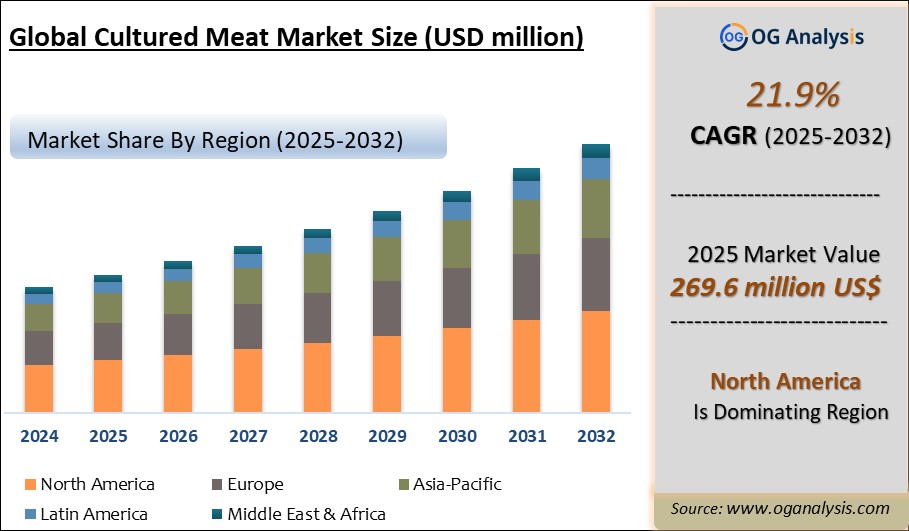

"Global Cultured Meat Market is valued at USD 269.6 million in 2025. Further, the market is expected to grow at a CAGR of 21.9% to reach USD 1601.1 million by 2034."

Global Cultured Meat Market – Overview and Introduction

The Cultured Meat Market is growing rapidly as a transformative alternative to conventional animal agriculture. Cultured meat—produced by growing animal cells in controlled bioreactors—offers a promising path toward sustainable and ethical protein, eliminating the need for livestock rearing, slaughter, and routine antibiotic use. This industry is gaining momentum thanks to increasing investment from private and public sectors, growing consumer interest in environmentally friendly food, and initial regulatory approvals in various regions. Although early-stage commercialization is focused on products like beef, chicken, and seafood, the market is expanding toward a broader range of cultured proteins.

Advances in cell biology, tissue engineering, and bioprocessing are fueling the maturation of cultured meat. Researchers are developing cost-efficient growth media, edible scaffolding for improved texture, and scalable bioreactor systems. Meanwhile, startups and incumbent food players are forming collaborations to bridge lab-scale production with industrial scale. Consumer acceptance remains a key focus, with efforts aimed at transparent labeling, sensory optimization, and safety validation. As the cost per product declines and scale increases, cultured meat is poised to enter premium foodservice, followed by retail and food manufacturing, offering a complementary, low-carbon alternative to traditional meat.

Global Cultured Meat Market- Trends, Drivers, and Challenges

-

Cultured meat replaces conventional livestock by producing muscle tissue in controlled environments, reducing land, water, and greenhouse gas requirements.

-

Early commercialization is targeting high-value products like beef, chicken, and seafood to appeal to eco-conscious and forward-thinking consumers.

-

Growth media cost remains a major barrier; innovators are working on plant-based or cell-free alternatives to trim production expenses.

-

Edible scaffolds and 3D bioprinting are being developed to improve texture and mouthfeel, closely mimicking conventional meat.

-

Bioreactor design and scale-up strategies are essential to transition from laboratory to industrial production volumes efficiently.

-

Companies are collaborating across biotech, food processing, and regulatory sectors to validate safety, optimize processes, and prepare for market entry.

-

Consumer education efforts are emphasizing natural ingredients, non-GMO labeling, and taste testing to build trust and acceptance.

-

Sustainability claims—such as reduced emissions and antibiotic-free production—are core to cultured meat’s market positioning.

-

Regions with supportive regulatory frameworks and funding (e.g., select countries in Asia, North America, Europe) are leading product launch efforts.

-

As costs decline and production scales, cultured meat is expected to expand from niche launches in restaurants to broader retail and food manufacturing segments.

North America for the Cultured Meat Market Analysis

North America remains a frontrunner in the cultured meat market, driven by robust technological infrastructure, strong investment ecosystems, and early regulatory engagement. The United States, in particular, has seen significant developments, with the Food and Drug Administration (FDA) and U.S. Department of Agriculture (USDA) working collaboratively on regulatory pathways for cell-based meats. Numerous startups are headquartered in the region, benefiting from venture capital funding and partnerships with established food companies. Consumer interest in ethical and sustainable eating further bolsters the region’s leadership position.

