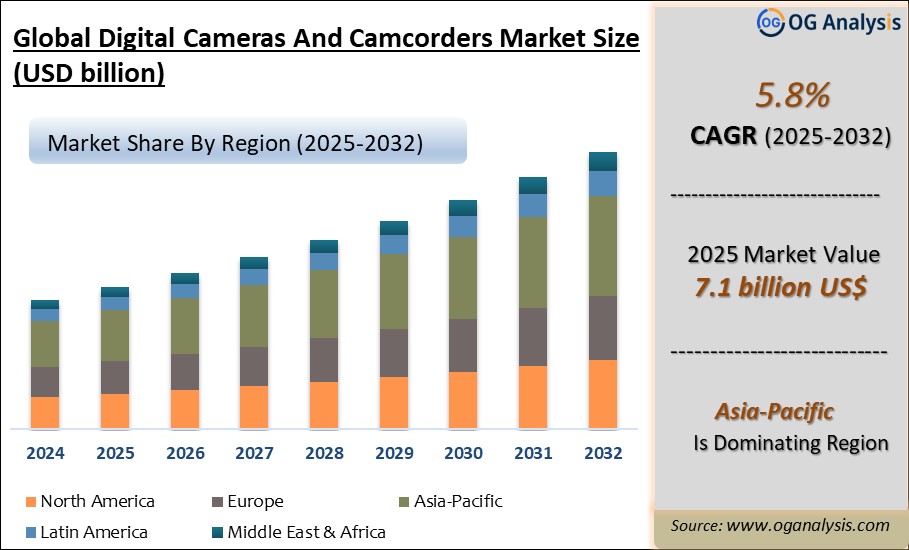

"The Global Digital Cameras And Camcorders Market Size was valued at USD 6.8 billion in 2024 and is projected to reach USD 7.1 billion in 2025. Worldwide sales of Digital Cameras And Camcorders are expected to grow at a significant CAGR of 5.8%, reaching USD 12.1 billion by the end of the forecast period in 2034."

Digital Cameras and Camcorders Market Overview

The digital cameras and camcorders market has evolved significantly over the past decade, driven by technological advancements and changing consumer preferences. Once dominated by traditional film cameras, the market has shifted towards digital solutions that offer superior image quality, ease of use, and connectivity features. Digital cameras and camcorders cater to a broad range of applications, from professional photography and videography to casual use by hobbyists and social media enthusiasts. The proliferation of smartphones with advanced camera capabilities has impacted the market, leading to a focus on high-end and specialized cameras that offer features beyond what smartphones can provide. Despite the competition from smartphones, the demand for digital cameras and camcorders remains robust, particularly in professional and enthusiast segments where image quality and versatility are paramount.

The market for digital cameras and camcorders is characterized by a diverse product range, including DSLRs, mirrorless cameras, action cameras, and professional camcorders. The rise of content creation for platforms like YouTube and Instagram has fueled demand for high-quality imaging devices. Additionally, advancements in sensor technology, image stabilization, and connectivity options have enhanced the appeal of digital cameras and camcorders. Manufacturers are continually innovating to offer features such as 4K and 8K video recording, improved low-light performance, and seamless integration with smartphones and other devices. As a result, the market is expected to grow steadily, driven by both consumer demand for superior image quality and the needs of professional photographers and videographers.

Latest Trends

One of the most significant trends in the digital cameras and camcorders market is the shift towards mirrorless cameras. These cameras offer several advantages over traditional DSLRs, including lighter weight, faster shooting speeds, and improved autofocus capabilities. Mirrorless cameras have gained popularity among both amateur and professional photographers, leading to increased market share. Another trend is the integration of advanced video features, such as 4K and 8K resolution, high frame rates, and professional-grade audio inputs, catering to the growing demand for high-quality video content. Additionally, manufacturers are focusing on enhancing connectivity features, allowing users to easily transfer photos and videos to their smartphones and computers for editing and sharing on social media platforms.

Drivers

Several factors are driving the growth of the digital cameras and camcorders market. The increasing popularity of social media platforms and content creation has spurred demand for high-quality imaging devices. Professional photographers, videographers, and content creators require advanced features and superior image quality, which drives demand for high-end digital cameras and camcorders. Technological advancements, such as improved sensor performance, image stabilization, and connectivity options, also contribute to market growth. The expansion of the vlogging and live streaming markets has further boosted the demand for cameras with advanced video capabilities. Moreover, the ongoing innovation by manufacturers to offer user-friendly interfaces, compact designs, and robust build quality appeals to a broad range of consumers, from professionals to hobbyists.

Market Challenges

Despite the positive growth outlook, the digital cameras and camcorders market faces several challenges. The most significant challenge is the competition from smartphones, which increasingly offer advanced camera features and high image quality. This competition has led to a decline in the sales of entry-level digital cameras, pushing manufacturers to focus on high-end and niche segments. Another challenge is the rapid pace of technological change, which requires continuous innovation and investment in research and development. Additionally, economic factors, such as fluctuating exchange rates and global trade uncertainties, can impact the market. The high cost of advanced digital cameras and camcorders can also be a barrier for some consumers, particularly in emerging markets where price sensitivity is higher.

