"The Beta Glucan Market valued at $702.6 million in 2024, is expected to grow by 7.3% CAGR to reach market size worth $1,451.2 million by 2034."

The Beta Glucan market is witnessing robust growth driven by rising global demand for functional and immune-boosting ingredients in food, healthcare, and personal care industries. Beta glucans are naturally occurring polysaccharides found in oats, barley, yeast, mushrooms, and certain algae. They are increasingly recognized for their scientifically proven health benefits, including cholesterol reduction, immune modulation, gut health improvement, and blood sugar regulation. These properties have led to widespread application in functional foods, dietary supplements, pharmaceuticals, and even skincare. The COVID-19 pandemic significantly accelerated consumer interest in immune health, further propelling demand for beta glucan-enriched products. Moreover, regulatory support from bodies such as the U.S. FDA and the EFSA—especially for oat- and barley-based beta glucans—has strengthened the market's credibility. In regions like North America and Europe, consumers are already familiar with fiber and heart-health ingredients, while the Asia-Pacific market is catching up rapidly due to growing health awareness, higher disposable incomes, and the popularity of traditional medicinal mushrooms. As a result, beta glucans are becoming a central focus of clean-label, plant-based, and preventive nutrition trends.

The competitive landscape of the Beta Glucan market includes a mix of established ingredient manufacturers and biotech innovators focusing on product purity, extraction efficiency, and novel applications. Innovations such as microencapsulation, liposomal delivery, and fermentation-based extraction methods are being adopted to enhance the bioavailability and stability of beta glucans in diverse end-use products. In the pharmaceutical industry, beta glucans are being investigated as adjunct therapies in cancer treatment, vaccine enhancement, and antimicrobial resistance due to their immune-stimulating effects. In cosmetics, they are increasingly used in moisturizers, serums, and anti-aging formulations due to their barrier-repair and anti-inflammatory properties. Meanwhile, food and beverage manufacturers are developing a wide range of beta glucan-infused cereals, dairy alternatives, snacks, and beverages. Sustainability is also becoming a strategic priority, with companies exploring low-impact sourcing and production techniques. The overall market outlook remains optimistic, supported by growing consumer preference for natural, multifunctional ingredients and a surge in wellness-focused product innovations across sectors.

The cereals segment is currently the largest in the Beta Glucan market due to widespread use of oat- and barley-derived beta glucans in the food and beverage industry. These sources are highly favored for their established health claims, especially cholesterol-lowering properties, and are easily incorporated into cereals, dairy alternatives, and baked goods.

The food & beverages segment dominates the market, driven by rising consumer demand for functional and clean-label products. Beta glucans are increasingly used in heart-health foods, digestive wellness products, and immune-boosting beverages, supported by strong regulatory endorsements and growing awareness of preventive nutrition across developed and emerging markets.

Key Insights

- Historically, beta glucan gained traction through its positioning as a soluble fiber for cholesterol reduction and heart-health support in oat- and barley-based foods. This early association with cardiovascular wellness created a strong foundation in breakfast cereals, baked goods, and health-focused beverages. Over time, it has expanded beyond traditional fiber positioning into broader functional and clinical nutrition roles.

- Source differentiation is a central feature of the market, with cereal-derived, yeast-derived, and mushroom/fungal beta glucans each offering distinct structural and functional profiles. Cereal sources are closely linked to cholesterol and glycemic benefits, while yeast and mushroom sources are more strongly associated with immune modulation. This segmentation allows manufacturers to tailor product portfolios to specific health-positioning and regulatory landscapes.

- Immune health has become one of the most powerful growth engines, particularly in dietary supplements, fortified foods, and beverages. Consumers increasingly seek everyday immune support rather than seasonal, short-term products, creating opportunities for beta glucan as a core ingredient in daily-use formulations. Combination products blending beta glucan with vitamins, minerals, and botanical extracts are gaining momentum in e-commerce and specialty retail channels.

- Clean-label and natural-origin expectations strongly influence ingredient selection, driving preference for recognizable cereal and yeast sources, minimal processing, and transparent supply chains. Brand owners emphasize non-GMO, allergen-conscious, and often vegan positioning to align with broader consumer values. Beta glucan’s ability to deliver both nutritional and functional benefits from familiar starting materials enhances its appeal in this environment.

- Regulatory approvals and health-claim frameworks in key markets have been important catalysts, providing structure for cholesterol and fiber-related claims on foods containing sufficient amounts of beta glucan. These frameworks encourage standardized dosing and quality specifications, reinforcing credibility among manufacturers and consumers. Ongoing scientific substantiation remains critical to defend and potentially expand permissible claims.

