"The Global Carbonated Beverage Processing Equipment Market was valued at USD 9.29 billion in 2025 and is projected to reach USD 21.55 billion by 2034, growing at a CAGR of 9.8%."

The Carbonated Beverage Processing Equipment Market plays a pivotal role in the beverage production industry by enabling efficient and scalable manufacturing of carbonated drinks, including soda, sparkling water, and flavored beverages. This market includes essential equipment such as sugar dissolvers, carbonation units, blenders and mixers, heat exchangers, silos, and filtration systems. Demand is driven by continuous consumer appetite for fizzy, ready-to-drink beverages and by manufacturers seeking advanced, compliant, and efficient processing solutions. The rise in demand for high-throughput, automated packaging systems and strict food safety standards are encouraging beverage producers to modernize their production lines. As consumer preferences shift toward healthier and craft offerings, flexible equipment capable of handling diverse formulations and packaging formats is also gaining prominence.

Market growth is being propelled by technological innovations that enhance operational efficiency, reduce energy consumption, and allow modular, scalable production capabilities. Integration with digital controls, IoT-enabled monitoring, and predictive maintenance systems is becoming increasingly common, empowering processors to optimize output and minimize downtime. Forecasts suggest steady expansion in equipment investments, signaling strong opportunities for equipment suppliers. Regions such as Asia-Pacific are poised for robust growth due to rising beverage consumption and industrialization, while North America and Europe are shifting toward sustainability-focused upgrades. Overall, evolving consumer trends and automation-led modernization position the carbonated beverage processing equipment market for sustained momentum.

Key Market Insights

- The increasing global consumption of soft drinks, sparkling water, and flavored carbonated beverages is significantly fueling the demand for carbonated beverage processing equipment, especially in emerging markets where consumer demand is rising rapidly across urban and semi-urban areas.

- Automation and digitalization are key trends reshaping the industry, as beverage manufacturers invest in IoT-enabled systems, real-time monitoring tools, and programmable logic controllers (PLCs) to improve production efficiency and reduce operational downtime.

- Compact and modular processing equipment is gaining traction among small and medium beverage producers, enabling flexible production capacities and cost-effective upgrades without large-scale infrastructure overhauls.

- Strict hygiene standards and food safety regulations are pushing manufacturers to adopt CIP (Clean-in-Place) systems, stainless steel components, and contamination control solutions to ensure compliance and avoid production halts.

- Growing health consciousness among consumers is influencing product formulations, leading manufacturers to adjust carbonation, sugar levels, and flavor concentrations necessitating adaptable equipment to handle diverse recipes.

- Energy-efficient and sustainable equipment solutions are increasingly favored, with innovations such as heat recovery systems, water reuse technologies, and minimal-waste operations becoming standard in new installations.

- Asia-Pacific is experiencing the fastest growth in equipment demand, supported by population growth, urbanization, and expanding beverage brands investing in local production facilities with advanced technologies.

- Premiumization trends in beverages, including the rise of craft sodas and functional sparkling drinks, are driving interest in small-batch, precision-controlled processing systems that cater to niche, high-value segments.

- COVID-19 accelerated the shift toward automated and remote-controlled processing environments, with manufacturers increasingly looking for solutions that enable workforce reduction while maintaining product consistency.

- Strategic partnerships between beverage brands and equipment manufacturers are emerging to co-develop tailored systems that reduce downtime, improve OEE (Overall Equipment Effectiveness), and accommodate rapid SKU changeovers.

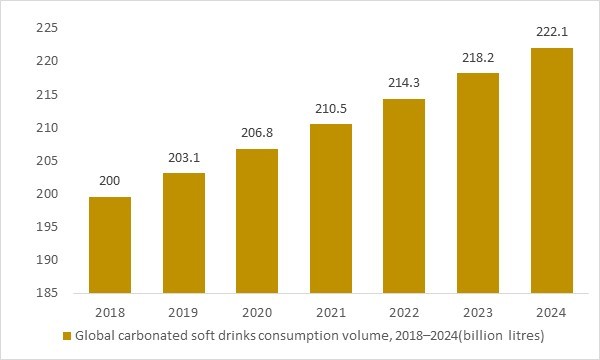

Global carbonated soft drinks consumption volume, 2018–2024(billion litres)

Figure: Global carbonated soft drink consumption increased from about 200 billion litres in 2018 to more than 220 billion litres in 2024, indicating sustained throughput growth across carbonation, blending, filling and packaging lines. This rising CSD volume directly supports investments in high-speed processing equipment, including automated carbonation systems, advanced PET and can filling lines, and integrated quality-control solutions, shaping the long-term expansion of the carbonated beverage processing equipment market.

