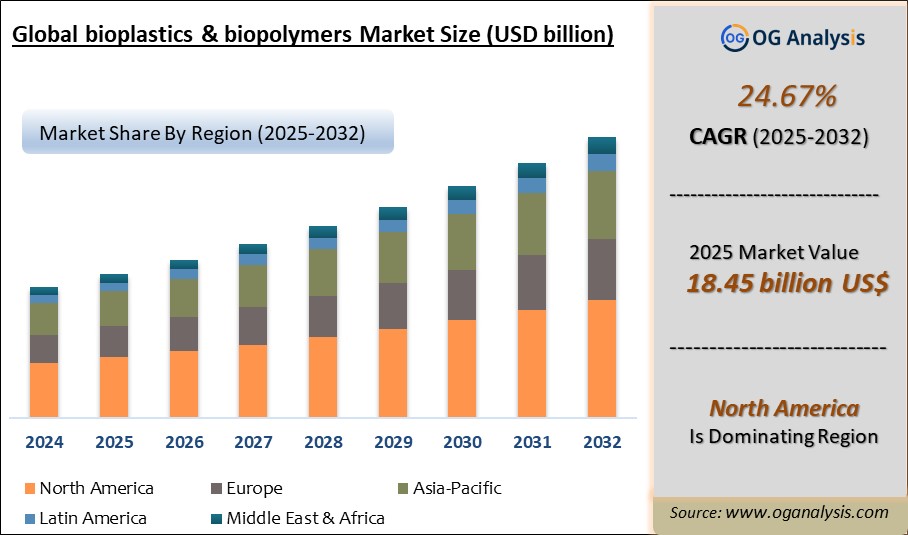

"The Global Bioplastics & Biopolymers Market valued at USD 14.8 billion in 2024, is expected to grow by 24.67% CAGR to reach market size worth USD 136.6 billion by 2034."

The bioplastics and biopolymers market is experiencing a period of rapid growth, driven by the increasing global demand for sustainable and environmentally friendly materials. Bioplastics and biopolymers are derived from renewable resources like starch, cellulose, vegetable oils, and other biomass, offering a viable alternative to traditional petroleum-based plastics. These materials provide a range of benefits, including biodegradability, compostability, and reduced carbon footprint, making them attractive solutions for reducing plastic waste and mitigating environmental impact. The market is propelled by increasing awareness of environmental concerns, growing government regulations promoting sustainable practices, and consumer preference for eco-friendly products. In 2024, the bioplastics and biopolymers market witnessed significant progress with the development of new bio-based polymers with improved properties like strength, flexibility, and biodegradability, leading to expanded applications in packaging, consumer goods, and other sectors.

Looking ahead to 2025, the bioplastics and biopolymers market is poised for continued robust growth. The global push towards a circular economy, coupled with the increasing adoption of sustainable packaging and the growing demand for compostable and biodegradable materials, are expected to fuel market expansion. The market is likely to see further advancements in bio-based polymer technology, leading to the development of materials with enhanced properties that can replace conventional plastics in a wider range of applications. However, the industry will also face challenges related to cost competitiveness with traditional plastics, ensuring consistent quality and performance of bio-based materials, and developing sustainable sourcing and supply chains for renewable feedstocks. The bioplastics and biopolymers market is therefore at a critical juncture, balancing the potential for environmental benefits with the need for cost-effective solutions, innovation, and responsible sourcing practices.

The Global Bioplastics & Biopolymers Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

North America is the leading region in the bioplastics & biopolymers market, propelled by stringent environmental regulations, strong governmental support for sustainable materials, and increasing consumer demand for eco-friendly packaging solutions. Packaging is the dominant segment in this market, fueled by the widespread adoption of biobased alternatives in food, beverage, and retail industries, rising awareness of plastic pollution, and the growing shift toward circular economy practices.

Trade Intelligence- Bioplastics & Biopolymers Market

| Global Natural polymers and modified polymers Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 2,520 | 3,125 | 3,643 | 3,904 | 3,419 |

| United States of America | 284 | 338 | 382 | 403 | 399 |

| Korea, Republic of | 185 | 260 | 237 | 360 | 257 |

| Japan | 227 | 233 | 241 | 285 | 228 |

| Germany | 163 | 189 | 211 | 206 | 204 |

| Netherlands | 121 | 96 | 164 | 140 | 170 |

| Source: OGAnalysis | |||||

- United States of America, Korea, Republic of, Japan, Germany and Netherlands are the top five countries importing 36.8% of global Natural polymers and modified polymers in 2024

- Global Natural polymers and modified polymers Imports increased by 35.7% between 2020 and 2024

- United States of America accounts for 11.7% of global Natural polymers and modified polymers trade in 2024

