"The Global Frozen Freeze Dried Pet Foods Market was valued at USD 90.52 billion in 2025 and is projected to reach USD 202 billion by 2034, growing at a CAGR of 9.33%."

The frozen freeze-dried pet foods market represents a rapidly evolving segment within the broader pet food industry, catering to the growing demand for high-quality, nutrient-dense, and minimally processed pet nutrition. Freeze-drying technology preserves the nutritional integrity, flavor, and texture of raw ingredients while extending shelf life without the need for artificial preservatives. These products, available in frozen or freeze-dried formats, appeal to pet owners seeking convenient yet wholesome feeding options that mimic natural diets. Rising pet humanization trends, where owners treat pets as family members, are driving a preference for premium, functional, and grain-free formulas. Additionally, increasing awareness of the health benefits of raw and high-protein diets, particularly for digestive health, coat condition, and energy levels, is boosting adoption. Distribution is expanding across specialty pet stores, online channels, and large retail chains, offering consumers diverse product choices and delivery formats.

The market is experiencing dynamic growth, supported by innovation in flavors, formulations, and packaging that address specific dietary needs such as hypoallergenic, weight management, and age-specific nutrition. Manufacturers are focusing on sustainable sourcing, traceability, and clean-label ingredient transparency to meet evolving consumer expectations. Technological advancements in freeze-drying processes are improving product texture, rehydration speed, and nutrient retention, enhancing the feeding experience for both pets and owners. Regional expansion is prominent in North America and Europe, with Asia Pacific emerging as a high-potential market due to rising disposable incomes and urban pet adoption. The industry is also seeing collaborations between pet food brands and e-commerce platforms to strengthen direct-to-consumer sales. As health-conscious pet ownership continues to grow, the frozen freeze-dried pet foods market is poised for sustained expansion, driven by premiumization, product diversification, and increased awareness of natural pet nutrition.

Key Market Insights

- The frozen freeze-dried pet foods market is gaining momentum as pet owners increasingly seek high-quality, minimally processed nutrition that aligns with natural feeding practices. Freeze-drying preserves nutrients, flavor, and texture while ensuring extended shelf life without synthetic preservatives, making it a preferred option for health-conscious consumers.

- Rising pet humanization trends are driving demand for premium and functional diets, with many owners willing to pay a higher price for products that promote digestive health, joint mobility, healthy skin, and improved energy levels. This shift is fueling growth in the premium raw and grain-free product categories.

- Product diversification is accelerating, with manufacturers introducing tailored formulas to meet specific needs such as hypoallergenic diets, breed-specific nutrition, weight control, and life-stage requirements. This trend is expanding consumer choice and increasing brand differentiation in the market.

- E-commerce is becoming a critical sales channel, offering convenience, subscription models, and access to niche brands that may not be widely available in physical retail stores. Direct-to-consumer delivery services are also gaining popularity, enhancing brand loyalty and customer retention.

- Technological advancements in freeze-drying are improving rehydration speed, maintaining ingredient integrity, and enhancing overall product appeal. These innovations are reducing production costs over time, enabling broader accessibility without compromising on quality.

- Ingredient sourcing transparency is becoming a major consumer demand, with brands highlighting locally sourced meats, sustainable farming practices, and clean-label certifications. Ethical sourcing is now a strong selling point that influences purchasing decisions.

- North America remains the largest market due to high pet ownership rates, established distribution networks, and consumer willingness to spend on premium pet foods. However, Asia Pacific is expected to see the fastest growth due to rising disposable incomes and urban pet adoption trends.

- Retail expansion is occurring through partnerships with specialty pet stores, veterinary clinics, and large supermarket chains, creating multiple touchpoints for consumers to discover and purchase these products.

- Environmental sustainability is influencing product development, with some companies adopting recyclable or biodegradable packaging and exploring alternative proteins to reduce ecological impact while maintaining nutritional quality.

- Marketing strategies are increasingly focusing on pet wellness education, highlighting the health benefits of freeze-dried nutrition through influencer partnerships, social media campaigns, and in-store demonstrations to boost consumer awareness and engagement.

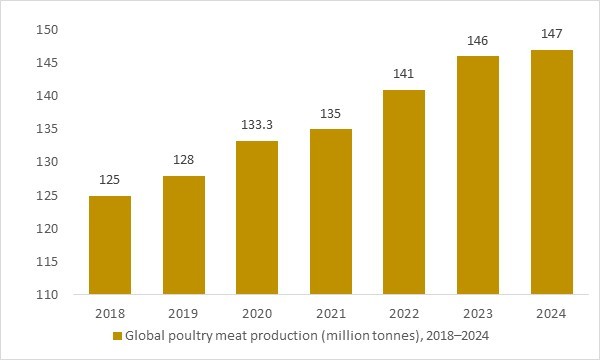

Global poultry meat production (million tonnes), 2018–2024

Figure:Global poultry meat production (million tonnes), 2018–2024 – a key raw material indicator for the global frozen and freeze dried pet foods market.

