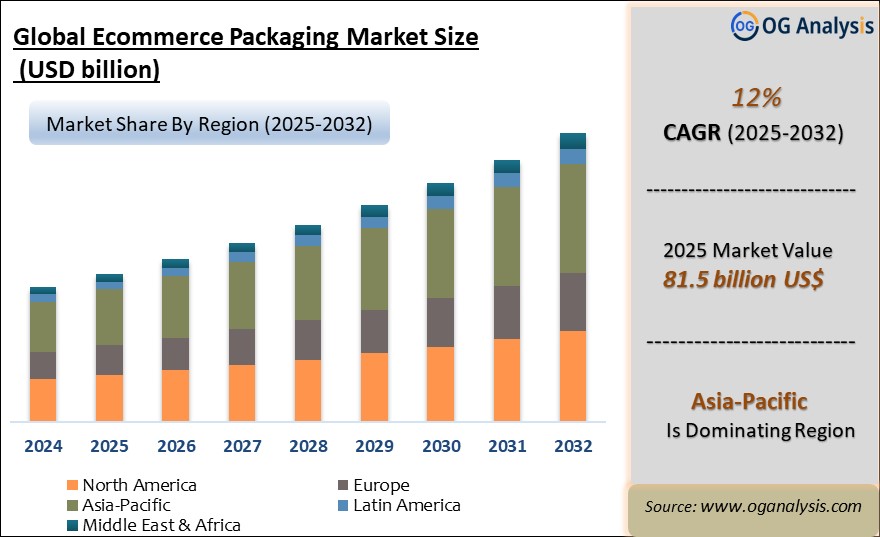

"The Global E-commerce Packaging Market is valued at USD 73.9 billion in 2024 and is projected to reach USD 81.5 billion in 2025. Worldwide sales of E-commerce Packaging are expected to grow at a significant CAGR of 12%, reaching USD 232.0 billion by the end of the forecast period in 2034."

"Sustainability and Efficiency Lead the Growth in the E-commerce Packaging Market: Evolving Consumer Preferences Drive Innovations"

The E-commerce Packaging Market has grown exponentially in recent years, driven by the rapid expansion of online shopping and the shift in consumer behavior toward convenience and quick delivery. Packaging plays a critical role in the e-commerce sector, providing protection, branding, and a superior unboxing experience. In 2024, the market has seen significant developments, with sustainability taking center stage. Companies are increasingly focusing on eco-friendly packaging materials, such as biodegradable and recyclable options, to reduce their environmental footprint. Additionally, smart packaging technologies are emerging as key innovations, offering features like tamper-evidence and real-time tracking, further enhancing the customer experience.

As the e-commerce landscape continues to evolve, the E-commerce Packaging Market is expected to experience steady growth into 2025. The continued rise of direct-to-consumer (DTC) brands and subscription-based services will boost demand for innovative and customizable packaging solutions. Moreover, the growing importance of omnichannel retail strategies will drive the need for versatile packaging that is suitable for both in-store and online sales. With consumer expectations evolving toward more sustainable, cost-effective, and efficient packaging, companies that can innovate in these areas will be well-positioned for success in the years ahead.

Asia-Pacific is the leading region in the ecommerce packaging market, propelled by rapid growth in online retail, expanding internet penetration, and rising consumer demand for convenient and sustainable packaging solutions.

E-commerce Packaging Market Latest Trends

The E-commerce Packaging Market is currently being shaped by several prominent trends. One of the most notable trends is the rise of sustainable packaging solutions. Consumers are becoming more environmentally conscious and increasingly prefer brands that adopt eco-friendly practices. In response, e-commerce companies are incorporating packaging materials such as recycled cardboard, biodegradable plastics, and reusable containers. This shift towards sustainability is not just a response to consumer demand but also a way for companies to comply with global regulations aimed at reducing waste and minimizing the environmental impact of packaging.

