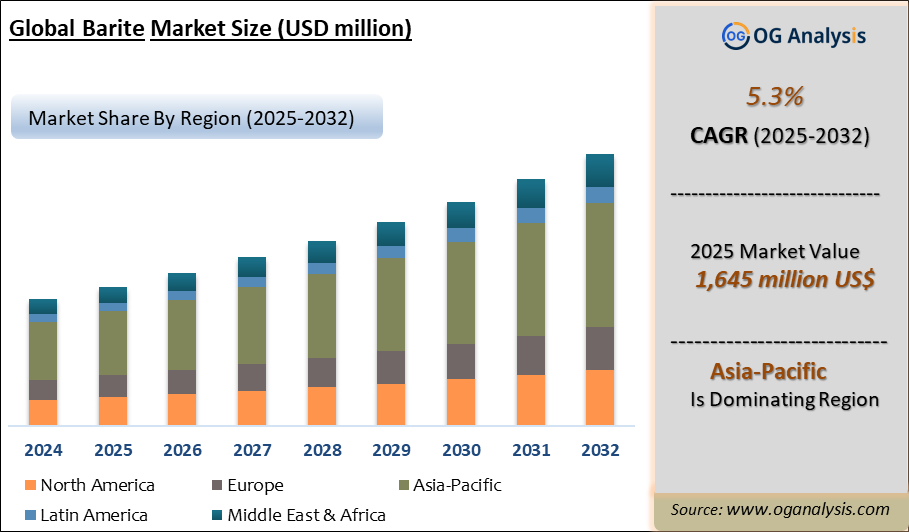

"The Global Barite market valued at USD 1,563. million in 2024, is expected to grow by 5.3% CAGR to reach market size worth USD 2,674.7 million by 2034."

The barite market, a critical component in diverse industries, is experiencing a dynamic shift driven by the growing demand for oil and gas exploration, alongside the increasing adoption of barite in various industrial applications. Barite's unique properties, including high density, inertness, and chemical stability, make it an indispensable material in drilling fluids, providing crucial weight and viscosity control during oil and gas extraction. Traditionally, the oil and gas sector has been the dominant consumer of barite, fueling substantial market growth over the years. However, the increasing focus on renewable energy sources and the rise of industrial sectors like construction and paint manufacturing are introducing new avenues for barite utilization. The year 2024 witnessed a surge in demand from the oil and gas sector, particularly in regions with robust exploration activities, while industrial applications experienced steady growth across various verticals.

Looking ahead to 2025, the barite market is expected to maintain a positive growth trajectory, influenced by several factors. The ongoing energy transition is likely to impact the market in a nuanced manner, with continued demand from traditional oil and gas exploration juxtaposed with emerging opportunities in geothermal energy and other renewable energy projects. Industrial applications are also anticipated to contribute significantly to market growth, driven by the global infrastructure boom and the increasing demand for high-performance materials in various industries. The barite market, therefore, stands at a crossroads, balancing the established needs of conventional energy sources with the evolving requirements of a more sustainable future. The ability of key players to navigate supply chain complexities and cater to the diversified needs of the market will be crucial in determining the overall market momentum in 2025.

The Global Barite Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

Asia-Pacific is the leading region in the barite market, propelled by the rapid expansion of oil & gas exploration activities, growing demand from the drilling fluids sector, and increasing infrastructure development across emerging economies.Drilling Grade Barite is the dominant segment in the barite market, fueled by its critical role in oil well drilling operations, rising global energy demand, and its superior density and purity requirements essential for high-performance drilling applications.

Barite Market Strategy, Price Trends, Drivers, Challenges and Opportunities to 2034

In terms of market strategy, price trends, drivers, challenges, and opportunities from2025 to 2034, Barite market players are directing investments toward acquiring new technologies, securing raw materials through efficient procurement and inventory management, enhancing product portfolios, and leveraging capabilities to sustain growth amidst challenging conditions. Regional-specific strategies are being emphasized due to highly varying economic and social challenges across countries.

Factors such as global economic slowdown, the impact of geopolitical tensions, delayed growth in specific regions, and the risks of stagflation necessitate a vigilant and forward-looking approach among Barite industry players. Adaptations in supply chain dynamics and the growing emphasis on cleaner and sustainable practices further drive strategic shifts within companies.

The market study delivers a comprehensive overview of current trends and developments in the Barite industry, complemented by detailed descriptive and prescriptive analyses for insights into the market landscape until 2034.

