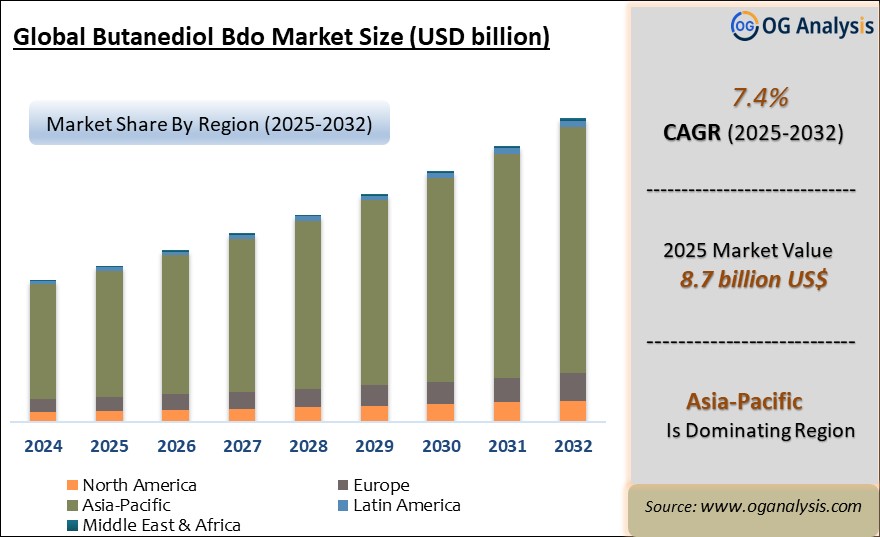

"The Global Butanediol (BDO) Market Size was valued at USD 8.1 billion in 2024 and is projected to reach USD 8.7 billion in 2025. Worldwide sales of Butanediol (BDO) are expected to grow at a significant CAGR of 7.4%, reaching USD 16.8 billion by the end of the forecast period in 2034."

The global butanediol (BDO) market is a vital component of the chemical industry, as butanediol is a versatile organic compound used in a wide array of applications, including plastics, automotive, and pharmaceutical products. BDO serves as a critical building block for the production of various chemicals such as tetrahydrofuran (THF), polyurethanes, and plasticizers. The market for BDO is driven by its widespread use in manufacturing products like spandex fibers, solvents, and coatings. The growth of key end-use industries, including textiles, automotive, and electronics, is fueling the demand for BDO. Additionally, increasing investments in renewable feedstocks for the production of BDO are fostering growth in the market. The ongoing industrialization and urbanization in emerging markets, particularly in Asia-Pacific, are anticipated to further bolster the demand for BDO. The market is also witnessing a shift towards more sustainable and eco-friendly production methods, as companies seek to reduce their environmental footprint. The global BDO market is expected to continue growing steadily, with demand expanding due to increased applications across various industries, including automotive and construction, where it is used in the production of durable materials and coatings.

The BDO market is expected to grow due to various factors such as the increasing adoption of BDO-based products in emerging industries and the growing demand for high-performance materials. The Asia-Pacific region, particularly China, is expected to be the largest consumer of BDO due to the rapidly expanding manufacturing sector. Moreover, BDO’s demand is also being driven by advancements in polymer production, with BDO being a key ingredient in polybutylene terephthalate (PBT) resins. Other key drivers include technological advancements in BDO production, such as the use of renewable raw materials, which is expected to reduce the carbon footprint of BDO production. As the demand for sustainable and high-performance products grows, BDO’s applications in various chemical processes and industrial products will continue to expand. However, the market faces challenges related to fluctuations in raw material prices and supply chain disruptions, which may affect market growth. Despite these challenges, the overall outlook for the BDO market remains positive, with increasing demand from end-use industries, the shift toward greener production methods, and ongoing investments in research and development.