- Korea, Republic of accounts for 7.5% of global Natural polymers and modified polymers trade in 2024

- Japan accounts for 6.7% of global Natural polymers and modified polymers trade in 2024

| Global Natural polymers and modified polymers Export Prices, USD/Ton, 2020-24 |

| |

| Source: OGAnalysis |

Bioplastics & Biopolymers Market Strategy, Price Trends, Drivers, Challenges and Opportunities to 2034

In terms of market strategy, price trends, drivers, challenges, and opportunities from2025 to 2034, Bioplastics & Biopolymers market players are directing investments toward acquiring new technologies, securing raw materials through efficient procurement and inventory management, enhancing product portfolios, and leveraging capabilities to sustain growth amidst challenging conditions. Regional-specific strategies are being emphasized due to highly varying economic and social challenges across countries.

Factors such as global economic slowdown, the impact of geopolitical tensions, delayed growth in specific regions, and the risks of stagflation necessitate a vigilant and forward-looking approach among Bioplastics & Biopolymers industry players. Adaptations in supply chain dynamics and the growing emphasis on cleaner and sustainable practices further drive strategic shifts within companies.

The market study delivers a comprehensive overview of current trends and developments in the Bioplastics & Biopolymers industry, complemented by detailed descriptive and prescriptive analyses for insights into the market landscape until 2034.

North America Bioplastics & Biopolymers Market Analysis

The North America Bioplastics & Biopolymers market exhibited robust developments in 2024, driven by advancements in precision agriculture, sustainable farming practices, and the adoption of cutting-edge technologies such as AI and robotics in agriculture. Key trends include a shift toward biological solutions like agricultural microbial and biopolymers, along with growing demand for connected agriculture platforms. Anticipated growth from 2025 is underpinned by increased government incentives promoting eco-friendly practices, the rising focus on food security, and enhanced technological integration across farming operations. The competitive landscape is marked by significant investments in R&D by leading players and strategic collaborations to develop innovative solutions. Companies leveraging AI, bioplastics, and agrochemical CDMO services are poised to gain a competitive edge, addressing evolving consumer and regulatory demands for sustainable agricultural practices.

Europe Bioplastics & Biopolymers Market Outlook

In 2024, the Europe Bioplastics & Biopolymers market witnessed accelerated developments in sustainable agriculture, with a notable emphasis on bioplastics, probiotics in animal feed, and aquaponics. These advancements align with stringent EU regulations promoting eco-friendly solutions and reducing chemical inputs. From 2025, the market is expected to see significant growth fueled by policy-driven innovation, growing consumer preference for organic products, and increased adoption of artificial intelligence in agriculture. The competitive landscape is characterized by a strong presence of regional players and cross-border collaborations aimed at advancing biological solutions and connected agriculture technologies. Innovations in agricultural packaging and the deployment of self-loading feed mixers further reinforce the region’s push toward sustainability and efficiency.

Asia-Pacific Bioplastics & Biopolymers Market Forecast

Asia-Pacific’s Bioplastics & Biopolymers market expanded significantly in 2024, driven by increasing investments in agricultural robotics, aquaponics, and microbial-based solutions to meet the rising food demand and combat resource constraints. Growth prospects from 2025 are bolstered by advancements in connected agriculture technologies, expanding government initiatives to modernize farming, and heightened focus on climate-resilient farming practices. The competitive landscape reveals a dynamic interplay of multinational corporations and emerging startups, particularly in markets like artificial intelligence in agriculture and agrochemical CDMO services. Players prioritizing scalability, cost-efficiency, and sustainable practices are likely to capitalize on the region's growing appetite for agricultural innovation.

Middle East, Africa, Latin America (RoW) Bioplastics & Biopolymers Market

The Middle East, Africa, Latin America Bioplastics & Biopolymers market demonstrated promising progress in 2024, with rising adoption of sustainable farming practices in regions like the Middle East, Africa, and South America. Key developments include the growing penetration of agricultural biologicals, artificial reefs for ecosystem restoration, and sea buckthorn cultivation for nutraceutical applications. Anticipated growth from 2025 is supported by increasing international funding for agri-tech solutions, burgeoning interest in aquaponics, and expanding agricultural trade networks. The competitive landscape features a mix of local innovators and global players leveraging region-specific strategies to address resource constraints and enhance productivity. Investments in AI-driven agriculture, bioplastics, and advanced feed solutions are expected to drive market expansion in underserved regions.

Bioplastics & Biopolymers Market Dynamics and Future Analytics

The research analyses the Bioplastics & Biopolymers parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Bioplastics & Biopolymers market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Bioplastics & Biopolymers market projections.

Recent deals and developments are considered for their potential impact on Bioplastics & Biopolymers's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Bioplastics & Biopolymers market.

