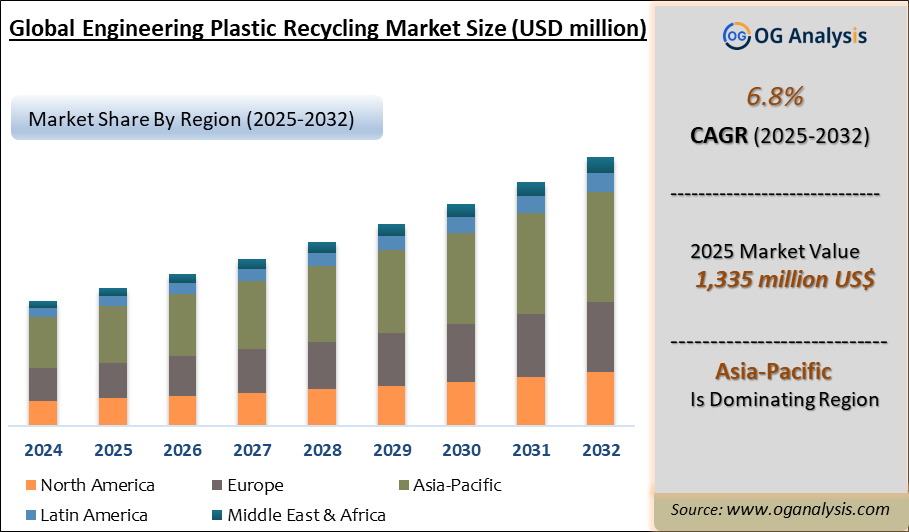

"The Global Engineering Plastic Recycling Market Size was valued at USD 1,261 million in 2024 and is projected to reach USD 1,335 million in 2025. Worldwide sales of Engineering Plastic Recycling are expected to grow at a significant CAGR of 6.8%, reaching USD 2,462 million by the end of the forecast period in 2034."

Introduction and Overview

The engineering plastic recycling market is emerging as a crucial segment in the broader plastics recycling industry, driven by increasing environmental awareness and regulatory pressure to reduce plastic waste. Engineering plastics, known for their superior mechanical properties, heat resistance, and durability, are widely used in automotive, aerospace, electronics, and consumer goods. These materials pose significant challenges for waste management due to their complex composition and high recycling costs. However, advancements in recycling technologies are paving the way for efficient recovery and reuse, presenting a promising opportunity for sustainable practices in various sectors.

The market is witnessing a paradigm shift, where both manufacturers and consumers are becoming more conscious of the environmental impact of plastics. With governments around the globe implementing stringent regulations to limit plastic use and promote recycling, the demand for recycled engineering plastics is expected to grow. Moreover, the increasing adoption of circular economy principles is driving investments in recycling technologies, enabling companies to transform waste into valuable resources. This not only supports sustainability goals but also enhances resource efficiency, ultimately contributing to a more sustainable future.

Asia-Pacific is the leading region in the engineering plastic recycling market, powered by the region’s expanding manufacturing base, stringent environmental regulations on plastic waste, and rapid industrialization across China, India, and Southeast Asia. Meanwhile, the polycarbonate segment is the dominating material type, propelled by its high recyclability, growing use in automotive and electronics applications, and increasing demand for lightweight yet durable materials in sustainable product designs.

Trade Intelligence for engineering plastic recycling market

| Global parings and scrap of plastics (excl. that of polymers of ethylene Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 1,284 | 1,749 | 2,161 | 1,578 | 1,659 |

| United States of America | 184 | 270 | 292 | 246 | 314 |

| Taipei, Chinese | 96 | 131 | 159 | 121 | 142 |

| Netherlands | 88 | 175 | 269 | 175 | 129 |

| Türkiye | 64 | 70 | 116 | 79 | 84 |

| Viet Nam | 98 | 138 | 126 | 87 | 75 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- United States of America, Taipei, Chinese, Netherlands, Türkiye and Viet Nam are the top five countries importing 44.8% of global parings and scrap of plastics (excl. that of polymers of ethylene in 2024

- Global parings and scrap of plastics (excl. that of polymers of ethylene Imports increased by 29.2% between 2020 and 2024

- United States of America accounts for 18.9% of global parings and scrap of plastics (excl. that of polymers of ethylene trade in 2024

- Taipei, Chinese accounts for 8.6% of global parings and scrap of plastics (excl. that of polymers of ethylene trade in 2024

- Netherlands accounts for 7.8% of global parings and scrap of plastics (excl. that of polymers of ethylene trade in 2024

| Global parings and scrap of plastics (excl. that of polymers of ethylene Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

engineering plastic recycling market- Latest Trends, Drivers, Challenges

One of the most notable trends in the engineering plastic recycling market is the rise of advanced recycling technologies, such as chemical recycling and solvent-based methods. These innovative techniques allow for the recycling of complex polymer structures that traditional mechanical recycling cannot efficiently process. By breaking down plastics into their fundamental monomers, advanced recycling facilitates the creation of high-quality recycled engineering plastics that can meet stringent industry standards. As a result, businesses are increasingly investing in these technologies to enhance their recycling capabilities and reduce reliance on virgin materials.

Another significant trend is the growing emphasis on sustainability and eco-friendly practices among consumers and companies alike. Brands are increasingly incorporating recycled materials into their products to appeal to environmentally conscious consumers. This shift is not just limited to consumer goods; industries such as automotive and electronics are also prioritizing sustainability in their supply chains. As more companies commit to sustainability goals, the demand for recycled engineering plastics is anticipated to surge, prompting manufacturers to develop more efficient recycling processes and supply chains that prioritize recycled content.