North America Barite Market Analysis

The North America Barite market demonstrated robust growth in 2024, driven by advancements in eco-friendly materials, regulatory shifts favoring sustainable production, and increased investments in R&D. Chemicals and Materials markets such as bio-based polymers, adhesives and sealants, and paints and coatings additives saw significant traction, spurred by strong demand from construction, automotive, and packaging sectors. The anticipated Barite industry growth in 2025 is underpinned by heightened focus on green building materials, innovative self-healing materials, and expansion of end-user industries such as electronics and aerospace. Competitive dynamics reflect increasing collaboration between key players and technology providers, with a focus on sustainable innovation and scaling advanced manufacturing technologies. Major players are leveraging partnerships and acquisitions to address regulatory standards and expand their market presence, creating an intensely competitive landscape.

Europe Barite Market Outlook

The European Barite market maintained a steady growth trajectory in 2024, bolstered by stringent environmental regulations and the growing adoption of circular economy principles. High demand for specialty chemicals and bio-based polymers was observed due to infrastructure projects and the push for green building initiatives. From 2025 onward, growth is expected to accelerate with innovations in materials catering to advanced applications in pharmaceuticals, cosmetics, and industrial coatings. The region’s leadership in sustainable technologies and commitment to reducing carbon footprints are key driving factors. The competitive landscape is characterized by well-established global leaders and emerging regional players focusing on localized manufacturing and energy-efficient solutions, creating a diverse and evolving market.

Asia-Pacific Barite Market Forecast

Asia-Pacific’s Barite market experienced dynamic growth in 2024, fueled by industrialization, urbanization, and increasing investments in construction, automotive, and consumer goods. Overall, the chemicals and Materials segment saw exponential demand due to infrastructure projects and expanding manufacturing bases. Anticipated growth from 2025 is supported by government initiatives promoting domestic production and green manufacturing. Its competitive production costs and technological advancements drive the region's dominance in key end-use markets. The competitive landscape is highly fragmented, with local manufacturers scaling operations to meet global export demands while international players continue to expand their footprints through joint ventures and acquisitions.

Middle East, Africa, Latin America Barite Market Overview

The Barite market across the Rest of the World, encompassing Latin America, the Middle East, and Africa, showed promising growth in 2024. This growth was supported by rising investments in the construction and energy sectors, driven by increasing oil and gas exploration and infrastructure development. From 2025, anticipated growth will stem from industrial diversification efforts, especially in GCC countries, and the adoption of high-performance materials like potassium sorbate and self-healing materials in emerging industries. The competitive landscape is evolving as regional players strengthen production capabilities and international players capitalize on untapped markets through strategic partnerships.

Barite Market Dynamics and Future Analytics

The research analyses the Barite parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Barite market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Barite market projections.

Recent deals and developments are considered for their potential impact on Barite's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Barite market.

Barite trade and price analysis helps comprehend Barite's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Barite price trends and patterns, and exploring new Barite sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Barite market.

Barite Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Barite market and players serving the Barite value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Barite market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Barite products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Barite market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Barite market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD Million |

| Market Splits Covered | By Product, By Application and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Available Customizations

The standard syndicate report is designed to serve the common interests of Barite Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below –

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Barite Pricing and Margins Across the Supply Chain, Barite Price Analysis / International Trade Data / Import-Export Analysis,

Supply Chain Analysis, Supply – Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Barite market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days

Barite Market Segmentation

By Sp. Grade

- Sp. Gr. 3.95

- Sp. Gr. 4.0

- Sp. Gr. 4.10

- Sp. Gr. 4.22

- Sp. Gr. 4.30 & above

By Deposit Type

- Residual

- Bedding

- Vein

- Others

By Application

- Weighting Agent

- Chemical raw material

- Fillers and Extenders

- Radiation Shielding & Medical Imaging

- Other Applications

By End-Use Industry

- Oil & Gas

- Paint, Coatings & Plastics

- Medical & Healthcare

- Rubber & Paper

- Electrical & Electronics

- Construction

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, UAE, Iran, South Africa, Rest of MEA)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Anglo Pacific Minerals

- Ashapura

- CIMBAR Performance Minerals

- Demeter O&G Supplies

- Excalibur Minerals

- International Earth Products

- P & S Barite Mining

- PVS

- SLB

- Andhra Pradesh Mineral Development Corporation

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Barite Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Barite Market Overview

