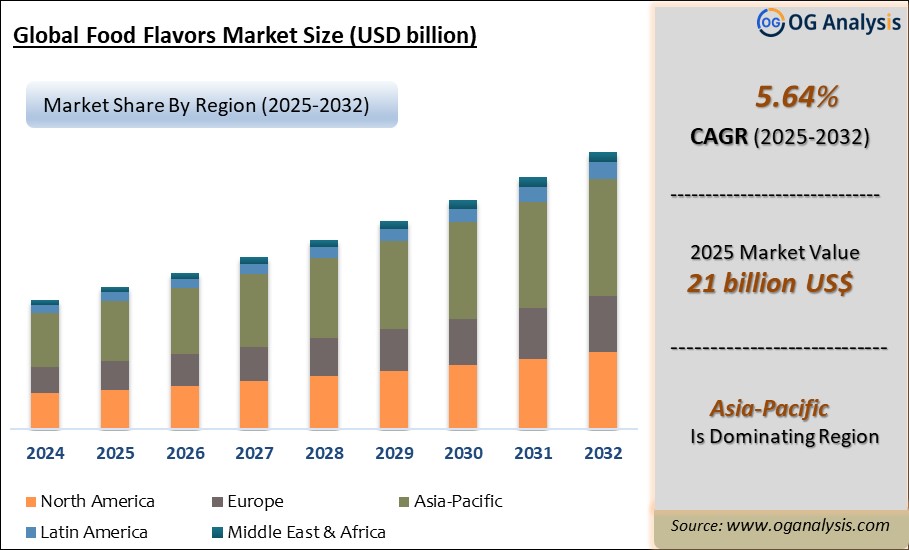

"The Food Flavors Market is estimated to be USD 19.9 billion in 2024. Furthermore, the market is expected to grow to USD 29.3 billion by 2031, with a Compound Annual Growth Rate (CAGR) of 5.64%."

The global food flavors market is experiencing robust growth driven by consumer demand for natural, clean-label, and innovative taste experiences. Food flavors encompass a broad range of ingredients—such as natural extracts, essential oils, oleoresins, and flavor compounds—used to impart desired taste and aroma profiles in diverse food and beverage applications, including bakery, dairy, confectionery, beverages, snacks, and savory products. As consumers become more health-conscious, manufacturers are increasingly replacing synthetic flavors with natural or nature-identical alternatives, emphasizing transparency and label-friendly formulations. Additionally, the rise of exotic and ethnic cuisines has fueled the creation of novel flavor blends, from exotic fruits and spices to fermented and umami-rich profiles. Technological advancements in extraction techniques, encapsulation, and flavor modulation are further enabling tailored flavor delivery, enhanced stability, and controlled release in complex food matrices. Regulatory support for defining and standardizing natural flavor classifications, combined with expanding global foodservice and packaged food sectors, underpins steady market expansion worldwide.

Market dynamics are shaped by regional taste preferences, with North America and Europe leading demand for healthy, clean-label flavors and Asia Pacific emerging as the fastest-growing market due to rising disposable incomes, urbanization, and expanding food processing industries in China, India, and Southeast Asia. Flavors for plant-based alternatives and functional foods—such as savory meat analogues, dairy-free beverages, and fortified snacks—have become high-priority development areas as manufacturers seek to combine health benefits with sensory satisfaction. Collaboration between flavor houses, food scientists, and consumer insights specialists is fostering the co-creation of customized flavor solutions, while digital tools and AI-driven taste mapping accelerate product innovation cycles. Challenges include raw material price volatility, sustainability concerns around sourcing exotic botanicals, and the need for robust sensory validation. As consumers continue to explore global taste trends and demand quality, natural flavor experiences, the food flavors market is poised for sustained growth, driven by innovation, regional expansion, and evolving regulatory frameworks.

In the food flavors market, beverages represent the largest application segment due to the vast variety of flavored drinks—ranging from carbonated soft drinks and functional beverages to ready-to-drink teas and flavored waters—requiring extensive flavor customization. Beverages’ high production volumes, rapid product turnover, and continuous innovation in flavor profiles sustain substantial demand for both liquid and powdered flavor systems, cementing beverages as the dominant application.

