"Global Dairy Alternatives Market is valued at USD 14.3 billion in 2025. Further, the market is expected to grow at a CAGR of 8.5% to reach USD 29.7 billion by 2034."

The dairy alternatives market has gained significant traction as consumers increasingly opt for plant-based products due to health concerns, dietary restrictions, and environmental considerations. Products such as almond milk, soy milk, and oat milk have become mainstream, offering lactose-free and vegan-friendly options that align with shifting consumer preferences. This market’s growth is further driven by innovations in taste and texture, making plant-based alternatives more appealing to a broader audience. As awareness of climate change and animal welfare grows, dairy alternatives continue to establish themselves as a sustainable and ethical choice in the global food and beverage industry.

In 2024, the market experienced considerable growth as major brands and new entrants launched a variety of fortified, protein-rich, and nutrient-enhanced dairy substitutes. The adoption of advanced processing techniques improved product quality, helping to overcome previous challenges related to flavor and mouthfeel. Additionally, partnerships with retailers and foodservice providers expanded the availability of dairy alternatives in cafés, restaurants, and grocery stores. Government initiatives promoting plant-based diets also provided a favorable regulatory environment, supporting the continued expansion of this category.

Looking forward, the dairy alternatives market is expected to evolve further with advancements in ingredient technology, such as precision fermentation and cellular agriculture. These innovations will likely lead to more affordable, nutritionally superior products that can compete directly with traditional dairy on taste, price, and availability. Moreover, increasing consumer demand for transparency and clean labels will encourage manufacturers to invest in simpler, more natural formulations. With continued growth in health-conscious and environmentally aware consumer segments, the dairy alternatives market is set to remain a dynamic and rapidly expanding sector.

Key Insights

- The market has shifted from serving primarily vegan and lactose-intolerant consumers to addressing a broad flexitarian base, where many shoppers mix dairy and non-dairy options. This widening of the core audience has encouraged mainstream brands and retailers to treat dairy alternatives as standard shelf fixtures rather than specialty products. As a result, the category is increasingly integrated into everyday consumption occasions rather than limited to specific dietary needs.

- Plant-based beverages remain the anchor segment, but growth is increasingly driven by yogurts, ice creams, creamers, and cheese alternatives that target indulgence and everyday usage. These formats allow brands to tap into desserts, breakfast, and coffee occasions with tailored textures and flavors. Success in these segments often hinges on replicating the creaminess, mouthfeel, and functional performance associated with traditional dairy.

- Raw material diversification is reshaping product portfolios, moving beyond early soy-based offerings into almond, oat, coconut, rice, pea, and multi-source blends. Each base offers different advantages in taste, nutrition, allergen profile, and environmental positioning. Manufacturers are increasingly combining bases to balance flavor, functionality, and label appeal, while also managing risks linked to crop yields, pricing, and regional supply security.

- Nutritional optimization is a central differentiator, with brands focusing on protein fortification, calcium and vitamin enrichment, and sugar reduction to address health-conscious consumers. Many launches emphasize balanced macronutrients, low or no added sugars, and the absence of artificial ingredients. This creates a space where dairy alternatives compete not only with dairy but also with functional beverages and better-for-you snacks.

- Clean-label and short-ingredient-list positioning strongly influences product development, pushing formulators to minimize use of stabilizers, artificial flavors, and challenging additives. At the same time, products must maintain acceptable shelf life, texture, and taste, making clean-label innovation technically demanding. Brands that successfully deliver simple labels without compromising sensorial quality often gain premium pricing and stronger brand loyalty.

- Coffee shops, cafés, and out-of-home channels play a critical role in driving trial and habit formation, especially through barista-style plant-based beverages and creamers. Consumers frequently first experience oat, almond, or other plant milks in specialty coffee drinks before adopting them at home. Partnerships with large coffee chains and foodservice operators therefore have outsized impact on category penetration and brand visibility.

- Retail dynamics are intensifying as supermarkets, discounters, and online platforms expand shelf space and offer both branded and private-label ranges. Private-label lines often position themselves as affordable, good-quality alternatives, increasing price competition in core beverage and yogurt segments. In response, branded players invest more heavily in differentiation through flavor innovation, targeted functional claims, and lifestyle-oriented marketing.

- Technological advancements in fermentation, flavor modulation, and plant protein processing are narrowing the sensory gap between dairy and non-dairy products. Fermented plant-based yogurts and cheeses, improved emulsification systems, and better fat structuring all contribute to more convincing taste and texture. Over time, such capabilities support the emergence of more sophisticated products including aged-style cheeses and culinary creams.