Another key trend is the demand for personalized and branded packaging. With the growth of direct-to-consumer models, brands are using packaging as a critical touchpoint to enhance the customer experience and build brand loyalty. Customized packaging designs, coupled with innovative unboxing experiences, are becoming essential to creating a lasting impression on consumers. This trend is particularly evident in the fashion, beauty, and electronics sectors, where packaging serves as a key differentiator in a crowded market.

Additionally, the development of smart packaging is gaining traction. This trend involves the integration of technology such as QR codes, RFID tags, and sensors into packaging to improve logistics, provide product information, and enhance customer engagement. Smart packaging also plays a role in supply chain efficiency, enabling better tracking and monitoring of packages throughout their journey, leading to reduced loss and improved delivery times. As e-commerce continues to grow, smart packaging solutions are expected to become more prevalent, offering additional value to both consumers and businesses.

E-commerce Packaging Market Future Market Drivers

Several factors are poised to drive the growth of the E-commerce Packaging Market in the coming years. One of the primary drivers is the ongoing expansion of the e-commerce industry itself. The rise of online shopping, accelerated by the COVID-19 pandemic, has permanently changed consumer behavior. With more people purchasing goods online, the demand for protective, lightweight, and durable packaging has surged. In particular, sectors such as fashion, electronics, and groceries are seeing higher volumes of e-commerce transactions, which in turn is fueling the need for more efficient packaging solutions.

Another significant driver is the increasing focus on reducing shipping costs. As logistics become more expensive, companies are turning to innovative packaging designs that reduce size and weight, ultimately lowering shipping costs. These designs often incorporate foldable or flexible materials that minimize the space required for shipping while still ensuring product protection. Furthermore, advances in material science are enabling the development of stronger, lighter packaging materials that optimize supply chain efficiency.

The rise of cross-border e-commerce is also contributing to the demand for e-commerce packaging. As more consumers shop from international retailers, the need for robust packaging that can withstand long-distance shipping is becoming more critical. Companies are investing in packaging solutions that ensure product integrity during extended transportation times, helping to reduce return rates and improve customer satisfaction. This trend is expected to continue as e-commerce grows on a global scale.

E-commerce Packaging Market Challenges

Despite its rapid growth, the E-commerce Packaging Market faces several challenges. One of the main obstacles is the rising cost of raw materials, particularly paper and plastics, which are commonly used in packaging. The fluctuation in prices for these materials can significantly impact profit margins for packaging manufacturers and e-commerce companies alike. This challenge is further compounded by supply chain disruptions, which can lead to delays and increased costs in the production of packaging materials.

Another challenge is the balance between sustainability and functionality. While consumers increasingly demand eco-friendly packaging, companies must ensure that these materials provide the necessary protection for products during shipping. Biodegradable or recycled materials may not always offer the same level of durability or moisture resistance as traditional packaging options. As a result, companies are investing in research and development to create sustainable packaging solutions that do not compromise on performance. Navigating this challenge will be key for businesses looking to remain competitive in the evolving market.

Competitive Landscape and Key Strategies

The competitive landscape of the E-commerce Packaging Market is characterized by the presence of both large global players and smaller, specialized firms. Leading companies are focusing on innovation, sustainability, and efficiency to differentiate themselves in the crowded market. Key strategies include investment in sustainable packaging solutions, such as the development of recyclable and biodegradable materials. Companies are also prioritizing packaging optimization to reduce material usage and shipping costs, while still ensuring product protection.

Partnerships with e-commerce platforms and logistics providers are another common strategy, allowing packaging companies to develop solutions that meet the specific needs of online retailers. Additionally, many companies are adopting smart packaging technologies to improve supply chain transparency and enhance the customer experience. By leveraging these strategies, top players in the market are positioning themselves to capitalize on the ongoing growth of the e-commerce sector.

