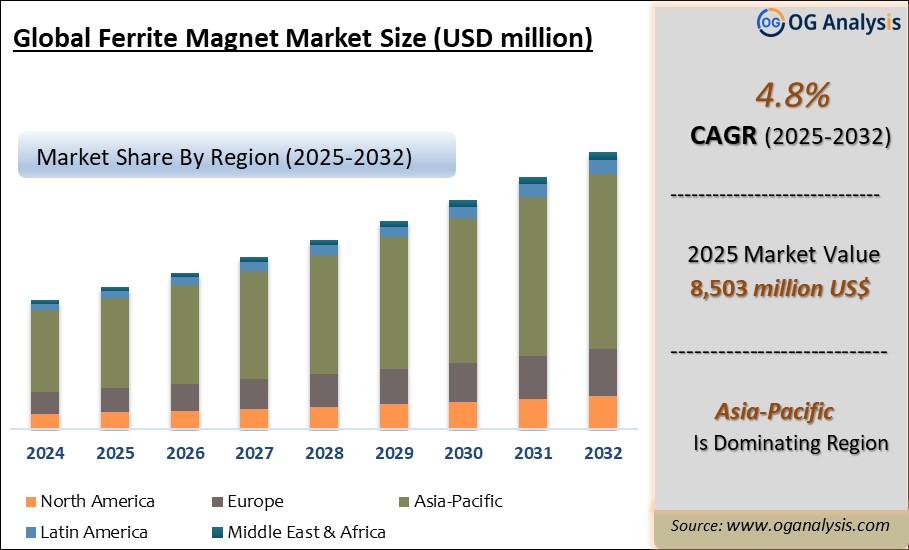

The Ferrite Magnet Market is estimated at USD 8,114 million in 2024. Further, the market is expected to grow from USD 8,503 million in 2025 to USD 12,967 million in 2032 at a CAGR of 4.8%.

Ferrite Magnet Market Market Overview

Ferrite magnets, also known as ceramic magnets are a type of permanent magnet and are produced by a combination of Iron oxide (Fe2O3), and ceramic materials barium or strontium carbonate sintered at high temperatures. Ferrite magnets, with the chemical formula SrO-6(Fe2O3), are employed in a wide range of applications such as electronics, consumer appliances, automotive, wind energy and medical owing to their low production costs and their heat resistance (up to 250?) and corrosion. Powder metallurgy is a method for creating ferrite magnets that involves mixing the raw ingredients, pressing them into shape, and then heating them to a high temperature in a sintering furnace.

The market for ferrite magnets is established and mature, and it is predicted that it will continue to increase over the next few years stimulated by the staggering growth in electric vehicles. Expanding application areas along with increasing research and development activity to improve the functionality of the permanent magnet are driving the market during the long term forecast period. Demand for ferrite magnets is registering significant growth across the world with Asia-Pacific leading the ferrite magnet market production and consumption followed by Europe and North America.

Latest Trends in the Ferrite Magnet Market

Increasing demand from the automotive industry:

Ferrite magnets are widely used in the automobile industry, where they can be found in electric vehicle motors, hybrid vehicle motors, and fuel injection systems. With the growing demand for electric vehicles and the necessity for energy-efficient solutions, ferrite magnet demand is likely to rise further. Key applications of ferrite magnets in the automobile industry include

Electric motors: Ferrite magnets are used in electric motors in hybrid and electric vehicles. They are used to generate a magnetic field that rotates the motor's rotor, which in turn drives the vehicle.

Alternators and generators: Ferrite magnets are used in alternators and generators to produce an electromagnetic field that generates electricity. These devices are used to charge the battery and power the electrical systems in the vehicle.

Magnetic sensors: Ferrite magnets are used in magnetic sensors that detect the position and speed of the vehicle's components, such as the wheels, crankshaft, and camshaft. This information is used to control the engine and transmission systems.

Speakers: Ferrite magnets are used in speakers to produce sound in the car's audio system. They are commonly used in lower-cost speakers due to their low cost and good performance.

Anti-lock braking systems (ABS): Ferrite magnets are used in ABS systems to detect the speed of the wheels and control the braking force. This helps to prevent the wheels from locking up during braking, which can cause the vehicle to skid.