By derivative, Tetrahydrofuran (THF) is the largest segment in the butanediol (BDO) market. THF, derived from BDO, is widely used in the production of polymers, resins, and solvents, particularly in industries such as automotive and pharmaceuticals. Its demand is driven by its essential role in producing coatings, adhesives, and in the manufacturing of polyurethanes and spandex fibers.

By technology, Reppe Process is the fastest-growing segment in the BDO market. This process is becoming more popular due to its efficient conversion of acetylene into BDO, making it an attractive choice for cost-effective production. It offers improved yields and is increasingly adopted by manufacturers looking to meet the rising demand for BDO, especially in Asia-Pacific.

Trade Intelligence for butanediol (BDO) market

| Global Butan-1-ol "n-butyl alcohol" Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 635 | 1,117 | 991 | 768 | 790 |

| Belgium | 111.9 | 198 | 181 | 126.4 | 138 |

| China | 183 | 201 | 188 | 184 | 131 |

| Germany | 104 | 143 | 152 | 90.2 | 118 |

| India | 37.4 | 52.8 | 44.3 | 44.9 | 77.1 |

| Korea, Republic of | 35.1 | 95.0 | 67.2 | 61.1 | 56.7 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- Belgium, China, Germany, India and Korea, Republic of are the top five countries importing 65.9% of global Butan-1-ol "n-butyl alcohol" in 2024

- Global Butan-1-ol "n-butyl alcohol" Imports increased by 24.4% between 2020 and 2024

- Belgium accounts for 17.5% of global Butan-1-ol "n-butyl alcohol" trade in 2024

- China accounts for 16.6% of global Butan-1-ol "n-butyl alcohol" trade in 2024

- Germany accounts for 14.9% of global Butan-1-ol "n-butyl alcohol" trade in 2024

| Global Butan-1-ol "n-butyl alcohol" Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Key insights

-

The butanediol (BDO) market is experiencing growth due to its diverse applications across various industries, including automotive, textiles, and pharmaceuticals. As a key ingredient in spandex fibers, coatings, and solvents, BDO’s versatility is driving demand across sectors that require high-performance materials and chemicals, contributing to its rising market presence globally.

-

Asia-Pacific, particularly China, remains the dominant consumer of butanediol, owing to the region's growing manufacturing sector. With robust industrialization and urbanization, the demand for BDO is expected to continue growing, as its applications in automotive, textiles, and coatings increase, further establishing Asia-Pacific’s strong foothold in the BDO market.

-

The automotive industry’s demand for durable and high-performance materials is fueling the growth of BDO, especially in the production of polybutylene terephthalate (PBT) resins. BDO’s role in the development of automotive parts, electrical connectors, and durable goods is driving increased usage in this sector, helping to meet rising demands for energy-efficient, lightweight vehicles.

-

Technological advancements in BDO production are focused on enhancing efficiency and reducing environmental impacts. Companies are increasingly adopting sustainable and eco-friendly production methods, utilizing renewable raw materials. These advancements align with growing market demand for greener manufacturing processes, making BDO a more attractive option in environmentally-conscious industries.

-

The growing demand for high-performance and sustainable building materials in the construction sector is driving the use of BDO-based products. Its application in adhesives, coatings, and sealants enhances product durability and performance, making it an essential component in modern infrastructure development and environmentally friendly construction materials.

-

BDO’s role in the production of bio-based products and renewable chemicals is expanding, with increasing investments in research and development. As companies look for alternatives to fossil fuel-based chemicals, BDO offers opportunities for the development of more sustainable bioplastics, reducing dependence on non-renewable resources and supporting the transition to a circular economy.

-

The shift toward renewable energy sources is increasing BDO’s importance in the energy sector. As BDO plays a critical role in energy-efficient technologies, such as wind turbine coatings and solar panel adhesives, its applications in the renewable energy market are set to grow, contributing to the development of greener energy solutions.

-

The demand for butanediol in personal care and cosmetic products is on the rise. Its role as a solvent and emollient in creams, lotions, and makeup products is expanding as consumers increasingly seek high-quality personal care products. BDO's multifunctional properties make it a preferred ingredient in this growing market.

