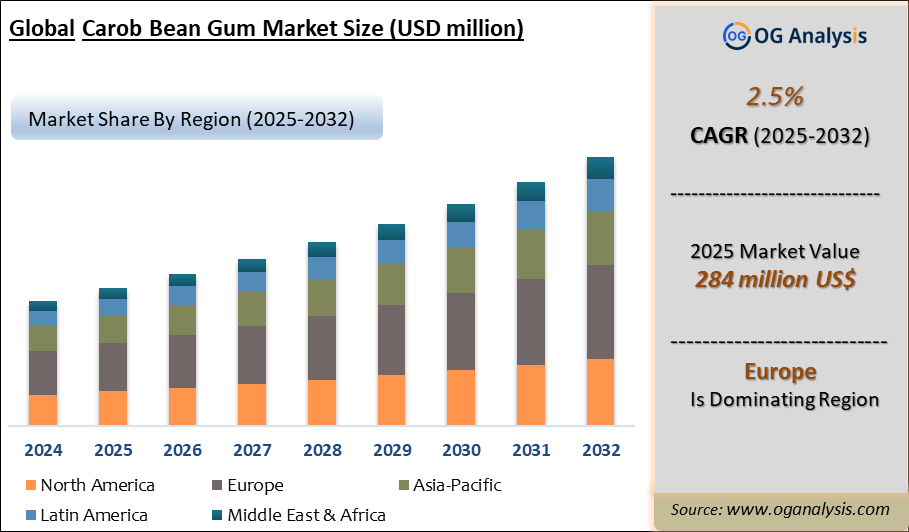

"The Global Carob Bean Gum Market Size was valued at USD 278 million in 2024 and is projected to reach USD 284 million in 2025. Worldwide sales of Carob Bean Gum are expected to grow at a significant CAGR of 2.5%, reaching USD 359 million by the end of the forecast period in 2034."

Introduction and Overview

The carob bean gum market is witnessing significant growth due to the increasing demand for natural and plant-based thickening agents in various industries, including food, cosmetics, and pharmaceuticals. Carob bean gum, derived from the seeds of the carob tree (Ceratonia siliqua), is known for its exceptional gelling and stabilizing properties, making it a preferred ingredient in numerous applications. With the rising consumer awareness about the benefits of natural ingredients, the market for carob bean gum is expanding, particularly in the food sector where it serves as a gluten substitute and a fat replacer in low-calorie products. The versatility of carob bean gum is further enhancing its attractiveness in the formulation of gluten-free and vegan products, aligning with current dietary trends.

Moreover, the carob bean gum market is characterized by technological advancements in extraction and processing methods, which have improved the quality and functionality of the gum. Innovations in manufacturing processes are enabling suppliers to meet the growing quality expectations of food manufacturers and other industries. Furthermore, increasing applications in the cosmetic industry, where carob bean gum is utilized for its emulsifying and stabilizing properties, are driving market growth. As global demand for natural and organic ingredients continues to rise, the carob bean gum market is poised for substantial growth, offering numerous opportunities for manufacturers and suppliers.

Europe is the leading region in the carob bean gum market, powered by strong demand from the dairy and bakery industries, well-established food processing infrastructure, and the widespread adoption of natural food additives.

Food & Beverages is the dominating segment in the carob bean gum market, fueled by increasing preference for plant-based stabilizers, growing consumption of processed foods, and rising demand for clean-label ingredients across global markets.

Carob bean gum market- Latest Trends, Drivers, Challenges

One of the notable trends in the carob bean gum market is the rising preference for clean label products among consumers. As awareness of food additives and their potential health impacts grows, manufacturers are increasingly seeking natural alternatives to synthetic thickeners and stabilizers. Carob bean gum, being a natural polysaccharide, fits well into this clean label movement. Companies are leveraging this trend by promoting carob bean gum as a healthier, plant-based option in their product formulations. This shift not only meets consumer demand but also enhances brand loyalty, as customers gravitate towards companies that prioritize transparency and ingredient quality.