Global Ferrite magnet Market Analysis 2025-2032: Industry Size, Share, Growth Trends, Competition and Forecast Report

Driving Factors

Increasing demand for electric vehicles:

With growing concern about environmental pollution and the need to cut carbon emissions, demand for electric vehicles (EVs) is rapidly expanding. Ferrite magnets are widely employed in EV motors, which is propelling the ferrite magnet market forward. Ferrite magnets are widely utilized in electric vehicles (EVs) for a variety of purposes.

A major application of Ferrite magnets in EVs is the electric motors that power the vehicle. The magnets are used in the rotor of the motor, where they create a magnetic field that interacts with the stator to produce rotational motion. Ferrite magnets are popular for use in electric motors gaining from their low cost and better magnetic properties. Ferrite magnets are also used in the charging systems of EVs. The magnets are used in the charging cable, where they create a magnetic field that is used to transfer power wirelessly from the charging station to the EV. This wireless charging technology is becoming increasingly popular in the EV market, as it allows for convenient and efficient charging without the need for cables or plugs.

Market Challenges

Lower magnetic strength compared to other magnets:

Ferrite magnets have a larger temperature tolerance range than other magnets, making them suited for use in high-temperature applications such as electric motors, transformers, and generators. Ferrite magnets are well-known for their exceptional resistance to demagnetization and ability to retain magnetic characteristics at high temperatures. As a result, they are frequently utilized in applications requiring a wide temperature tolerance.

A key reason for ferrite magnets' lower magnetic strength is their lower energy product, which measures the amount of magnetic energy that can be stored in the magnet. Ferrite magnets typically have an energy product of 1 to 4 megagauss-oersteds (MGOe), which is lower than the energy product of neodymium magnets, which can be as high as 50 MGOe. As a result, ferrite magnets have a lesser magnetic field and are less useful in applications that demand a high magnetic field.

Companies Mentioned

TDK Corporation

PROTERIAL, Ltd. (Hitachi Metals Pvt. Ltd.)

DAIDO STEEL CO., LTD.

Adams Magnetic Products

JPMF Guangdong Co., Ltd

Arnold Magnetic Technologies

|

Parameter |

Detail |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Size-Units |

USD million |

|

Market Splits Covered |

By End-Use industry ,By process and By product Type |

|

Countries Covered |

North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

|

Analysis Covered |

Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

|

Customization |

10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

|

Post-Sale Support |

4 analyst hours, available up to 4 weeks |

|

Delivery Format |

The Latest Updated PDF and Excel Datafile |

Market Segmentation

|

|

|

|

By End-Use Industry |

|

|

By Process |

|

|

By Product Type |

|

|

By Geography |

|

TABLE OF CONTENTS

1. GLOBALFERRITE MAGNET INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. FERRITE MAGNET MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2022-2030

