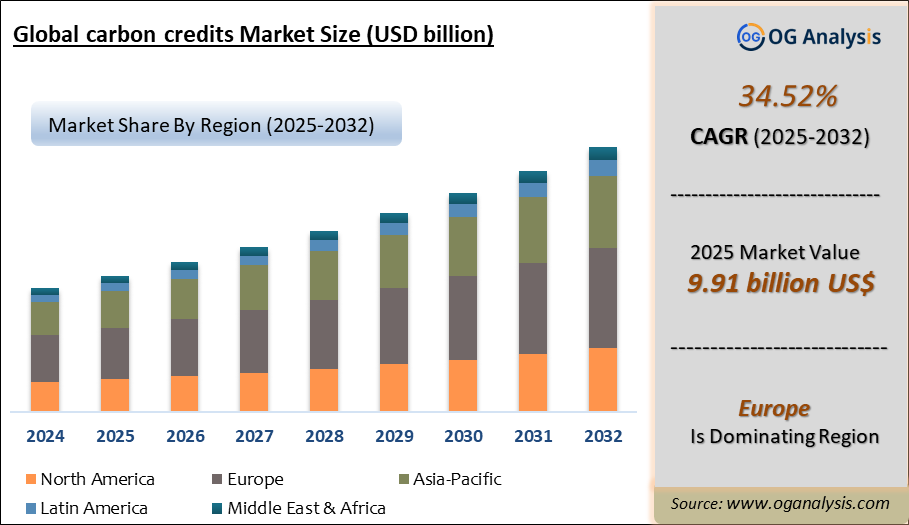

"The Global Carbon Credits Market valued at USD 463. billion in 2024, is expected to grow by 34.52% CAGR to reach market size worth USD 9,172.2 billion by 2034."

The carbon credits market, a dynamic and fast-growing segment within the global environmental finance landscape, facilitates the trading of emission reduction units, known as carbon credits. These credits represent verified reductions in greenhouse gas emissions, providing a mechanism for companies and organizations to offset their emissions and contribute to climate change mitigation. The carbon credits market emerged as a response to the growing urgency to combat climate change and the need for market-based mechanisms to incentivize emissions reductions.

In 2024, the carbon credits market witnessed a significant surge in activity, driven by a confluence of factors, including increasing global awareness of climate change, the adoption of carbon pricing mechanisms, and the implementation of stricter emissions regulations by governments worldwide. The market is also experiencing a shift towards more robust verification and monitoring systems, ensuring the integrity and credibility of carbon credits.

The Global Carbon Credits Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

Europe leads the carbon credits market with a 38% share, propelled by stringent climate policies and a mature Emissions Trading System (ETS); the compliance segment dominates, driven by regulatory mandates for corporations to offset their greenhouse gas emissions.

Carbon Credits Market Strategy, Price Trends, Drivers, Challenges and Opportunities to 2034

In terms of market strategy, price trends, drivers, challenges, and opportunities from2025 to 2034, Carbon Credits market players are directing investments toward acquiring new technologies, securing raw materials through efficient procurement and inventory management, enhancing product portfolios, and leveraging capabilities to sustain growth amidst challenging conditions. Regional-specific strategies are being emphasized due to highly varying economic and social challenges across countries.

Factors such as global economic slowdown, the impact of geopolitical tensions, delayed growth in specific regions, and the risks of stagflation necessitate a vigilant and forward-looking approach among Carbon Credits industry players. Adaptations in supply chain dynamics and the growing emphasis on cleaner and sustainable practices further drive strategic shifts within companies.

The market study delivers a comprehensive overview of current trends and developments in the Carbon Credits industry, complemented by detailed descriptive and prescriptive analyses for insights into the market landscape until 2034.

North America Carbon Credits Market Analysis

The North America Carbon Credits market witnessed transformative advancements in 2024, driven by increased adoption of sustainable technologies, government incentives, and evolving energy infrastructure. Key developments included major investments in renewable energy integration and advancements in carbon-neutral solutions, reflecting a shift towards decarbonization and energy independence. Anticipated growth from 2025 is underpinned by robust demand from industrial and commercial applications, supported by a favorable policy framework, innovation in storage and distribution technologies, and growing environmental awareness. Competitive dynamics remain intense, with leading players focusing on strategic partnerships, technology innovations, and capacity expansions. The market’s trajectory aligns with trends favoring clean energy transitions and efficiency-focused solutions, making it a lucrative region for stakeholders.