The natural flavor category is the fastest-growing flavor type, driven by clean-label and health-conscious consumer preferences. Brands are prioritizing plant-derived extracts, essential oils, and nature-identical compounds to replace synthetic alternatives, meeting regulatory “natural” definitions and delivering tastier, perceived-healthier products. This shift fuels rapid growth in natural flavor development and adoption across all food and beverage sectors.

Key Insights

-

The shift to natural and clean-label formats is a primary driver, with manufacturers replacing synthetic flavor compounds with plant-derived extracts, essential oils, and oleoresins to meet consumer preferences for transparency and perceived health benefits.

-

Asia Pacific is the fastest-growing regional market, fueled by rising middle-class populations in China, India, and Southeast Asia, expanding modern retail, and growing demand for convenient processed foods and beverages with localized flavor profiles.

-

North America and Europe remain leading markets for food flavors, driven by high per-capita consumption of processed foods, stringent regulations defining natural flavor classifications, and consumer willingness to pay a premium for premium and functional flavors.

-

Flavor innovation is focused on exotic fruits, spices, and culturally inspired blends—such as yuzu, turmeric, harissa, and matcha—to cater to adventurous consumers seeking novel sensory experiences in snacks, beverages, and sauces.

-

Plant-based and alternative protein applications are creating new demand for savory and umami-rich flavors, enabling meat, dairy, and egg substitutes to deliver authentic taste and aroma that mimic traditional animal-based products.

-

Technologies like encapsulation and microencapsulation enhance flavor stability, mask off-notes, and allow controlled release in complex formulations, improving shelf life and sensory performance in baked goods and ready-to-eat meals.

-

Functional and fortification trends—such as added vitamins, probiotics, and adaptogens—are driving development of tailored flavor systems that can mask bitterness and optimize taste in health-focused beverages and nutritional bars.

-

Collaboration between flavor houses, food developers, and AI-driven taste mapping platforms accelerates R&D, enabling rapid screening of flavor combinations and data-driven consumer insights to reduce time-to-market.

-

Raw material sourcing poses challenges, as volatility in prices of key botanicals (e.g., vanilla, citrus oils) and sustainability concerns around exotic ingredients require supply-chain diversification and certified ethical sourcing strategies.

-

Regulatory frameworks in major markets increasingly define “natural” and “nature-identical” flavors, compelling manufacturers to ensure compliance with local and international standards, influencing ingredient selection and labeling.

Global Sugar Production(million tonnes)2018-2024

Figure: Global sugar production has remained structurally high, fluctuating from around 168 million tonnes in 2019–2020 to more than 180 million tonnes in 2023 and only slightly easing in 2024e. This stable yet expanding sugar base reflects the large and resilient volumes of sweetened beverages, confectionery, bakery and dessert products that rely on flavor systems for differentiation and reformulation. OG Analysis estimates, aligned with international sugar statistics, illustrate how the long-term sugar supply supports sustained demand for both natural and synthetic flavors across global food and beverage markets.

The food flavors market reflecting the sustained scale of flavored beverages, confectionery, bakery and dairy categories worldwide. Growing volumes in 2022–2023 highlight the resilience of sweetened and indulgent product lines that rely heavily on flavor systems for differentiation and reformulation. Even with a slight moderation expected in 2024, the world sugar supply remains structurally robust, supporting ongoing innovation in natural, botanical, fruit, dessert and ethnic flavor profiles. This stable upstream raw-material landscape reinforces long-term growth opportunities for global flavor houses and ingredient manufacturers.

Reort Scope

| Parameter | food flavors Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

Food Flavors Market, By Application

- Beverages

- Savory and Snacks

- Bakery

- Dairy

- Confectionery

- Other

Food Flavors Market, By Type

- Natural Flavor

- Artificial Flavor

- Nature-identical Flavor

Countries Covered

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Food Flavors market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Food Flavors market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Food Flavors market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Food Flavors business prospects by region, key countries, and top companies' information to channel their investments.

