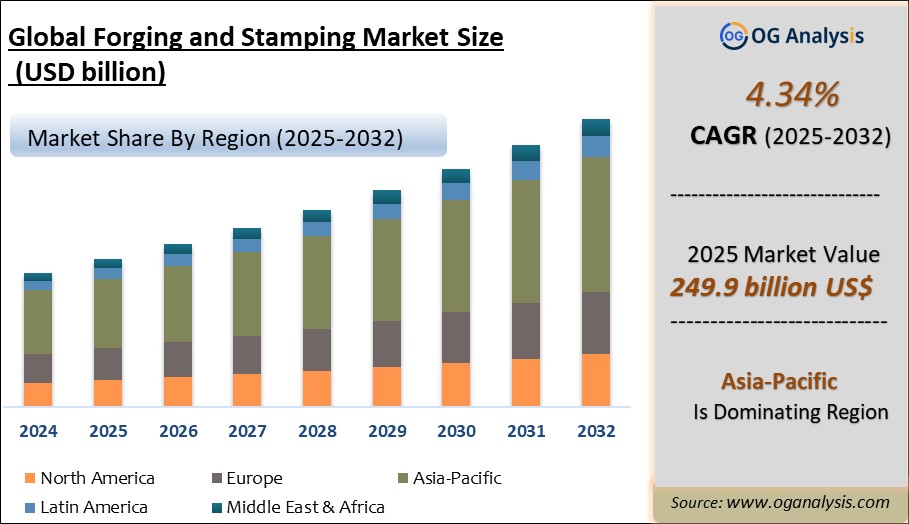

"The Global Forging And Stamping Market is valued at USD 249.9 billion in 2025. Worldwide sales of Forging And Stamping Market are expected to grow at a significant CAGR of 4.34%, reaching USD 336.4 billion by the end of the forecast period in 2032."

The forging and stamping industries are integral components of global manufacturing, providing critical processes for shaping metals into desired forms. Although these techniques have been utilized for centuries, they continue to advance through innovations in materials science, automation, and industrial applications. The global forging and stamping markets serve diverse sectors, including automotive, aerospace, construction, industrial machinery, and consumer goods.

Forging is a manufacturing process that involves shaping metal using localized compressive forces, typically delivered through hammering, pressing, or rolling. It is widely regarded as one of the oldest known metalworking processes, dating back to ancient blacksmithing techniques. Modern forging has evolved significantly, incorporating advanced machinery, precision tools, and automation to meet the demands of high-performance industries.

The global forging market is characterized by its ability to produce components with superior strength, durability, and structural integrity. These qualities make forged parts essential in industries such as automotive, aerospace, oil and gas, and power generation. Forged components are often used in critical applications where failure could result in catastrophic consequences, such as aircraft landing gear, turbine blades, and automotive crankshafts.

Key factors driving the demand for forged products include the increasing production of commercial vehicles, passenger cars, and aircraft. The automotive sector, in particular, remains the largest consumer of forged components, accounting for a significant share of the market. Forged parts are preferred in this industry due to their ability to withstand high stress and fatigue, making them ideal for engine components, transmission systems, and chassis parts. In terms of materials, steel remains the dominant material in forging due to its versatility, strength, and cost-effectiveness. However, there is a growing demand for lightweight materials such as aluminum and titanium, particularly in the aerospace and automotive industries. These materials offer weight reduction benefits without compromising performance, aligning with the trend toward fuel efficiency and sustainability.

Geographically, Asia Pacific dominates the forging market, driven by robust industrialization and the presence of major automotive and aerospace hubs in countries like China, India, and Japan. North America and Europe also hold significant market shares, supported by advanced manufacturing capabilities and stringent quality standards. The Middle East and Africa are emerging markets, with growth fueled by investments in infrastructure and energy projects.

Asia Pacific is the leading region in the forging and stamping market, propelled by rapid industrialization, robust automotive production, and increasing infrastructure development across emerging economies.

Automotive components dominate the segment, fueled by rising vehicle manufacturing, stringent quality standards, and the growing demand for high-strength, precision-engineered parts.

Surge in Demand for Lightweight and High-Strength Materials: One of the most influential trends in the forging and stamping market is the escalating demand for lightweight yet high-strength materials, particularly from the automotive, aerospace, and defense industries. As manufacturers aim to reduce overall product weight without compromising on structural integrity or safety, materials such as advanced high-strength steels (AHSS), titanium alloys, and aluminum are increasingly favored. This shift is driven largely by regulatory pressures to enhance fuel efficiency and reduce carbon emissions, which in turn motivates OEMs to adopt lightweight components produced through forging and stamping. These advanced materials, while difficult to machine traditionally, are well-suited to hot and cold forging processes that can handle high tensile strength.