Europe Carbon Credits Market Outlook

In Europe, the Carbon Credits market flourished in 2024, fueled by stringent environmental regulations, ambitious climate goals, and a strong emphasis on sustainable energy transitions. The region showcased key innovations in renewable energy systems, advanced battery storage, and carbon capture technologies, setting a benchmark for global markets. Growth prospects from 2025 are bolstered by increasing industrial decarbonization efforts, rising demand for clean energy sources, and significant R&D investments. The competitive landscape reflects active participation by global and regional players leveraging cutting-edge technologies and collaborations to address evolving market needs. Europe’s commitment to net-zero emissions continues to position the market for sustained expansion and innovation.

Asia-Pacific Carbon Credits Market Forecast

The Asia-Pacific Carbon Credits market experienced significant momentum in 2024, driven by rapid industrialization, urbanization, and increasing energy demands across emerging economies. The region saw notable advancements in bio-based solutions, decentralized power systems, and renewable fuel technologies, catalyzed by government initiatives and international collaborations. Expected growth from 2025 is fueled by expanding investments in infrastructure, supportive policies for green energy transitions, and rising awareness of sustainable practices. Competitive dynamics in this market are shaped by high activity levels from global leaders and domestic innovators, focusing on scaling production and improving efficiency. Asia-Pacific’s role as a key growth hub underscores its strategic importance in the global market landscape.

Middle East, Africa, Latin America Carbon Credits Market Overview

The Middle East, Africa, Latin America Carbon Credits market recorded steady progress in 2024, with regional developments emphasizing sustainable energy solutions tailored to local needs. Growth drivers included increasing adoption of off-grid systems, biofuels, and portable power technologies in areas with limited access to centralized energy infrastructure. From 2025 onward, the market is expected to grow steadily, propelled by international funding, technology transfer initiatives, and rising energy security concerns. The competitive landscape is defined by a mix of global corporations and regional players addressing niche applications through innovative, cost-effective solutions. RoW markets continue to provide untapped potential for investors, particularly in renewable and decentralized energy systems.

Carbon Credits Market Dynamics and Future Analytics

The research analyses the Carbon Credits parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Carbon Credits market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Carbon Credits market projections.

Recent deals and developments are considered for their potential impact on Carbon Credits's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Carbon Credits market.

Carbon Credits trade and price analysis helps comprehend Carbon Credits's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Carbon Credits price trends and patterns, and exploring new Carbon Credits sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Carbon Credits market.

Carbon Credits Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Carbon Credits market and players serving the Carbon Credits value chain along with their strategies for the near, medium, and long term period.

OGAnalysis’ proprietary company revenue and product analysis model unveils the Carbon Credits market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Carbon Credits products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Carbon Credits market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Carbon Credits market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Carbon Credits Market Research Scope

• Global Carbon Credits market size and growth projections (CAGR), 2024- 2034

• Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Carbon Credits Trade and Supply-chain

• Carbon Credits market size, share, and outlook across 5 regions and 27 countries, 2023- 2034

• Carbon Credits market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023- 2034

• Short and long-term Carbon Credits market trends, drivers, restraints, and opportunities

• Porter’s Five Forces analysis, Technological developments in the Carbon Credits market, Carbon Credits supply chain analysis

• Carbon Credits trade analysis, Carbon Credits market price analysis, Carbon Credits supply/demand

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

• Latest Carbon Credits market news and developments

The Carbon Credits Market international scenario is well established in the report with separate chapters on North America Carbon Credits Market, Europe Carbon Credits Market, Asia-Pacific Carbon Credits Market, Middle East and Africa Carbon Credits Market, and South and Central America Carbon Credits Markets. These sections further fragment the regional Carbon Credits market by type, application, end-user, and country.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Regional Insights