TABLE OF CONTENTS

1. GLOBAL FOOD FLAVORS INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. FOOD FLAVORS MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023 -2031

2.1. Food Flavors Market Latest Trends

2.1.1. Growing Consumer Demand for Healthy and Natural Foods Flavors

2.1.2. Companies continue to boost R&D spending on product differentiation and innovative solutions

2.1.3. Clean Label Requirements

2.1.4. Improving Product Features

2.1.5. Sweet, Indulge & Comfort

2.1.6. Acquisitions Remain Key Strategy for Companies

2.2. Food Flavors Market Insights, 2023-2031

2.2.1. Global Food Flavors Market Value, By Application 2023-2031

2.2.2. Global Food Flavors Market by Geography, 2023-2031

2.3. Food Flavors Market Drivers and Restraints

2.3.1. Food Flavors Demand Drivers to 2031

2.3.2. Food Flavors Challenges to 2031

2.4. Food Flavors Market-Five Forces Analysis

3. GLOBAL FOOD FLAVORS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

3.1. Global Food Flavors Market Overview, 2023

3.2. Global Food Flavors Market Size and Share Outlook, By Application, 2023-2031

3.2.1. Beverages

3.2.2. Savory and Snacks

3.2.3. Bakery

3.2.4. Dairy

3.2.5. Confectionery

3.2.6. Other

3.3. Global Food Flavors Market Size and Share Outlook, By Type, 2023-2031

3.3.1. Natural Flavor

3.3.2. Artificial Flavor

3.3.3. Nature-identical Flavor

3.4. Global Food Flavors Market Size and Share Outlook by Region, 2023-2031

4. EUROPE FOOD FLAVORS MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

4.1. Europe Food Flavors Market Overview, 2023

4.2. Europe Food Flavors Market Size and Share Outlook by Application, 2023-2031

4.3. Europe Food Flavors Market Size and Share Outlook by Type, 2023-2031

4.4. Europe Food Flavors Market Size and Share Outlook by Country, 2023-2031

4.4.1. Germany

4.4.2. France

4.4.3. Spain

4.4.4. United Kingdom

4.4.5. Italy

4.4.6. Belgium

4.4.7. Netherlands

4.4.8. Luxembourg

4.4.9. Rest of Europe

5. NORTH AMERICA FOOD FLAVORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

5.1. North America Food Flavors Market Overview, 2023

5.2. North America Food Flavors Market Size and Share Outlook by Application, 2023-2031

5.3. North America Food Flavors Market Size and Share Outlook by Type, 2023-2031

5.4. North America Food Flavors Market Size and Share Outlook by Country, 2023-2031

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. ASIA PACIFIC FOOD FLAVORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

6.1. Asia Pacific Food Flavors Market Overview, 2023

6.2. Asia Pacific Food Flavors Market Size and Share Outlook by Application, 2023-2031

6.3. Asia Pacific Food Flavors Market Size and Share Outlook by Type, 2023-2031

6.4. Asia Pacific Food Flavors Market Size and Share Outlook by Country, 2023-2031

6.4.1. China

6.4.2. Japan

6.4.3. India

6.4.4. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA FOOD FLAVORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

7.1. South and Central America Food Flavors Market Overview, 2023

7.2. South and Central America Food Flavors Market Size and Share Outlook by Application, 2023-2031

7.3. South and Central America Food Flavors Market Size and Share Outlook by Type, 2023-2031

7.4. South and Central America Food Flavors Market Size and Share Outlook by Country, 2023-2031

7.4.1. Brazil

7.4.2. Argentina

7.4.3. Rest of South and Central America

8. MIDDLE EAST AFRICA FOOD FLAVORS MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Middle East Africa Food Flavors Market Overview, 2023

8.2. Middle East Africa Food Flavors Market Size and Share Outlook by Application, 2023-2031

8.3. Middle East Africa Food Flavors Market Size and Share Outlook by Type, 2023-2031

8.4. Middle East Africa Food Flavors Market Size and Share Outlook by Country, 2023-2031

8.4.1. Middle East

8.4.2. Africa

9. FOOD FLAVORS MARKET STRUCTURE

9.1. Givaudan SA

9.2. Koninklijke DSM N.V.

9.3. Archer Daniels midland

9.4. Kerry Group Plc

9.5. BASF SE

10. APPENDIX

10.1. About Us

10.2. Sources

10.3. Research Methodology

10.4. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Food Flavors Market is estimated to generate USD 19.9 billion in revenue in 2024.

The Global Food Flavors Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.64% during the forecast period from 2025 to 2032.

The Food Flavors Market is estimated to reach USD 30.9 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!