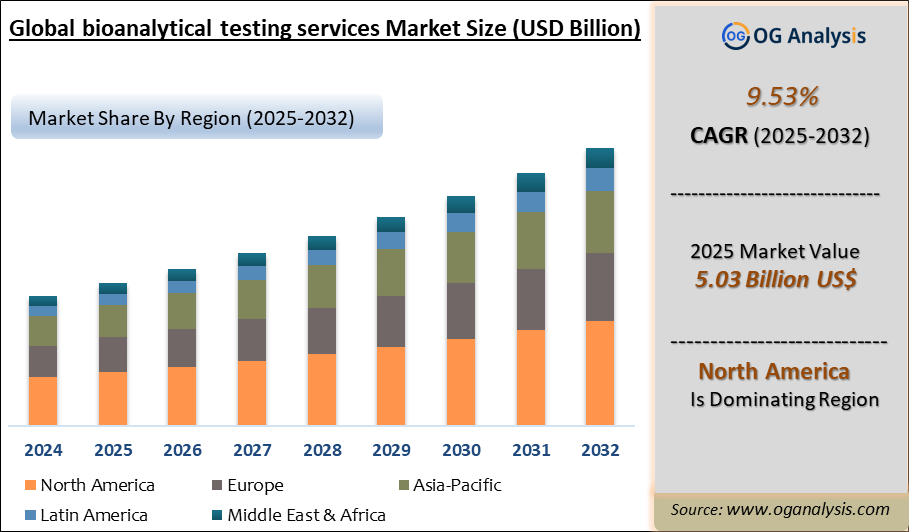

The Bioanalytical Testing Services Market is a rapidly evolving segment of the global pharmaceutical and biotechnology industry, playing a crucial role in supporting drug development and regulatory compliance. These services encompass a broad range of analytical testing—including pharmacokinetics (PK), pharmacodynamics (PD), bioavailability, and bioequivalence studies—performed to ensure safety, efficacy, and quality of pharmaceutical products. The market is being propelled by increased R&D spending, stringent regulatory standards, the growing complexity of biologics and biosimilars, and an increasing trend of outsourcing by pharmaceutical companies. As demand for personalized medicine, cell and gene therapies, and novel biologics continues to rise, bioanalytical testing providers are increasingly required to deliver specialized and high-throughput analytical capabilities across preclinical and clinical phases. North America currently dominates the market, owing to robust biopharma pipelines and advanced regulatory frameworks, while Asia Pacific is expected to be the fastest-growing region driven by increasing investments and CRO expansions. Strategic partnerships, mergers, and technology-driven service expansion remain key competitive strategies in the market. Contract research organizations (CROs) are increasingly incorporating automation, LC-MS/MS, high-throughput screening, and digitalized laboratory informatics to meet the dynamic needs of pharmaceutical clients. Overall, the bioanalytical testing market is poised for significant expansion through 2030, driven by innovation and demand for compliant, cost-effective testing solutions.

As pharmaceutical pipelines grow increasingly complex, the need for precise, rapid, and regulatory-compliant testing solutions has become indispensable. Bioanalytical testing services enable pharmaceutical firms to assess the pharmacokinetic profile of new drug compounds, evaluate safety margins, and meet FDA and EMA submission requirements. The market’s expansion is supported by the rising incidence of chronic diseases, which is triggering new drug discovery efforts globally. Furthermore, contract-based outsourcing offers flexibility, cost control, and access to specialized expertise, especially for smaller biotech companies. The rise of biologics and biosimilars presents new analytical challenges, increasing demand for customized assay development and validation. The industry is also seeing advancements in multiplexed assay formats and biomarker validation techniques. Players in this space are continually investing in expanding laboratory capacity, enhancing technical capabilities, and strengthening global regulatory adherence. The growing trend of decentralized clinical trials (DCTs) and real-world evidence (RWE) studies is adding new dimensions to sample logistics and bioanalytical methodologies. Additionally, bioanalytical labs are adopting quality-by-design (QbD) principles and data integrity tools to meet regulatory expectations. Despite challenges such as high validation costs and evolving regulatory frameworks, the market outlook remains strong due to high-value partnerships and increasing demand from emerging markets.

DMPK (Drug Metabolism and Pharmacokinetics) testing is the largest segment due to its indispensable role in determining the absorption, distribution, metabolism, and excretion (ADME) characteristics of drug candidates. It is a regulatory requirement in early-stage trials and is used extensively across both biologics and small molecule drug development programs.

Oncology is the largest application segment, fueled by the high number of oncology-focused clinical trials, complex therapeutic approaches, and the need for comprehensive bioanalytical support. The growth of targeted therapies, immuno-oncology, and biomarker-driven studies further amplifies the demand for specialized analytical services in cancer research.

Key Insights

The increasing complexity of drug molecules, especially biologics and biosimilars, is driving demand for advanced bioanalytical testing services. These molecules require highly sensitive and specific assays to measure pharmacokinetics, pharmacodynamics, and immunogenicity, prompting service providers to invest in assay development capabilities and next-generation technologies to meet evolving biopharma requirements and regulatory expectations across global markets.