North America Carbon Credits market data and outlook to 2034

United States

Canada

Mexico

Europe Carbon Credits market data and outlook to 2034

Germany

United Kingdom

France

Italy

Spain

BeNeLux

Russia

Asia-Pacific Carbon Credits market data and outlook to 2034

China

Japan

India

South Korea

Australia

Indonesia

Malaysia

Vietnam

Middle East and Africa Carbon Credits market data and outlook to 2034

Saudi Arabia

South Africa

Iran

UAE

Egypt

South and Central America Carbon Credits market data and outlook to 2034

Brazil

Argentina

Chile

Peru

* We can include data and analysis of additional coutries on demand

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Carbon Credits market sales data at the global, regional, and key country levels with a detailed outlook to 2034 allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Carbon Credits market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Carbon Credits market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Carbon Credits business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Carbon Credits Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below –

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Carbon Credits Pricing and Margins Across the Supply Chain, Carbon Credits Price Analysis / International Trade Data / Import-Export Analysis,

Supply Chain Analysis, Supply – Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Carbon Credits market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days

Carbon Credit Market Segmentation

by Type

- Compliance

- Voluntary

by Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

End-use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

-

South Pole

-

Climate Impact Partners

-

Bluesource

-

EcoAct

-

3Degrees

-

Finite Carbon

-

Carbonfund

-

ClimatePartner

-

Terrapass

-

Carbon Credit Capital

-

Moss Earth

-

Native Energy

-

ClearSky Climate Solutions

-

Enking International (EKI Energy Services Ltd.)

-

ClimeCo

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Carbon Credits Market Review, 2024

2.1 Carbon Credits Industry Overview

2.2 Research Methodology

3. Carbon Credits Market Insights

3.1 Carbon Credits Market Trends to 2034

3.2 Future Opportunities in Carbon Credits Market

3.3 Dominant Applications of Carbon Credits, 2024 Vs 2034

3.4 Key Types of Carbon Credits, 2024 Vs 2034

3.5 Leading End Uses of Carbon Credits Market, 2024 Vs 2034

3.6 High Prospect Countries for Carbon Credits Market, 2024 Vs 2034

4. Carbon Credits Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Carbon Credits Market

4.2 Key Factors Driving the Carbon Credits Market Growth

4.2 Major Challenges to the Carbon Credits industry, 2025- 2034

4.3 Impact of Wars and geo-political tensions on Carbon Credits supply chain

5 Five Forces Analysis for Global Carbon Credits Market

5.1 Carbon Credits Industry Attractiveness Index, 2024

5.2 Carbon Credits Market Threat of New Entrants

5.3 Carbon Credits Market Bargaining Power of Suppliers

5.4 Carbon Credits Market Bargaining Power of Buyers

5.5 Carbon Credits Market Intensity of Competitive Rivalry

5.6 Carbon Credits Market Threat of Substitutes

6. Global Carbon Credits Market Data – Industry Size, Share, and Outlook

6.1 Carbon Credits Market Annual Sales Outlook, 2025- 2034 ($ Million)

6.1 Global Carbon Credits Market Annual Sales Outlook by Type, 2025- 2034 ($ Million)

6.2 Global Carbon Credits Market Annual Sales Outlook by Application, 2025- 2034 ($ Million)

6.3 Global Carbon Credits Market Annual Sales Outlook by End-User, 2025- 2034 ($ Million)

6.4 Global Carbon Credits Market Annual Sales Outlook by Region, 2025- 2034 ($ Million)

7. Asia Pacific Carbon Credits Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Carbon Credits Market Revenue Forecast by Type, 2025- 2034 (USD Million)

7.3 Asia Pacific Carbon Credits Market Revenue Forecast by Application, 2025- 2034(USD Million)

7.4 Asia Pacific Carbon Credits Market Revenue Forecast by End-User, 2025- 2034 (USD Million)

7.5 Asia Pacific Carbon Credits Market Revenue Forecast by Country, 2025- 2034 (USD Million)

7.5.1 China Carbon Credits Analysis and Forecast to 2034

7.5.2 Japan Carbon Credits Analysis and Forecast to 2034

7.5.3 India Carbon Credits Analysis and Forecast to 2034

7.5.4 South Korea Carbon Credits Analysis and Forecast to 2034

7.5.5 Australia Carbon Credits Analysis and Forecast to 2034

7.5.6 Indonesia Carbon Credits Analysis and Forecast to 2034

7.5.7 Malaysia Carbon Credits Analysis and Forecast to 2034

7.5.8 Vietnam Carbon Credits Analysis and Forecast to 2034

7.6 Leading Companies in Asia Pacific Carbon Credits Industry

8. Europe Carbon Credits Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Carbon Credits Market Size and Percentage Breakdown by Type, 2025- 2034 (USD Million)