- Technological advances in extraction, purification, and fermentation are improving yield, consistency, and bioactivity of commercial beta glucan ingredients. Producers are optimizing molecular weight and solubility profiles to enhance functionality in beverages, dairy alternatives, and clear formulations without compromising sensory properties. Continued process innovation also supports cost competitiveness and scalability for high-volume applications.

- Application diversification is reshaping demand, with beta glucan moving into sports and active nutrition, infant and medical nutrition, and specialized metabolic-health products. In these categories, its roles in glycemic management, satiety, and immune support complement existing protein and micronutrient platforms. This opens opportunities for premium formulations targeting specific life stages and health conditions.

- The cosmetics and personal care segment is emerging as a meaningful niche, leveraging beta glucan’s perceived benefits for skin barrier reinforcement, hydration, and soothing of sensitive skin. Formulators use it in serums, creams, and after-sun or post-procedure products where barrier repair and calmness claims are central. This cross-category presence enhances ingredient visibility and diversifies revenue streams for suppliers.

- Competitive dynamics are intensifying as large ingredient companies, regional fiber specialists, and biotech players all seek to capture share through branded beta glucan concepts. Differentiation is built around clinical dossiers, application trials, co-branding opportunities, and robust technical support. Strategic partnerships with major food, beverage, supplement, and cosmetic brands are increasingly important to secure long-term volume commitments.

- Looking ahead, the beta glucan market is likely to benefit from macro trends in preventative health, healthy ageing, and metabolic wellness, as well as from continued focus on immune resilience. As health systems and consumers place more emphasis on proactive nutrition and everyday functional products, demand for multi-benefit, evidence-based ingredients should strengthen. Beta glucan is well positioned to serve as a backbone component within broader portfolios addressing heart, gut, and immune health across global consumer markets.

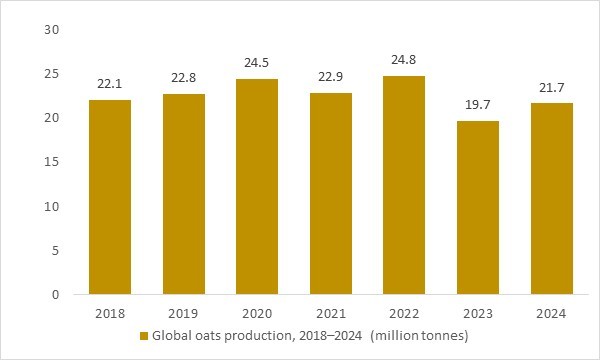

Global oats production, 2018–2024 (million tonnes)

Figure: Global oats production increased steadily between 2018 and 2024, providing a stable cereal base for extracting beta glucan used in heart-health and immune-support formulations. As food, beverage and nutraceutical manufacturers expand portfolios of oat-based cereals, drinks, snacks and supplements, this growing oat harvest underpins the long-term availability of raw materials for beta glucan ingredients. OG Analysis estimates, derived from international grains statistics, highlight how upstream agricultural trends directly influence the outlook for the global beta glucan market.

- Global oats production expanded over 2018–2024, reinforcing the availability of one of the richest cereal sources of beta glucan used in functional foods, nutraceuticals and supplements. As food and beverage brands scale up oat-based cereals, drinks and snacks, this growing harvest deepens the upstream raw material base for beta glucan extraction. The trend highlights how agricultural gains in oats cultivation support long-term supply security, product innovation and market penetration for beta glucan ingredients worldwide.

Regional Insights

North America Beta Glucan Market Analysis

The North America Beta Glucan market demonstrated robust growth in 2024, driven by advancements in personalized medicine, the proliferation of digital health solutions, and increased investment in biotechnologies such as biosimilars, biologics CDMO, and AI-driven medical diagnostics. The market is set to expand further in 2025, with a healthy CAGR driven by the rise in chronic disease incidence, aging demographics, and government initiatives supporting pharmaceutical innovation. Other notable growth drivers to 2034 include advancements in therapeutics and diagnostics, including biomarkers and gene therapy, as well as expanding applications of AI in drug discovery and clinical decision-making. Regulatory approvals and strategic partnerships between key players are enabling faster commercialization of cutting-edge therapies and medical technologies. This Beta Glucan market growth trajectory reflects a dynamic market landscape, with innovation, demand for digital transformation, and regulatory adaptation playing pivotal roles.

Europe Beta Glucan Market Outlook

The European Beta Glucan market witnessed steady growth in 2024, underpinned by increased funding for healthcare innovation, robust R&D, and the adoption of advanced diagnostic solutions. The Beta Glucan market is projected to continue growth in 2025, driven by the region's aging population and rising prevalence of autoimmune diseases. Key trends include the expansion of biostimulants and biotechnology, enhanced clinical trial imaging, and the adoption of AI-based diagnostic tools. Government policies promoting digital transformation in healthcare and incentives for eco-friendly medical plastics further support market expansion. Europe remains a hub for groundbreaking innovations, with collaborative frameworks facilitating faster regulatory approvals and market entry.

