"The Dehydrated Potato Market is valued at $ 8 billion in 2025. Further, the market is expected to grow at a CAGR of 8.9% to reach $ 17.3 billion by 2034."

The dehydrated potato market is evolving from a purely cost- and shelf-life driven ingredient business into a strategic enabler of convenience, waste reduction, and product innovation across the food industry. Manufacturers of snacks, ready meals, bakery products, soups, and sauces increasingly rely on dehydrated flakes, granules, powders, and dices to ensure consistent quality, year-round availability, and efficient logistics. Growth is supported by rising consumption of processed and packaged foods, busy lifestyles, and the expansion of quick-service restaurants and institutional catering. At the same time, producers are focusing on yield optimization, better storage and processing technologies, and tighter control over raw potato quality to manage price volatility and secure reliable supply.

On the demand side, food companies are reformulating recipes to meet clean-label, low-waste, and sustainability expectations, which benefits dehydrated potatoes due to their long shelf life, reduced transport weight, and portioning flexibility. There is growing use of dehydrated potato ingredients in premium and differentiated products such as specialty snacks, fortified convenience foods, and gluten-free or plant-forward formulations. Innovation in texture, flavor, and functionality—such as improved rehydration, better mouthfeel, and tailored particle sizes—helps dehydrated potato suppliers move beyond commodity positioning and deepen collaboration with food manufacturers. Overall, the market is shifting toward higher-value, customized solutions with an emphasis on quality, consistency, and supply-chain resilience.

Key Insights Of the Market

- Shift toward convenient and shelf-stable ingredients – Dehydrated potato products are increasingly preferred by food manufacturers for their long shelf life, uniform quality, and easy storage. They fit well into processed and convenience foods, from instant mixes to ready meals. This shift supports continuous production planning and reduces dependence on seasonal fresh potato availability. As consumers rely more on quick-to-prepare foods, demand for dehydrated potato inputs expands across multiple categories.

- Rising use in snacks, bakery, and ready meals – Flakes, granules, and powders are becoming core ingredients in snacks, bakery items, extruded snacks, and ready-to-eat or ready-to-cook dishes. Their ability to provide consistent texture, volume, and binding helps manufacturers maintain product standards across batches. Premium snack brands and global quick-service chains are broadening recipe portfolios with dehydrated potato formats. This pulls the market toward higher-quality, application-specific grades.

- Product innovation across flakes, granules, powders, and dices – Suppliers are moving beyond generic flakes to offer differentiated formats tailored to specific applications. Finer powders support batters, coatings, and instant soups, while granules and dices target side dishes, fillings, and meal kits. Innovations around rehydration speed, mouthfeel, and color stability are key differentiators. As customers seek unique textures and culinary experiences, specialized dehydrated potato formats gain traction.

- Advancements in drying and processing technologies – Improvements in drum drying, spray drying, and other technologies are enhancing product quality and process efficiency. Modern plants focus on gentle drying to preserve flavor, color, and nutritional characteristics. Better sorting, peeling, and blanching systems reduce defects and waste before dehydration. These advances help producers control costs, improve yields, and maintain consistent quality for demanding industrial customers.

- Clean label and reduced additive formulations – Food manufacturers are under pressure to reduce artificial additives, preservatives, and complex ingredient lists. Dehydrated potato, when processed with minimal additives, fits well into clean-label and simple-ingredient recipes. Brands highlight real vegetable content, familiar ingredients, and transparent processing to appeal to health-conscious consumers. This trend favors suppliers who can certify quality, traceability, and limited use of processing aids.

- Sustainability, waste reduction, and resource efficiency – Dehydrated potatoes support lower food waste by extending shelf life and enabling precise portioning in industrial kitchens and packaged foods. Producers increasingly optimize water, energy, and by-product utilization during processing to align with sustainability goals. Retailers and foodservice operators value ingredients that reduce spoilage in storage and distribution. As environmental performance becomes a buying criterion, more efficient dehydrated potato plants gain a competitive edge.

- Growing demand from foodservice and institutional sectors – Hotels, restaurants, quick-service chains, and catering firms rely on dehydrated potatoes for standardized, easy-to-prepare sides and ingredients. The products reduce preparation time, labor requirements, and variability in taste and texture across outlets. Institutional buyers, including schools and workplaces, also favor dehydrated formats for large-scale meal planning. Expansion of organized foodservice networks thus directly supports the underlying ingredient demand.