Major Players in the Digital Cameras and Camcorders Market

1. Canon Inc.

2. Nikon Corporation

3. Sony Corporation

4. Panasonic Corporation

5. Fujifilm Holdings Corporation

6. Olympus Corporation

7. GoPro, Inc.

8. Samsung Electronics Co., Ltd.

9. Ricoh Company, Ltd.

10. Leica Camera AG

11. Blackmagic Design Pty Ltd

12. Hasselblad

13. Red Digital Cinema Camera Company

14. Casio Computer Co., Ltd.

15. JVC Kenwood Corporation

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Application, and By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

- By Type:

- DSLR Cameras

- Mirrorless Cameras

- Action Cameras

- Camcorders

- Compact Cameras

- By Application:

- Professional Photography

- Amateur Photography

- Content Creation

- Personal Use

- By Distribution Channel:

- Online Stores

- Offline Stores

- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Digital Cameras And Camcorders Latest Trends, Drivers and Challenges, 2024- 2032

2.1 Digital Cameras And Camcorders Overview

2.2 Key Strategies of Leading Digital Cameras And Camcorders Companies

2.3 Digital Cameras And Camcorders Insights, 2024- 2032

2.3.1 Leading Digital Cameras And Camcorders Types, 2024- 2032

2.3.2 Leading Digital Cameras And Camcorders End-User industries, 2024- 2032

2.3.3 Fast-Growing countries for Digital Cameras And Camcorders sales, 2024- 2032

2.4 Digital Cameras And Camcorders Drivers and Restraints

2.4.1 Digital Cameras And Camcorders Demand Drivers to 2032

2.4.2 Digital Cameras And Camcorders Challenges to 2032

2.5 Digital Cameras And Camcorders- Five Forces Analysis

2.5.1 Digital Cameras And Camcorders Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Digital Cameras And Camcorders Value, Market Share, and Forecast to 2032

3.1 Global Digital Cameras And Camcorders Overview, 2024

3.2 Global Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

3.3 Global Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

3.3.1 DSLR Cameras

3.3.2 Mirrorless Cameras

3.3.3 Action Cameras

3.3.4 Camcorders

3.3.5 Compact Cameras

3.4 Global Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

3.4.1 Professional Photography

3.4.2 Amateur Photography

3.4.3 Content Creation

3.4.4 Personal Use

3.5 Global Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

3.5.1 Online Stores

3.5.2 Offline Stores

3.6 Global Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

3.7 Global Digital Cameras And Camcorders Size and Share Outlook by Region, 2024- 2032

4. Asia Pacific Digital Cameras And Camcorders Value, Market Share and Forecast to 2032

4.1 Asia Pacific Digital Cameras And Camcorders Overview, 2024

4.2 Asia Pacific Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

4.3 Asia Pacific Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

4.4 Asia Pacific Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

4.5 Asia Pacific Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

4.6 Asia Pacific Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

4.7 Asia Pacific Digital Cameras And Camcorders Size and Share Outlook by Country, 2024- 2032

4.8 Key Companies in Asia Pacific Digital Cameras And Camcorders

5. Europe Digital Cameras And Camcorders Value, Market Share, and Forecast to 2032

5.1 Europe Digital Cameras And Camcorders Overview, 2024

5.2 Europe Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

5.3 Europe Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

5.4 Europe Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

5.5 Europe Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

5.6 Europe Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

5.7 Europe Digital Cameras And Camcorders Size and Share Outlook by Country, 2024- 2032

5.8 Key Companies in Europe Digital Cameras And Camcorders

6. North America Digital Cameras And Camcorders Value, Market Share and Forecast to 2032

6.1 North America Digital Cameras And Camcorders Overview, 2024

6.2 North America Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

6.3 North America Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

6.4 North America Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

6.5 North America Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

6.6 North America Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

6.7 North America Digital Cameras And Camcorders Size and Share Outlook by Country, 2024- 2032

6.8 Key Companies in North America Digital Cameras And Camcorders

7. South and Central America Digital Cameras And Camcorders Value, Market Share and Forecast to 2032

7.1 South and Central America Digital Cameras And Camcorders Overview, 2024

7.2 South and Central America Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

7.3 South and Central America Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

7.4 South and Central America Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

7.5 South and Central America Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

7.6 South and Central America Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

7.7 South and Central America Digital Cameras And Camcorders Size and Share Outlook by Country, 2024- 2032

7.8 Key Companies in South and Central America Digital Cameras And Camcorders

8. Middle East Africa Digital Cameras And Camcorders Value, Market Share and Forecast to 2032

8.1 Middle East Africa Digital Cameras And Camcorders Overview, 2024

8.2 Middle East and Africa Digital Cameras And Camcorders Revenue and Forecast, 2024- 2032 (US$ Million)

8.3 Middle East Africa Digital Cameras And Camcorders Size and Share Outlook By Type, 2024- 2032

8.4 Middle East Africa Digital Cameras And Camcorders Size and Share Outlook By Application, 2024- 2032

8.5 Middle East Africa Digital Cameras And Camcorders Size and Share Outlook By Distribution Channel, 2024- 2032

8.6 Middle East Africa Digital Cameras And Camcorders Size and Share Outlook 0, 2024- 2032

8.7 Middle East Africa Digital Cameras And Camcorders Size and Share Outlook by Country, 2024- 2032

8.8 Key Companies in Middle East Africa Digital Cameras And Camcorders

9. Digital Cameras And Camcorders Structure

9.1 Key Players

9.2 Digital Cameras And Camcorders Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Digital Cameras And Camcorders Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Digital Cameras And Camcorders Market is estimated to generate USD 6.8 billion in revenue in 2024.

The Global Digital Cameras And Camcorders Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2025 to 2032.

The Digital Cameras And Camcorders Market is estimated to reach USD 10.7 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!