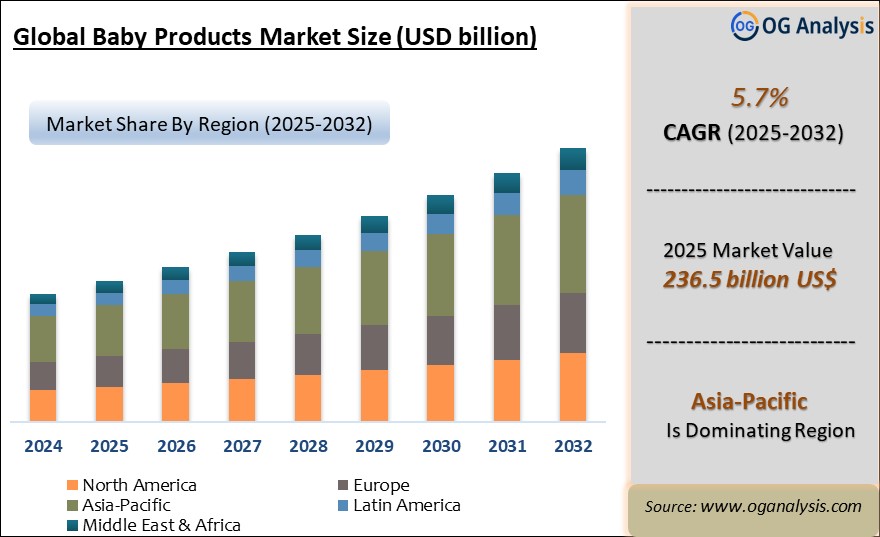

"The Global Baby Products Market Size was valued at USD 225.5 billion in 2024 and is projected to reach USD 236.5 billion in 2025. Worldwide sales of Baby Products are expected to grow at a significant CAGR of 5.7%, reaching USD 396.8 billion by the end of the forecast period in 2034."

Introduction and Overview

The global baby products market is a dynamic and fast-evolving sector driven by increasing consumer awareness about infant health, rising disposable incomes, and growing trends of urbanization. Baby products include a wide array of categories, ranging from nutrition, clothing, personal care, safety products, toys, and accessories. In recent years, parents have increasingly gravitated toward premium, organic, and eco-friendly products, reflecting a shift in consumer priorities toward sustainability and health-conscious purchasing. With a growing number of nuclear families, the demand for convenience-driven products like baby monitors, disposable diapers, and portable feeding equipment has surged. Moreover, the rise of e-commerce platforms has further facilitated easy access to these products, contributing significantly to market growth.

In terms of regional dynamics, the baby products market is flourishing in both developed and developing nations. In developed regions such as North America and Europe, high spending power and widespread consumer awareness have fueled the adoption of premium baby care products. Meanwhile, in developing regions like Asia-Pacific and Africa, improving economic conditions, population growth, and increased awareness about infant care are driving significant market expansion. These regions are also witnessing a rise in multinational baby product manufacturers, offering a mix of traditional and modern products to cater to a diverse customer base.

Asia-Pacific is the leading region in the baby products market, fueled by rising birth rates, increasing disposable incomes, and growing awareness of infant hygiene and wellness across emerging economies.

Baby toiletries dominate the segment, propelled by heightened demand for baby skincare and hygiene solutions, expanding retail availability, and innovations in organic and chemical-free formulations.

Baby Products Market Latest Trends

One of the latest trends in the baby products market is the rising demand for organic and eco-friendly products. Parents are increasingly seeking out sustainable alternatives in baby care, such as biodegradable diapers, natural baby skincare products, and organic baby food, to reduce their environmental impact while ensuring the safety of their children. Additionally, there has been a notable shift toward gender-neutral baby products, breaking away from the traditional blue for boys and pink for girls concept. This trend has gained popularity as parents increasingly advocate for gender inclusivity from an early age, which has encouraged brands to rethink their marketing strategies.

Another key trend reshaping the market is the integration of technology into baby products. From smart baby monitors that track sleep patterns and health data to strollers equipped with GPS, tech-savvy parents are gravitating toward products that offer enhanced safety and convenience. The market is also witnessing innovations in baby nutrition, with a surge in demand for organic formula, probiotic-infused products, and fortified snacks designed to support infants„¢ cognitive and physical development. As technology becomes a more integral part of parenting, the scope for innovation in the baby products sector continues to expand.

Lastly, the personalization of baby products is gaining momentum, as parents seek unique, tailored items for their children. Customizable products such as personalized clothing, furniture, and toys are rising in popularity, giving parents the ability to design items that cater specifically to their child„¢s needs and preferences. This trend is especially prominent in the luxury baby products segment, where affluent consumers are willing to invest in premium, bespoke items. Companies are leveraging this trend by offering product customization options through online platforms, allowing customers to personalize their purchases with minimal effort.

Baby Products Market Drivers

One of the primary drivers of the baby products market is the increasing global birth rate in certain regions, particularly in developing countries. As populations grow, the demand for essential baby products like diapers, wipes, baby food, and clothing rises accordingly. Additionally, rising disposable incomes, particularly in emerging economies, have contributed to a shift in consumer behavior, with parents more willing to spend on premium, high-quality products for their babies. Improved healthcare systems and better access to infant care knowledge also drive the market by encouraging parents to invest in specialized products that ensure their child's well-being.