2.1. Ferrite Magnet in xEV Market

2.2. Ferrite Magnet Market Latest Trends

2.2.1. Increasing demand from the automotive industry:

2.2.2. Growing adoption of renewable energy sources:

2.2.3. Technological advancements in ferrite magnet manufacturing:

2.2.4. Improved manufacturing processes:

2.2.5. Shift towards sustainable and recyclable ferrite magnets:

2.2.6. Increasing use of ferrite magnets in medical equipment:

2.3. Ferrite Magnet Market Insights, 2022-2030

2.3.1. Leading Ferrite Magnet End-Use Industry, 2022-2030

2.3.2. Leading Ferrite Magnet Process, 2022-2030

2.3.3. Dominant Ferrite Magnet Product Type, 2022-2030

2.3.4. Fast-Growing Geographies for Ferrite Magnet, 2022-2030

2.4. Ferrite Magnet Market Drivers to 2030

2.4.1. Increasing demand for electric vehicles:

2.4.2. Growing adoption of automation and robotics:

2.4.3. Rising demand for consumer electronics:

2.4.4. Wide temperature tolerance:

2.5. Ferrite Magnet Market Restraints to 2030

2.5.1. Lower magnetic strength compared to other magnets:

2.5.2. Limited use in high-frequency applications:

2.5.3. Increasing competition from other magnet types:

2.5.4. Limited availability of raw materials:

2.6. Ferrite Magnet Market-Five Forces Analysis

3. GLOBAL FERRITE MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

3.1. Global Ferrite Magnet Market Overview, 2022

3.2. Global Ferrite Magnet Market Size and Share Outlook, By End-Use Industry, 2022-2030

3.2.1. Electronics & Appliances

3.2.2. Automotive

3.2.3. Industrial

3.2.4. Energy & Power

3.2.5. Medical

3.2.6. Other End-Use Industry

3.3. Global Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

3.3.1. Sintered Ferrite Magnet

3.3.2. Bonded Ferrite Magnet

3.4. Global Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

3.4.1. Hard Ferrite

3.4.2. Semi-Hard Ferrite

3.4.3. Soft Ferrite

3.5. Global Ferrite Magnet Market Size and Share Outlook by Region, 2022-2030

4. NORTH AMERICA FERRITE MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

4.1. North America Ferrite Magnet Market Overview, 2022

4.2. North America Ferrite Magnet Market Size and Share Outlook by End-Use Industry, 2022-2030

4.3. North America Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

4.4. North America Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

4.5. North America Ferrite Magnet Market Size and Share Outlook by Country, 2022-2030

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. EUROPE FERRITE MAGNET MARKET VALUE, MARKET SHARE, AND FORECAST TO 2030

5.1. Europe Ferrite Magnet Market Overview, 2022

5.2. Europe Ferrite Magnet Market Size and Share Outlook by End-Use Industry, 2022-2030

5.3. Europe Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

5.4. Europe Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

5.5. Europe Ferrite Magnet Market Size and Share Outlook by Country, 2022-2030

5.5.1. Germany

5.5.2. UK

5.5.3. Italy

5.5.4. France

5.5.5. Spain

5.5.6. Rest of Europe

6. ASIA PACIFIC FERRITE MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

6.1. Asia Pacific Ferrite Magnet Market Overview, 2022

6.2. Asia Pacific Ferrite Magnet Market Size and Share Outlook by End-Use Industry, 2022-2030

6.3. Asia Pacific Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

6.4. Asia Pacific Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

6.5. Asia Pacific Ferrite Magnet Market Size and Share Outlook by Country, 2022-2030

6.5.1. China

6.5.2. Japan

6.5.3. India

6.5.4. South Korea

6.5.5. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA FERRITE MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

7.1. South and Central America Ferrite Magnet Market Overview, 2022

7.2. South and Central America Ferrite Magnet Market Size and Share Outlook by End-Use Industry, 2022-2030

7.3. South and Central America Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

7.4. South and Central America Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

7.5. South and Central America Ferrite Magnet Market Size and Share Outlook by Country, 2022-2030

7.5.1. Brazil

7.5.2. Argentina

7.5.3. Rest of South and Central America

8. MIDDLE EAST AFRICA FERRITE MAGNET MARKET VALUE, MARKET SHARE AND FORECAST TO 2030

8.1. Middle East Africa Ferrite Magnet Market Overview, 2022

8.2. Middle East Africa Ferrite Magnet Market Size and Share Outlook by End-Use Industry, 2022-2030

8.3. Middle East Africa Ferrite Magnet Market Size and Share Outlook, By Process, 2022-2030

8.4. Middle East Africa Ferrite Magnet Market Size and Share Outlook, By Product Type, 2022-2030

8.5. Middle East Africa Ferrite Magnet Market Size and Share Outlook by Country, 2022-2030

8.5.1. Middle East

8.5.2. Africa

9. FERRITE MAGNET MARKET STRUCTURE

9.1. TDK Corporation

9.2. PROTERIAL, Ltd. (Hitachi Metals Pvt. Ltd.)

9.3. DAIDO STEEL CO., LTD.

9.4. Adams Magnetic Products

9.5. JPMF Guangdong Co., Ltd

9.6. Arnold Magnetic Technologies

10. APPENDIX

10.1. Ferrite Magnet Trade Data

10.1.1. Ferrite Magnet Imports, 2019-2022

10.2. About Us

10.3. Sources

10.4. Research Methodology

10.5. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

Challenges include competition from rare-earth magnets (like neodymium), relatively lower magnetic strength compared to other magnets, and environmental concerns in the production process.

Key growth drivers include rising demand for electric vehicles (EVs), increased use in renewable energy systems (e.g., wind turbines), expansion of consumer electronics, and industrial automation.

Ferrite magnets are commonly used in loudspeakers, motors, transformers, microwave devices, magnetic separators, and sensors. They are prevalent in automotive, electronics, electrical, and industrial applications.

Ferrite magnets, also known as ceramic magnets, are permanent magnets made from iron oxide and barium or strontium carbonate. They are widely used due to their low cost, corrosion resistance, and high magnetic strength.

$4150- 30%

$6450- 40%

$8450- 50%

$2180- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!