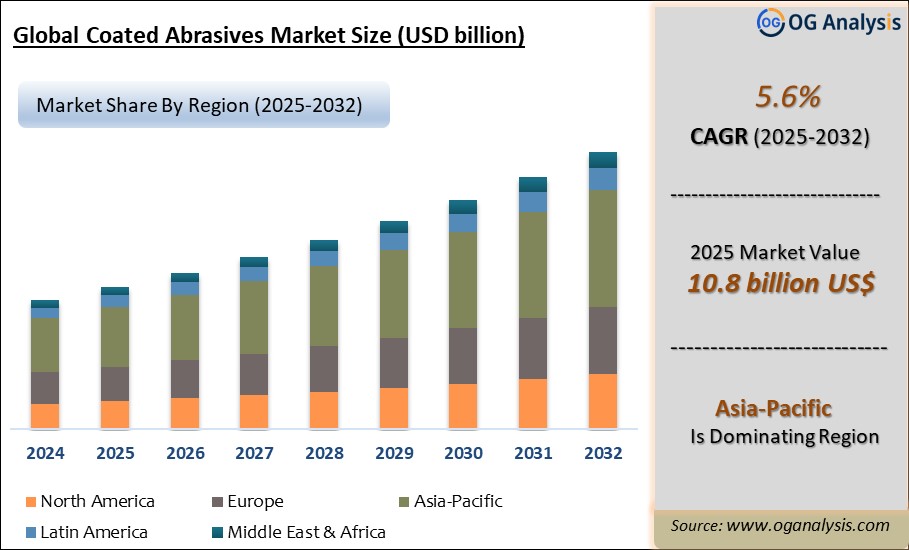

"The Global Coated Abrasives Market Size was valued at USD 10.3 billion in 2024 and is projected to reach USD 10.8 billion in 2025. Worldwide sales of Coated Abrasives are expected to grow at a significant CAGR of 5.6%, reaching USD 17.9 billion by the end of the forecast period in 2034."

Introduction and Overview

The coated abrasives market is a vital segment within the broader abrasives industry, characterized by the application of abrasive grains onto a flexible backing material. These abrasives are crucial for various industrial processes, including grinding, polishing, and finishing. Coated abrasives are used across multiple sectors, such as automotive, metalworking, woodworking, and electronics, owing to their ability to provide superior surface finishes and precision. The market has seen considerable growth driven by advancements in technology and increasing demand for high-performance materials. Enhanced coating techniques and the development of new abrasive materials have broadened their application range, contributing to the market's expansion.

In recent years, the coated abrasives market has experienced a surge in demand due to industrialization and technological innovations. The expansion of manufacturing sectors, particularly in emerging economies, has led to increased consumption of coated abrasives. The growing trend towards automation and the need for precision in manufacturing processes have further accelerated market growth. Additionally, the emphasis on improving product quality and operational efficiency has driven the adoption of advanced coated abrasive products. This trend is expected to continue as industries seek more effective solutions to meet their evolving requirements.

Asia-Pacific dominates the Coated Abrasives Market, accounting for the largest regional share of 42% due to its robust manufacturing base, expanding automotive sector, and growing metalworking industries. The automotive segment emerged as the leading application area, driven by high demand for surface finishing and precision grinding solutions.

Trade Intelligence for coated abrasives market

| Global Abrasive powder on paper/paperboard base Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 1,305 | 1,575 | 1,374 | 1,342 | 1,351 |

| Germany | 197 | 234 | 172 | 182 | 181 |

| United States of America | 160 | 173 | 157 | 147 | 151 |

| Poland | 98.2 | 128.8 | 81.1 | 84.3 | 78.6 |

| Belgium | 56.7 | 67.1 | 57.2 | 59.4 | 64.3 |

| India | 29.6 | 56.1 | 57.2 | 53.5 | 60.1 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- Germany, United States of America, Poland, Belgium and India are the top five countries importing 39.6% of global Abrasive powder on paper/paperboard base in 2024

- Global Abrasive powder on paper/paperboard base Imports increased by 3.5% between 2020 and 2024

- Germany accounts for 13.4% of global Abrasive powder on paper/paperboard base trade in 2024

- United States of America accounts for 11.2% of global Abrasive powder on paper/paperboard base trade in 2024

- Poland accounts for 5.8% of global Abrasive powder on paper/paperboard base trade in 2024

| Global Abrasive powder on paper/paperboard base Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Coated abrasives market: Latest Trends

One of the prominent trends in the coated abrasives market is the shift towards eco-friendly and sustainable products. With growing environmental concerns, manufacturers are increasingly focusing on developing abrasives with reduced environmental impact. This includes the use of recycled materials and the reduction of hazardous substances in the abrasive coatings. Companies are also investing in research and development to create products that offer longer life cycles and improved performance while minimizing waste. This trend aligns with the broader push towards sustainability across various industries and is expected to drive future market growth.