- Global poultry meat production has continuously expanded from 2018 to 2024, providing a solid raw-material foundation for the growth of the frozen and freeze dried pet foods market. As poultry remains the leading animal protein used in premium pet nutrition, this rising supply supports manufacturers in developing high-protein, minimally processed diets that appeal to pet owners seeking natural and nutritionally rich feeding options, ultimately driving positive market outlook and investment interest.

Regional Insights

North America Frozen Freeze Dried Pet Foods Market

The North America frozen freeze dried pet foods market is propelled by high pet ownership, strong premiumization, and widespread acceptance of raw-inspired diets supported by specialty retail and robust e-commerce fulfillment. Opportunities are expanding in functional formulations that target digestive health, joint mobility, and weight management, as well as in transparent sourcing and limited-ingredient recipes that address sensitivities. Latest trends include subscription-based replenishment, veterinary co-branded lines, and sustainable packaging that reduces material footprint while preserving product integrity. The forecast indicates sustained growth as brands deepen omni-channel reach, optimize cold-chain logistics for frozen formats, and scale manufacturing to stabilize costs. Recent developments feature partnerships between independent brands and large distributors, expansion of regional production facilities to shorten lead times, and collaborations with pet wellness platforms to enhance education and drive repeat purchase.

Asia Pacific Frozen Freeze Dried Pet Foods Market

In Asia Pacific, rapid urbanization, rising disposable incomes, and evolving pet humanization are accelerating adoption of premium freeze dried and frozen diets, though awareness and price sensitivity vary across markets. Companies find lucrative opportunities in smaller pack sizes, localized protein choices, and education-led marketing that demystifies rehydration and portioning for first-time buyers. Key trends include marketplace-centric launches, cross-border direct-to-consumer models, and partnerships with veterinary networks to build clinical credibility. The forecast points to faster-than-average expansion as domestic manufacturing ramps, import channels diversify, and retailers allocate more shelf space to raw-inspired formats. Recent developments include brand entries through online megastores, co-manufacturing agreements that ensure supply continuity, and investments in regional freeze-drying capacity to enhance freshness, traceability, and cost control.

Europe Frozen Freeze Dried Pet Foods Market

Europe’s market is shaped by stringent quality standards, strong interest in natural ingredients, and a mature specialty retail ecosystem that favors detailed labeling and sustainability claims. Opportunities exist in novel proteins, organic and ethically sourced inputs, and recipes tailored to breed size and life stage, supported by recyclable or compostable packaging solutions. Trends include growth of veterinarian-guided feeding plans, expansion of mixed-feeding routines that combine kibble with freeze dried toppers, and increasing use of lifecycle assessments to substantiate environmental benefits. The forecast suggests steady expansion as consumers trade up to minimally processed diets and retailers broaden private label offerings to compete on value and provenance. Recent developments highlight certification-driven product launches, distributor consolidation to enhance coverage across markets, and technology investments that improve rehydration performance and palatability without compromising nutrient retention.

Report Scope

| Parameter | Frozen freeze dried pet foods Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Frozen Freeze Dried Pet Foods Market Segments Covered In The Report

By Product

- Frozen Pet Food

- Freeze-Dried Pet Food

By Source

- Synthetic

- Plant-Based

- Animal-Based

By Pet Type

- Dog

- Cat

- Fish

- Other Pet Types

By Distribution Channel

- Supermarkets Or Hypermarkets

- Specialty Pet Stores

- Online

- Other Distribution Channels

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

- Mars Inc.

- Merrick Pet Care

- Stella & Chewy's LLC

- WellPet

- Ziwi Peak

- Nature's Variety

- L Catterton

- Primal Pet Foods Inc.

- Nutro Co.

- Bravo Pet Foods

- Carnivore Meat Company LLC

- Deuerer

- Natura Pet Products Inc.

- NRG Dog Products

- Canvasback Pet Supplies

- Steve's Real Food

- Kelly & Company

- Grandma Lucy's

- Harmony House

- K9 Natural Ltd.

- Vital Essentials

Recent Industry Developments

- August 2025 – Formula Raw opened a new, USDA-approved 15,000 sq ft facility in Canada, quadrupling its freeze-dried production capacity and enabling its premium products to officially enter the U.S. market.

- July 2025 – Kelly & Co’s secured its fourth consecutive “Brand of the Year” title in the freeze-dried pet treats category at the World Branding Awards for 2025–2026.

- June 2025 – Woof Gang introduced a new Freeze-Dried Raw pet food line in the U.S., offering complete meals, functional toppings, and single-ingredient treats free from fillers and artificial ingredients.

- June 2025 – Ultimate Pet Nutrition launched its Nutra Complete freeze-dried dog food and Nutra Thrive supplement across 650 Pet Supplies Plus stores nationwide, marking its largest retail expansion to date.

- April 2025 – Stella & Chewy’s expanded its distribution by making a full range of premium raw and freeze-dried pet food products available at H-E-B supermarket chains starting that spring.