Additionally, collaboration across the value chain is becoming more prevalent in the engineering plastic recycling market. Partnerships between manufacturers, recyclers, and research institutions are essential for developing innovative solutions to recycling challenges. These collaborations often focus on research and development efforts to improve recycling technologies, create awareness about the benefits of recycling, and foster a circular economy. By working together, stakeholders can drive the adoption of recycled engineering plastics, resulting in a more integrated and sustainable recycling ecosystem.

The growth of the engineering plastic recycling market is primarily driven by increasing environmental regulations and the urgent need to mitigate plastic pollution. Governments worldwide are enacting policies aimed at reducing plastic waste, promoting recycling, and encouraging the use of recycled materials. These regulations create a favorable environment for recycling initiatives, compelling manufacturers to adopt sustainable practices and invest in recycling technologies. As compliance becomes a key focus for businesses, the demand for recycled engineering plastics is expected to rise significantly, making it a strategic priority for many companies.

Another critical driver is the rising awareness among consumers about the environmental impact of plastic waste. The public's growing concern about sustainability is influencing purchasing decisions, leading consumers to prefer products made from recycled materials. Companies that align their product offerings with consumer preferences are likely to gain a competitive edge in the market. This shift in consumer behavior not only drives demand for recycled engineering plastics but also encourages manufacturers to innovate and create more sustainable product designs, further boosting the recycling market.

Furthermore, the economic benefits associated with recycling engineering plastics are propelling market growth. Recycled materials are often less expensive than their virgin counterparts, providing cost savings for manufacturers. By integrating recycled plastics into their production processes, companies can reduce material costs while also minimizing their carbon footprint. As the economic advantages of recycling become more apparent, businesses are increasingly viewing engineering plastic recycling as a viable strategy for enhancing profitability while contributing to sustainability efforts.

Despite the promising growth of the engineering plastic recycling market, several challenges persist that could hinder its progress. One of the primary obstacles is the complexity of engineering plastics, which often consist of multiple polymer types and additives. This heterogeneity makes recycling processes more challenging and costly. Traditional recycling methods may not be effective for certain types of engineering plastics, leading to lower recovery rates and lower-quality recycled materials. As a result, many companies are hesitant to invest in recycling technologies that may not guarantee a return on investment, creating a barrier to market expansion.

Moreover, the lack of standardization in recycling practices poses significant challenges. Variations in material properties, local regulations, and recycling technologies can lead to inconsistencies in the quality of recycled engineering plastics. This variability can deter manufacturers from fully integrating recycled materials into their production processes due to concerns about performance and reliability. As a result, establishing industry-wide standards and best practices for engineering plastic recycling is essential to build confidence in recycled materials and promote their adoption.

Lastly, the market faces competition from virgin plastic materials, which are often cheaper and more readily available. Despite the growing demand for sustainable practices, the initial costs associated with recycling processes can be a deterrent for manufacturers. Until recycling technologies become more efficient and cost-competitive with virgin plastics, the transition to a more sustainable engineering plastic recycling market may be slow. Addressing these challenges will require collaboration between stakeholders, investment in research and development, and the establishment of robust recycling infrastructure.

Market Players

- EF Plastics UK Limited

- Euresi Plastics SL

- Kuusakoski

- MBA Polymers Inc.

- Mumford Industries

- Pistoni Srl

- PolyClean Technologies

- Teijin Limited

- Alpek Polyester

- Centriforce Products Limited

- Clean Tech UK Ltd

- Far Eastern New Century Corporation

- Foss Performance Materials

- Indorama Ventures Public Company Limited

- JFC Group

- Lotte Chemical Corporation

- PETCO

- Placon

- PolyQuest

- Reliance Industries Limited

- REPRO-PET

- UltrePET LLC

- Verdeco Recycling Inc.

Report Scope

| Parameter | engineering plastic recycling market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD million |

| Market Splits Covered | By Type and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Type

- Polycarbonate (PC)

- Polyethylene Terephthalate (PET)

- Styrene Copolymers (ABS and SAN)

- Polyamide (PA)

- Polybutylene Terephthalate (PBT)

- Other Engineering Plastics

By End-user Industry

- Packaging

- Industrial Yarn

- Electrical and Electronics

- Building and Construction

- Automotive

- Other End-user Industries

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

- ExxonMobil paused large investments in two European chemical recycling projects due to concerns over upcoming EU mass-balance rules that could disadvantage integrated petrochemical sites.

- Cabka partnered with Renewi to launch a new reusable pallet made entirely from recycled engineering-grade polyethylene plastics recovered from hard-to-recycle streams.

- Plastic Energy, in collaboration with SABIC, produced its first commercial batch of TACOIL™ recycled oil from mixed plastic waste at its new advanced recycling plant in the Netherlands.

- Borealis, Dow, and Neste collectively cancelled planned plastics recycling plants in Europe, citing unfavorable market economics compared to virgin resin production.

- Versalis, part of Eni, commissioned its Hoop chemical recycling demonstration facility for converting mixed plastic waste into feedstock suitable for producing high-performance plastics.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Engineering Plastic Recycling Market is estimated to generate USD 1261 million in revenue in 2024.

The Global Engineering Plastic Recycling Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2025 to 2032.

The Engineering Plastic Recycling Market is estimated to reach USD 2134.4 million by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!