- Regional expansion and rising consumption in emerging markets – Urbanization, changing diets, and growth of modern retail in emerging economies are boosting processed food consumption. As local manufacturers expand snacks, instant foods, and ready-meal portfolios, they increasingly source dehydrated potatoes to ensure reliability and uniformity. International suppliers often partner with local distributors or set up regional processing capacities to reduce logistics costs. This widens the customer base beyond traditional mature markets.

- Customization, co-creation, and technical support for customers – Large food companies seek customized blends, particle sizes, and functionality that work seamlessly in their formulations. Dehydrated potato producers differentiate through application labs, joint product development, and technical troubleshooting. Tailored solutions for rehydration behavior, viscosity, and bake or fry performance deepen supplier–customer relationships. Such collaboration shifts the market from commodity sales to value-added, service-driven partnerships.

- Supply chain resilience and raw potato availability – Weather variability, crop disease, and competing uses for potatoes can influence raw material availability and quality. Dehydrated potato manufacturers increasingly diversify sourcing regions, invest in storage infrastructure, and collaborate with growers on contract farming. Strategic inventory management and flexible sourcing help mitigate disruptions and price swings. Players that secure stable, high-quality potato supplies are better positioned to serve long-term contracts with global food brands.

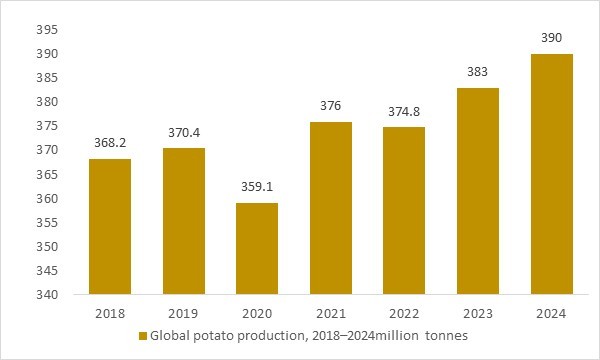

Global potato production, 2018–2023(million tonnes)

Figure: Global potato production increased from around 368 million tonnes in 2018 to nearly 383 million tonnes in 2023, confirming a large, resilient raw-material base for dehydrated potato processors. As processing-grade potatoes are channelled into flakes, granules, powders and instant mixes for retail, foodservice and industrial applications, this stable production trend underpins long-term supply security and capacity utilization. OG Analysis estimates, derived from FAO potato statistics and international potato industry data, illustrate how sustained output growth supports demand for dehydrated potato ingredients across global convenience and packaged food markets.

The dehydrated potato market is supported by a large and resilient raw-material base, with global potato production rising from about 368 million tonnes in 2018 to nearly 383 million tonnes in 2023. Steady output growth across major producers ensures consistent availability of processing-grade potatoes used for flakes, granules, powders and value-added convenience foods. Productivity improvements in seed quality, irrigation and storage have strengthened supply stability even amid climatic and market disruptions. As foodservice, packaged foods and instant meal categories expand, this robust production trend reinforces long-term demand for dehydrated potato ingredients worldwide

Report Scope

| Parameter | dehydrated potato Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Form

- Flakes

- Powder

- Dices

- Shreds

- Other Forms

By Nature

- Organic

- Conventional

By Flavor

- Sweet Potato

- Regular

By Distribution Channel

- Supermarkets And Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Other Distribution Channels

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players

- Cargill Incorporated

- Nestle SA

- Pepsico Inc.

- Kraft Heinz Company

- Intersnack Group GmbH & Co. KG

- Lamb Weston Holdings Inc.

- Lamb-Weston/ Meijer V.O.F

- Agrana Group

- Emsland Group

- McCain Foods Limited

- Basic American Foods Inc.

- Aviko BV

- Idahoan Foods LLC

- Basic American Foods

- Lutosa SA

- Mydibel SA

- Idaho Pacific Corporation

- Idaho Supreme Potatoes Inc.

- Oregon Potato Company

- Rixona BV

- Augason Farms

- JR Short Milling Co

- Agrarfrost GmbH & Co. KG

- Avebe U.A.

- Keystone Potato Products LLC

- JSC Belaya Dacha Trading

- Pacific Valley Foods

- Engel Food Solutions

- Linquan Hengda Food Co Ltd.

- Agistin Biotech Pvt. Ltd.

