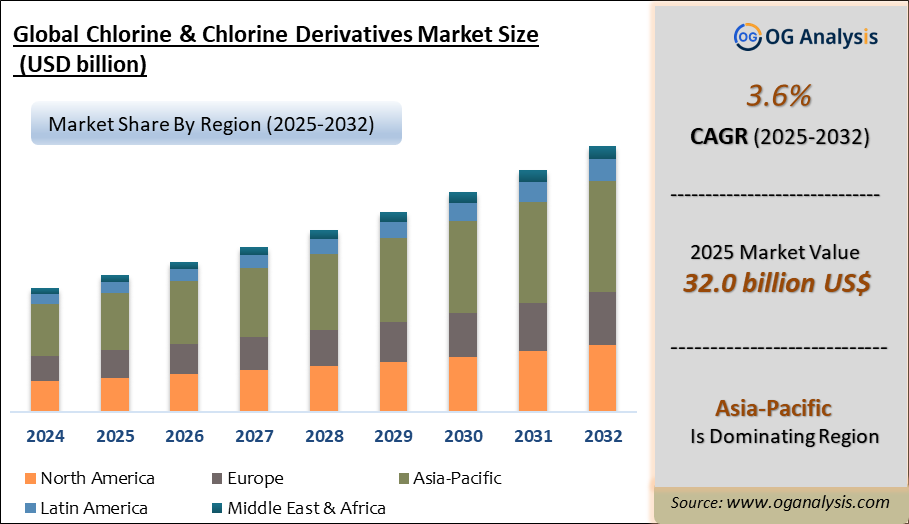

"The Global Chlorine & Chlorine Derivatives Market Size was valued at USD 31.1 billion in 2024 and is projected to reach USD 32.0 billion in 2025. Worldwide sales of Chlorine & Chlorine Derivatives are expected to grow at a significant CAGR of 3.6%, reaching USD 44.5 billion by the end of the forecast period in 2034."

The global chlorine and chlorine derivatives market is witnessing stable growth driven by extensive applications in water treatment, chemicals manufacturing, pharmaceuticals, and plastics production. Chlorine is a vital industrial chemical used for disinfection, bleaching, and as a raw material for producing derivatives such as hydrochloric acid, sodium hypochlorite, polyvinyl chloride (PVC), chlorinated paraffins, and other organochlorines. Growing urbanisation, stringent regulations on water sanitation, and rising demand for PVC in construction and infrastructure sectors are major growth drivers. The market is characterised by vertically integrated players, strategic expansions, and capacity enhancements to meet rising consumption across regions. However, environmental concerns regarding chlorine production and safety risks are leading companies to adopt sustainable manufacturing practices and efficient waste management systems.

Asia-Pacific dominates the market, driven by China and India’s industrial growth, expanding water treatment facilities, and robust PVC demand in construction and automotive industries. North America and Europe remain mature markets with strict environmental regulations prompting technological advancements for chlorine production efficiency and reduced emissions. Key companies are focusing on regional expansions, partnerships, and product innovations to strengthen their market positions. Increasing investments in chemical intermediates, pharmaceuticals, and agrochemicals continue to augment demand for chlorine derivatives globally. Meanwhile, the market is experiencing a gradual shift towards green chemistry initiatives and circular economy models to mitigate environmental impact while ensuring continued growth and application expansion in diverse industries.

By type, calcium chloride is the largest segment due to its wide-ranging applications in de-icing, dust control, water treatment, and as a drying agent in various industries. Its cost-effectiveness, high solubility, and ease of handling make it a preferred chlorine derivative across construction, oil & gas, and food processing sectors globally.

By application, water and wastewater treatment is the largest segment as chlorine derivatives such as calcium chloride, sodium chlorate, and iron chloride are extensively used for water purification, disinfection, and sludge treatment. Rising urbanisation, stringent environmental regulations, and the need for safe potable water are driving consistent demand growth in this segment worldwide.

