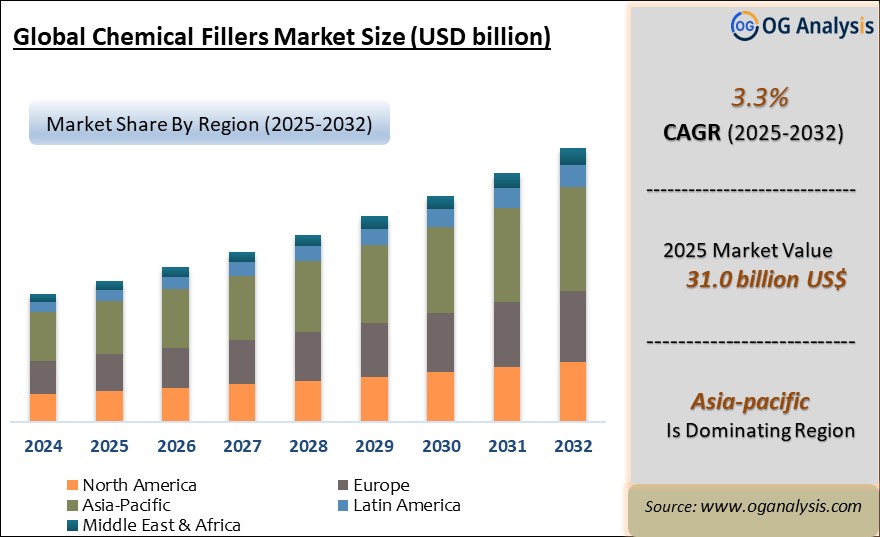

"The Global Chemical Fillers Market Size was valued at USD 30.2 billion in 2024 and is projected to reach USD 31.0 billion in 2025. Worldwide sales of Chemical Fillers are expected to grow at a significant CAGR of 3.3%, reaching USD 42.0 billion by the end of the forecast period in 2034."

The Chemical Fillers Market is experiencing steady growth driven by increasing demand across plastics, rubber, coatings, adhesives, construction, and paper industries. Chemical fillers such as calcium carbonate, silica, talc, kaolin, and clay are added to formulations to improve mechanical properties, reduce costs, and enhance product performance. They serve as extenders, modifiers, and performance enhancers, supporting the development of lightweight, durable, and cost-efficient materials for diverse applications. Growing focus on sustainability, lightweight composites, and high-performance materials in automotive, packaging, electronics, and construction sectors is driving market expansion globally.

The market is highly competitive with leading manufacturers focusing on capacity expansion, product innovation, and strategic partnerships to strengthen their market position. Asia Pacific dominates the market due to rapid industrialisation, manufacturing growth, and infrastructure development in countries like China and India, while North America and Europe maintain steady demand driven by mature industrial sectors and advanced product applications. Challenges include fluctuating raw material costs, regulatory concerns over environmental and health safety, and supply chain disruptions. However, increasing adoption of functionalised, nano, and hybrid fillers is creating new growth opportunities in advanced composites, 3D printing, and sustainable material applications worldwide.

By Product, the largest segment is Port Wine. This is because port wine has established global popularity due to its rich flavour profile, traditional consumption in European and North American markets, and strong integration in culinary applications and premium alcoholic beverage portfolios, maintaining consistent demand across retail and on-trade channels.

By End User, the fastest-growing segment is Supermarkets and Hypermarkets. This rapid growth is driven by their extensive distribution networks, wide product assortment, competitive pricing, and consumer preference for convenient one-stop shopping experiences, enabling higher sales volumes and market penetration for chemical fillers used in packaging and related retail products.

Trade Intelligence for Chemical Fillers Market

| Global Chemical products and preparations of the chemical or allied industries Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 35,660 | 45,517 | 51,209 | 51,538 | 48,535 |

| China | 6,527 | 8,299 | 7,213 | 6,515 | 6,842 |

| United States of America | 4,302 | 4,215 | 6,300 | 7,856 | 6,245 |

| Germany | 2,446 | 2,901 | 2,983 | 2,843 | 2,829 |

| Hungary | 503 | 1,069 | 2,363 | 3,723 | 2,093 |

| Korea, Republic of | 1,713 | 1,886 | 1,819 | 1,694 | 1,698 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- China, United States of America, Germany, Hungary and Korea, Republic of are the top five countries importing 40.6% of global Chemical products and preparations of the chemical or allied industries in 2024