Pharmaceutical and biotechnology companies are increasingly outsourcing bioanalytical testing to Contract Research Organizations (CROs) to reduce operational costs and focus on core R&D. Outsourcing enables access to specialized expertise, scalability, and regulatory compliance, with CROs offering end-to-end support from method development to regulatory submission, thereby accelerating timelines and enhancing efficiency in drug development pipelines.

North America continues to lead the global bioanalytical testing services market, supported by a robust pharmaceutical industry, stringent regulatory frameworks, and a high concentration of global CRO headquarters. The region’s dominance is further strengthened by rapid technological innovation, widespread adoption of mass spectrometry, and growing investments in large molecule testing platforms and lab automation.

Asia Pacific is emerging as the fastest-growing region in the bioanalytical testing market, driven by rising clinical trial activities, cost-effective lab services, and government initiatives supporting pharmaceutical R&D. Countries like China and India are witnessing increasing CRO investments, enabling regional companies to compete on a global scale by offering GxP-compliant, scalable testing infrastructure and fast turnaround times.

Pharmacokinetic (PK) and pharmacodynamic (PD) testing hold a significant share of the market, as they are essential for understanding drug action and dosage optimization. These tests are fundamental during both preclinical and clinical phases, and the rising number of novel therapeutics is creating sustained demand for high-throughput, validated PK/PD assays for regulatory submissions.

The rise of cell and gene therapies is reshaping the bioanalytical landscape by necessitating new assay formats for viral vectors, transgene expression, and immune response characterization. Service providers are expanding their capabilities in flow cytometry, qPCR, and next-generation sequencing to cater to complex biologics and comply with evolving regulatory standards for advanced therapies.

Technological advancements, such as liquid chromatography-tandem mass spectrometry (LC-MS/MS) and automated liquid handling, are enhancing the sensitivity, reproducibility, and throughput of bioanalytical testing. These tools are now integral to method validation, biomarker discovery, and small molecule analysis, allowing laboratories to process higher volumes of clinical samples while maintaining data integrity and regulatory compliance.

Stringent regulatory requirements from authorities such as the FDA, EMA, and ICH are compelling service providers to maintain rigorous quality management systems. Compliance with GxP standards, audit-readiness, data integrity protocols, and thorough documentation practices are becoming critical differentiators for CROs operating in highly competitive and regulated bioanalytical environments.

With the growing adoption of decentralized clinical trials (DCTs), bioanalytical service providers are adapting to new logistical and analytical demands. This includes mobile phlebotomy, remote sample collection kits, and robust sample tracking systems that ensure integrity and traceability of biospecimens across diverse geographies and time zones, supporting global trial execution.

Strategic mergers, partnerships, and capacity expansions are shaping the competitive dynamics of the market. Key players are acquiring niche laboratories, investing in global lab networks, and integrating digital tools like Laboratory Information Management Systems (LIMS) to streamline operations, enhance client engagement, and deliver customized testing solutions aligned with evolving biopharma needs.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Molecule Type, By Test Type, By Application By End User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Bioanalytical Testing Services Market Segmentation

By Molecule Type

- Small molecule

- Large molecule

By Test Type

- DMPK testing

- Biomarker testing

- Virology testing

- Serology testing

- Immunogenicity testing

- Other

By Application

- Oncology

- Neurology

- Infectious diseases

- Gastroenterology

- Cardiology

- Other applications

By End-user

- Pharmaceutical & biotechnology companies

- Contract research organizations

- Research & academic institutes

- Other end-users

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

Thermo Fisher

-

ICON

-

Charles River Laboratories

-

IQVIA

-

Syneos Health

-

SGS

-

Labcorp

-

Intertek

-

Pace Analytical Services

-

WuXi AppTec

What You Receive

• Global Bioanalytical Testing Services market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Bioanalytical Testing Services.

• Bioanalytical Testing Services market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Bioanalytical Testing Services market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Bioanalytical Testing Services market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Bioanalytical Testing Services market, Bioanalytical Testing Services supply chain analysis.

• Bioanalytical Testing Services trade analysis, Bioanalytical Testing Services market price analysis, Bioanalytical Testing Services Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Bioanalytical Testing Services market news and developments.

