"The Global Bioplastic Market was valued at $11.61 billion in 2025 and is projected to reach $ 45.8 billion by 2034, growing at a CAGR of 16.47%."

The bioplastic market is experiencing rapid growth as global industries shift toward sustainable and eco-friendly material solutions. Bioplastics are derived from renewable biomass sources such as corn starch, sugarcane, cellulose, and vegetable oils, offering an environmentally responsible alternative to conventional petroleum-based plastics. These materials can be biodegradable, compostable, or bio-based, making them highly attractive for reducing carbon footprints and addressing plastic pollution challenges. Key sectors driving demand include packaging, agriculture, consumer goods, automotive, and textiles, where companies are seeking materials that align with circular economy principles and meet regulatory pressures for sustainable practices. Increasing awareness among consumers, coupled with technological advancements in production and processing, is expanding the range of applications for bioplastics and making them more competitive with traditional plastics in terms of performance and cost-effectiveness.

The market is evolving with innovations in polymer chemistry, blending techniques, and manufacturing processes to improve the mechanical strength, heat resistance, and durability of bioplastics, thereby widening their industrial use. Governments worldwide are introducing incentives, bans on single-use plastics, and green procurement policies, further accelerating adoption. Asia Pacific is emerging as a dominant player in production due to abundant agricultural resources and growing manufacturing capabilities, while Europe leads in policy-driven market development and research initiatives. North America is also seeing rising demand, particularly in the packaging and automotive industries. With advancements in bio-based feedstocks, integration of waste-derived raw materials, and strategic collaborations between resin producers and brand owners, the bioplastic market is set to achieve significant scalability, fostering a more sustainable global materials economy.

Key Market Insights

- The bioplastic market is witnessing accelerated growth due to increasing environmental concerns, stringent regulations on single-use plastics, and the global push for sustainable materials. Demand is rising across industries that require eco-friendly alternatives without compromising performance and functionality.

- Packaging remains the largest end-use sector for bioplastics, driven by consumer demand for compostable and recyclable packaging solutions in food, beverages, and e-commerce. Companies are developing high-barrier bio-based films and containers to enhance product shelf life while meeting sustainability goals.

- Technological advancements in polymer science are enabling the development of bioplastics with enhanced thermal stability, tensile strength, and processability. These improvements are expanding their applications into high-performance areas such as automotive interiors, consumer electronics, and industrial components.

- The automotive industry is adopting bioplastics to reduce vehicle weight, lower emissions, and integrate renewable materials into dashboards, trims, and upholstery. This trend is supported by automakers’ sustainability targets and regulatory requirements for greener supply chains.

- Asia Pacific is emerging as the fastest-growing production hub for bioplastics due to its strong agricultural base, increasing manufacturing capabilities, and expanding domestic markets. Countries like China, Thailand, and India are investing heavily in bioplastic production facilities.

- Europe leads in research, innovation, and policy support for bioplastics, with strong emphasis on circular economy principles. EU directives banning certain single-use plastics have accelerated the transition to biodegradable and compostable alternatives across various sectors.

- North America is witnessing significant growth in bioplastic demand, particularly in packaging, agriculture, and consumer goods. Local producers are focusing on scaling production capacity and enhancing raw material sourcing from agricultural waste and non-food biomass.

- Raw material innovations, including the use of algae, waste cooking oil, and food industry by-products, are reducing production costs and enhancing the environmental profile of bioplastics. These feedstock alternatives also help address concerns about competition with food crops.

- Brand owners and retailers are increasingly committing to using bioplastics as part of their sustainability strategies. Partnerships between resin producers, converters, and consumer brands are accelerating the commercialization of high-quality bio-based products at competitive prices.

- Challenges remain in waste management infrastructure, as many regions lack the facilities to compost or recycle bioplastics effectively. This gap is driving investment in composting technologies, recycling innovations, and public awareness initiatives to ensure the material’s full environmental benefits are realized.

Regional Insights

North America Bioplastic Market

The North American bioplastic market is gaining momentum, shaped by growing consumer demand for sustainable packaging and corporate commitments to net-zero goals. Companies have significant opportunities in producing compostable films, biodegradable containers, and bio-based resins optimized for performance-sensitive applications. Collaborations between bioplastic producers and fast-moving consumer goods companies are enabling tailored, eco-friendly packaging solutions with strong brand appeal. Key trends include leveraging agri-waste and non-food feedstocks to reduce cost and environmental impact, and investing in regional bioplastic recycling and industrial composting infrastructure. With supportive policies emerging and investment in green material innovation increasing, the market outlook shows robust expansion across packaging, agriculture, and consumer goods sectors.

