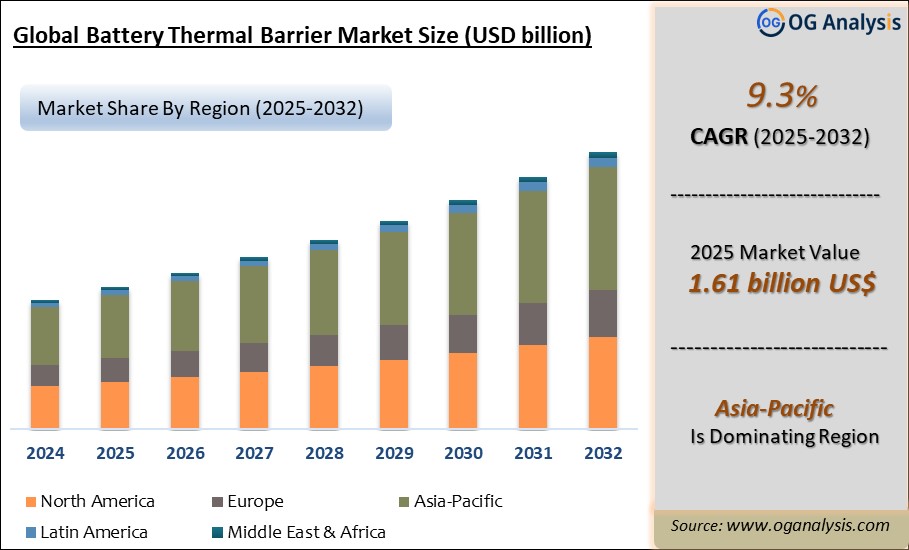

"The Global Battery Thermal Barrier Market Size is valued at USD 1.61 Billion in 2025. Worldwide sales of Battery Thermal Barrier Market are expected to grow at a significant CAGR of 9.3%, reaching USD 3.01 Billion by the end of the forecast period in 2032."

The battery thermal barrier market plays a crucial role in enhancing the safety and efficiency of energy storage systems, particularly in electric vehicles (EVs) and renewable energy applications. Battery thermal barriers are specially designed materials or structures that mitigate the risks of thermal runaway, a phenomenon where a cell’s temperature rapidly increases and can trigger a chain reaction in neighboring cells. By containing heat and preventing it from spreading, these barriers ensure greater stability, prolong battery life, and improve overall performance. With the accelerating adoption of EVs and the increasing reliance on energy storage solutions for renewable sources, manufacturers have focused on developing advanced thermal barriers that combine lightweight, durable, and cost-effective properties. As a result, the market has witnessed significant innovation, creating opportunities for both established players and emerging startups.

The market is driven by the need to meet stringent safety standards, address consumer concerns over battery reliability, and support advancements in battery chemistries. Battery thermal barriers are now more than just safety components; they are integral to enabling high-energy-density batteries that can sustain long ranges and fast-charging capabilities. From traditional materials like ceramic composites to next-generation aerogels and phase-change materials, the spectrum of available solutions is expanding rapidly. This innovation is complemented by growing collaboration among automotive OEMs, battery manufacturers, and material science companies. With the increasing push toward sustainable transportation and renewable energy, battery thermal barriers are set to remain a critical component of the evolving energy storage ecosystem.

Asia Pacific is the leading region in the battery thermal barrier market, propelled by the rapid expansion of electric vehicle production, strong government incentives for battery safety, and the growing presence of lithium-ion battery manufacturers. The passenger EV segment is the dominating segment in the market, fueled by rising consumer demand, advancements in battery technology, and stringent thermal management safety standards.

Battery Thermal Barrier Market Key Takeaways

- Battery thermal barriers prevent thermal runaway and enhance battery safety and longevity.

- Advanced materials like aerogels and phase-change solutions offer higher efficiency and reduced weight.

- Growing EV adoption drives demand for thermal barriers that support long-range and fast-charging batteries.

- Collaboration among automakers, battery producers, and material companies accelerates innovation in thermal barrier technologies.

- Regulatory pressure to improve battery safety standards encourages the use of advanced thermal management solutions.

- Increased renewable energy storage applications create new opportunities for battery thermal barriers.

- Battery manufacturers are prioritizing thermal management systems to improve performance and consumer confidence.

- Next-generation batteries with higher energy densities require more efficient and durable thermal barriers.

- Regional markets with aggressive EV adoption targets, such as China and the European Union, are at the forefront of thermal barrier technology integration.

- Sustainability trends are pushing for the development of recyclable and eco-friendly thermal barrier materials.

- R&D investments focus on creating cost-effective, lightweight, and scalable solutions for large-scale battery production.

- Thermal barriers enhance overall vehicle safety, making them a critical factor in EV development strategies.

- Customizable barrier solutions allow manufacturers to address different cell chemistries and module designs.

- Emerging startups are challenging traditional players with innovative approaches to thermal barrier materials.