-

Despite its growth, the BDO market faces challenges related to fluctuations in raw material prices and supply chain disruptions. These factors can lead to price volatility and shortages in BDO availability, affecting manufacturers’ production costs and potentially slowing market growth, especially in regions with less access to key feedstocks.

-

Ongoing research and development efforts in the BDO market are focusing on improving production methods and discovering new applications. Innovations such as the development of bio-based BDO and more cost-effective production processes are expected to enhance BDO’s market competitiveness and expand its use across emerging industries.

Market Players

BASF SE

Mitsubishi Chemical Corporation

Ashland Inc.

LyondellBasell Industries N.V.

The Dow Chemical Company

Invista S.a.r.l.

Shanxi Sanwei Group Co. Ltd.

Sinopec Yizheng Chemical Fiber Company

Dairen Chemical Corporation

MarkorChem

Novamont S.p.A.

Zhongyuan Dahua Group

Genomatica, Inc.

Report Scope

| Parameter | butanediol (BDO) market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Derivative, By End user, By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Derivative

- Tetrahydrofuran (THF)

- Polybutylene Terephthalate (PBT)

- Gamma Butyrolactone (GBL)

- Polyurethane (PU)

- Other Derivatives

By End User

- Automotive

- Healthcare and Pharmaceutical

- Textile

- Electrical and Electronics

- Other End user Industries

By Technology

- Reppe Process

- Davy Process

- Butadiene Process

- Propylene Oxide Process

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

-

In July 2025, Qore® commenced operations at its large-scale bio-based butanediol (BDO) plant in Iowa, marking a significant milestone in sustainable chemical production. The plant utilizes Genomatica's GENO™ BDO technology, producing QIRA®, a bio-based BDO that serves as a direct replacement for fossil-derived BDO in various applications. The LYCRA Company is adopting QIRA® to enhance the sustainability of LYCRA fiber, with the potential to reduce its carbon footprint by up to 44% compared to fossil-based alternatives.

-

In September 2023, BASF SE secured long-term access to QIRA®, Qore®'s bio-based 1,4-butanediol, to expand its portfolio of bio-based derivatives. This strategic move aligns with BASF's commitment to sustainable development and is expected to provide commercial quantities of bio-based BDO by Q1 2025.

-

Genomatica's GENO™ BDO technology continues to gain traction in the industry, with multiple companies adopting the bio-based BDO produced through this process. The technology offers a sustainable alternative to traditional fossil-derived BDO, aligning with the growing demand for eco-friendly chemicals in various industries.

-

In October 2022, BASF SE announced the manufacturing of 1,4-butanediol through renewable feedstock, including Genomatica's patented GENO BDO technology. This move supports BASF's expansion of its bio-based derivatives portfolio, including tetrahydrofuran and polytetrahydrofuran, with commercial quantities anticipated by Q1 2025.

-

Effective July 1, 2014, BASF announced a price increase for 1,4-butanediol (BDO) and its derivatives in North America. The price increase applies to various grades of BDO and is part of BASF's strategy to adjust to market conditions and maintain product quality.

-

In April 2025, LyondellBasell announced a price increase for 1,4-butanediol (BDO) and its derivatives, effective April 1, 2025. The price adjustment reflects the company's response to market dynamics and aims to support continued investment in its product portfolio.

-

In January 2021, Ashland Global Specialty Chemicals Inc. announced a price increase for 1,4-butanediol (BDO) and various derivative products in North America. The price of BDO was raised by 45 cents per pound, effective January 1, 2021, or as agreements allow.

