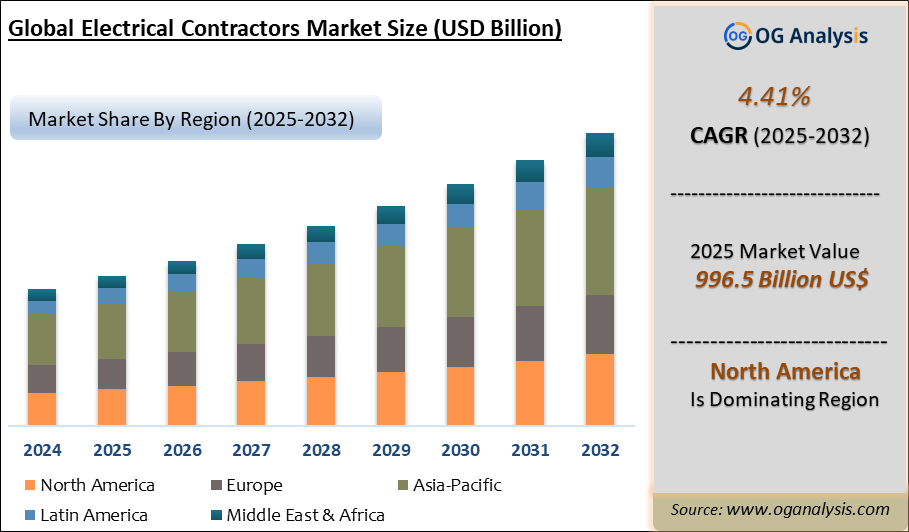

The Electrical Contractors Market is estimated at USD 954.4 billion in 2024. Further, the market is expected to grow from USD 996.5 billion in 2025 to USD 1,469.4 billion in 2034 at a CAGR of 4.41%.

Electrical Contractors Market Market Overview

An electrical contractor is an entrepreneur or a company that works in technical architecture associated with designing, installing, and maintaining electrical systems in amenities (i.e., homes, offices, and industrial buildings). The common misconception about electrical Contractors is that they are limited to installing electrical equipment. While they have the exclusive competencies to do so, they are also involved upstream and downstream of the installation stage. In the construction industry, electrical contractors are generally categorized into three major work types: inside electrical contractors, outside electrical contractors and integrated building systems contractors. Electrical contractors are also strongly engaged in the engineering and infrastructure market. Whether it is public infrastructure for lighting, electricity or telecoms, power plants, or airports, they have the knowledge to handle all types of electrical installations.

North America is the leading region in the electrical contractors market, powered by strong investments in infrastructure modernization, widespread adoption of smart grid technologies, and a growing emphasis on energy-efficient construction across residential and commercial sectors.

Non-residential construction is the dominating segment in the electrical contractors market, fueled by the rapid expansion of industrial facilities, commercial complexes, and data centers, alongside rising demand for advanced electrical installation and maintenance services.

Latest Key Insights in Electrical Contractors Market

- The electrical contractors market is expanding as construction rebounds across residential, commercial, and industrial segments, with backlog levels supported by large infrastructure, data center, and manufacturing projects. Contractors that balance service work with project work are better insulated against cycles, while preventative maintenance contracts provide recurring revenue and margin stability.

- Electrification is a structural demand driver, spanning heat pump retrofits, EV charging rollouts, induction-ready wiring, and building-to-grid integration. Scope is shifting from simple installs to full-stack solutions that include load studies, panel upgrades, smart breaker systems, and ongoing monitoring to optimize energy use and reliability.

- Grid modernization and distributed energy resources are creating complex opportunities in medium-voltage work, protection relays, and advanced metering. Contractors with substation, switchgear, and SCADA experience are capturing utility and campus microgrid projects, while mastering interconnection standards and arc-flash safety is becoming a core competency.

- Data center expansion is intensifying demand for mission-critical electrical packages, including UPS systems, busway distribution, redundant feeders, and high-density cooling integration. Owners increasingly prefer design-build partners who can model fault currents, coordinate protection, and stage procurement for long-lead switchgear and transformers.

- Codes and compliance remain central, with evolving requirements around NEC updates, selective coordination, GFCI/AFCI protection, and fire-life safety. Winning firms invest in continuous code training, digital commissioning records, and standardized QA/QC checklists that reduce rework, accelerate inspections, and improve warranty outcomes.

- Labor constraints persist, elevating the value of apprenticeship pipelines, cross-training, and modular prefabrication. Offsite kitting, preassembled racks, and plug-and-play branch wiring reduce onsite hours, improve safety, and compress schedules, while digital work instructions help newer crews deliver consistent quality.