Europe for the Cultured Meat Market Analysis

Europe follows closely, marked by a growing number of research collaborations, public funding initiatives, and a favorable consumer base inclined toward sustainable food systems. Countries like the Netherlands, Germany, and the United Kingdom are leading the charge, with many of the world's first cultured meat prototypes and pilot facilities originating from this region. While the European Food Safety Authority (EFSA) is progressing cautiously, the region is poised for growth once regulatory clarity is achieved. Public interest in reducing meat consumption and a growing vegan and flexitarian population are also contributing to regional momentum.

Asia-Pacific for the Cultured Meat Market Analysis

Asia-Pacific is emerging as a high-potential market, largely due to its massive population, rising middle class, and increasing meat consumption. Singapore became the first country in the world to approve the commercial sale of cultured meat, setting a precedent for others in the region. Countries like China and Japan are investing heavily in alternative proteins to meet food security goals and reduce reliance on traditional livestock farming. With supportive government policies and growing innovation hubs, Asia-Pacific is expected to be a key growth engine for the cultured meat industry over the coming decade.

Report Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD million |

| Market Splits Covered | By Type, By Application, By Distribution and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Poultry

- Beef

- Seafood

- Pork

- Duck

By Application

- Nuggets

- Sausages

- Burgers

- Hot Dogs

- Meatballs

- Other Applications

By Distribution Channel

- Hypermarkets

- Food And Drink Specialty Stores

- Convenience Stores

- Online Retail

- Other Distribution Channels

By End-User

- Household

- Food Services

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Emergy Inc.

- Shiok Meats Pte. Ltd.

- Because Animals Inc.

- Lab Farm Foods Ltd.

- Biofood Systems Inc.

- Mosa Meat BV

- Higher Steaks Cultivated Meat Ltd.

- UPSIDE Foods Inc.

- Eat Just Inc.

- Mission Barns Food Inc.

- Memphis Meats Inc.

- Mirai Foods Co. Ltd.

- Aleph Farms Ltd.

- Vow Foods Pty. Ltd.

- BioTech Foods Ltd.

- Meatable Pte. Ltd.

- Future Meat Technologies Ltd.

- Hoxton Farms Inc.

- Modern Meadow Inc.

- Bond Pet Foods Inc.

- Redefine Meat Ltd.

- MeaTech 3D Ltd.

- Finless Foods Inc.

- SuperMeat Ltd.

- Integriculture Inc.

- Cubiq Foods Inc.

- Cell Farm Food Tech Ltd.

- Avant Meats Company Inc.

- Cultured Decadence LLC

- Biozoon RGS Group

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Cultured Meat Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Cultured Meat Market Overview

2.2 Cultured Meat Market Developments

2.2.1 Cultured Meat Market -Supply Chain Disruptions

2.2.2 Cultured Meat Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Cultured Meat Market -Price Development

2.2.4 Cultured Meat Market -Regulatory and Compliance Management

2.2.5 Cultured Meat Market -Consumer Expectations and Trends

2.2.6 Cultured Meat Market -Market Structure and Competition

2.2.7 Cultured Meat Market -Technological Adaptation

2.2.8 Cultured Meat Market -Changing Retail Dynamics

2.3 Cultured Meat Market Insights, 2025- 2034

2.3.1 Prominent Cultured Meat Market product types, 2025- 2034

2.3.2 Leading Cultured Meat Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Cultured Meat Market sales, 2025- 2034

2.4 Cultured Meat Market Drivers and Restraints

2.4.1 Cultured Meat Market Demand Drivers to 2034

2.4.2 Cultured Meat Market Challenges to 2034

2.5 Cultured Meat Market- Five Forces Analysis

2.5.1 Cultured Meat Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Cultured Meat Market Value, Market Share, and outlook to 2034

3.1 Global Cultured Meat Market Overview, 2025

3.2 Global Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Cultured Meat Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Cultured Meat Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Cultured Meat Market Overview, 2025

4.2 Asia Pacific Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Cultured Meat Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Cultured Meat Market

5. Europe Cultured Meat Market Value, Market Share, and Forecast to 2034

5.1 Europe Cultured Meat Market Overview, 2025

5.2 Europe Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Cultured Meat Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Cultured Meat Market

6. North America Cultured Meat Market Value, Market Share, and Forecast to 2034

6.1 North America Cultured Meat Market Overview, 2025

6.2 North America Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Cultured Meat Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Cultured Meat Market

7. South and Central America Cultured Meat Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Cultured Meat Market Overview, 2025

7.2 South and Central America Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Cultured Meat Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Cultured Meat Market

8. Middle East Africa Cultured Meat Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Cultured Meat Market Overview, 2025

8.2 Middle East and Africa Cultured Meat Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Cultured Meat Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Cultured Meat Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Cultured Meat Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Cultured Meat Market

9. Cultured Meat Market Players Analysis

9.1 Cultured Meat Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Cultured Meat Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Cultured Meat Market is estimated to reach USD 1601.1 million by 2034.

The Global Cultured Meat Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 21.9% during the forecast period from 2025 to 2034.

The Global Cultured Meat Market is estimated to generate USD 269.6 million in revenue in 2025.

$2900- 30%

$4350- 40%

$5800- 50%

$2150- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!