Another significant trend is the growing application of carob bean gum in the pharmaceutical and nutraceutical sectors. The demand for natural thickening agents in medicinal formulations is on the rise, as these ingredients are recognized for their ability to enhance the bioavailability of active compounds. Additionally, carob bean gum is being used in dietary supplements, where it functions as a binder and stabilizer. This expanding utilization in health-focused products aligns with the global trend towards preventive healthcare and wellness, thereby boosting the market for carob bean gum.

Furthermore, sustainability is becoming an essential factor in the carob bean gum market. Consumers are increasingly concerned about the environmental impact of their purchasing decisions, prompting manufacturers to adopt more sustainable practices. This includes sourcing carob beans from environmentally friendly farms and ensuring ethical production methods. Companies are also focusing on reducing their carbon footprint throughout the supply chain. By highlighting sustainability efforts, brands can attract environmentally conscious consumers and differentiate themselves in a competitive market, further driving demand for carob bean gum.

The carob bean gum market is being driven by several factors, with one of the primary drivers being the increasing health consciousness among consumers. With the rising prevalence of dietary restrictions and preferences, such as gluten-free and vegan diets, the demand for natural, plant-based food ingredients has surged. Carob bean gum serves as an ideal thickening agent for gluten-free products, enabling food manufacturers to cater to a broader audience. The gum's natural origin and health benefits are appealing to consumers looking for nutritious alternatives to traditional additives, thus fueling market growth.

Moreover, the versatility of carob bean gum is another significant driver of market expansion. Its multifunctional properties allow it to be used across various industries, from food and beverages to cosmetics and pharmaceuticals. In the food industry, it acts as a stabilizer, thickener, and emulsifier, while in cosmetics, it serves as a binding agent and texture enhancer. This broad applicability enables suppliers to tap into multiple market segments, enhancing their business potential and overall revenue. As industries continue to seek innovative solutions for formulation challenges, the demand for carob bean gum is expected to rise.

Additionally, the global trend towards clean label and natural ingredients is propelling the carob bean gum market. As consumers become more informed about the ingredients in their food and personal care products, they are increasingly seeking products with simple, recognizable components. This trend encourages manufacturers to incorporate carob bean gum into their formulations, promoting it as a natural, non-GMO option. The growing inclination towards transparency in labeling further supports the carob bean gum market, as brands strive to align their offerings with consumer preferences.

Despite the promising growth of the carob bean gum market, several challenges could hinder its expansion. One of the primary challenges is the variability in the supply of carob beans. Factors such as climate change, fluctuations in agricultural practices, and regional growing conditions can impact the yield and quality of carob beans, leading to supply chain disruptions. Manufacturers may face difficulties in sourcing consistent, high-quality raw materials, which can affect production processes and product quality.

Another significant challenge is the presence of substitute products in the market. While carob bean gum is recognized for its unique properties, it faces competition from other natural thickening agents such as guar gum, xanthan gum, and locust bean gum. These alternatives may offer similar functionalities at lower costs, making it challenging for carob bean gum to maintain its market share. To counter this competition, manufacturers must invest in marketing strategies that effectively communicate the unique benefits of carob bean gum and its applications in various industries.

Lastly, regulatory hurdles and compliance issues can pose challenges for carob bean gum manufacturers. Different regions have varying regulations regarding the use of food additives, including thickening agents. Navigating these regulatory landscapes can be complex and time-consuming, leading to potential delays in product launches and increased operational costs. Manufacturers must stay informed about changing regulations and ensure compliance to mitigate these challenges and sustain their market position.

Market Players

Cargill, Inc.

DuPont de Nemours, Inc.

Tate & Lyle PLC

LBG Sicilia Ingredients

CP Kelco U.S., Inc.

AEP Colloids

FMC Corporation

Genu Products Group

TIC Gums, Inc. (Ingredion Incorporated)

Nactis Flavours

Carob S.A.