Technological advancements are significantly influencing the coated abrasives market, particularly with the introduction of advanced coating technologies. Innovations such as ceramic abrasives and superabrasives are enhancing the efficiency and lifespan of coated products. These technologies offer superior cutting performance, durability, and resistance to heat and wear. Additionally, the integration of digital technologies and automation in manufacturing processes is streamlining production and improving the precision of coated abrasives. This trend towards high-tech solutions is shaping the market landscape and driving demand for more sophisticated abrasive products.

The expansion of the automotive and aerospace industries is another key trend impacting the coated abrasives market. As these sectors continue to grow, the demand for coated abrasives used in surface preparation, finishing, and maintenance applications is increasing. The need for high-quality, precision-engineered components in these industries is driving the adoption of advanced coated abrasives. Additionally, the shift towards lightweight materials and advanced composites in automotive and aerospace applications is creating new opportunities for coated abrasives, further fueling market growth.

Coated abrasives market Drivers

Several factors are driving the growth of the coated abrasives market. First and foremost, the expansion of industrial activities globally is a major driver. As industries such as automotive, construction, and manufacturing continue to grow, the demand for coated abrasives for various applications, including grinding and polishing, is rising. Additionally, the increasing focus on improving product quality and efficiency in manufacturing processes is fueling the adoption of advanced coated abrasives. Companies are investing in high-performance abrasive products to meet stringent quality standards and enhance operational productivity, further driving market growth.

The rise of automation and technological advancements in manufacturing processes is also a significant driver for the coated abrasives market. Automation increases the precision and efficiency of abrasive applications, leading to higher demand for advanced coated abrasives that can meet the demands of automated systems. Furthermore, technological innovations such as the development of new abrasive materials and coating techniques are enhancing the performance and lifespan of coated abrasives. These advancements are creating new opportunities for market growth and driving the adoption of high-tech abrasive solutions.

The growth of the automotive and aerospace sectors is another key driver for the coated abrasives market. These industries require high-quality abrasives for various applications, including surface finishing and component maintenance. The increasing production of vehicles and aircraft, coupled with the demand for precision-engineered parts, is driving the need for advanced coated abrasives. Additionally, the shift towards lightweight and high-performance materials in these sectors is creating new opportunities for coated abrasives, further contributing to market growth.

Coated abrasives market Challenges

Despite its growth, the coated abrasives market faces several challenges. One of the primary challenges is the volatility of raw material prices. The cost of materials such as aluminum oxide, silicon carbide, and synthetic resins can fluctuate significantly, impacting production costs and profit margins. Additionally, the coated abrasives industry is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars and pressure on margins. Moreover, the need for continuous innovation to meet evolving customer demands and technological advancements requires substantial investment in research and development. Companies must balance these costs while maintaining product quality and competitiveness in the market.

Market Players

1. Asahi Diamond Industrial Co., Ltd.

2. Bosch Ltd.

3. Cabot Microelectronics Corporation

4. Carborundum Universal Limited (CUMI)

5. Fujimi Incorporated

6. Henkel AG & Co

7. Jason Incorporated

8. KGaA

9. Krebs & Riedel

10. KWH Mirka

11. Nippon Resibon Corporation

12. Noritake Co., Limited

13. Robert Bosch GmbH

14. Saint-Gobain

15. The 3M Company

16. TYROLIT Group

Report Scope

| Parameter | coated abrasives Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | by Grain type, by Backing material, by Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

by Grain type

- Aluminum oxide

- Ceramic

- Silicon carbide

- Alumina zirconia

- Others

by Backing material

- Fiber

- Paper

- Cloth

- Polyester

- Others

by Application

- Automotive

- Metalworking

- Woodworking

- Electronics and Semiconductors

- Aerospace and Defense

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

- A leading abrasives manufacturer introduced the first environmental product declarations (EPDs) for coated and bonded abrasives, highlighting the use of recycled raw materials and reduced carbon footprint in production.

- A global abrasives company launched a new sustainability-focused brand line of abrasive grains, featuring products designed with higher recycled content and lower energy consumption during manufacturing.

- A major abrasives producer completed a large-scale upgrade of its European production facility, installing advanced high-performance machinery to enhance precision and output capacity for coated abrasives.

- One of the top abrasives suppliers implemented a price adjustment across its coated abrasives portfolio, increasing prices moderately while phasing out region-specific surcharges to streamline global supply.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Coated Abrasives Market is estimated to reach USD 15.9 billion by 2032.

The Global Coated Abrasives Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period from 2025 to 2032.

The Global Coated Abrasives Market is estimated to generate USD 10.3 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!