Bioplastics & Biopolymers trade and price analysis helps comprehend Bioplastics & Biopolymers's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Bioplastics & Biopolymers price trends and patterns, and exploring new Bioplastics & Biopolymers sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Bioplastics & Biopolymers market.

Bioplastics & Biopolymers Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Bioplastics & Biopolymers market and players serving the Bioplastics & Biopolymers value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Bioplastics & Biopolymers market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Bioplastics & Biopolymers products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Bioplastics & Biopolymers market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Bioplastics & Biopolymers market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Bioplastics & Biopolymers Market Research Scope

• Global Bioplastics & Biopolymers market size and growth projections (CAGR), 2024- 2034

• Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Bioplastics & Biopolymers Trade and Supply-chain

• Bioplastics & Biopolymers market size, share, and outlook across 5 regions and 27 countries, 2023- 2034

• Bioplastics & Biopolymers market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023- 2034

• Short and long-term Bioplastics & Biopolymers market trends, drivers, restraints, and opportunities

• Porter’s Five Forces analysis, Technological developments in the Bioplastics & Biopolymers market, Bioplastics & Biopolymers supply chain analysis

• Bioplastics & Biopolymers trade analysis, Bioplastics & Biopolymers market price analysis, Bioplastics & Biopolymers supply/demand

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

• Latest Bioplastics & Biopolymers market news and developments

The Bioplastics & Biopolymers Market international scenario is well established in the report with separate chapters on North America Bioplastics & Biopolymers Market, Europe Bioplastics & Biopolymers Market, Asia-Pacific Bioplastics & Biopolymers Market, Middle East and Africa Bioplastics & Biopolymers Market, and South and Central America Bioplastics & Biopolymers Markets. These sections further fragment the regional Bioplastics & Biopolymers market by type, application, end-user, and country.

Report Scope

| Parameter | Bioplastics & Biopolymers Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Regional Insights

North America Bioplastics & Biopolymers market data and outlook to 2034

United States

Canada

Mexico

Europe Bioplastics & Biopolymers market data and outlook to 2034

Germany

United Kingdom

France

Italy

Spain

BeNeLux

Russia

Asia-Pacific Bioplastics & Biopolymers market data and outlook to 2034

China

Japan

India

South Korea

Australia

Indonesia

Malaysia

Vietnam

Middle East and Africa Bioplastics & Biopolymers market data and outlook to 2034

Saudi Arabia

South Africa

Iran

UAE

Egypt

South and Central America Bioplastics & Biopolymers market data and outlook to 2034

Brazil

Argentina

Chile

Peru

* We can include data and analysis of additional coutries on demand

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Bioplastics & Biopolymers market sales data at the global, regional, and key country levels with a detailed outlook to 2034 allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Bioplastics & Biopolymers market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Bioplastics & Biopolymers market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Bioplastics & Biopolymers business prospects by region, key countries, and top companies' information to channel their investments.

Biopolymers & Bioplastics Market Segmentation

By Product Type

- Biodegradable Bioplastics

- Non-Biodegradable/Bio-Based Bioplastics

- Others

By Raw Material Type

- Sugarcane/Sugarbeet

- Corn Starch

- Potato

- Cassava

- Wheat

- Switchgrass

- Others

By End-Use Industry

- Packaging

- Packaging

- Consumer Goods

- Automotive & Transportation

- Textiles

- Coatings & Adhesives

- Building & Construction

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

NatureWorks

-

Braskem

-

BASF

-

Total Corbion

-

Versalis

-

Biome Bioplastics

-

Mitsubishi Chemical

-

Biotec

-

Plantic Technologies

-

Toray Industries

Recent Developments

- A researcher at GITAM Deemed University in Visakhapatnam patented an eco-friendly bioplastic created from dairy industry ghee residue, blended with glycerol, beeswax, chitin, and zein protein; it biodegrades within 24 hours in water and within 20–30 days in soil, aimed at sustainable food packaging solutions.

- University of Queensland scientists developed a biodegradable bioplastic by fermenting bacteria-derived PHAs reinforced with Radiata pine sawdust; the resulting punnets for strawberries match the strength of conventional plastics and biodegrade across soil, water, and compost environments.