Trade Intelligence for chlorine and chlorine derivatives market

| Global Chlorine Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 174 | 220 | 351 | 352 | 368 |

| United States of America | 41.2 | 67.6 | 177 | 174 | 215 |

| Belgium | 4.34 | 5.46 | 6.41 | 7.03 | 10.7 |

| Dominican Republic | 6.08 | 5.45 | 8.67 | 7.93 | 7.39 |

| Ukraine | 1.74 | 1.10 | 3.92 | 6.48 | 6.30 |

| Philippines | 3.63 | 4.94 | 5.97 | 6.04 | 6.16 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- United States of America, Belgium, Dominican Republic, Ukraine and Philippines are the top five countries importing 66.7% of global Chlorine in 2024

- Global Chlorine Imports increased by 111.5% between 2020 and 2024

- United States of America accounts for 58.4% of global Chlorine trade in 2024

- Belgium accounts for 2.9% of global Chlorine trade in 2024

- Dominican Republic accounts for 2% of global Chlorine trade in 2024

| Global Chlorine Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Key Insights

- The chlorine and chlorine derivatives market is primarily driven by the water treatment industry, where chlorine serves as a highly effective disinfectant for municipal and industrial water purification processes, ensuring safe potable water supply and compliance with stringent hygiene and public health standards globally.

- Polyvinyl chloride (PVC) remains the largest derivative segment, with significant demand from construction, automotive, and electrical industries due to its durability, chemical resistance, and cost-effectiveness, prompting companies to expand chlorine capacities to secure PVC production value chains.

- Hydrochloric acid, a major chlorine derivative, is extensively used in steel pickling, oil well acidising, food processing, and chemical manufacturing, with demand supported by infrastructure development, industrial growth, and diversified downstream applications across regions.

- Asia-Pacific leads the market, driven by robust manufacturing activities, rising urban infrastructure projects, expanding chemical industries, and growing need for clean drinking water, with China and India accounting for the largest consumption shares regionally and globally.

- Environmental concerns over chlorine production, storage, and transportation safety risks have prompted companies to invest in advanced production technologies, sustainable practices, and stringent compliance measures to reduce emissions and mitigate health and ecological hazards.

- Sodium hypochlorite is witnessing rising demand as a household and industrial bleaching and disinfecting agent, particularly driven by heightened hygiene awareness post-pandemic and widespread applications in sanitation, cleaning, and wastewater treatment processes globally.

- Key players are focusing on capacity expansions, mergers, and strategic partnerships to strengthen supply security, optimise distribution networks, and gain competitive advantage in emerging markets with growing industrial chemical consumption and infrastructural investments.

- The market is witnessing a gradual shift towards green chemistry initiatives, including alternative chlorination processes and circular economy models to improve sustainability and address increasing regulatory and environmental concerns in the chemical manufacturing sector.

- Chlorinated paraffins continue to find applications as flame retardants, plasticisers, and lubricants in metalworking fluids, rubber, paints, and sealants industries, driving their demand despite regulatory scrutiny in some regions due to environmental and toxicity concerns.

- Technological advancements in membrane cell chlor-alkali production processes have enabled enhanced energy efficiency, reduced environmental footprint, and operational cost reductions, supporting industry profitability and compliance with global environmental standards.

Report Scope

| Parameter | chlorine and chlorine derivatives Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Chromium Chloride

- Iron Chloride

- Copper Chloride

- Calcium Chloride

- Sodium Chlorate

- Others

By Application

- Water and Wastewater Treatment

- Textile Bleaching

- Solvent Manufacturing

- Insecticide Manufacturing

- Cosmetics and Personal Care

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Market Players

1. The Dow Chemical Company

2. Olin Corporation

3. Occidental Petroleum Corporation

4. Westlake Chemical Corporation

5. Tata Chemicals Limited

6. BASF SE

7. Ineos Group Holdings S.A.

8. Ercros S.A.

9. Tosoh Corporation

10. Formosa Plastics Corporation

11. Hanwha Solutions Corporation

12. Shin-Etsu Chemical Co., Ltd.

13. PPG Industries, Inc.

14. FMC Corporation

15. Axiall Corporation

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Chlorine Chlorine Derivatives market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Chlorine Chlorine Derivatives market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Chlorine Chlorine Derivatives market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Chlorine Chlorine Derivatives business prospects by region, key countries, and top companies' information to channel their investments.

Recent Developments

- Olin Corporation reported a decline in earnings from its Chlor Alkali Products & Vinyls segment due to lower ethylene dichloride pricing and higher maintenance-related costs, despite seeing improved production volumes.

- BioLab Inc. announced it will not rebuild its Conyers chlorine production plant following repeated fire and explosion incidents, confirming that only its distribution center at the site will continue operations.

- Olin Corporation experienced a chlorine gas release at its Freeport Plant B in Texas, which triggered local shelter-in-place protocols until the leak was contained and response teams secured the site.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Chlorine & Chlorine Derivatives Market is estimated to reach USD 41.3 billion by 2032.

The Global Chlorine & Chlorine Derivatives Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.6% during the forecast period from 2025 to 2032.

The Global Chlorine & Chlorine Derivatives Market is estimated to generate USD 31.1 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!