Asia Pacific Bioplastic Market

Asia Pacific stands at the forefront of bioplastic production, powered by abundant biomass feedstocks, expanding industrial capacity, and rising demand in packaging and consumer products. Companies are well-positioned to scale production of bio-based polymers using sugarcane, cassava, and industrial by-products, while forging partnerships to develop high-barrier bioplastic films and injection-molded parts for electronics and automotive interiors. A growing emphasis on circular economy principles is fostering pilot programs in municipal composting, biodegradable agricultural films, and localized recycling schemes. With supportive government incentives, growing middle-class markets, and sustainability-focused branding, the region is expected to sustain strong bioplastic market growth and innovation.

Europe Bioplastic Market

Europe's bioplastic market is anchored in stringent environmental regulations, strong circular economy policy frameworks, and consumer preference for sustainable goods. There is growing demand for enzymes, bio-based composites, and certified compostable packaging mandated by legislation targeting single-use plastics. Companies are innovating with bio-based formulations derived from organic waste and algae, and introducing drop-in bioplastic alternatives for conventional packaging and consumer goods. Trends include investment in industrial-scale composting facilities and material recovery infrastructure, allowing seamless integration of bioplastics into existing waste management systems. With powerful policy support and brand alignment around sustainability, Europe’s bioplastic market is poised for strategic expansion across packaging, agriculture, and specialty applications.

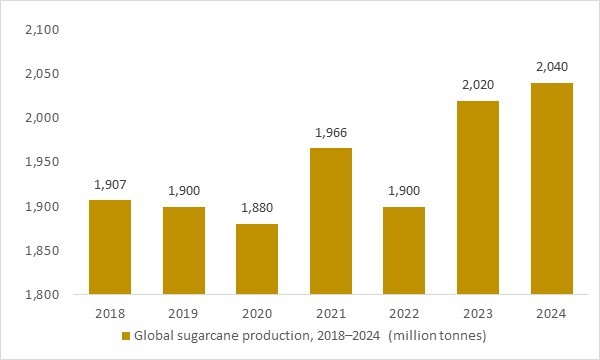

Global sugarcane production, 2018–2024 (million tonnes)

Figure: Global sugarcane production increased from providing a massive and expanding carbohydrate feedstock base for bioplastics. OG Analysis estimates, derived from FAO data, show how this abundant sugarcane supply underpins bio-PE, bio-PET, PLA and other bio-based polymers used in packaging, consumer goods and industrial components. The same bio-based materials increasingly feature in sustainable housings, enclosures and logistics packaging for radiation-detection, monitoring and security applications, aligning decarbonization goals with safety and compliance.

Global sugarcane production has risen from about 1,900 million tonnes in 2018 to an estimated 2,040 million tonnes by 2024, providing a massive and expanding carbohydrate feedstock base. This abundant supply underpins the growth of bioplastics made via sugar/ethanol routes to bio-PE, bio-PET, PLA and other bio-based polymers used in packaging, consumer goods and industrial components. As brands and regulators push for lower-carbon materials, sugarcane-derived bioplastics increasingly replace fossil plastics in housings, enclosures and logistics packaging. In radiation-detection, monitoring and security applications, this same bio-based material base supports more sustainable instrument casings, cable jackets and transport packs for radiopharmaceuticals, aligning safety infrastructure with decarbonization goals.

Report Scope

| Parameter | bioplastic market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type ,By Distribution Channel ,By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Bioplastic Market Segments Covered In The Report

By Type

- Biodegradable

- Non-Biodegradable

By Distribution Channel

- Online

- Offline

By Application

- Rigid Packaging

- Flexible Packaging

- Textile

- Agriculture And Horticulture

- Consumer Goods

- Automotive

- Electronics

- Building And Construction

- Other Applications

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Lonza Group AG, Fujifilm Diosynth Biotechnologies USA Inc., Thermo Fisher Scientific Inc., Samsung BioLogics Co. Ltd., WuXi Biologics Co. Ltd., Lonza Ltd., JRS Pharma Group, CMC Biologics AS, Catalent Inc., Boehringer Ingelheim GmbH, Rentschler Biopharma SE, AGC Biologics Inc., Abzena Ltd., AbbVie Inc., AstraZeneca plc, Bayer AG, Biogen Inc., Bristol-Myers Squibb Co., Eli Lilly and Company, Gilead Sciences Inc., GlaxoSmithKline plc, Johnson & Johnson, Merck & Co., Novartis AG, Pfizer Inc., Roche Holding Ag, Sanofi SA, Takeda Pharmaceuticals Co., Teva Pharmaceutical Industries Ltd., Vertex Pharmaceuticals Company, Moderna BioTechnology Company