Changing lifestyles and urbanization are further fueling market growth. With the prevalence of nuclear families and working parents, there is an increasing need for convenience-based products. This includes disposable diapers, baby carriers, and pre-packaged baby food, which simplify childcare for busy parents. Additionally, the growing popularity of online shopping has provided consumers with easy access to a wide range of baby products, along with the added convenience of home delivery and flexible payment options. The rise of digital platforms has also facilitated the comparison of products, leading to more informed purchasing decisions.

The global awareness of baby safety standards is another factor driving the baby products market. Governments and regulatory bodies have imposed stringent safety guidelines, particularly in developed regions, ensuring that products meet high safety and quality standards. These regulations have encouraged companies to innovate, leading to the development of safer and more reliable baby products. Parents, in turn, have become more discerning in their choices, opting for products that align with global safety standards, further pushing demand in the market.

Baby Products Market Challenges

Despite its promising growth trajectory, the baby products market faces several challenges. One of the most significant hurdles is the high cost of premium and organic baby products, which can limit accessibility for a large portion of the population. While affluent consumers in developed regions can afford these products, families in developing economies may struggle with the price points, leading to a preference for more affordable, mass-produced alternatives. Additionally, the rise of counterfeit and low-quality products poses a threat to market growth, especially in countries where regulatory enforcement may be weaker. These products can undermine consumer trust and damage the reputation of established brands.

Market Players

Procter & Gamble Co.

Johnson & Johnson

Kimberly-Clark Corporation

Unilever

Nestle S.A.

Danone S.A.

Abbott Laboratories

Koninklijke Philips N.V.

The Himalaya Drug Company

Artsana Group

Pigeon Corporation

Dorel Industries Inc.

Reckitt Benckiser Group PLC

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Baby Cosmetics & Toiletries, By Baby Food, By Baby Safety & Convenience |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Baby Cosmetics & Toiletries

- Skin Care

- Toiletries

- Baby wipes

- Hair Care

- Others

By Baby Food

- Milk Products

- Frozen Baby Food

- Baby Juice

- Food Snacks

- Food Cereals

- Others

By Baby Safety & Convenience

- Baby Strollers

- Baby Car Seats

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Baby Products Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Baby Products Market Overview

2.2 Key Strategies of Leading Baby Products Companies

2.3 Baby Products Market Insights, 2024- 2034

2.3.1 Leading Baby Products Types, 2024- 2034

2.3.2 Leading Baby Products End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Baby Products sales, 2024- 2034

2.4 Baby Products Market Drivers and Restraints

2.4.1 Baby Products Demand Drivers to 2034

2.4.2 Baby Products Challenges to 2034

2.5 Baby Products Market- Five Forces Analysis

2.5.1 Baby Products Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Baby Products Market Value, Market Share, and Forecast to 2034

3.1 Global Baby Products Market Overview, 2024

3.2 Global Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

3.3.1 Skin Care

3.3.2 Toiletries

3.3.3 Baby wipes

3.3.4 Hair Care

3.3.5 Others

3.4 Global Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

3.4.1 Milk Products

3.4.2 Frozen Baby Food

3.4.3 Baby Juice

3.4.4 Food Snacks

3.4.5 Food Cereals

3.4.6 Others

3.5 Global Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

3.5.1 Baby Strollers

3.5.2 Baby Car Seats

3.5.3 Others

3.6 Global Baby Products Market Size and Share Outlook 0, 2024- 2034

3.7 Global Baby Products Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Baby Products Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Baby Products Market Overview, 2024

4.2 Asia Pacific Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

4.4 Asia Pacific Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

4.5 Asia Pacific Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

4.6 Asia Pacific Baby Products Market Size and Share Outlook by Country, 2024- 2034

4.7 Key Companies in Asia Pacific Baby Products Market

5. Europe Baby Products Market Value, Market Share, and Forecast to 2034

5.1 Europe Baby Products Market Overview, 2024

5.2 Europe Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

5.4 Europe Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

5.5 Europe Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

5.6 Europe Baby Products Market Size and Share Outlook by Country, 2024- 2034

5.7 Key Companies in Europe Baby Products Market

6. North America Baby Products Market Value, Market Share and Forecast to 2034

6.1 North America Baby Products Market Overview, 2024

6.2 North America Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

6.4 North America Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

6.5 North America Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

6.6 North America Baby Products Market Size and Share Outlook by Country, 2024- 2034

6.7 Key Companies in North America Baby Products Market

7. South and Central America Baby Products Market Value, Market Share and Forecast to 2034

7.1 South and Central America Baby Products Market Overview, 2024

7.2 South and Central America Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

7.4 South and Central America Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

7.5 South and Central America Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

7.6 South and Central America Baby Products Market Size and Share Outlook by Country, 2024- 2034

7.7 Key Companies in South and Central America Baby Products Market

8. Middle East Africa Baby Products Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Baby Products Market Overview, 2024

8.2 Middle East and Africa Baby Products Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Baby Products Market Size and Share Outlook By Baby Cosmetics & Toiletries, 2024- 2034

8.4 Middle East Africa Baby Products Market Size and Share Outlook By Baby Food, 2024- 2034

8.5 Middle East Africa Baby Products Market Size and Share Outlook By Baby Safety & Convenience, 2024- 2034

8.6 Middle East Africa Baby Products Market Size and Share Outlook by Country, 2024- 2034

8.7 Key Companies in Middle East Africa Baby Products Market

9. Baby Products Market Structure

9.1 Key Players

9.2 Baby Products Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Baby Products Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Baby Products Market is estimated to reach USD 351.4 billion by 2032.

The Global Baby Products Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period from 2025 to 2032.

The Global Baby Products Market is estimated to generate USD 225.5 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!