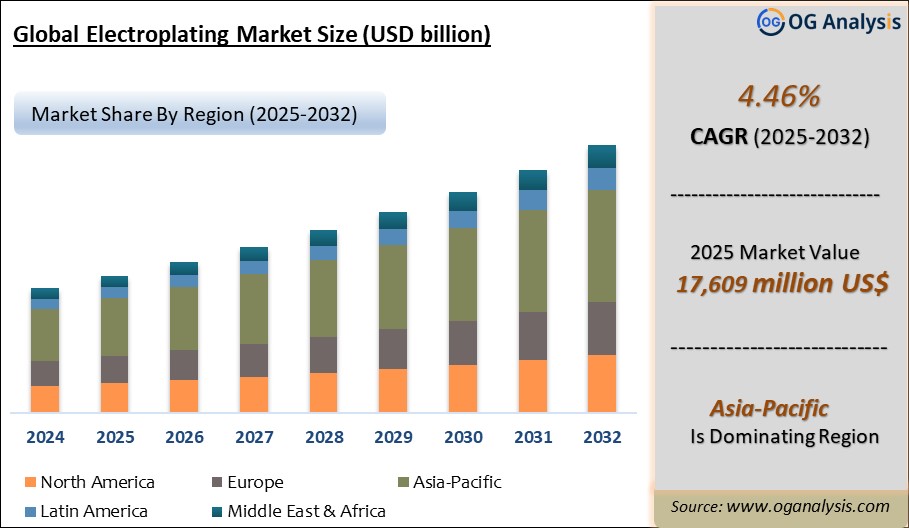

The Electroplating Market is estimated to be USD 16,857.3 million in 2024. Furthermore, the market is expected to grow to USD 22,879.1 million by 2031, with a Compound Annual Growth Rate (CAGR) of 4.46%.

Electroplating Market Overview

Electroplating is the process of electroplating a thin layer of other metal or alloy on the surface of certain metals by electrolysis. It is the use of electrolysis to attach a metal film to the surface of metal or other materials to prevent corrosion and improve wear resistance, electrical conductivity, reflective properties and enhance aesthetics. The process is used to plate or coat several ferrous and non-ferrous metal objects and plastics by using metals such as copper, tin, zinc, gold, palladium, platinum, silver, chromium, and aluminum.

There are different processes by which people can electroplate metals such as mass plating (also barrel plating), rack plating, continuous plating, and line plating. Based on processing methods, the electroplating market is categorized into barrel plating, rack plating, continuous plating, and Others. In 2021, the barrel plating segment dominated the market with xx of the global market share.

The Asia-Pacific region dominates the global Electroplating Market, propelled by substantial investments in the Automotive. It is projected to account for approximately 42% of the total market share.

Electroplating Market: Latest Trends,Driving and Challenges

Rising Demand for Electronic Devices:

Rising digitization and the rapid rise in urbanization have augmented the demand for electrical and electronic devices across the globe. The consumption of consumer electronics, such as wearable devices, smartphones, laptops, tablets, camcorders, and portable chargers, has witnessed a surge in recent years owing to the improvement in living standards and a rise in disposable income of consumers across the globe, especially in emerging economies such as China, India, and Brazil.

Electroplating is a vital process involved in the manufacture of electrical and electronic devices and components. The process enhances corrosion resistance, improves electrical conductivity, increases the solderability of the substrate, and enhances protection from wear and tear. Several metals are used in the electroplating process, such as Zinc, Copper, Nickel, Chromium, gold, silver, palladium, and ceramics. Therefore, the expansion of the electrical and electronics industry across the globe is expected to propel the growth of the global electroplating market during the forecast period.

Increasing Disposable Income in Fast-Developing Asian Markets:

Robust growth in the economies of key Asian and Latin American countries is enabling a huge middle-class population to shift towards aesthetics in products. Increasing penetration of television, refrigerators, smartphones, washing machines, laptops, and other consumer electronics products are favoring the growth of the Electroplating Market. Apart from these, the booming automotive industry bodes well for the electroplating market.

Rising preference to lead a comfortable lifestyle coupled with growing urbanization and globalization is pushing the automotive industry, which is directly helping the electroplating market to reach new heights. Furthermore, rising demand for electroplating from aerospace & defense applications for providing proper finishing to the machinery is anticipated to foster the market growth of electroplating.