- Global demand for carbonated soft drinks has steadily increased from around 199.6 billion litres in 2018 to more than 218 billion litres in 2023, with volumes expected to exceed 222 billion litres in 2024. This sustained rise in production and consumption directly expands throughput requirements across carbonation, mixing, filling, capping and packaging lines. As beverage manufacturers introduce more low-sugar, flavoured and premium CSD variants, the need for flexible, high-speed and hygienic processing equipment grows further. These structural volume and SKU trends create a strong, long-term demand base for carbonated beverage processing equipment worldwide.

Regional Insights

North America Carbonated Beverage Processing Equipment Market

The North American market is anchored by well-established beverage production infrastructure and rising demand for automated, high-throughput carbonated beverage processing systems. Manufacturers are investing in IoT-enabled predictive maintenance, compact modular equipment, and clean-in-place (CIP) systems to improve hygiene and reduce downtime. Health-conscious trends and consumer expectations for customizable beverages are fueling demand for flexible machinery capable of handling varied formulations. Forecasted growth is steady, with scope for suppliers offering tailored automation, energy-efficient upgrades, and integrated packaging solutions.

Asia‑Pacific Carbonated Beverage Processing Equipment Market

Asia-Pacific leads global growth in carbonated beverage processing equipment, driven by urbanization, a burgeoning middle class, and mounting demand for soft drinks and flavored waters. Producers are expanding with localized manufacturing, low-cost scalable systems, and innovative carbonation and blending equipment. The embracing of Industry 4.0 practices offers competitive differentiation. Forecasts show dynamic expansion, with opportunities centered on small-batch, energy-efficient, and IoT-connected machinery designed for diverse beverage categories.

Europe Carbonated Beverage Processing Equipment Market

Europe’s market is shaped by stringent food safety and environmental regulations, pushing manufacturers to adopt stainless-steel processing lines with efficient hygiene control and low carbon footprints. Brands prioritize sustainable, clean-label beverage production, leading to increased demand for modular and multi-function equipment that supports rapid recipe changes and premium formats. Forecasts point to moderate yet stable growth, with attractive prospects for system providers that excel in sustainability, quality assurance, and flexible manufacturing tailored to craft and functional beverage segments.

Report Scope

| Parameter | Carbonated Beverage Processing Equipment Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Carbonated Beverage Processing Equipment Market Segments Covered In The Report

By Equipment Type

- Sugar Dissolvers

- Carbonation Equipment

- Blender And Mixers

- Heat Exchangers

- Silos

- Filtration Equipment

By Beverage Type

- Flavored Drinks

- Functional Drinks

- Club Soda And Sparkling Water

By Distribution Channel

- Original Equipment Manufacturer

- Aftermarket Sales

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Tetra Laval International SA, GEA Group AG, Alfa Laval Group, Krones AG, SPX flow inc., KHS GmbH, A Due Di Squeri Donato & Cspa, Van Der Molen GmbH, Seppelec SL, TCP Pioneer Co. Ltd., A Water System srl, Pentair plc, Shreeji Projects, Roquette Frères, Mitsui Sugar Co.Ltd., Archer-Daniels-Midland Company, Tate & Lyle plc, Pyure Brands LLC, PureCircle, Ajinomoto Health & Nutrition North America Inc., Goma Engineering Pvt. Ltd., Tetra Pak International S.A., PepsiCo Inc., The Coca-Cola Company, Keurig Dr Pepper Inc., Britvic plc, National Beverage Corp., Parle Agro Private Limited, The Pepsi Bottling Group, The Dr. Pepper Snapple Group .

Recent Industry Developments

- August 2025: Beverage industry veterans launched Pittston Co-Packers, a 403,000 sq.ft. contract manufacturing and packaging facility in Pennsylvania, designed to support large-scale production for carbonated beverages and ready-to-drink products.

- February 2025: Equipment manufacturers introduced new-generation processing systems equipped with enhanced automation, smart monitoring features, and IoT integration to meet growing demand for diversified carbonated beverage formulations.

- June 2024: Rotarex Solutions released the BubbleBox Carbo Pro, an advanced inline carbonation system targeting hospitality venues, offering consistent and scalable sparkling water production with minimal installation footprint.

What You Receive

• Global Carbonated Beverage Processing Equipment market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Carbonated Beverage Processing Equipment.

