotive Infotainment sales, 2024 - 2034

2.4 Automotive Infotainment Market Drivers and Restraints

2.4.1 Automotive Infotainment Demand Drivers to 2034

2.4.2 Automotive Infotainment Challenges to 2034

2.5 Automotive Infotainment Market- Five Forces Analysis

2.5.1 Automotive Infotainment Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Automotive Infotainment Market Value, Market Share, and Forecast to 2034

3.1 Global Automotive Infotainment Market Overview, 2024

3.2 Global Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

3.4 Global Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

3.5 Global Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

3.6 Global Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Automotive Infotainment Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Automotive Infotainment Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Automotive Infotainment Market Overview, 2024

4.2 Asia Pacific Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

4.4 Asia Pacific Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

4.5 Asia Pacific Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

4.6 Asia Pacific Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Automotive Infotainment Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Automotive Infotainment Market Value, Market Share, and Forecast to 2034

5.1 Europe Automotive Infotainment Market Overview, 2024

5.2 Europe Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

5.4 Europe Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

5.5 Europe Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

5.6 Europe Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Automotive Infotainment Market Size and Share Outlook by Country, 2024 - 2034

6. North America Automotive Infotainment Market Value, Market Share and Forecast to 2034

6.1 North America Automotive Infotainment Market Overview, 2024

6.2 North America Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

6.4 North America Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

6.5 North America Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

6.6 North America Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Automotive Infotainment Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Automotive Infotainment Market Value, Market Share and Forecast to 2034

7.1 South and Central America Automotive Infotainment Market Overview, 2024

7.2 South and Central America Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

7.4 South and Central America Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

7.5 South and Central America Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

7.6 South and Central America Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Automotive Infotainment Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Automotive Infotainment Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Automotive Infotainment Market Overview, 2024

8.2 Middle East and Africa Automotive Infotainment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Automotive Infotainment Market Size and Share Outlook By Operating System, 2024 - 2034

8.4 Middle East Africa Automotive Infotainment Market Size and Share Outlook By Form, 2024 - 2034

8.5 Middle East Africa Automotive Infotainment Market Size and Share Outlook By Vehicle Type, 2024 – 2034

8.6 Middle East Africa Automotive Infotainment Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Automotive Infotainment Market Size and Share Outlook by Country, 2024 - 2034

9. Automotive Infotainment Market Structure

9.1 Key Players

9.2 Automotive Infotainment Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Automotive Infotainment Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Automotive Infotainment Market is estimated to generate USD 19.45 billion in revenue in 2025.

The Global Automotive Infotainment Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.32% during the forecast period from 2025 to 2034.

The Automotive Infotainment Market is estimated to reach USD 33.76 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!