Expanding Automotive Production and Growing Adoption of EVs: The global shift toward electric vehicles (EVs) and sustained demand for internal combustion engine (ICE) vehicles in emerging markets continues to boost forging and stamping processes, which are essential for manufacturing critical auto components. Forging is widely used for engine parts, gears, and bearings, while stamping is integral to body structures, chassis, and safety components. With automotive OEMs under pressure to improve fuel efficiency, reduce emissions, and optimize performance, lightweight stamped parts made from high-strength steel and aluminum have become increasingly important. Additionally, EV platforms require unique stamped components for battery trays, motor housings, and high-performance suspension systems, all of which intensify the demand for precision forging and stamping operations.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Process, By Material and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Forging And Stamping Market Segmentation

By Process

- Food & Beverage

- Pharmaceuticals

- Cosmetics

- Livestock

- Others

By Material

- Powder

- Granules

- Other

By End-User Industry

- Carbon Steels

- Acidity Regulators

- Preservatives

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Market Players Presented in the Report Include

- American Axle & Manufacturing Holdings Inc.

- ASAHI FORGE CORPORATION

- ATI Inc.

- Berkshire Hathaway Inc. (Precision Castparts Corp.)

- Bharat Forge Limited

- Bruck GmbH

- Canada Forgings Inc.

- China First Heavy Machinery Co., Ltd.

- Diehl Metall

- ELLWOOD Group Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Larsen & Toubro Ltd.

- Manor Tool & Manufacturing Company

- NIPPON STEEL CORPORATION

- Precision Castparts Corp.

