"The Global Food Service Lockers Market Size is valued at $ 6.1 Billion in 2025. Worldwide sales of Food Service Lockers Market are expected to grow at a significant CAGR of 8.5%, reaching $ 10.82 Billion by the end of the forecast period in 2032."

The Food Service Lockers Market is gaining momentum globally as demand grows for secure, contactless food pickup and delivery solutions across restaurants, ghost kitchens, cafeterias, and institutional food service providers. These temperature-controlled lockers, designed for hot, cold, and ambient storage, offer a hygienic, efficient, and tech-enabled solution for storing and retrieving meals without direct human contact. The market is being driven by the rise in digital food ordering, consumer demand for convenience, and the need for operational efficiency in high-volume food service environments. Technology integration, such as IoT, app-based access, and real-time inventory management, is transforming food lockers into smart, automated solutions for last-mile fulfillment and order management.Key adopters include QSR chains, universities, corporate canteens, airports, and hospitals—settings that benefit from enhanced order accuracy, minimized wait times, and improved food safety. Post-pandemic hygiene awareness has further boosted locker installations, while the surge in meal delivery services continues to push innovation in locker size, modular design, and integration with third-party delivery platforms. North America leads the market due to early adoption and technological maturity, but Asia-Pacific and Europe are emerging as fast-growing regions amid rapid urbanization, e-commerce growth, and rising consumer expectations. Sustainability is also shaping locker design, with energy-efficient models and recyclable materials gaining preference.

Electronic lockers are the largest segment by type due to their widespread use in digital food ecosystems, offering features like app-based access, automated alerts, and secure compartmentalized storage. These lockers align with the growing need for contactless and tech-integrated food service solutions.

Mechanical lockers are the fastest-growing segment as they offer a cost-effective and low-maintenance alternative for small and mid-sized food service operators. Their simplicity and ease of use make them suitable for environments without digital infrastructure.

Food delivery is the largest application segment, driven by rising demand for secure, unattended pickup points in fast-paced delivery operations. These lockers help reduce delivery time, order confusion, and labor dependency in high-volume service environments.

Kitchen storage is the fastest-growing application segment, with food service providers using lockers for organized storage of meals, ingredients, and supplies. This helps improve workflow, reduce cross-contamination, and optimize space in busy kitchen operations.

Key Insights

-

Smart food service lockers are gaining popularity due to the surge in contactless food delivery, allowing restaurants and service providers to offer hygienic, secure pickup points without requiring human interaction.

-

Integration with digital platforms, including mobile ordering apps and restaurant POS systems, enables seamless order management, real-time pickup notifications, and enhanced customer satisfaction.

-

Temperature-controlled compartments—designed to maintain hot, cold, or ambient conditions—ensure that food remains fresh and safe until collected, which is crucial for maintaining food quality standards.

-

Food lockers are being deployed in high-traffic locations like universities, hospitals, and corporate offices to facilitate self-service pickup and reduce crowding during peak meal times.

-

Ghost kitchens and delivery-only restaurants are embracing food lockers as a means to streamline order handoff, eliminate delivery errors, and optimize labor resources in high-volume environments.

-

Customization in locker design—such as flexible compartment sizes, digital access controls, and brand-specific finishes—allows food businesses to meet operational and aesthetic requirements.

-

North America leads in adoption, driven by tech maturity and consumer preference for convenience, while Asia-Pacific shows rapid growth fueled by rising urbanization and digital ordering trends.

-

Environmental sustainability is emerging as a key focus, with manufacturers offering lockers that consume less energy and are built with recyclable, low-impact materials.

-

Modular locker systems that can scale across locations are enabling chains and institutional clients to replicate locker-based food pickup models efficiently and consistently.

-

Transport hubs, entertainment venues, and public service buildings are increasingly using food lockers to provide round-the-clock access to meals and snacks for commuters and visitors.

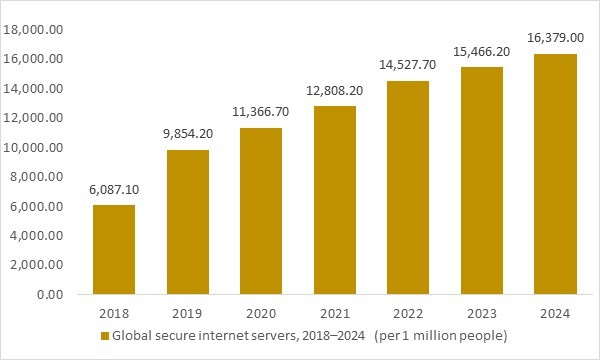

Global secure internet servers, 2018–2024(per million)

Figure: Global secure internet servers increased from around 6,087 per million people in 2018 to an estimated 16,379 per million people in 2024e, reflecting the rapid strengthening of digital infrastructure required for seamless online food ordering, authentication and contactless pickup. As restaurants, QSR chains and grocery retailers expand app-based ordering ecosystems, the rise in secure servers enables faster, safer and more reliable digital payment workflows, directly supporting the deployment of smart heated, chilled and ambient food-service lockers. OG Analysis estimates, derived from World Bank secure server indicators and global digital infrastructure assessments, illustrate how accelerating cybersecurity capacity underpins long-term scalability, operational efficiency and customer-centric innovation in the food-service lockers market.