Market Players

Key companies operating in the E-commerce Packaging Market include:

1. DS Smith Plc

2. Mondi Group

3. International Paper Company

4. Smurfit Kappa Group

5. Amcor Plc

6. Sealed Air Corporation

7. WestRock Company

8. Stora Enso Oyj

9. Packaging Corporation of America

10. Crown Holdings, Inc.

11. Georgia-Pacific LLC

12. Uline, Inc.

13. Pregis Corporation

14. Ranpak Holdings Corp.

15. Sonoco Products Company

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Material, By End user |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Material

- Plastics

- Corrugated Board

- Paper & Paperboard

- Other Materials

By End Use Industry

- Fashion and Apparels

- Electronics & Consumer goods

- Food & Beverages

- Healthcare & Personal care

- Home furnishing

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. ecommerce packaging market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 ecommerce packaging market Overview

2.2 Key Strategies of Leading ecommerce packaging Companies

2.3 ecommerce packaging market Insights, 2024- 2034

2.3.1 Leading ecommerce packaging Types, 2024- 2034

2.3.2 Leading ecommerce packaging End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for ecommerce packaging sales, 2024- 2034

2.4 ecommerce packaging market Drivers and Restraints

2.4.1 ecommerce packaging Demand Drivers to 2034

2.4.2 ecommerce packaging Challenges to 2034

2.5 ecommerce packaging market- Five Forces Analysis

2.5.1 ecommerce packaging Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global ecommerce packaging market Value, Market Share, and Forecast to 2034

3.1 Global ecommerce packaging market Overview, 2024

3.2 Global ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

3.3.1 Plastics

3.3.2 Corrugated Board

3.3.3 Paper & Paperboard

3.3.4 Other Materials

3.4 Global ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

3.4.1 Fashion and Apparels

3.4.2 Electronics & Consumer goods

3.4.3 Food & Beverages

3.4.4 Healthcare & Personal care

3.4.5 Home furnishing

3.4.6 Others

3.5 Global ecommerce packaging market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific ecommerce packaging market Value, Market Share and Forecast to 2034

4.1 Asia Pacific ecommerce packaging market Overview, 2024

4.2 Asia Pacific ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

4.4 Asia Pacific ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

4.6 Asia Pacific ecommerce packaging market Size and Share Outlook by Country, 2024- 2034

4.7 Key Companies in Asia Pacific ecommerce packaging market

5. Europe ecommerce packaging market Value, Market Share, and Forecast to 2034

5.1 Europe ecommerce packaging market Overview, 2024

5.2 Europe ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

5.4 Europe ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

5.6 Europe ecommerce packaging market Size and Share Outlook by Country, 2024- 2034

5.7 Key Companies in Europe ecommerce packaging market

6. North America ecommerce packaging market Value, Market Share and Forecast to 2034

6.1 North America ecommerce packaging market Overview, 2024

6.2 North America ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

6.4 North America ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

6.5 North America ecommerce packaging market Size and Share Outlook by Country, 2024- 2034

6.6 Key Companies in North America ecommerce packaging market

7. South and Central America ecommerce packaging market Value, Market Share and Forecast to 2034

7.1 South and Central America ecommerce packaging market Overview, 2024

7.2 South and Central America ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

7.4 South and Central America ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

7.6 South and Central America ecommerce packaging market Size and Share Outlook by Country, 2024- 2034

7.7 Key Companies in South and Central America ecommerce packaging market

8. Middle East Africa ecommerce packaging market Value, Market Share and Forecast to 2034

8.1 Middle East Africa ecommerce packaging market Overview, 2024

8.2 Middle East and Africa ecommerce packaging market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa ecommerce packaging market Size and Share Outlook By Material, 2024- 2034

8.4 Middle East Africa ecommerce packaging market Size and Share Outlook By End Use Industry, 2024- 2034

8.5 Middle East Africa ecommerce packaging market Size and Share Outlook by Country, 2024- 2034

8.6 Key Companies in Middle East Africa ecommerce packaging market

9. ecommerce packaging market Structure

9.1 Key Players

9.2 ecommerce packaging Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. ecommerce packaging Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The E-commerce Packaging Market is estimated to reach USD 183 billion by 2032.

The Global E-commerce Packaging Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12% during the forecast period from 2025 to 2032.

The Global E-commerce Packaging Market is estimated to generate USD 73.9 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!