- Technology adoption is accelerating: BIM for clash detection, point-cloud scanning for as-builts, and construction management platforms that integrate RFIs, submittals, and change orders. Advanced estimating tied to supplier catalogs improves takeoff accuracy; field apps with barcode tracking raise tool, material, and asset utilization.

- Energy efficiency and ESG are reshaping scopes through LED retrofits, networked lighting controls, power quality remediation, and demand-response enablement. Measurement and verification, panel-level metering, and power analytics create add-on service opportunities and help clients achieve decarbonization targets without compromising uptime.

- Supply chain volatility in switchgear, conductors, and transformers is driving early procurement strategies, alternates approval, and framework agreements with distributors. Value engineering focuses on cable tray optimization, standardized gear lineups, and harmonized spec packages to mitigate lead times and cost exposure.

- Competitive differentiation increasingly hinges on safety performance, bonding capacity, and financial discipline, alongside customer experience metrics like schedule adherence and first-pass inspection rates. Firms that pair strong preconstruction services with lifecycle maintenance and 24/7 service desks are positioned to deepen client retention and expand wallet share.

Region Analysis

North America: A mature market driven by steady construction activity, modernization of grid infrastructure, and adoption of smart technologies. There's also a strong focus on safety standards and energy efficiency.

Europe: Emphasizes sustainable construction and energy transition. Governments are investing in green building projects, which is boosting demand for contractors skilled in renewable and low voltage installations.

Asia-Pacific: The fastest-growing market due to rapid urbanization, industrialization, and significant investments in infrastructure across countries like China, India, and Southeast Asia.

Market Scope

|

Parameter |

Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD billion |

|

Market Splits Covered |

By Product, By Service Type, and By End-User |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type

- Electrical Wiring Services

- Power distribution

- Lighting systems

- Control & Automation

- Uninterrupted power systems

- Other

By Service Type

- New Construction

- Renovation

- Maintenance & Repair

By End-User

- Residential

- Commercial

- Infra & Engineering

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Companies Mentioned

- Quanta Services Inc.

- MYR Group Inc.

- IES Holdings Inc.

- MDU Construction Services Group Inc.

- MMR Group Inc.

- Helix Electric Inc.

- Cupertino Electric Inc.

- Cache Valley Electric Co.

- Miller Electric Co.

- Tilbury Douglas Engineering Limited

- TClarke plc

- Wayne J. Griffin Electric Inc.

- Motor City Electric Co.

- MasTec Inc.

- E-J Electric Installation Co.

- Carter Synergy Limited

- McPhee Electric & Telecommunications Inc.

- Gratte Brothers Limited

- Hunt Electric Corp.

- Five Star Electric Corp.

- Clarkson Evans Limited

- Haydon Mechanical & Electrical

- LJJ Ltd.

- Gloster MEP Limited

- Halsall Electrical Limited

- Quartzelec Ltd.

- Cilantro Engineering UK Ltd.

- FES Limited

- F.P.Hurley & Sons Limited

Recent Developments

July 2025 – Shimmick Corporation launched Axia Electric LLC, a specialized electrical subsidiary, securing $42 million in new contracts and holding over $380 million in active electrical work, to serve low- and medium-voltage infrastructure with commissioning and O&M services.

August 2025 – K2 Electric, a leading electrical contractor in Arizona, implemented lean manufacturing methodologies across its fabrication and assembly operations, enhancing efficiency and integrating best practices from manufacturing industries into its project delivery processes.

August 2025 – Potawatomi Ventures acquired Lyons Electric, a Wisconsin-based commercial and industrial electrical contractor, to expand its capabilities in energy infrastructure services, EV charging, and tribal enterprise development, while continuing Lyons Electric’s operations and leadership.

August 2025 – San Jose–based Rosendin opened a new office in Boise, Idaho, to support growing demand for high-tech infrastructure, healthcare and commercial builds, and launched partnerships for apprenticeship and mentorship programs to develop local skilled labor.