The steady rise in global secure internet servers from 2018 to 2024 highlights the rapid strengthening of digital transaction infrastructure worldwide, enabling more reliable app-based ordering and authenticated pickups. As restaurants, QSR chains, and grocery retailers scale their online ordering ecosystems, the need for seamless, contactless fulfillment grows in parallel. This expansion directly accelerates adoption of heated, chilled, and ambient food-service lockers as operators optimize last-mile efficiency and reduce wait-time congestion. Overall, the digitization of consumer food purchasing behavior forms a strong foundational driver for sustained growth in the food-service lockers market.

Reort Scope

| Parameter | Food Service Lockers Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Food Service Lockers Market Segmentation

By Type

- Electronic Lockers

- Mechanical Lockers

By Application

- Food Delivery

- Kitchen Storage

By End User

- Restaurants

- Cafeterias

- Hospitals

By Technology

- Smart Lockers

- Traditional Lockers

By Distribution Channel

- Online

- Offline

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Companies Operating in the Food Service Lockers Market

- Luxer One

- Parcel Pending (Quadient)

- Bell and Howell

- Apex Supply Chain Technologies

- KEBA AG

- StrongPoint

- Zippin

- Grabango

- Smiota

- DeBourgh Manufacturing Co.

- Electrolux Professional

- Food Lockers Direct

- Locker & Lock

- Cleveron

- HMY Group

What You Receive

• Global Food Service Lockers market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Food Service Lockers.

• Food Service Lockers market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Food Service Lockers market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Food Service Lockers market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Food Service Lockers market, Food Service Lockers supply chain analysis.

• Food Service Lockers trade analysis, Food Service Lockers market price analysis, Food Service Lockers Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Food Service Lockers market news and developments.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Food Service Lockers Market Latest Trends, Drivers and Challenges, 2025- 2032

2.1 Food Service Lockers Market Overview

2.2 Market Strategies of Leading Food Service Lockers Companies

2.3 Food Service Lockers Market Insights, 2025- 2032

2.3.1 Leading Food Service Lockers Types, 2025- 2032

2.3.2 Leading Food Service Lockers End-User industries, 2025- 2032

2.3.3 Fast-Growing countries for Food Service Lockers sales, 2025- 2032

2.4 Food Service Lockers Market Drivers and Restraints

2.4.1 Food Service Lockers Demand Drivers to 2032

2.4.2 Food Service Lockers Challenges to 2032

2.5 Food Service Lockers Market- Five Forces Analysis

2.5.1 Food Service Lockers Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Food Service Lockers Market Value, Market Share, and Forecast to 2032

3.1 Global Food Service Lockers Market Overview, 2024

3.2 Global Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

3.3 Global Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

3.4 Global Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

3.5 Global Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

3.6 Global Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

3.7 Global Food Service Lockers Market Size and Share Outlook By By Distribution Channel, 2025- 2032

3.8 Global Food Service Lockers Market Size and Share Outlook by Region, 2025- 2032

4. Asia Pacific Food Service Lockers Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Food Service Lockers Market Overview, 2024

4.2 Asia Pacific Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

4.3 Asia Pacific Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

4.4 Asia Pacific Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

4.5 Asia Pacific Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

4.6 Asia Pacific Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

4.7 Asia Pacific Food Service Lockers Market Size and Share Outlook by Country, 2025- 2032

4.8 Key Companies in Asia Pacific Food Service Lockers Market

5. Europe Food Service Lockers Market Value, Market Share, and Forecast to 2032

5.1 Europe Food Service Lockers Market Overview, 2024

5.2 Europe Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

5.3 Europe Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

5.4 Europe Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

5.5 Europe Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

5.6 Europe Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

5.7 Europe Food Service Lockers Market Size and Share Outlook by Country, 2025- 2032

5.8 Key Companies in Europe Food Service Lockers Market

6. North America Food Service Lockers Market Value, Market Share and Forecast to 2032

6.1 North America Food Service Lockers Market Overview, 2024

6.2 North America Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

6.3 North America Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

6.4 North America Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

6.5 North America Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

6.6 North America Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

6.7 North America Food Service Lockers Market Size and Share Outlook by Country, 2025- 2032

6.8 Key Companies in North America Food Service Lockers Market

7. South and Central America Food Service Lockers Market Value, Market Share and Forecast to 2032

7.1 South and Central America Food Service Lockers Market Overview, 2024

7.2 South and Central America Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

7.3 South and Central America Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

7.4 South and Central America Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

7.5 South and Central America Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

7.6 South and Central America Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

7.7 South and Central America Food Service Lockers Market Size and Share Outlook by Country, 2025- 2032

7.8 Key Companies in South and Central America Food Service Lockers Market

8. Middle East Africa Food Service Lockers Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Food Service Lockers Market Overview, 2024

8.2 Middle East and Africa Food Service Lockers Market Revenue and Forecast, 2025- 2032 (US$ Billion)

8.3 Middle East Africa Food Service Lockers Market Size and Share Outlook By Product Type, 2025- 2032

8.4 Middle East Africa Food Service Lockers Market Size and Share Outlook By Application, 2025- 2032

8.5 Middle East Africa Food Service Lockers Market Size and Share Outlook By Technology, 2025- 2032

8.6 Middle East Africa Food Service Lockers Market Size and Share Outlook By End User, 2025- 2032

8.7 Middle East Africa Food Service Lockers Market Size and Share Outlook by Country, 2025- 2032

8.8 Key Companies in Middle East Africa Food Service Lockers Market

9. Food Service Lockers Market Structure

9.1 Key Players

9.2 Food Service Lockers Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Food Service Lockers Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Food Service Lockers Market is estimated to generate USD 6.1 Billion in revenue in 2025.

The Global Food Service Lockers Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period from 2025 to 2032.

The Food Service Lockers Market is estimated to reach USD 10.82 Billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!