The Bioanalytical Testing Services Market international scenario is well established in the report with separate chapters on North America Bioanalytical Testing Services Market, Europe Bioanalytical Testing Services Market, Asia-Pacific Bioanalytical Testing Services Market, Middle East and Africa Bioanalytical Testing Services Market, and South and Central America Bioanalytical Testing Services Markets. These sections further fragment the regional Bioanalytical Testing Services market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Bioanalytical Testing Services market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Bioanalytical Testing Services market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Bioanalytical Testing Services market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Bioanalytical Testing Services business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Bioanalytical Testing Services Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Bioanalytical Testing Services Pricing and Margins Across the Supply Chain, Bioanalytical Testing Services Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Bioanalytical Testing Services market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Bioanalytical Testing Services Market Review, 2024

2.1 Bioanalytical Testing Services Industry Overview

2.2 Research Methodology

3. Bioanalytical Testing Services Market Insights

3.1 Bioanalytical Testing Services Market Trends to 2034

3.2 Future Opportunities in Bioanalytical Testing Services Market

3.3 Dominant Applications of Bioanalytical Testing Services, 2024 Vs 2034

3.4 Key Types of Bioanalytical Testing Services, 2024 Vs 2034

3.5 Leading End Uses of Bioanalytical Testing Services Market, 2024 Vs 2034

3.6 High Prospect Countries for Bioanalytical Testing Services Market, 2024 Vs 2034

4. Bioanalytical Testing Services Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Bioanalytical Testing Services Market

4.2 Key Factors Driving the Bioanalytical Testing Services Market Growth

4.2 Major Challenges to the Bioanalytical Testing Services industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Bioanalytical Testing Services supply chain

5 Five Forces Analysis for Global Bioanalytical Testing Services Market

5.1 Bioanalytical Testing Services Industry Attractiveness Index, 2024

5.2 Bioanalytical Testing Services Market Threat of New Entrants

5.3 Bioanalytical Testing Services Market Bargaining Power of Suppliers

5.4 Bioanalytical Testing Services Market Bargaining Power of Buyers

5.5 Bioanalytical Testing Services Market Intensity of Competitive Rivalry

5.6 Bioanalytical Testing Services Market Threat of Substitutes

6. Global Bioanalytical Testing Services Market Data – Industry Size, Share, and Outlook

6.1 Bioanalytical Testing Services Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Bioanalytical Testing Services Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Bioanalytical Testing Services Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Bioanalytical Testing Services Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Bioanalytical Testing Services Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Bioanalytical Testing Services Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Bioanalytical Testing Services Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Bioanalytical Testing Services Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Bioanalytical Testing Services Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Bioanalytical Testing Services Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.2 Japan Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.3 India Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.4 South Korea Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.5 Australia Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.6 Indonesia Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.7 Malaysia Bioanalytical Testing Services Analysis and Forecast to 2034

7.5.8 Vietnam Bioanalytical Testing Services Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Bioanalytical Testing Services Industry

8. Europe Bioanalytical Testing Services Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Bioanalytical Testing Services Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Bioanalytical Testing Services Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Bioanalytical Testing Services Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Bioanalytical Testing Services Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.3 2024 France Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.4 2024 Italy Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.5 2024 Spain Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Bioanalytical Testing Services Market Size and Outlook to 2034

8.5.7 2024 Russia Bioanalytical Testing Services Market Size and Outlook to 2034

8.6 Leading Companies in Europe Bioanalytical Testing Services Industry

9. North America Bioanalytical Testing Services Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Bioanalytical Testing Services Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Bioanalytical Testing Services Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Bioanalytical Testing Services Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Bioanalytical Testing Services Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Bioanalytical Testing Services Market Analysis and Outlook

9.5.2 Canada Bioanalytical Testing Services Market Analysis and Outlook

9.5.3 Mexico Bioanalytical Testing Services Market Analysis and Outlook

9.6 Leading Companies in North America Bioanalytical Testing Services Business

10. Latin America Bioanalytical Testing Services Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Bioanalytical Testing Services Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Bioanalytical Testing Services Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Bioanalytical Testing Services Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Bioanalytical Testing Services Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Bioanalytical Testing Services Market Analysis and Outlook to 2034

10.5.2 Argentina Bioanalytical Testing Services Market Analysis and Outlook to 2034

10.5.3 Chile Bioanalytical Testing Services Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Bioanalytical Testing Services Industry

11. Middle East Africa Bioanalytical Testing Services Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Bioanalytical Testing Services Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Bioanalytical Testing Services Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Bioanalytical Testing Services Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Bioanalytical Testing Services Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Bioanalytical Testing Services Market Outlook

11.5.2 Egypt Bioanalytical Testing Services Market Outlook

11.5.3 Saudi Arabia Bioanalytical Testing Services Market Outlook

11.5.4 Iran Bioanalytical Testing Services Market Outlook

11.5.5 UAE Bioanalytical Testing Services Market Outlook

11.6 Leading Companies in Middle East Africa Bioanalytical Testing Services Business

12. Bioanalytical Testing Services Market Structure and Competitive Landscape

12.1 Key Companies in Bioanalytical Testing Services Business

12.2 Bioanalytical Testing Services Key Player Benchmarking

12.3 Bioanalytical Testing Services Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Bioanalytical Testing Services Market

14.1 Bioanalytical Testing Services trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Bioanalytical Testing Services Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Bioanalytical Testing Services Market is estimated to reach USD 11.6 billion by 2034.

The Global Bioanalytical Testing Services Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.53% during the forecast period from 2025 to 2034.

The Global Bioanalytical Testing Services Market is estimated to generate USD 5.0 billion in revenue in 2025

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!