- Regulatory and labelling frameworks, including standards for naming, allergen declaration, and nutritional claims, influence how products are positioned and communicated to consumers. Debates over the use of dairy-related terms and comparative nutrition claims shape packaging strategies and brand education efforts. Companies must navigate differing regional regulations while maintaining consistent brand messages and avoiding consumer confusion.

- Sustainability narratives around carbon footprint, water use, and animal welfare remain powerful demand drivers and brand storytelling anchors. Many players highlight responsible sourcing, local ingredient partnerships, recyclable packaging, and climate-related commitments to strengthen their market position. As retailers and foodservice operators adopt broader environmental and social responsibility agendas, dairy alternatives are increasingly integrated into corporate sustainability strategies and menu transitions.

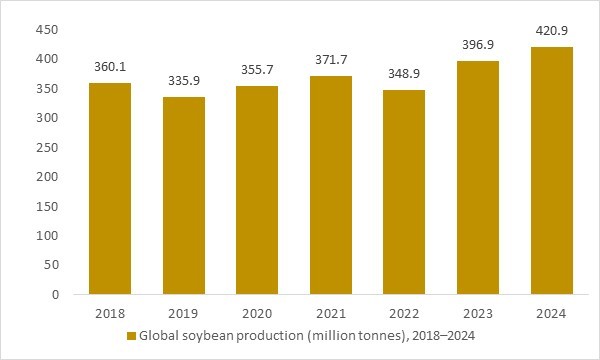

Global soybean production (million tonnes), 2018–2024

Figure: Global soybean production increased steadily between 2018 and 2024, expanding the plant-protein base that supports soy beverages, yogurts and other dairy alternatives. As food and beverage manufacturers scale up plant-based product portfolios, this growing soybean crop underpins raw material availability and supports long-term growth in the dairy alternatives market.

- Global soybean production increased from 2018 to 2024, expanding the plant-protein supply base needed for soy beverages, yogurts, and other dairy alternatives. Steady growth in oilseed availability supports large-scale manufacturing, product innovation, and consumer transition toward healthier and sustainable dairy-free options in global markets.

Regional Insights

North America Dairy alternatives market

In North America, the dairy-alternatives-market has moved firmly into the mainstream, supported by high awareness of lactose intolerance, health and wellness trends, and strong out-of-home consumption through coffee chains and cafés. Plant-based milks, creamers, yogurts, and ice creams enjoy wide distribution in supermarkets, club stores, natural food retailers, and e-commerce platforms. Innovation focuses on barista-ready beverages, high-protein and low-sugar varieties, kid-friendly formats, and functional claims such as gut health and immunity. The region also sees active participation from both legacy dairy companies and pure-play plant-based brands, intensifying competition and driving frequent product launches. Private-label offerings are gaining share, prompting branded players to differentiate via taste, texture, sustainability messaging, and lifestyle branding.

Europe Dairy alternatives market

Europe is a mature but still fast-evolving market where dairy alternatives benefit from strong vegan, vegetarian, and flexitarian movements, as well as robust organic and natural food cultures. Northern and Western European countries show high per-capita consumption of plant-based beverages and yogurts, with retailers dedicating prominent shelf space and refrigerated zones to the category. Regulatory scrutiny over labelling, nutritional claims, and the use of dairy-related terms influences how brands position their products, pushing them toward transparent communication and clear differentiation. Sustainability credentials, including carbon footprint, packaging recyclability, and local sourcing of oats or other crops, are increasingly important purchase drivers. The presence of established European plant-based specialists alongside major dairy and beverage companies creates a competitive environment centered on quality, innovation, and brand values.

Asia-Pacific Dairy alternatives market

Asia-Pacific represents the largest and fastest-expanding region for dairy alternatives, underpinned by long-standing familiarity with soy-based drinks and tofu, combined with rising interest in newer bases such as almond, oat, coconut, and pea. Rapid urbanization, growing middle-class incomes, and changing breakfast and snacking habits are fostering adoption of plant-based beverages, yogurts, and frozen desserts. Local and regional players frequently adapt flavors and formats to match traditional tastes, such as tea-based drinks, regional dessert profiles, and on-the-go beverages. E-commerce and modern retail formats are key enablers, while foodservice outlets and bubble tea chains increasingly incorporate plant milks as standard options. At the same time, the region’s strong focus on digestive health, beauty-from-within, and functional nutrition supports premiumization within the category.

Rest of the World Dairy alternatives market

In Rest of the World markets, including Latin America, the Middle East, and Africa, the dairy-alternatives-market is at an earlier development stage but growing quickly from a low base. Demand is driven by urban consumers, younger demographics, and expatriate populations seeking lactose-free, plant-based, or lifestyle-oriented products. Availability is expanding in modern retail chains, specialty health stores, and selected foodservice chains, often starting with plant-based milks and gradually extending into yogurts and ice creams. Economic sensitivities and price positioning remain important, creating room for both affordable private-label ranges and aspirational imported brands. Local producers are beginning to explore regionally relevant crops such as coconut, nuts, and pulses as raw material bases, aligning with interest in local sourcing and halal, kosher, or other dietary certifications.