Asia-Pacific Beta Glucan Market Forecast

Asia-Pacific’s Beta Glucan market emerged as a high-growth region in 2024, driven by escalating demand for affordable healthcare solutions, rapid advancements in biotechnology, and the integration of AI in drug discovery and diagnostics. The Beta Glucan market is poised for exponential growth from 2025 to 2034, supported by increasing healthcare expenditure, a rising middle class, and government initiatives fostering local manufacturing of biosimilars and biologics. Expansion in therapeutics, cell therapy, and autoimmune disease diagnostics underscores the region's focus on precision medicine. Key markets such as China, India, and Japan are spearheading innovation, bolstered by favorable policies and global collaborations. The region’s adoption of digital therapeutics and clinical trial technologies marks a transformative phase, positioning Asia-Pacific as a critical player in the global Beta Glucan market landscape.

Middle East, Africa, Latin America Beta Glucan Market Overview

The Beta Glucan market across Middle East, Africa and South America displayed notable growth in 2024, particularly in emerging economies fueled by improving healthcare infrastructure and rising pharmaceutical investments. Growth from 2025 to 2034 is expected to accelerate, driven by increasing demand for affordable diagnostics, biosimilars, and vaccines to combat infectious and chronic diseases. Countries in the Middle East, Africa, and South America are witnessing significant advancements in areas like antimicrobial susceptibility testing, digital health solutions, and medical plastics. Government-led healthcare reforms, international partnerships, and a focus on localized production are key growth enablers. Additionally, the uptake of AI-driven diagnostics, eClinical solutions, and cancer therapeutics signals a shift towards innovative healthcare delivery. These trends highlight the potential of RoW markets as pivotal contributors to global healthcare evolution.

Beta Glucan Market Dynamics and Future Analytics

The research analyses the Beta Glucan parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Beta Glucan market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Beta Glucan market projections.

Recent deals and developments are considered for their potential impact on Beta Glucan's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Beta Glucan market.

Beta Glucan trade and price analysis helps comprehend Beta Glucan's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Beta Glucan price trends and patterns, and exploring new Beta Glucan sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Beta Glucan market.

Beta Glucan Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Beta Glucan market and players serving the Beta Glucan value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Beta Glucan market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Beta Glucan products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Beta Glucan market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Beta Glucan market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Beta Glucan Market Research Scope

• Global Beta Glucan market size and growth projections (CAGR), 2024- 2034

• Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Beta Glucan Trade and Supply-chain

• Beta Glucan market size, share, and outlook across 5 regions and 27 countries, 2023- 2034

• Beta Glucan market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023- 2034

• Short and long-term Beta Glucan market trends, drivers, restraints, and opportunities

• Porter’s Five Forces analysis, Technological developments in the Beta Glucan market, Beta Glucan supply chain analysis

• Beta Glucan trade analysis, Beta Glucan market price analysis, Beta Glucan supply/demand

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

• Latest Beta Glucan market news and developments

The Beta Glucan Market international scenario is well established in the report with separate chapters on North America Beta Glucan Market, Europe Beta Glucan Market, Asia-Pacific Beta Glucan Market, Middle East and Africa Beta Glucan Market, and South and Central America Beta Glucan Markets. These sections further fragment the regional Beta Glucan market by type, application, end-user, and country.

Market Scope

| Parameter | Beta glucan Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Segmentation

By Type

- (1.3) Beta Glucan

- (1,4) Beta Glucan

- (1,6) Beta Glucan

By Source

- Yeast

- Mushroom

- Cereals

- Microalgae

By Application

- Food & Beverages

- Animal Feed

- Personal Care

- Pharmaceuticals

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

Kerry Group plc.

-

Givaudan SA

-

Koninklijke DSM N.V.

-

Euglena Co. Ltd

-

Biotec Pharmacon ASA

-

Tate & Lyle plc.

-

Lesaffre Group

-

Kemin Industries, Inc.

-

Super Beta Glucan

-

Garuda International, Inc.

Recent Developments

-

Feb 2025 – Layn Natural Ingredients: Launched Galacan®, a next-generation beta-glucan produced via precision fermentation, positioned for improved water solubility/bioavailability across supplements and functional foods. The company also announced a newly expanded biotechnology facility to scale precision-fermentation and enzyme production.

-

Apr 2025 – COSCIENS Biopharma: Reported successful manufacturing of yeast beta-glucan (YBG) powder as part of its scale-up activities and stated it was finalizing a capsule-format immune booster for planned commercialization in H2 2025. The company also cited development of YBG as a delivery system when combined with other bioactives.

-

Jun 2023 – Kemin Industries: Received Thailand FDA (TFDA) Novel Food approval for BetaVia™ Complete, an algae-derived beta-glucan ingredient intended for immune and gut-health supplementation. The approval enables use in human food supplements in Thailand at an indicated daily intake level.

