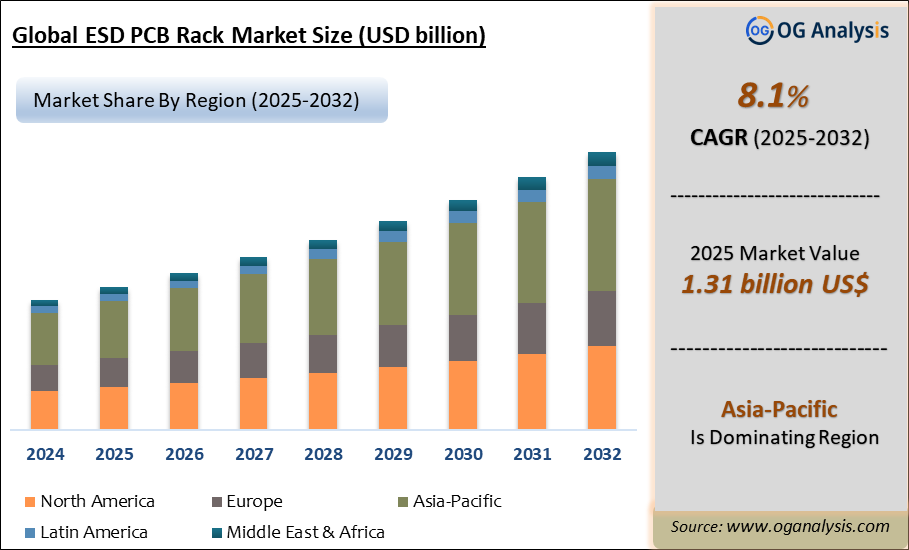

"The Global ESD PCB Rack Market Size is valued at USD 1.31 Billion in 2025. Worldwide sales of ESD PCB Rack Market are expected to grow at a significant CAGR of 8.1%, reaching USD 2.26 Billion by the end of the forecast period in 2032."

The ESD PCB rack market caters to the need for electrostatic discharge-safe storage and handling of printed circuit boards during manufacturing, assembly, and logistics operations. These racks are designed to protect sensitive electronic components from static damage, ensuring high reliability in production processes across electronics, automotive, aerospace, and telecommunications sectors. The market growth is driven by increasing electronics manufacturing, stringent quality standards, and the rising adoption of automation in assembly lines. Manufacturers focus on developing racks with lightweight conductive plastics, adjustable configurations, and modular designs to cater to diverse production environments.

The market is witnessing innovation in materials, with conductive composites replacing traditional plastics to improve durability, thermal resistance, and environmental sustainability. Asia Pacific remains the fastest-growing region due to strong electronics output and expanding manufacturing capacities, while North America and Europe focus on compliance with ESD safety standards. Key suppliers are enhancing their portfolios with customisation options, ergonomic designs, and mobile rack solutions to meet the operational efficiency needs of modern factories. The market outlook remains positive with rising SMT production, miniaturisation trends, and increasing investments in cleanroom and ESD-compliant infrastructure globally.

By Product – Mobile ESD PCB Racks: Mobile ESD PCB racks are the fastest-growing segment due to their flexibility and ease of movement within manufacturing facilities, supporting lean workflows, efficient material handling, and quick reconfiguration of assembly lines to adapt to changing production needs.

By Application – Manufacturing: Manufacturing is the largest application segment as ESD PCB racks are extensively used on assembly lines and production floors to safely handle and transport sensitive electronic boards, ensuring static protection during critical stages of manufacturing processes.

Key Insights

- Electronics manufacturing expansion across automotive, telecom, and medical sectors is increasing demand for ESD-safe PCB racks to protect sensitive boards during assembly and storage processes.

- Manufacturers are developing modular and stackable rack designs to optimise floor space utilisation and streamline workflows in high-density production lines.

- Use of conductive plastics and carbon-filled composites is growing to provide effective static dissipation while ensuring lightweight and corrosion-resistant rack solutions.

- Automation trends in SMT assembly lines are driving the need for magazine-style and conveyor-compatible racks to enable seamless transport between workstations.

- Customisation features such as adjustable slot widths, heat resistance, and chemical durability are becoming standard requirements across aerospace and defence electronics manufacturing.

- Asia Pacific leads market growth with high-volume PCB production in China, South Korea, and Southeast Asia, supported by smart manufacturing and factory automation initiatives.

- Key players focus on offering broad product portfolios, strong technical support, and aftersales services to strengthen their competitive position globally.

- Environmental sustainability is influencing product development with recyclable materials and low-VOC coatings gaining preference for compliance with green manufacturing standards.

- Research and development efforts focus on enhancing impact resistance, temperature tolerance, and long-term durability of racks used in harsh industrial environments.

- Market competition is intensifying with companies expanding regional distribution networks and forming strategic partnerships to meet rising global demand efficiently.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User, By Technology, By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

ESD PCB Rack Market Segmentation

By Product

- Static ESD PCB Racks

- Mobile ESD PCB Racks

By Application

- Manufacturing

- Testing

- Storage

By End User

- Electronics

- Automotive

- Aerospace

By Technology

- Traditional

- Advanced Coating

By Distribution Channel

- Online

- Offline

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Top 15 Companies in the ESD PCB Rack Market

- Schroff GmbH (nVent)

- Desco Industries, Inc.

- 3M Company

- Conductive Containers, Inc.

- Protektive Pak

- Botron Company Inc.

- Statclean Technology (S) Pte Ltd.

- Elcom (UK) Ltd.