2.2 Market Strategies of Leading Barite Companies

2.3 Barite Market Insights, 2024- 2034

2.3.1 Leading Barite Types, 2024- 2034

2.3.2 Leading Barite End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Barite sales, 2024- 2034

2.4 Barite Market Drivers and Restraints

2.4.1 Barite Demand Drivers to 2034

2.4.2 Barite Challenges to 2034

2.5 Barite Market- Five Forces Analysis

2.5.1 Barite Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Barite Market Value, Market Share, and Forecast to 2034

3.1 Global Barite Market Overview, 2024

3.2 Global Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Barite Market Size and Share Outlook By Grade, 2024- 2034

3.3.1 Sp. Gr. 3.95

3.3.2 Sp. Gr. 4.0

3.3.3 Sp. Gr. 4.10

3.3.4 Sp. Gr. 4.22

3.3.5 Sp. Gr. 4.30 & above

3.4 Global Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

3.4.1 Residual

3.4.2 Bedding

3.4.3 Vein

3.4.4 Others

3.5 Global Barite Market Size and Share Outlook By Application, 2024- 2034

3.5.1 Weighting Agent

3.5.2 Chemical raw material

3.5.3 Fillers and Extenders

3.5.4 Radiation Shielding & Medical Imaging

3.5.5 Other Applications

3.6 Global Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

3.6.1 Oil & Gas

3.6.2 Paint, Coatings & Plastics

3.6.3 Medical & Healthcare

3.6.4 Rubber & Paper

3.6.5 Electrical & Electronics

3.6.6 Construction

3.6.7 Others

3.7 Global Barite Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Barite Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Barite Market Overview, 2024

4.2 Asia Pacific Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Barite Market Size and Share Outlook By Grade, 2024- 2034

4.4 Asia Pacific Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

4.5 Asia Pacific Barite Market Size and Share Outlook By Application, 2024- 2034

4.6 Asia Pacific Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

4.7 Asia Pacific Barite Market Size and Share Outlook by Country, 2024- 2034

4.8 Key Companies in Asia Pacific Barite Market

5. Europe Barite Market Value, Market Share, and Forecast to 2034

5.1 Europe Barite Market Overview, 2024

5.2 Europe Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Barite Market Size and Share Outlook By Grade, 2024- 2034

5.4 Europe Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

5.5 Europe Barite Market Size and Share Outlook By Application, 2024- 2034

5.6 Europe Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

5.7 Europe Barite Market Size and Share Outlook by Country, 2024- 2034

5.8 Key Companies in Europe Barite Market

6. North America Barite Market Value, Market Share and Forecast to 2034

6.1 North America Barite Market Overview, 2024

6.2 North America Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Barite Market Size and Share Outlook By Grade, 2024- 2034

6.4 North America Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

6.5 North America Barite Market Size and Share Outlook By Application, 2024- 2034

6.6 North America Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

6.7 North America Barite Market Size and Share Outlook by Country, 2024- 2034

6.8 Key Companies in North America Barite Market

7. South and Central America Barite Market Value, Market Share and Forecast to 2034

7.1 South and Central America Barite Market Overview, 2024

7.2 South and Central America Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Barite Market Size and Share Outlook By Grade, 2024- 2034

7.4 South and Central America Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

7.5 South and Central America Barite Market Size and Share Outlook By Application, 2024- 2034

7.6 South and Central America Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

7.7 South and Central America Barite Market Size and Share Outlook by Country, 2024- 2034

7.8 Key Companies in South and Central America Barite Market

8. Middle East Africa Barite Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Barite Market Overview, 2024

8.2 Middle East and Africa Barite Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Barite Market Size and Share Outlook By Grade, 2024- 2034

8.4 Middle East Africa Barite Market Size and Share Outlook By Deposit Type , 2024- 2034

8.5 Middle East Africa Barite Market Size and Share Outlook By Application, 2024- 2034

8.6 Middle East Africa Barite Market Size and Share Outlook By End-Use Industry, 2024- 2034

8.7 Middle East Africa Barite Market Size and Share Outlook by Country, 2024- 2034

8.8 Key Companies in Middle East Africa Barite Market

9. Barite Market Structure

9.1 Key Players

9.2 Barite Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Barite Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Barite market is estimated to reach USD 2,674.7 million by 2034.

The Global Barite market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period from 2025 to 2034.

The Global Barite market is estimated to generate USD 1,629.4 million in revenue in 2025

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!