-

Jul 2020 – Lantmännen Functional Foods: Launched PromOat Instant, positioned as a fully water-soluble oat beta-glucan ingredient designed for powdered beverages and supplement formats. The product targets easier formulation and broader application use versus conventional oat beta-glucan powders.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Beta Glucan Market Review, 2024

2.1 Beta Glucan Industry Overview

2.2 Research Methodology

3. Beta Glucan Market Insights

3.1 Beta Glucan Market Trends to 2034

3.2 Future Opportunities in Beta Glucan Market

3.3 Dominant Applications of Beta Glucan, 2024 Vs 2034

3.4 Key Types of Beta Glucan, 2024 Vs 2034

3.5 Leading End Uses of Beta Glucan Market, 2024 Vs 2034

3.6 High Prospect Countries for Beta Glucan Market, 2024 Vs 2034

4. Beta Glucan Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Beta Glucan Market

4.2 Key Factors Driving the Beta Glucan Market Growth

4.2 Major Challenges to the Beta Glucan industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Beta Glucan supply chain

5 Five Forces Analysis for Global Beta Glucan Market

5.1 Beta Glucan Industry Attractiveness Index, 2024

5.2 Beta Glucan Market Threat of New Entrants

5.3 Beta Glucan Market Bargaining Power of Suppliers

5.4 Beta Glucan Market Bargaining Power of Buyers

5.5 Beta Glucan Market Intensity of Competitive Rivalry

5.6 Beta Glucan Market Threat of Substitutes

6. Global Beta Glucan Market Data – Industry Size, Share, and Outlook

6.1 Beta Glucan Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Beta Glucan Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Beta Glucan Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Beta Glucan Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Beta Glucan Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Beta Glucan Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Beta Glucan Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Beta Glucan Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Beta Glucan Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Beta Glucan Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Beta Glucan Analysis and Forecast to 2034

7.5.2 Japan Beta Glucan Analysis and Forecast to 2034

7.5.3 India Beta Glucan Analysis and Forecast to 2034

7.5.4 South Korea Beta Glucan Analysis and Forecast to 2034

7.5.5 Australia Beta Glucan Analysis and Forecast to 2034

7.5.6 Indonesia Beta Glucan Analysis and Forecast to 2034

7.5.7 Malaysia Beta Glucan Analysis and Forecast to 2034

7.5.8 Vietnam Beta Glucan Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Beta Glucan Industry

8. Europe Beta Glucan Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Beta Glucan Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Beta Glucan Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Beta Glucan Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Beta Glucan Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Beta Glucan Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Beta Glucan Market Size and Outlook to 2034

8.5.3 2024 France Beta Glucan Market Size and Outlook to 2034

8.5.4 2024 Italy Beta Glucan Market Size and Outlook to 2034

8.5.5 2024 Spain Beta Glucan Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Beta Glucan Market Size and Outlook to 2034

8.5.7 2024 Russia Beta Glucan Market Size and Outlook to 2034

8.6 Leading Companies in Europe Beta Glucan Industry

9. North America Beta Glucan Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Beta Glucan Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Beta Glucan Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Beta Glucan Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Beta Glucan Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Beta Glucan Market Analysis and Outlook

9.5.2 Canada Beta Glucan Market Analysis and Outlook

9.5.3 Mexico Beta Glucan Market Analysis and Outlook

9.6 Leading Companies in North America Beta Glucan Business

10. Latin America Beta Glucan Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Beta Glucan Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Beta Glucan Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Beta Glucan Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Beta Glucan Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Beta Glucan Market Analysis and Outlook to 2034

10.5.2 Argentina Beta Glucan Market Analysis and Outlook to 2034

10.5.3 Chile Beta Glucan Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Beta Glucan Industry

11. Middle East Africa Beta Glucan Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Beta Glucan Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Beta Glucan Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Beta Glucan Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Beta Glucan Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Beta Glucan Market Outlook

11.5.2 Egypt Beta Glucan Market Outlook

11.5.3 Saudi Arabia Beta Glucan Market Outlook

11.5.4 Iran Beta Glucan Market Outlook

11.5.5 UAE Beta Glucan Market Outlook

11.6 Leading Companies in Middle East Africa Beta Glucan Business

12. Beta Glucan Market Structure and Competitive Landscape

12.1 Key Companies in Beta Glucan Business

12.2 Beta Glucan Key Player Benchmarking

12.3 Beta Glucan Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Beta Glucan Market

14.1 Beta Glucan trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Beta Glucan Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Beta Glucan Market is estimated to generate USD 746.4 million in revenue in 2025

The Global Beta Glucan Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% during the forecast period from 2025 to 2034.

The Beta Glucan Market is estimated to reach USD 1,451.2 million by 2034.

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!