- CabinetTec Systems

- Shanghai Leenol ESD Protection Equipment Co., Ltd.

- RS Pro (RS Group)

- GSM Valtech Industries

- OK International (a Dover company)

- Worklon (Superior Uniform Group)

- Teknis Ltd.

What You Receive

• Global Esd Pcb Rack market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Esd Pcb Rack.

• Esd Pcb Rack market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Esd Pcb Rack market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Esd Pcb Rack market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Esd Pcb Rack market, Esd Pcb Rack supply chain analysis.

• Esd Pcb Rack trade analysis, Esd Pcb Rack market price analysis, Esd Pcb Rack Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Esd Pcb Rack market news and developments.

The Esd Pcb Rack Market international scenario is well established in the report with separate chapters on North America Esd Pcb Rack Market, Europe Esd Pcb Rack Market, Asia-Pacific Esd Pcb Rack Market, Middle East and Africa Esd Pcb Rack Market, and South and Central America Esd Pcb Rack Markets. These sections further fragment the regional Esd Pcb Rack market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Esd Pcb Rack market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Esd Pcb Rack market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Esd Pcb Rack market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Esd Pcb Rack business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Esd Pcb Rack Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Esd Pcb Rack Pricing and Margins Across the Supply Chain, Esd Pcb Rack Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Esd Pcb Rack market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. ESD PCB Rack Market Latest Trends, Drivers and Challenges, 2025- 2032

2.1 ESD PCB Rack Market Overview

2.2 Market Strategies of Leading ESD PCB Rack Companies

2.3 ESD PCB Rack Market Insights, 2025- 2032

2.3.1 Leading ESD PCB Rack Types, 2025- 2032

2.3.2 Leading ESD PCB Rack End-User industries, 2025- 2032

2.3.3 Fast-Growing countries for ESD PCB Rack sales, 2025- 2032

2.4 ESD PCB Rack Market Drivers and Restraints

2.4.1 ESD PCB Rack Demand Drivers to 2032

2.4.2 ESD PCB Rack Challenges to 2032

2.5 ESD PCB Rack Market- Five Forces Analysis

2.5.1 ESD PCB Rack Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global ESD PCB Rack Market Value, Market Share, and Forecast to 2032

3.1 Global ESD PCB Rack Market Overview, 2024

3.2 Global ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

3.3 Global ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

3.4 Global ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

3.5 Global ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

3.6 Global ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

3.7 Global ESD PCB Rack Market Size and Share Outlook By By Distribution Channel, 2025- 2032

3.8 Global ESD PCB Rack Market Size and Share Outlook by Region, 2025- 2032

4. Asia Pacific ESD PCB Rack Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific ESD PCB Rack Market Overview, 2024

4.2 Asia Pacific ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

4.3 Asia Pacific ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

4.4 Asia Pacific ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

4.5 Asia Pacific ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

4.6 Asia Pacific ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

4.7 Asia Pacific ESD PCB Rack Market Size and Share Outlook by Country, 2025- 2032

4.8 Key Companies in Asia Pacific ESD PCB Rack Market

5. Europe ESD PCB Rack Market Value, Market Share, and Forecast to 2032

5.1 Europe ESD PCB Rack Market Overview, 2024

5.2 Europe ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

5.3 Europe ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

5.4 Europe ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

5.5 Europe ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

5.6 Europe ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

5.7 Europe ESD PCB Rack Market Size and Share Outlook by Country, 2025- 2032

5.8 Key Companies in Europe ESD PCB Rack Market

6. North America ESD PCB Rack Market Value, Market Share and Forecast to 2032

6.1 North America ESD PCB Rack Market Overview, 2024

6.2 North America ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

6.3 North America ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

6.4 North America ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

6.5 North America ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

6.6 North America ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

6.7 North America ESD PCB Rack Market Size and Share Outlook by Country, 2025- 2032

6.8 Key Companies in North America ESD PCB Rack Market

7. South and Central America ESD PCB Rack Market Value, Market Share and Forecast to 2032

7.1 South and Central America ESD PCB Rack Market Overview, 2024

7.2 South and Central America ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

7.3 South and Central America ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

7.4 South and Central America ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

7.5 South and Central America ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

7.6 South and Central America ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

7.7 South and Central America ESD PCB Rack Market Size and Share Outlook by Country, 2025- 2032

7.8 Key Companies in South and Central America ESD PCB Rack Market

8. Middle East Africa ESD PCB Rack Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa ESD PCB Rack Market Overview, 2024

8.2 Middle East and Africa ESD PCB Rack Market Revenue and Forecast, 2025- 2032 (US$ Billion)

8.3 Middle East Africa ESD PCB Rack Market Size and Share Outlook By Product Type, 2025- 2032

8.4 Middle East Africa ESD PCB Rack Market Size and Share Outlook By Application, 2025- 2032

8.5 Middle East Africa ESD PCB Rack Market Size and Share Outlook By Technology, 2025- 2032

8.6 Middle East Africa ESD PCB Rack Market Size and Share Outlook By End User, 2025- 2032

8.7 Middle East Africa ESD PCB Rack Market Size and Share Outlook by Country, 2025- 2032

8.8 Key Companies in Middle East Africa ESD PCB Rack Market

9. ESD PCB Rack Market Structure

9.1 Key Players

9.2 ESD PCB Rack Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. ESD PCB Rack Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global ESD PCB Rack Market is estimated to generate USD 1.31 Billion in revenue in 2025.

The Global ESD PCB Rack Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% during the forecast period from 2025 to 2032.

The ESD PCB Rack Market is estimated to reach USD 2.26 Billion by 2032.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!