- A peer-reviewed study found that starch-based bioplastics—often promoted as eco-friendly—may cause health risks in mice, including organ damage and metabolic disruption, and degrade into microparticles similar to conventional plastics.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Bioplastics & Biopolymers Market Review, 2024

2.1 Bioplastics & Biopolymers Industry Overview

2.2 Research Methodology

3. Bioplastics & Biopolymers Market Insights

3.1 Bioplastics & Biopolymers Market Trends to 2034

3.2 Future Opportunities in Bioplastics & Biopolymers Market

3.3 Dominant Applications of Bioplastics & Biopolymers, 2024 Vs 2034

3.4 Key Types of Bioplastics & Biopolymers, 2024 Vs 2034

3.5 Leading End Uses of Bioplastics & Biopolymers Market, 2024 Vs 2034

3.6 High Prospect Countries for Bioplastics & Biopolymers Market, 2024 Vs 2034

4. Bioplastics & Biopolymers Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Bioplastics & Biopolymers Market

4.2 Key Factors Driving the Bioplastics & Biopolymers Market Growth

4.2 Major Challenges to the Bioplastics & Biopolymers industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Bioplastics & Biopolymers supply chain

5 Five Forces Analysis for Global Bioplastics & Biopolymers Market

5.1 Bioplastics & Biopolymers Industry Attractiveness Index, 2024

5.2 Bioplastics & Biopolymers Market Threat of New Entrants

5.3 Bioplastics & Biopolymers Market Bargaining Power of Suppliers

5.4 Bioplastics & Biopolymers Market Bargaining Power of Buyers

5.5 Bioplastics & Biopolymers Market Intensity of Competitive Rivalry

5.6 Bioplastics & Biopolymers Market Threat of Substitutes

6. Global Bioplastics & Biopolymers Market Data – Industry Size, Share, and Outlook

6.1 Bioplastics & Biopolymers Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Bioplastics & Biopolymers Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Bioplastics & Biopolymers Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Bioplastics & Biopolymers Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Bioplastics & Biopolymers Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Bioplastics & Biopolymers Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Bioplastics & Biopolymers Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Bioplastics & Biopolymers Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Bioplastics & Biopolymers Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Bioplastics & Biopolymers Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.2 Japan Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.3 India Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.4 South Korea Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.5 Australia Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.6 Indonesia Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.7 Malaysia Bioplastics & Biopolymers Analysis and Forecast to 2034

7.5.8 Vietnam Bioplastics & Biopolymers Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Bioplastics & Biopolymers Industry

8. Europe Bioplastics & Biopolymers Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Bioplastics & Biopolymers Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Bioplastics & Biopolymers Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Bioplastics & Biopolymers Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Bioplastics & Biopolymers Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.3 2024 France Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.4 2024 Italy Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.5 2024 Spain Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Bioplastics & Biopolymers Market Size and Outlook to 2034

8.5.7 2024 Russia Bioplastics & Biopolymers Market Size and Outlook to 2034

8.6 Leading Companies in Europe Bioplastics & Biopolymers Industry

9. North America Bioplastics & Biopolymers Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Bioplastics & Biopolymers Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Bioplastics & Biopolymers Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Bioplastics & Biopolymers Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Bioplastics & Biopolymers Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Bioplastics & Biopolymers Market Analysis and Outlook

9.5.2 Canada Bioplastics & Biopolymers Market Analysis and Outlook

9.5.3 Mexico Bioplastics & Biopolymers Market Analysis and Outlook

9.6 Leading Companies in North America Bioplastics & Biopolymers Business

10. Latin America Bioplastics & Biopolymers Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Bioplastics & Biopolymers Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Bioplastics & Biopolymers Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Bioplastics & Biopolymers Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Bioplastics & Biopolymers Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Bioplastics & Biopolymers Market Analysis and Outlook to 2034

10.5.2 Argentina Bioplastics & Biopolymers Market Analysis and Outlook to 2034

10.5.3 Chile Bioplastics & Biopolymers Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Bioplastics & Biopolymers Industry

11. Middle East Africa Bioplastics & Biopolymers Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Bioplastics & Biopolymers Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Bioplastics & Biopolymers Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Bioplastics & Biopolymers Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Bioplastics & Biopolymers Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Bioplastics & Biopolymers Market Outlook

11.5.2 Egypt Bioplastics & Biopolymers Market Outlook

11.5.3 Saudi Arabia Bioplastics & Biopolymers Market Outlook

11.5.4 Iran Bioplastics & Biopolymers Market Outlook

11.5.5 UAE Bioplastics & Biopolymers Market Outlook

11.6 Leading Companies in Middle East Africa Bioplastics & Biopolymers Business

12. Bioplastics & Biopolymers Market Structure and Competitive Landscape

12.1 Key Companies in Bioplastics & Biopolymers Business

12.2 Bioplastics & Biopolymers Key Player Benchmarking

12.3 Bioplastics & Biopolymers Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Bioplastics & Biopolymers Market

14.1 Bioplastics & Biopolymers trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Bioplastics & Biopolymers Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Bioplastics & Biopolymers Market is estimated to reach USD 136.6 billion by 2034.

The Global Bioplastics & Biopolymers Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 24.67% during the forecast period from 2025 to 2034.

The Global Bioplastics & Biopolymers Market is estimated to generate USD 18.3 billion in revenue in 2025

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!