- Procordia Food AB

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Dehydrated Potato Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Dehydrated Potato Market Overview

2.2 Dehydrated Potato Market Developments

2.2.1 Dehydrated Potato Market -Supply Chain Disruptions

2.2.2 Dehydrated Potato Market -Direct/Indirect Impact of Tariff Changes and Trade Restrictions

2.2.3 Dehydrated Potato Market -Price Development

2.2.4 Dehydrated Potato Market -Regulatory and Compliance Management

2.2.5 Dehydrated Potato Market -Consumer Expectations and Trends

2.2.6 Dehydrated Potato Market -Market Structure and Competition

2.2.7 Dehydrated Potato Market -Technological Adaptation

2.2.8 Dehydrated Potato Market -Changing Retail Dynamics

2.3 Dehydrated Potato Market Insights, 2025- 2034

2.3.1 Prominent Dehydrated Potato Market product types, 2025- 2034

2.3.2 Leading Dehydrated Potato Market End-User markets, 2025- 2034

2.3.3 Fast-Growing countries for Dehydrated Potato Market sales, 2025- 2034

2.4 Dehydrated Potato Market Drivers and Restraints

2.4.1 Dehydrated Potato Market Demand Drivers to 2034

2.4.2 Dehydrated Potato Market Challenges to 2034

2.5 Dehydrated Potato Market- Five Forces Analysis

2.5.1 Dehydrated Potato Market Industry Attractiveness Index, 2025

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Dehydrated Potato Market Value, Market Share, and outlook to 2034

3.1 Global Dehydrated Potato Market Overview, 2025

3.2 Global Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

3.3 Global Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

3.4 Global Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

3.5 Global Dehydrated Potato Market Size and Share Outlook by Region, 2025- 2034

4. Asia Pacific Dehydrated Potato Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Dehydrated Potato Market Overview, 2025

4.2 Asia Pacific Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

4.3 Asia Pacific Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

4.4 Asia Pacific Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

4.5 Asia Pacific Dehydrated Potato Market Size and Share Outlook by Country, 2025- 2034

4.6 Key Companies in Asia Pacific Dehydrated Potato Market

5. Europe Dehydrated Potato Market Value, Market Share, and Forecast to 2034

5.1 Europe Dehydrated Potato Market Overview, 2025

5.2 Europe Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

5.3 Europe Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

5.4 Europe Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

5.5 Europe Dehydrated Potato Market Size and Share Outlook by Country, 2025- 2034

5.6 Key Companies in Europe Dehydrated Potato Market

6. North America Dehydrated Potato Market Value, Market Share, and Forecast to 2034

6.1 North America Dehydrated Potato Market Overview, 2025

6.2 North America Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

6.3 North America Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

6.4 North America Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

6.5 North America Dehydrated Potato Market Size and Share Outlook by Country, 2025- 2034

6.6 Key Companies in North America Dehydrated Potato Market

7. South and Central America Dehydrated Potato Market Value, Market Share, and Forecast to 2034

7.1 South and Central America Dehydrated Potato Market Overview, 2025

7.2 South and Central America Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

7.3 South and Central America Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

7.4 South and Central America Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

7.5 South and Central America Dehydrated Potato Market Size and Share Outlook by Country, 2025- 2034

7.6 Key Companies in South and Central America Dehydrated Potato Market

8. Middle East Africa Dehydrated Potato Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Dehydrated Potato Market Overview, 2025

8.2 Middle East and Africa Dehydrated Potato Market Revenue and Forecast, 2025- 2034 (US$ Million)

8.3 Middle East Africa Dehydrated Potato Market Size and Share Outlook by Type, 2025- 2034

8.4 Middle East Africa Dehydrated Potato Market Size and Share Outlook by End-User, 2025- 2034

8.5 Middle East Africa Dehydrated Potato Market Size and Share Outlook by Country, 2025- 2034

8.6 Key Companies in Middle East Africa Dehydrated Potato Market

9. Dehydrated Potato Market Players Analysis

9.1 Dehydrated Potato Market Companies - Key Strategies and Financial Analysis

9.1.1 Snapshot

9.1.2 Business Description

9.1.3 Products and Services

9.1.4 Financial Analysis

10. Dehydrated Potato Market Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Dehydrated Potato Market is estimated to generate USD 8 billion in revenue in 2025.

The Global Dehydrated Potato Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% during the forecast period from 2025 to 2034.

The Dehydrated Potato Market is estimated to reach USD 17.3 billion by 2034.

$2900- 30%

$4350- 40%

$5800- 50%

$2150- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!