- Global Chemical products and preparations of the chemical or allied industries Imports increased by 36.1% between 2020 and 2024

- China accounts for 14.1% of global Chemical products and preparations of the chemical or allied industries trade in 2024

- United States of America accounts for 12.9% of global Chemical products and preparations of the chemical or allied industries trade in 2024

- Germany accounts for 5.8% of global Chemical products and preparations of the chemical or allied industries trade in 2024

| Global Chemical products and preparations of the chemical or allied industries Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Key Insights

- The chemical fillers market is growing steadily as manufacturers across plastics, rubber, coatings, and construction use fillers to improve material properties such as strength, thermal stability, opacity, and durability while reducing overall formulation costs by replacing more expensive resins or polymers in diverse industrial applications.

- Calcium carbonate holds the largest market share due to its wide availability, low cost, and versatile benefits including improved stiffness, whiteness, opacity, and processing performance in plastics, paper, paints, adhesives, and sealants, supporting cost optimisation and product quality enhancements globally.

- Silica and talc are widely used as functional fillers in rubber, paints, and coatings to improve abrasion resistance, thermal stability, dispersion, and surface finish, enabling manufacturers to meet stringent product performance and durability requirements in automotive and industrial applications effectively.

- Nano-fillers are gaining rapid adoption due to their superior surface area, dispersion, and mechanical reinforcement properties, enabling lightweight, high-strength, and multifunctional composites used in automotive parts, packaging films, electronics, and advanced construction materials globally.

- Asia Pacific dominates the chemical fillers market driven by rapid industrialisation, strong manufacturing base, infrastructure development, and rising demand for lightweight, durable, and cost-efficient materials in China, India, Japan, South Korea, and Southeast Asia.

- North America and Europe maintain steady market growth supported by mature plastics, automotive, construction, and electronics industries, with increasing focus on sustainable, high-performance, and regulatory-compliant filler materials that enhance product quality and meet environmental standards.

- Automotive lightweighting trends are creating opportunities for functional fillers that reduce component weight, improve fuel efficiency, and support emission reduction goals, driving demand for fillers in thermoplastics, composites, and under-the-hood applications in vehicle manufacturing globally.

- Advanced processing technologies and surface treatments are enhancing filler compatibility, dispersion, and functionality, enabling development of high-performance formulations in adhesives, sealants, coatings, and engineering plastics used across industrial and consumer applications worldwide.

- Manufacturers are investing in R&D to develop bio-based, hybrid, and eco-friendly fillers that align with sustainability goals, regulatory compliance, and consumer preferences for environmentally responsible materials in packaging, construction, automotive, and electronics industries globally.

- Strategic mergers, acquisitions, and capacity expansions by major market players are strengthening distribution networks, enhancing product portfolios, and supporting customised formulation solutions, ensuring competitiveness and growth in key industrial markets worldwide.

Report Scope

| Parameter | Chemical Fillers Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product Type, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

- By Product Type

- Organic

- Shell Flour

- Wood Flour

- Others

- Inorganic

- Calcium Carbonate

- Talc

- Silica

- Kaolin

- Others

- By Application

- Paper

- Thermoplastic and Thermoset

- Flame Retardants

- Paints and Coatings

- Rubber

- Adhesives and Sealants

- Others

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

What You Receive

• Global Chemical Fillers market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Chemical Fillers.

• Chemical Fillers market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Chemical Fillers market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Chemical Fillers market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Chemical Fillers market, Chemical Fillers supply chain analysis.

• Chemical Fillers trade analysis, Chemical Fillers market price analysis, Chemical Fillers Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Chemical Fillers market news and developments.

The Chemical Fillers Market international scenario is well established in the report with separate chapters on North America Chemical Fillers Market, Europe Chemical Fillers Market, Asia-Pacific Chemical Fillers Market, Middle East and Africa Chemical Fillers Market, and South and Central America Chemical Fillers Markets. These sections further fragment the regional Chemical Fillers market by type, application, end-user, and country.

Recent Developments

- A leading aesthetics brand received regulatory approval for a new hyaluronic acid gel filler using advanced core technology, marking its official entry into the U.S. filler segment.

- A global aesthetics partnership introduced a next-generation filler line with mepivacaine as an anesthetic alternative to lidocaine, aiming to reduce bruising while maintaining product performance.