- Future advancements may integrate intelligent thermal management systems, combining sensors with barrier materials.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product Type, By Application, By End User, By Technology, By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Battery Thermal Barrier Market Segmentation

By Product

- Foam

- Coatings

- Fabrics

By Application

- Electric Vehicles

- Consumer Electronics

- Renewable Energy Storage

By End User

- Automotive

- Aerospace

- Electronics

By Technology

- Passive

- Active

By Distribution Channel

- Online

- Offline

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Top 15 Companies Operating in the Battery Thermal Barrier Market

- 3M Company

- Asahi Kasei Corporation

- BASF SE

- Covestro AG

- DuPont

- Evonik Industries AG

- Henkel AG & Co. KGaA

- Kaneka Corporation

- LG Chem

- Saint-Gobain Performance Plastics

- Solvay S.A.

- Sika AG

- Sumitomo Chemical Company, Limited

- Thermo Fisher Scientific Inc.

- Toray Industries, Inc.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Battery Thermal Barrier Market Latest Trends, Drivers and Challenges, 2025- 2032

2.1 Battery Thermal Barrier Market Overview

2.2 Market Strategies of Leading Battery Thermal Barrier Companies

2.3 Battery Thermal Barrier Market Insights, 2025- 2032

2.3.1 Leading Battery Thermal Barrier Types, 2025- 2032

2.3.2 Leading Battery Thermal Barrier End-User industries, 2025- 2032

2.3.3 Fast-Growing countries for Battery Thermal Barrier sales, 2025- 2032

2.4 Battery Thermal Barrier Market Drivers and Restraints

2.4.1 Battery Thermal Barrier Demand Drivers to 2032

2.4.2 Battery Thermal Barrier Challenges to 2032

2.5 Battery Thermal Barrier Market- Five Forces Analysis

2.5.1 Battery Thermal Barrier Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Battery Thermal Barrier Market Value, Market Share, and Forecast to 2032

3.1 Global Battery Thermal Barrier Market Overview, 2024

3.2 Global Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

3.3 Global Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

3.4 Global Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

3.5 Global Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

3.6 Global Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

3.7 Global Battery Thermal Barrier Market Size and Share Outlook By By Distribution Channel, 2025- 2032

3.8 Global Battery Thermal Barrier Market Size and Share Outlook by Region, 2025- 2032

4. Asia Pacific Battery Thermal Barrier Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Battery Thermal Barrier Market Overview, 2024

4.2 Asia Pacific Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

4.3 Asia Pacific Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

4.4 Asia Pacific Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

4.5 Asia Pacific Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

4.6 Asia Pacific Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

4.7 Asia Pacific Battery Thermal Barrier Market Size and Share Outlook by Country, 2025- 2032

4.8 Key Companies in Asia Pacific Battery Thermal Barrier Market

5. Europe Battery Thermal Barrier Market Value, Market Share, and Forecast to 2032

5.1 Europe Battery Thermal Barrier Market Overview, 2024

5.2 Europe Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

5.3 Europe Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

5.4 Europe Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

5.5 Europe Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

5.6 Europe Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

5.7 Europe Battery Thermal Barrier Market Size and Share Outlook by Country, 2025- 2032

5.8 Key Companies in Europe Battery Thermal Barrier Market

6. North America Battery Thermal Barrier Market Value, Market Share and Forecast to 2032

6.1 North America Battery Thermal Barrier Market Overview, 2024

6.2 North America Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

6.3 North America Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

6.4 North America Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

6.5 North America Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

6.6 North America Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

6.7 North America Battery Thermal Barrier Market Size and Share Outlook by Country, 2025- 2032

6.8 Key Companies in North America Battery Thermal Barrier Market

7. South and Central America Battery Thermal Barrier Market Value, Market Share and Forecast to 2032

7.1 South and Central America Battery Thermal Barrier Market Overview, 2024

7.2 South and Central America Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

7.3 South and Central America Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

7.4 South and Central America Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

7.5 South and Central America Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

7.6 South and Central America Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

7.7 South and Central America Battery Thermal Barrier Market Size and Share Outlook by Country, 2025- 2032

7.8 Key Companies in South and Central America Battery Thermal Barrier Market

8. Middle East Africa Battery Thermal Barrier Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Battery Thermal Barrier Market Overview, 2024

8.2 Middle East and Africa Battery Thermal Barrier Market Revenue and Forecast, 2025- 2032 (US$ Billion)

8.3 Middle East Africa Battery Thermal Barrier Market Size and Share Outlook By Product Type, 2025- 2032

8.4 Middle East Africa Battery Thermal Barrier Market Size and Share Outlook By Application, 2025- 2032

8.5 Middle East Africa Battery Thermal Barrier Market Size and Share Outlook By Technology, 2025- 2032

8.6 Middle East Africa Battery Thermal Barrier Market Size and Share Outlook By End User, 2025- 2032

8.7 Middle East Africa Battery Thermal Barrier Market Size and Share Outlook by Country, 2025- 2032

8.8 Key Companies in Middle East Africa Battery Thermal Barrier Market

9. Battery Thermal Barrier Market Structure

9.1 Key Players

9.2 Battery Thermal Barrier Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Battery Thermal Barrier Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Battery Thermal Barrier Market is estimated to reach USD 3.01 Billion by 2032.

The Global Battery Thermal Barrier Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period from 2025 to 2032.

The Global Battery Thermal Barrier Market is estimated to generate USD 1.61 Billion in revenue in 2025.

$3950- 5%

$6450- 10%

$8450- 15%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!