TABLE OF CONTENTS

1. GLOBALELECTRICAL CONTRACTORS INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. ELECTRICAL CONTRACTORS MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2021-2030

2.1. Electrical Contractors Market Latest Trends

2.1.1. Decentralized Electrical and Digital Technologies:

2.1.2. Growing digitalization:

2.1.3. Growing number of R&D investments & partnerships:

2.1.4. Government focus on the reconstruction of transmission & distribution lines across the existing infrastructure:

2.1.5. Use of AR & VR, Increasing Smart Home Trends:

2.2. Electrical Contractors Market Insights, 2021-2030

2.2.1. Leading Electrical Contractors Product Type, 2021-2030

2.2.2. Leading Electrical Contractors Communication Service Type, 2021-2030

2.2.3. Dominant Electrical Contractors Application, 2021-2030

2.2.4. Fast-Growing Geographies for Electrical Contractors, 2021-2030

2.3. Electrical Contractors Market Drivers to 2030

2.3.1. Growing demand for electricians:

2.3.2. Rising Globalization and Increasing Consumer & Commercial Trends:

2.3.3. Ongoing construction activities across commercial, industrial, and utility sectors:

2.3.4. Grid Modernization & Smart Grid Deployments:

2.4. Electrical Contractors Market Restraints to 2030

2.4.1. Shortage of Electricians:

2.4.2. Fluctuating Raw Material Prices:

2.4.3. Logistics Bottlenecks & Supply Chain Issues:

2.5. Electrical Contractors Market-Five Forces Analysis

3. GLOBAL ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

3.1. Global Electrical Contractors Market Overview, 2021

3.2. Global Electrical Contractors Market Size and Share Outlook, By Product Type, 2021-2030

3.2.1. Electrical Wiring Services

3.2.2. Power distribution

3.2.3. Lighting systems

3.2.4. Control & Automation

3.2.5. Uninterrupted power systems

3.2.6. Other Services

3.3. Global Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

3.3.1. New Construction

3.3.2. Renovation

3.3.3. Maintenance & Repair

3.4. Global Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

3.4.1. Residential

3.4.2. Commercial

3.4.3. Infra & Engineering

3.4.4. Other End Users

3.5. Global Electrical Contractors Market Size and Share Outlook by Region, 2021-2030

4. NORTH AMERICA ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

4.1. North America Electrical Contractors Market Overview, 2021

4.2. North America Electrical Contractors Market Size and Share Outlook by Product Type, 2021-2030

4.3. North America Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

4.4. North America Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

4.5. North America Electrical Contractors Market Size and Share Outlook by Country, 2021-2030

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. EUROPE ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

5.1. Europe Electrical Contractors Market Overview, 2021

5.2. Europe Electrical Contractors Market Size and Share Outlook by Product Type, 2021-2030

5.3. Europe Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

5.4. Europe Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

5.5. Europe Electrical Contractors Market Size and Share Outlook by Country, 2021-2030

5.5.1. Germany

5.5.2. France

5.5.3. UK

5.5.4. Italy

5.5.5. Spain

5.5.6. Rest of Europe

6. ASIA PACIFIC ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

6.1. Asia Pacific Electrical Contractors Market Overview, 2021

6.2. Asia Pacific Electrical Contractors Market Size and Share Outlook by Product Type, 2021-2030

6.3. Asia Pacific Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

6.4. Asia Pacific Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

6.5. Asia Pacific Electrical Contractors Market Size and Share Outlook by Country, 2021-2030

6.5.1. China

6.5.2. Japan

6.5.3. India

6.5.4. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

7.1. South and Central America Electrical Contractors Market Overview, 2021

7.2. South and Central America Electrical Contractors Market Size and Share Outlook by Product Type, 2021-2030

7.3. South and Central America Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

7.4. South and Central America Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

7.5. South and Central America Electrical Contractors Market Size and Share Outlook by Country, 2021-2030

7.5.1. Brazil

7.5.2. Argentina

7.5.3. Rest of South and Central America

8. MIDDLE EAST AFRICA ELECTRICAL CONTRACTORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

8.1. Middle East Africa Electrical Contractors Market Overview, 2021

8.2. Middle East Africa Electrical Contractors Market Size and Share Outlook by Product Type, 2021-2030

8.3. Middle East Africa Electrical Contractors Market Size and Share Outlook, By Service Type, 2021-2030

8.4. Middle East Africa Electrical Contractors Market Size and Share Outlook, By End User, 2021-2030

8.5. Middle East Africa Electrical Contractors Market Size and Share Outlook by Country, 2021-2030

8.5.1. Middle East

8.5.2. Africa

9. ELECTRICAL CONTRACTORS MARKET STRUCTURE

9.1. QUANTA SERVICES

9.2. EMCOR GROUP

9.3. IES HOLDINGS, INC.

9.4. MYR GROUP Inc.

9.5. THE TORO COMPANY

9.6. Wasion Holdings Limited

9.7. Genus Power Infrastructure Ltd.

9.8. ABB Ltd

9.9. Eaton Corporation plc

10. APPENDIX

10.1. About Us

10.2. Sources

10.3. Research Methodology

10.4. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2180- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!