- A top aesthetics company launched a consumer education campaign to address misconceptions about injectable fillers, emphasizing safety, natural outcomes, and broader awareness.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Chemical Fillers Market Latest Trends, Drivers and Challenges, 2024- 2032

2.1 Chemical Fillers Market Overview

2.2 Market Strategies of Leading Chemical Fillers Market Companies

2.3 Chemical Fillers Market Insights, 2024- 2032

2.3.1 Leading Chemical Fillers Market Types, 2024- 2032

2.3.2 Leading Chemical Fillers Market End-User industries, 2024- 2032

2.3.3 Fast-Growing countries for Chemical Fillers Market sales, 2024- 2032

2.4 Chemical Fillers Market Drivers and Restraints

2.4.1 Chemical Fillers Market Demand Drivers to 2032

2.4.2 Chemical Fillers Market Challenges to 2032

2.5 Chemical Fillers Market- Five Forces Analysis

2.5.1 Chemical Fillers Market Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Chemical Fillers Market Value, Market Share, and Forecast to 2032

3.1 Global Chemical Fillers Market Overview, 2024

3.2 Global Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

3.3 Global Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

3.3.1 Organic

3.3.2 Shell Flour

3.3.3 Wood Flour

3.3.4 Others

3.3.5 Inorganic

3.3.6 Calcium Carbonate

3.3.7 Talc

3.3.8 Silica

3.3.9 Kaolin

3.3.10 Others

3.4 Global Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

3.4.1 Paper

3.4.2 Thermoplastic and Thermoset

3.4.3 Flame Retardants

3.4.4 Paints and Coatings

3.4.5 Rubber

3.4.6 Adhesives and Sealants

3.4.7 Others

3.5 Global Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

3.6 Global Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

3.7 Global Chemical Fillers Market Size and Share Outlook by Region, 2024- 2032

4. Asia Pacific Chemical Fillers Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Chemical Fillers Market Overview, 2024

4.2 Asia Pacific Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

4.3 Asia Pacific Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

4.4 Asia Pacific Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

4.5 Asia Pacific Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

4.6 Asia Pacific Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

4.7 Asia Pacific Chemical Fillers Market Size and Share Outlook by Country, 2024- 2032

4.8 Key Companies in Asia Pacific Chemical Fillers Market

5. Europe Chemical Fillers Market Value, Market Share, and Forecast to 2032

5.1 Europe Chemical Fillers Market Overview, 2024

5.2 Europe Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

5.3 Europe Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

5.4 Europe Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

5.5 Europe Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

5.6 Europe Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

5.7 Europe Chemical Fillers Market Size and Share Outlook by Country, 2024- 2032

5.8 Key Companies in Europe Chemical Fillers Market

6. North America Chemical Fillers Market Value, Market Share and Forecast to 2032

6.1 North America Chemical Fillers Market Overview, 2024

6.2 North America Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

6.3 North America Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

6.4 North America Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

6.5 North America Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

6.6 North America Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

6.7 North America Chemical Fillers Market Size and Share Outlook by Country, 2024- 2032

6.8 Key Companies in North America Chemical Fillers Market

7. South and Central America Chemical Fillers Market Value, Market Share and Forecast to 2032

7.1 South and Central America Chemical Fillers Market Overview, 2024

7.2 South and Central America Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

7.3 South and Central America Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

7.4 South and Central America Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

7.5 South and Central America Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

7.6 South and Central America Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

7.7 South and Central America Chemical Fillers Market Size and Share Outlook by Country, 2024- 2032

7.8 Key Companies in South and Central America Chemical Fillers Market

8. Middle East Africa Chemical Fillers Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Chemical Fillers Market Overview, 2024

8.2 Middle East and Africa Chemical Fillers Market Revenue and Forecast, 2024- 2032 (US$ Million)

8.3 Middle East Africa Chemical Fillers Market Size and Share Outlook By Product Type, 2024- 2032

8.4 Middle East Africa Chemical Fillers Market Size and Share Outlook By Application, 2024- 2032

8.5 Middle East Africa Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

8.6 Middle East Africa Chemical Fillers Market Size and Share Outlook 0, 2024- 2032

8.7 Middle East Africa Chemical Fillers Market Size and Share Outlook by Country, 2024- 2032

8.8 Key Companies in Middle East Africa Chemical Fillers Market

9. Chemical Fillers Market Structure

9.1 Key Players

9.2 Chemical Fillers Market Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Chemical Fillers Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Chemical Fillers Market is estimated to reach USD 39.2 billion by 2032.

The Global Chemical Fillers Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.3% during the forecast period from 2025 to 2032.

The Global Chemical Fillers Market is estimated to generate USD 30.2 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!