Market Scope

| Parameter | Dairy alternatives Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type

- Non-Dairy Milk

- Butter

- Cheese

- Yogurts

- Ice Cream

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Danone S.A.

- Blue Diamond Growers

- The Hain Celestial Group

- Inc.

- Oatly Group AB

- Vitasoy International Holdings

- SunOpta Inc.

- Unilever PLC

- Freedom Foods Group Limited

- Nestlé S.A.

- Daiya Foods Inc.

- Hershey Private Limited

- Life Health Foods Private Limited

- Rakyan Beverages Private Limited

- Dabur Ltd

- Sahmyook Foods

- Bonsoy

- Hebei Yangyuan Zhihui Beverage Co. (Yang yuan walnut milk)

- Coconut palm

- Yinglu (peanut milk)

- Dali foods (soy milk)

- Lulu (almond milk)

- Follow Your Heart

- Sanitarium Health and Wellbeing Company

- Axiom Foods

- Inc.

- Conagra Brands

- Earth’s Own Food Company

- Inc.

- Agrana

- Efko Group

- Jogurty Magda

- Albalact

- First Choice Ingredients

- Organic Valley

- Zahini

- Archer Daniels Midland Company

- Nutriops S. L.

- Alpro

- Arla

- Soyfresh

- Koita

- Diamond River General Trading Llc

- Almustaqbal-Santa Corperation

- Bartech International Llc

- Synergs General Trading Fzc

- Soy Afric Limited

- Panos Brands Llc

- Eden Foods Inc.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Dairy Alternatives Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Dairy Alternatives Market Overview

2.2 Dairy Alternatives Market Developments

2.2.1 Dairy Alternatives Market -Supply Chain Disruptions

2.2.2 Dairy Alternatives Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Dairy Alternatives Market -Price Development

2.2.4 Dairy Alternatives Market -Regulatory and Compliance Management

2.2.5 Dairy Alternatives Market -Consumer Expectations and Trends

2.2.6 Dairy Alternatives Market -Market Structure and Competition

2.2.7 Dairy Alternatives Market -Technological Adaptation

2.2.8 Dairy Alternatives Market -Changing Retail Dynamics

2.3 Dairy Alternatives Market Insights, 2025- 2034

2.3.1 Prominent Dairy Alternatives Market product types, 2025- 2034

2.3.2 Leading Dairy Alternatives Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Dairy Alternatives Market sales, 2025- 2034

2.4 Dairy Alternatives Market Drivers and Restraints

2.4.1 Dairy Alternatives Market Demand Drivers to 2034

2.4.2 Dairy Alternatives Market Challenges to 2034

2.5 Dairy Alternatives Market- Five Forces Analysis

2.5.1 Dairy Alternatives Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Dairy Alternatives Market Value, Market Share, and outlook to 2034

3.1 Global Dairy Alternatives Market Overview, 2025

3.2 Global Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Dairy Alternatives Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Dairy Alternatives Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Dairy Alternatives Market Overview, 2025

4.2 Asia Pacific Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Dairy Alternatives Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Dairy Alternatives Market

5. Europe Dairy Alternatives Market Value, Market Share, and Forecast to 2034

5.1 Europe Dairy Alternatives Market Overview, 2025

5.2 Europe Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Dairy Alternatives Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Dairy Alternatives Market

6. North America Dairy Alternatives Market Value, Market Share, and Forecast to 2034

6.1 North America Dairy Alternatives Market Overview, 2025

6.2 North America Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Dairy Alternatives Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Dairy Alternatives Market

7. South and Central America Dairy Alternatives Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Dairy Alternatives Market Overview, 2025

7.2 South and Central America Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Dairy Alternatives Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Dairy Alternatives Market

8. Middle East Africa Dairy Alternatives Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Dairy Alternatives Market Overview, 2025

8.2 Middle East and Africa Dairy Alternatives Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Dairy Alternatives Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Dairy Alternatives Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Dairy Alternatives Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Dairy Alternatives Market

9. Dairy Alternatives Market Players Analysis

9.1 Dairy Alternatives Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Dairy Alternatives Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Dairy Alternatives Market is estimated to generate USD 14.3 billion in revenue in 2025.

The Global Dairy Alternatives Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period from 2025 to 2034.

The Dairy Alternatives Market is estimated to reach USD 29.7 billion by 2034.

$2900- 30%

$4350- 40%

$5800- 50%

$2150- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!