Recent Industry Developments

- August 2025: Scientists at Washington University unveiled a novel bioplastic—named LEAFF—that biodegrades at room temperature, can be printed on, resists air and water, and offers significantly improved strength over conventional petroplastics.

- June 2025: Braskem inaugurated its $20 million Renewable Innovation Center in Massachusetts to advance research in converting bio-based feedstocks into next-generation bioplastics, aiming to scale biopolymer production toward one million tons annually by 2030.

- June 2025: A leading U.S. packaging manufacturer launched a new product line made entirely from compostable bioplastics for food service packaging, reinforcing its strategy to reduce landfill waste through sustainable packaging alternatives.

- June 2025: Danimer Scientific introduced a next-generation biodegradable resin with enhanced moisture resistance, tailored for food packaging applications, signifying technological progress in bioplastic performance.

- May 2025: An American biopolymer startup revealed an innovative algae-based bioplastic that offers improved biodegradability and moisture resistance, marking progress in eco-friendly material development.

- May 2025: Intec Bioplastics launched EarthPlus® Hercules Bioflex™ Stretch Wrap—a sustainable, high-performance packaging material incorporating 35% renewable plant-based content and notable stretch properties, designed for pallet and food-wrapping use.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Bioplastic market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Bioplastic market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Bioplastic market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Bioplastic business prospects by region, key countries, and top companies' information to channel their investments.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Bioplastic Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Bioplastic Market Overview

2.2 Market Strategies of Leading Bioplastic Companies

2.3 Bioplastic Market Insights, 2024 - 2034

2.3.1 Leading Bioplastic Types, 2024 - 2034

2.3.2 Leading Bioplastic End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Bioplastic sales, 2024 - 2034

2.4 Bioplastic Market Drivers and Restraints

2.4.1 Bioplastic Demand Drivers to 2034

2.4.2 Bioplastic Challenges to 2034

2.5 Bioplastic Market- Five Forces Analysis

2.5.1 Bioplastic Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Bioplastic Market Value, Market Share, and Forecast to 2034

3.1 Global Bioplastic Market Overview, 2024

3.2 Global Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

3.4 Global Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

3.5 Global Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

3.6 Global Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Bioplastic Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Bioplastic Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Bioplastic Market Overview, 2024

4.2 Asia Pacific Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

4.4 Asia Pacific Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

4.5 Asia Pacific Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

4.6 Asia Pacific Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Bioplastic Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Bioplastic Market Value, Market Share, and Forecast to 2034

5.1 Europe Bioplastic Market Overview, 2024

5.2 Europe Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

5.4 Europe Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

5.5 Europe Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

5.6 Europe Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Bioplastic Market Size and Share Outlook by Country, 2024 - 2034

6. North America Bioplastic Market Value, Market Share and Forecast to 2034

6.1 North America Bioplastic Market Overview, 2024

6.2 North America Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

6.4 North America Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

6.5 North America Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

6.6 North America Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Bioplastic Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Bioplastic Market Value, Market Share and Forecast to 2034

7.1 South and Central America Bioplastic Market Overview, 2024

7.2 South and Central America Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

7.4 South and Central America Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

7.5 South and Central America Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

7.6 South and Central America Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Bioplastic Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Bioplastic Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Bioplastic Market Overview, 2024

8.2 Middle East and Africa Bioplastic Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Bioplastic Market Size and Share Outlook By Type, 2024 - 2034

8.4 Middle East Africa Bioplastic Market Size and Share Outlook By Distribution Channel, 2024 - 2034

8.5 Middle East Africa Bioplastic Market Size and Share Outlook By Application, 2024 – 2034

8.6 Middle East Africa Bioplastic Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Bioplastic Market Size and Share Outlook by Country, 2024 - 2034

9. Bioplastic Market Structure

9.1 Key Players

9.2 Bioplastic Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Bioplastic Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Bioplastic Market is estimated to generate USD 11.61 billion in revenue in 2025.

The Global Bioplastic Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 16.47% during the forecast period from 2025 to 2034.

The Bioplastic Market is estimated to reach USD 45.8 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!