• Carbonated Beverage Processing Equipment market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Carbonated Beverage Processing Equipment market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Carbonated Beverage Processing Equipment market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Carbonated Beverage Processing Equipment market, Carbonated Beverage Processing Equipment supply chain analysis.

• Carbonated Beverage Processing Equipment trade analysis, Carbonated Beverage Processing Equipment market price analysis, Carbonated Beverage Processing Equipment Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Carbonated Beverage Processing Equipment market news and developments.

The Carbonated Beverage Processing Equipment Market international scenario is well established in the report with separate chapters on North America Carbonated Beverage Processing Equipment Market, Europe Carbonated Beverage Processing Equipment Market, Asia-Pacific Carbonated Beverage Processing Equipment Market, Middle East and Africa Carbonated Beverage Processing Equipment Market, and South and Central America Carbonated Beverage Processing Equipment Markets. These sections further fragment the regional Carbonated Beverage Processing Equipment market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Carbonated Beverage Processing Equipment Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Carbonated Beverage Processing Equipment Market Overview

2.2 Market Strategies of Leading Carbonated Beverage Processing Equipment Companies

2.3 Carbonated Beverage Processing Equipment Market Insights, 2024 - 2034

2.3.1 Leading Carbonated Beverage Processing Equipment Types, 2024 - 2034

2.3.2 Leading Carbonated Beverage Processing Equipment End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Carbonated Beverage Processing Equipment sales, 2024 - 2034

2.4 Carbonated Beverage Processing Equipment Market Drivers and Restraints

2.4.1 Carbonated Beverage Processing Equipment Demand Drivers to 2034

2.4.2 Carbonated Beverage Processing Equipment Challenges to 2034

2.5 Carbonated Beverage Processing Equipment Market- Five Forces Analysis

2.5.1 Carbonated Beverage Processing Equipment Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Carbonated Beverage Processing Equipment Market Value, Market Share, and Forecast to 2034

3.1 Global Carbonated Beverage Processing Equipment Market Overview, 2024

3.2 Global Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

3.4 Global Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

3.5 Global Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

3.6 Global Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Carbonated Beverage Processing Equipment Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Carbonated Beverage Processing Equipment Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Carbonated Beverage Processing Equipment Market Overview, 2024

4.2 Asia Pacific Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

4.4 Asia Pacific Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

4.5 Asia Pacific Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

4.6 Asia Pacific Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Carbonated Beverage Processing Equipment Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Carbonated Beverage Processing Equipment Market Value, Market Share, and Forecast to 2034

5.1 Europe Carbonated Beverage Processing Equipment Market Overview, 2024

5.2 Europe Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

5.4 Europe Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

5.5 Europe Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

5.6 Europe Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Carbonated Beverage Processing Equipment Market Size and Share Outlook by Country, 2024 - 2034

6. North America Carbonated Beverage Processing Equipment Market Value, Market Share and Forecast to 2034

6.1 North America Carbonated Beverage Processing Equipment Market Overview, 2024

6.2 North America Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

6.4 North America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

6.5 North America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

6.6 North America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Carbonated Beverage Processing Equipment Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Carbonated Beverage Processing Equipment Market Value, Market Share and Forecast to 2034

7.1 South and Central America Carbonated Beverage Processing Equipment Market Overview, 2024

7.2 South and Central America Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

7.4 South and Central America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

7.5 South and Central America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

7.6 South and Central America Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Carbonated Beverage Processing Equipment Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Carbonated Beverage Processing Equipment Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Carbonated Beverage Processing Equipment Market Overview, 2024

8.2 Middle East and Africa Carbonated Beverage Processing Equipment Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Carbonated Beverage Processing Equipment Market Size and Share Outlook By Equipment Type, 2024 - 2034

8.4 Middle East Africa Carbonated Beverage Processing Equipment Market Size and Share Outlook By Beverage Type, 2024 - 2034

8.5 Middle East Africa Carbonated Beverage Processing Equipment Market Size and Share Outlook By Distribution Channel, 2024 – 2034

8.6 Middle East Africa Carbonated Beverage Processing Equipment Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Carbonated Beverage Processing Equipment Market Size and Share Outlook by Country, 2024 - 2034

9. Carbonated Beverage Processing Equipment Market Structure

9.1 Key Players

9.2 Carbonated Beverage Processing Equipment Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Carbonated Beverage Processing Equipment Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Carbonated Beverage Processing Equipment Market is estimated to generate USD 9.29 billion in revenue in 2025.

The Global Carbonated Beverage Processing Equipment Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period from 2025 to 2034.

The Carbonated Beverage Processing Equipment Market is estimated to reach USD 21.55 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!