- Trenton Forging

1. TABLE OF CONTENTS

1.1. List of TABLES

1.2. LIST of FIGURES

2. GLOBAL FORGING AND STAMPING INDUSTRY

2.1. Market Scope and Definition

2.2. Study Assumptions

3. FORGING AND STAMPING MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2024-2032

3.1. Forging And Stamping Market Latest Trends

3.1.1. Surge in Demand for Lightweight and High-Strength Materials

3.1.2. Automation and Industry 4.0 Integration

3.1.3. Rising Localization of Supply Chain

3.1.4. Sustainability and Green Manufacturing Practices

3.1.5. Growth in Defense and Heavy Engineering Sectors

3.2. Forging And Stamping Market Insights, 2024-2032

3.2.1. Leading Forging And Stamping Process, 2024-2032

3.2.2. Top Forging And Stamping Material, 2024-2032

3.2.1. Largest Forging And Stamping End-User Industry, 2024-2032

3.2.2. Fast-Growing Geographies for Forging And Stamping, 2024-2032

3.3. Forging And Stamping Market Drivers to 2031

3.4. Forging And Stamping Market Restraints

3.5. Forging And Stamping Market-Five Forces Analysis

4. GLOBAL FORGING AND STAMPING MARKET VALUE, MARKET SHARE, AND FORECAST TO 2032

4.1. Global Forging And Stamping Market Overview, 2024

4.2. Global Forging And Stamping Market Size and Share Outlook By Process, 2024-2032

4.2.1. Metal Stamping

4.2.2. Forging

4.2.3. Custom Roll Forming

4.2.4. Other

4.3. Global Forging And Stamping Market Size and Share Outlook, By Material, 2024-2032

4.3.1. Forging And Stamping Market, By Material, Aluminum

4.3.2. Forging And Stamping Market, By Material, Titanium

4.3.3. Forging And Stamping Market, By Material, Stainless Steel

4.3.4. Forging And Stamping Market, By Material, Magnesium

4.3.5. Forging And Stamping Market, By Material, Alloy Steel

4.3.6. Forging And Stamping Market, By Material, Carbon Steel

4.3.7. Forging And Stamping Market, By Material, Others

4.4. Global Forging And Stamping Market Size and Share Outlook, By End-User Industry, 2024-2032

4.4.1. Forging And Stamping Market, By End-User Industry, Electricals & Electronics

4.4.2. Forging And Stamping Market, By End-User Industry, Medical

4.4.3. Forging And Stamping Market, By End-User Industry, Industrial Machinery & Equipment

4.4.4. Forging And Stamping Market, By End-User Industry, Aerospace & Defense

4.4.5. Forging And Stamping Market, By End-User Industry, Automotive & Transportation

4.4.6. Forging And Stamping Market, By End-User Industry, Oil & Gas

4.4.7. Forging And Stamping Market, By End-User Industry, Construction

4.4.8. Forging And Stamping Market, By End-User Industry, Telecommunication

4.4.9. Forging And Stamping Market, By End-User Industry, Other

4.5. Global Forging And Stamping Market Size and Share Outlook by Region, 2024-2032

5. NORTH AMERICA FORGING AND STAMPING MARKET VALUE, MARKET SHARE, AND FORECAST TO 2032

5.1. North America Forging And Stamping Market Overview, 2024

5.2. North America Forging And Stamping Market Size and Share Outlook, By Process, 2024-2032

5.3. North America Forging And Stamping Market Size and Share Outlook by Material, 2024-2032

5.4. North America Forging And Stamping Market Size and Share Outlook by End-User Industry, 2024-2032

5.5. North America Forging And Stamping Market Size and Share Outlook by Country, 2024-2032

5.5.1. United States

5.5.2. Mexico

5.5.3. Canada

6. EUROPE FORGING AND STAMPING MARKET VALUE, MARKET SHARE, AND FORECAST TO 2032

6.1. Europe Forging And Stamping Market Overview, 2024

6.2. Europe Forging And Stamping Market Size and Share Outlook, By Process, 2024-2032

6.3. Europe Forging And Stamping Market Size and Share Outlook by Material, 2024-2032

6.4. Europe Forging And Stamping Market Size and Share Outlook by End-User Industry, 2024-2032

6.5. Europe Forging And Stamping Market Size and Share Outlook by Country, 2024-2032

6.5.1. Germany

6.5.2. UK

6.5.3. France

6.5.4. Spain

6.5.5. Italy

6.5.6. Russia

6.5.7. Rest of Europe

7. ASIA PACIFIC FORGING AND STAMPING MARKET VALUE, MARKET SHARE AND FORECAST TO 2032

7.1. Asia Pacific Forging And Stamping Market Overview, 2024

7.2. Asia Pacific Forging And Stamping Market Size and Share Outlook, By Process, 2024-2032

7.3. Asia Pacific Forging And Stamping Market Size and Share Outlook by Material, 2024-2032

7.4. Asia Pacific Forging And Stamping Market Size and Share Outlook by End-User Industry, 2024-2032

7.5. Asia Pacific Forging And Stamping Market Size and Share Outlook by Country, 2024-2032

7.5.1. India

7.5.2. China

7.5.3. Taiwan

7.5.4. South Korea

7.5.5. Australia

7.5.6. Japan

7.5.7. Rest of Asia Pacific

8. SOUTH AND CENTRAL AMERICA FORGING AND STAMPING MARKET VALUE, MARKET SHARE AND FORECAST TO 2032

8.1. South and Central America Forging And Stamping Market Overview, 2024

8.2. South and Central America Forging And Stamping Market Size and Share Outlook, By Process, 2024-2032

8.3. South and Central America Forging And Stamping Market Size and Share Outlook by Material, 2024-2032

8.4. South and Central America Forging And Stamping Market Size and Share Outlook by End-User Industry, 2024-2032

8.5. South and Central America Forging And Stamping Market Size and Share Outlook by Country, 2024-2032

8.5.1. Brazil

8.5.2. Argentina

8.5.3. Chile

8.5.4. Rest of SCA

9. MIDDLE EAST AFRICA FORGING AND STAMPING MARKET VALUE, MARKET SHARE AND FORECAST TO 2032

9.1. Middle East Africa Forging And Stamping Market Overview, 2024

9.2. Middle East Africa Forging And Stamping Market Size and Share Outlook, By Process, 2024-2032

9.3. Middle East Africa Forging And Stamping Market Size and Share Outlook by Material, 2024-2032

9.4. Middle East Africa Forging And Stamping Market Size and Share Outlook by End-User Industry, 2024-2032

9.5. Middle East Africa Forging And Stamping Market Size and Share Outlook by Country, 2024-2032

9.5.1. Saudi Arabia

9.5.2. UAE

9.5.3. South Africa

9.5.4. Iran

9.5.5. Rest of MEA

10. FORGING AND STAMPING MARKET STRUCTURE

10.1. Magna International Inc.

10.2. American Axle & Manufacturing Holdings, Inc.

10.3. Thyssenkrupp AG

10.4. China First Heavy Industries

10.5. Bharat Forge Limited

10.6. Illinois Tool Works Inc.

10.7. Smith & Wesson Brands, Inc.

11. APPENDIX

11.1. About Us

11.2. Sources

11.3. Research Methodology

11.4. Research Process

11.5. Research Execution

11.6. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!