Increasing Environmental Concerns and Stringent Regulations:

With the electroplating market developing quickly, the ecological concerns regarding the electroplating process are increasing. Many governments around the world are passing stricter environmental laws and regulations concerning how chemical waste is treated and the types of chemicals industries may use in development and manufacturing processes. For example, in the European Union the regulation Registration, Evaluation, Authorization, and Restriction of Chemicals, known as REACh, has banned numerous chemicals or is in the process of banning chemicals such as boric acid from substantial industrial use. Accordingly, the metal plating industries that manufacture and sell electroplating baths that typically include boric acid have attempted to develop boric acid-free baths.

Companies Mentioned

- Atotech (MKS Instruments, Inc.)

- Technic Inc.

- Kuntz Electroplating Inc.

- Coventya

- Columbia Chemical

- Interplex Industries, Inc. (Ennovi Holdings Pte. Ltd.)

- Allied Finishing, Inc.

- Sharretts Plating Company (SPC)

- Peninsula Metal Finishing, Inc.

- Aalberts N.V.

- HC Starck

- Uyemura & Co.

- MacDermid Enthone Industrial Solutions

- SIFCO ASC

- Plating Resources, Inc.

Market scope

|

Parameter |

Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD Million |

|

Market Splits Covered |

By Type, By Matel and By End User |

|

Countries Covered |

North America (USA, Canada, Mexico) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Data file |