8.3 Europe Carbon Credits Market Size and Percentage Breakdown by Application, 2025- 2034 (USD Million)

8.4 Europe Carbon Credits Market Size and Percentage Breakdown by End-User, 2025- 2034 (USD Million)

8.5 Europe Carbon Credits Market Size and Percentage Breakdown by Country, 2025- 2034 (USD Million)

8.5.1 2024 Germany Carbon Credits Market Size and Outlook to 2034

8.5.2 2024 United Kingdom Carbon Credits Market Size and Outlook to 2034

8.5.3 2024 France Carbon Credits Market Size and Outlook to 2034

8.5.4 2024 Italy Carbon Credits Market Size and Outlook to 2034

8.5.5 2024 Spain Carbon Credits Market Size and Outlook to 2034

8.5.6 2024 BeNeLux Carbon Credits Market Size and Outlook to 2034

8.5.7 2024 Russia Carbon Credits Market Size and Outlook to 2034

8.6 Leading Companies in Europe Carbon Credits Industry

9. North America Carbon Credits Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Carbon Credits Market Analysis and Outlook by Type, 2025- 2034($ Million)

9.3 North America Carbon Credits Market Analysis and Outlook by Application, 2025- 2034($ Million)

9.4 North America Carbon Credits Market Analysis and Outlook by End-User, 2025- 2034($ Million)

9.5 North America Carbon Credits Market Analysis and Outlook by Country, 2025- 2034($ Million)

9.5.1 United States Carbon Credits Market Analysis and Outlook

9.5.2 Canada Carbon Credits Market Analysis and Outlook

9.5.3 Mexico Carbon Credits Market Analysis and Outlook

9.6 Leading Companies in North America Carbon Credits Business

10. Latin America Carbon Credits Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Carbon Credits Market Future by Type, 2025- 2034($ Million)

10.3 Latin America Carbon Credits Market Future by Application, 2025- 2034($ Million)

10.4 Latin America Carbon Credits Market Future by End-User, 2025- 2034($ Million)

10.5 Latin America Carbon Credits Market Future by Country, 2025- 2034($ Million)

10.5.1 Brazil Carbon Credits Market Analysis and Outlook to 2034

10.5.2 Argentina Carbon Credits Market Analysis and Outlook to 2034

10.5.3 Chile Carbon Credits Market Analysis and Outlook to 2034

10.6 Leading Companies in Latin America Carbon Credits Industry

11. Middle East Africa Carbon Credits Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Carbon Credits Market Statistics by Type, 2025- 2034 (USD Million)

11.3 Middle East Africa Carbon Credits Market Statistics by Application, 2025- 2034 (USD Million)

11.4 Middle East Africa Carbon Credits Market Statistics by End-User, 2025- 2034 (USD Million)

11.5 Middle East Africa Carbon Credits Market Statistics by Country, 2025- 2034 (USD Million)

11.5.1 South Africa Carbon Credits Market Outlook

11.5.2 Egypt Carbon Credits Market Outlook

11.5.3 Saudi Arabia Carbon Credits Market Outlook

11.5.4 Iran Carbon Credits Market Outlook

11.5.5 UAE Carbon Credits Market Outlook

11.6 Leading Companies in Middle East Africa Carbon Credits Business

12. Carbon Credits Market Structure and Competitive Landscape

12.1 Key Companies in Carbon Credits Business

12.2 Carbon Credits Key Player Benchmarking

12.3 Carbon Credits Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Carbon Credits Market

14.1 Carbon Credits trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Carbon Credits Industry Report Sources and Methodology

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Carbon Credits Market is estimated to reach USD 9,172.2 billion by 2034.

The Global Carbon Credits Market is estimated to generate USD 616.6 billion in revenue in 2025

The Global Carbon Credits Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 34.52% during the forecast period from 2025 to 2034.

$3950- 30%

$5850- 40%

$7850- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!