-

In April 2025, INEOS Solvents SA lodged a complaint prompting the European Commission to initiate an anti-dumping investigation into imports of 1,4-butanediol (BDO) originating from China, Saudi Arabia, and the United States. The investigation aims to assess whether these imports are being dumped and causing material injury to the EU industry.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Butanediol Bdo Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Butanediol Bdo Market Overview

2.2 Key Strategies of Leading butanediol bdo Companies

2.3 Butanediol Bdo Market Insights, 2024- 2034

2.3.1 Leading butanediol bdo Types, 2024- 2034

2.3.2 Leading butanediol bdo End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for butanediol bdo sales, 2024- 2034

2.4 Butanediol Bdo Market Drivers and Restraints

2.4.1 butanediol bdo Demand Drivers to 2034

2.4.2 butanediol bdo Challenges to 2034

2.5 Butanediol Bdo Market- Five Forces Analysis

2.5.1 butanediol bdo Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Butanediol Bdo Market Value, Market Share, and Forecast to 2034

3.1 Global Butanediol Bdo Market Overview, 2024

3.2 Global Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

3.3.1 Tetrahydrofuran (THF)

3.3.2 Polybutylene Terephthalate (PBT)

3.3.3 Gamma Butyrolactone (GBL)

3.3.4 Polyurethane (PU)

3.3.5 Other Derivatives

3.4 Global Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

3.4.1 Automotive

3.4.2 Healthcare and Pharmaceutical

3.4.3 Textile

3.4.4 Electrical and Electronics

3.4.5 Other End user Industries

3.5 Global Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

3.5.1 Reppe Process

3.5.2 Davy Process

3.5.3 Butadiene Process

3.5.4 Propylene Oxide Process

3.5.5 Others

3.6 Global Butanediol Bdo Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Butanediol Bdo Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Butanediol Bdo Market Overview, 2024

4.2 Asia Pacific Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

4.4 Asia Pacific Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

4.5 Asia Pacific Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

4.6 Asia Pacific Butanediol Bdo Market Size and Share Outlook by Country, 2024- 2034

4.7 Key Companies in Asia Pacific Butanediol Bdo Market

5. Europe Butanediol Bdo Market Value, Market Share, and Forecast to 2034

5.1 Europe Butanediol Bdo Market Overview, 2024

5.2 Europe Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

5.4 Europe Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

5.5 Europe Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

5.6 Europe Butanediol Bdo Market Size and Share Outlook by Country, 2024- 2034

5.7 Key Companies in Europe Butanediol Bdo Market

6. North America Butanediol Bdo Market Value, Market Share and Forecast to 2034

6.1 North America Butanediol Bdo Market Overview, 2024

6.2 North America Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

6.4 North America Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

6.5 North America Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

6.6 North America Butanediol Bdo Market Size and Share Outlook by Country, 2024- 2034

6.7 Key Companies in North America Butanediol Bdo Market

7. South and Central America Butanediol Bdo Market Value, Market Share and Forecast to 2034

7.1 South and Central America Butanediol Bdo Market Overview, 2024

7.2 South and Central America Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

7.4 South and Central America Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

7.5 South and Central America Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

7.6 South and Central America Butanediol Bdo Market Size and Share Outlook by Country, 2024- 2034

7.7 Key Companies in South and Central America Butanediol Bdo Market

8. Middle East Africa Butanediol Bdo Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Butanediol Bdo Market Overview, 2024

8.2 Middle East and Africa Butanediol Bdo Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Butanediol Bdo Market Size and Share Outlook By Derivative, 2024- 2034

8.4 Middle East Africa Butanediol Bdo Market Size and Share Outlook By End User, 2024- 2034

8.5 Middle East Africa Butanediol Bdo Market Size and Share Outlook By Technology, 2024- 2034

8.6 Middle East Africa Butanediol Bdo Market Size and Share Outlook by Country, 2024- 2034

8.7 Key Companies in Middle East Africa Butanediol Bdo Market

9. Butanediol Bdo Market Structure

9.1 Key Players

9.2 butanediol bdo Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. butanediol bdo Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Butanediol (BDO) Market is estimated to reach USD 14.3 billion by 2032.

The Global Butanediol (BDO) Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.4% during the forecast period from 2025 to 2032.

The Global Butanediol (BDO) Market is estimated to generate USD 8.1 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!