Market Segmentation

Electroplating Market, By Type

- Barrel Plating

- Rack Plating

- Continuous Plating

- Others

Electroplating Market, By Metal

- Zinc

- Copper

- Nickel

- Chromium

- Gold

- Others

Electroplating Market, By End Use

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Jewelry

- Others

Electroplating Market, By Region

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

TABLE OF CONTENTS

1. TABLE OF CONTENTS

1.1. LIST of TABLES

1.2. LIST of FIGURES

2. GLOBAL ELECTROPLATING MARKET REVIEW, 2023

2.1. Electroplating Market Industry Overview

2.2. Research Methodology

2.2.1. Market Scope and Definition

2.2.2. Study Assumptions

3. ELECTROPLATING MARKET INSIGHTS

3.1. Key Types of Electroplating Market to 2031

3.2. Leading Metal of Electroplating Market to 2031

3.3. Dominant End Use of Electroplating Market to 2031

3.4. High Prospect Geography for Electroplating Market to 2031

4. ELECTROPLATING MARKET TRENDS, DRIVERS, AND RESTRAINTS

4.1. Latest Trends and Recent Developments in Electroplating Market

4.1.1. Rising Demand for Electronic Devices

4.1.2. Shift to Environmentally Friendly Substrate Materials

4.1.3. Increasing Disposable Income in Fast Developing Asian Markets

4.1.4. Growing Metal Consumption

4.2. Key Factors Driving the Electroplating Market Growth

4.2.1. Rising Demand for Electroplating Applications in Automotive Industry

4.2.2. Increasing Demand from New End-Use Industries

4.2.3. On-Going Industrialization Around the Globe

4.2.4. Implementation of Innovative and Environmental-friendly Techniques

4.2.5. Increasing Use of Automatic Soldering Over Manual Soldering

4.3. Major Challenges to the Electroplating Market Industry, 2023-2031

4.4. Five Forces Analysis for Global Electroplating Market

5. GLOBAL ELECTROPLATING MARKET DATA - INDUSTRY SIZE, SHARE, AND OUTLOOK

5.1. Electroplating Market Annual Sales Outlook, 2023-2031 ($Million)

5.2. Global Electroplating Market Annual Sales Outlook by Type, 2023-2031 ($Million)

5.2.1. Barrel Plating Market Outlook, 2023-2031

5.2.2. Rack Plating Market Outlook, 2023-2031

5.2.3. Continuous Plating Market Outlook, 2023-2031

5.2.4. Other Types Market Outlook, 2023-2031

5.3. Global Electroplating Market Annual Sales Outlook by Metal, 2023-2031 ($Million)

5.3.1. Zinc Market Outlook, 2023-2031

5.3.2. Copper Market Outlook, 2023-2031

5.3.3. Nickel Market Outlook, 2023-2031

5.3.4. Chromium Market Outlook, 2023-2031

5.3.5. Gold Market Outlook, 2023-2031

5.3.6. Other Market Outlook, 2023-2031

5.4. Global Electroplating Market Annual Sales Outlook by End Use, 2023-2031 ($Million)

5.4.1. Automotive, Market Outlook, 2023-2031

5.4.2. Electrical & Electronics, Market Outlook, 2023-2031

5.4.3. Aerospace & Defense, Market Outlook, 2023-2031

5.4.4. Jewelry, Market Outlook, 2023-2031

5.4.5. Other End-user Industries, Market Outlook, 2023-2031

5.5. Global Electroplating Market Annual Sales Outlook by Geography, 2023-2031 ($Million)

6. ASIA PACIFIC ELECTROPLATING MARKET INDUSTRY STATISTICS - MARKET SIZE, SHARE, COMPETITION AND OUTLOOK

6.1. Asia Pacific Market Insights, 2023

6.2. Asia Pacific Electroplating Market Revenue Forecast by Type, 2023-2031 (USD Million)

6.3. Asia Pacific Electroplating Market Revenue Forecast by Metal, 2023-2031 (USD Million)

6.4. Asia Pacific Electroplating Market Revenue Forecast by End-Use, 2023-2031 (USD Million)

6.5. Asia Pacific Electroplating Market Revenue Forecast by Country, 2023-2031 (USD Million)

6.5.1. China

6.5.2. Japan

6.5.3. India

6.5.4. Rest of Asia Pacific

7. EUROPE OUTLOOK AND GROWTH OPPORTUNITIES

7.1. Europe Market Insights, 2023

7.2. Europe Electroplating Market Revenue Forecast by Type, 2023-2031 (USD Million)

7.3. Europe Electroplating Market Revenue Forecast by Metal, 2023-2031 (USD Million)

7.4. Europe Electroplating Market Revenue Forecast by End Use, 2023-2031 (USD Million)

7.5. Europe Electroplating Market Revenue Forecast by Country, 2023-2031 (USD Million)

7.5.1. Germany

7.5.2. United Kingdom

7.5.3. France

7.5.4. Italy

7.5.5. Spain

7.5.6. Rest of Europe

8. NORTH AMERICA OUTLOOK AND GROWTH OPPORTUNITIES

8.1. North America Market Insights, 2023

8.2. North America Electroplating Market Revenue Forecast by Type, 2023-2031 (USD Million)

8.3. North America Electroplating Market Revenue Forecast by Metal, 2023-2031 (USD Million)

8.4. North America Electroplating Market Revenue Forecast by End Use, 2023-2031 (USD Million)

8.5. North America Electroplating Market Revenue Forecast by Country, 2023-2031 (USD Million)

8.5.1. United States

8.5.2. Canada

8.5.3. Mexico

9. SOUTH AND CENTRAL AMERICA OUTLOOK AND GROWTH OPPORTUNITIES

9.1. South and Central America Market Insights, 2023

9.2. South and Central America Electroplating Market Revenue Forecast by Type, 2023-2031 (USD Million)

9.3. South and Central America Electroplating Market Revenue Forecast by Metal, 2023-2031 (USD Million)

9.4. South and Central America Electroplating Market Revenue Forecast by End-Use, 2023-2031 (USD Million)

9.5. South and Central America Electroplating Market Revenue Forecast by Country, 2023-2031 (USD Million)

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Rest of South and Central America

10. MIDDLE EAST AFRICA OUTLOOK AND GROWTH OPPORTUNITIES

10.1. Middle East Africa Market Insights, 2023

10.2. Middle East Africa Electroplating Market Revenue Forecast by Type, 2023-2031 (USD Million)

10.3. Middle East Africa Electroplating Market Revenue Forecast by Metal, 2023-2031 (USD Million)

10.4. Middle East Africa Electroplating Market Revenue Forecast by End Use, 2023-2031 (USD Million)

10.5. Middle East Africa Electroplating Market Revenue Forecast by Country, 2023-2031 (USD Million)

10.5.1. Middle East

10.5.2. Africa

11. ELECTROPLATING MARKET STRUCTURE AND COMPETITIVE LANDSCAPE

11.1. Atotech Ltd.

11.2. Dr.-Ing. Max Schlötter GmbH & Co. KG

11.3. DUPONT

11.4. APPLIED MATERIALS, INC.

12. APPENDIX

12.1. About Us

12.2. Sources

12.3. Research Methodology

12.4. Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Electroplating Market is estimated to reach USD 23899.5 million by 2032.

The Global Electroplating Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.46% during the forecast period from 2025 to 2032.

The Global Electroplating Market is estimated to generate USD 16857.3 million in revenue in 2024.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!