CEAMSA (Compania Espanola de Algas Marinas)

Pedro Perez S.L.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Form, By End-User industry, By Food Type |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Form

- Powder

- Gel

By End-use Industry

- Food and Beverages

- Pharmaceuticals

- Cosmetic / Personal care

- Paper & Textile

- Others

By Food Type

- Dairy

- Bakery and confectionary

- Meat Products

- Dressings and Sauces

- Soft drinks

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Carob Bean Gum Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Carob Bean Gum Market Overview

2.2 Market Strategies of Leading Carob Bean Gum Companies

2.3 Carob Bean Gum Market Insights, 2024 - 2034

2.3.1 Leading Carob Bean Gum Types, 2024 - 2034

2.3.2 Leading Carob Bean Gum End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Carob Bean Gum sales, 2024 - 2034

2.4 Carob Bean Gum Market Drivers and Restraints

2.4.1 Carob Bean Gum Demand Drivers to 2034

2.4.2 Carob Bean Gum Challenges to 2034

2.5 Carob Bean Gum Market- Five Forces Analysis

2.5.1 Carob Bean Gum Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Carob Bean Gum Market Value, Market Share, and Forecast to 2034

3.1 Global Carob Bean Gum Market Overview, 2024

3.2 Global Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

3.3 Global Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

3.3.1 Food and Beverages

3.3.2 Pharmaceuticals

3.3.3 Cosmetic / Personal care

3.3.4 Paper & Textile

3.3.5 Others

3.4 Global Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

3.4.1 Powder

3.4.2 Gel

3.5 Global Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

3.5.1 Dairy

3.5.2 Bakery and confectionary

3.5.3 Meat Products

3.5.4 Dressings and Sauces

3.5.5 Soft drinks

3.5.6 Others

3.7 Global Carob Bean Gum Market Size and Share Outlook, by Region, 2024 - 2034

4. Asia Pacific Carob Bean Gum Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Carob Bean Gum Market Overview, 2024

4.2 Asia Pacific Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

4.3 Asia Pacific Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

4.4 Asia Pacific Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

4.5 Asia Pacific Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

4.6 Asia Pacific Carob Bean Gum Market Size and Share Outlook, by Country, 2024 – 2034

4.7 Key Companies in Asia Pacific Carob Bean Gum Market

5. Europe Carob Bean Gum Market Value, Market Share, and Forecast to 2034

5.1 Europe Carob Bean Gum Market Overview, 2024

5.2 Europe Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

5.3 Europe Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

5.4 Europe Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

5.5 Europe Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

5.6Europe Carob Bean Gum Market Size and Share Outlook, by Country, 2024 - 2034

5.7 Key Companies in Europe Carob Bean Gum Market

6. North America Carob Bean Gum Market Value, Market Share and Forecast to 2034

6.1 North America Carob Bean Gum Market Overview, 2024

6.2 North America Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

6.3 North America Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

6.4 North America Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

6.5 North America Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

6.6North America Carob Bean Gum Market Size and Share Outlook, by Country, 2024 - 2034

6.7 Key Companies in North America Carob Bean Gum Market

7. South and Central America Carob Bean Gum Market Value, Market Share and Forecast to 2034

7.1 South and Central America Carob Bean Gum Market Overview, 2024

7.2 South and Central America Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

7.3 South and Central America Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

7.4 South and Central America Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

7.5 South and Central America Carob Bean Gum Market Size and Share Outlook, by Form, 2024 – 2034

7.6 South and Central America Carob Bean Gum Market Size and Share Outlook, by Country, 2024 - 2034

7.7 Key Companies in South and Central America Carob Bean Gum Market

8. Middle East Africa Carob Bean Gum Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Carob Bean Gum Market Overview, 2024

8.2 Middle East and Africa Carob Bean Gum Market Revenue and Forecast, 2024 - 2034 (US$ Million)

8.3 Middle East Africa Carob Bean Gum Market Size and Share Outlook, by Application, 2024 - 2034

8.4 Middle East Africa Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

8.5 Middle East Africa Carob Bean Gum Market Size and Share Outlook, by Form, 2024 - 2034

8.6Middle East Africa Carob Bean Gum Market Size and Share Outlook, by Country, 2024 - 2034

8.7 Key Companies in Middle East Africa Carob Bean Gum Market

9. Carob Bean Gum Market Structure

9.1 Key Players

9.2 Carob Bean Gum Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Carob Bean Gum Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Carob Bean Gum Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.5% during the forecast period from 2025 to 2032.

The Global Carob Bean Gum Market is estimated to generate USD 278 million in revenue in 2024.

The Carob Bean Gum Market is estimated to reach USD 338.7 million by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!