- March 2025 – We Feed Raw introduced a new Freeze-Dried Raw Food for Dogs, featuring two premium recipes (Grass-fed Beef and Cage-free Chicken) made with 85 % animal protein, human-grade meats, and free from grains and artificial preservatives.

- March 2025 – Catit (Hagen Group) debuted its Double Fusion Freeze-Dried cat food line combining freeze-dried raw-infused kibble with raw bites, across six recipes tailored for life stages and health concerns at Global Pet Expo.

What You Receive

• Global Frozen Freeze Dried Pet Foods market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Frozen Freeze Dried Pet Foods.

• Frozen Freeze Dried Pet Foods market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Frozen Freeze Dried Pet Foods market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Frozen Freeze Dried Pet Foods market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Frozen Freeze Dried Pet Foods market, Frozen Freeze Dried Pet Foods supply chain analysis.

• Frozen Freeze Dried Pet Foods trade analysis, Frozen Freeze Dried Pet Foods market price analysis, Frozen Freeze Dried Pet Foods Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Frozen Freeze Dried Pet Foods market news and developments.

The Frozen Freeze Dried Pet Foods Market international scenario is well established in the report with separate chapters on North America Frozen Freeze Dried Pet Foods Market, Europe Frozen Freeze Dried Pet Foods Market, Asia-Pacific Frozen Freeze Dried Pet Foods Market, Middle East and Africa Frozen Freeze Dried Pet Foods Market, and South and Central America Frozen Freeze Dried Pet Foods Markets. These sections further fragment the regional Frozen Freeze Dried Pet Foods market by type, application, end-user, and country.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Frozen Freeze Dried Pet Foods Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Frozen Freeze Dried Pet Foods Market Overview

2.2 Market Strategies of Leading Frozen Freeze Dried Pet Foods Companies

2.3 Frozen Freeze Dried Pet Foods Market Insights, 2024 - 2034

2.3.1 Leading Frozen Freeze Dried Pet Foods Types, 2024 - 2034

2.3.2 Leading Frozen Freeze Dried Pet Foods End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Frozen Freeze Dried Pet Foods sales, 2024 - 2034

2.4 Frozen Freeze Dried Pet Foods Market Drivers and Restraints

2.4.1 Frozen Freeze Dried Pet Foods Demand Drivers to 2034

2.4.2 Frozen Freeze Dried Pet Foods Challenges to 2034

2.5 Frozen Freeze Dried Pet Foods Market- Five Forces Analysis

2.5.1 Frozen Freeze Dried Pet Foods Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Frozen Freeze Dried Pet Foods Market Value, Market Share, and Forecast to 2034

3.1 Global Frozen Freeze Dried Pet Foods Market Overview, 2024

3.2 Global Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

3.4 Global Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

3.5 Global Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

3.6 Global Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

3.7 Global Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Frozen Freeze Dried Pet Foods Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Frozen Freeze Dried Pet Foods Market Overview, 2024

4.2 Asia Pacific Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

4.4 Asia Pacific Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

4.5 Asia Pacific Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

4.6 Asia Pacific Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

4.7 Asia Pacific Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Frozen Freeze Dried Pet Foods Market Value, Market Share, and Forecast to 2034

5.1 Europe Frozen Freeze Dried Pet Foods Market Overview, 2024

5.2 Europe Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

5.4 Europe Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

5.5 Europe Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

5.6 Europe Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

5.7 Europe Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Country, 2024 - 2034

6. North America Frozen Freeze Dried Pet Foods Market Value, Market Share and Forecast to 2034

6.1 North America Frozen Freeze Dried Pet Foods Market Overview, 2024

6.2 North America Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

6.4 North America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

6.5 North America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

6.6 North America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

6.7 North America Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Frozen Freeze Dried Pet Foods Market Value, Market Share and Forecast to 2034

7.1 South and Central America Frozen Freeze Dried Pet Foods Market Overview, 2024

7.2 South and Central America Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

7.4 South and Central America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

7.5 South and Central America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

7.6 South and Central America Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

7.7 South and Central America Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Frozen Freeze Dried Pet Foods Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Frozen Freeze Dried Pet Foods Market Overview, 2024

8.2 Middle East and Africa Frozen Freeze Dried Pet Foods Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Product, 2024 - 2034

8.4 Middle East Africa Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Source, 2024 - 2034

8.5 Middle East Africa Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Pet Type, 2024 – 2034

8.6 Middle East Africa Frozen Freeze Dried Pet Foods Market Size and Share Outlook By Distribution Channel, 2024 - 2034

8.7 Middle East Africa Frozen Freeze Dried Pet Foods Market Size and Share Outlook by Country, 2024 - 2034

9. Frozen Freeze Dried Pet Foods Market Structure

9.1 Key Players

9.2 Frozen Freeze Dried Pet Foods Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Frozen Freeze Dried Pet Foods Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Frozen Freeze Dried Pet Foods Market is estimated to generate USD 90.52 billion in revenue in 2025.

The Global Frozen Freeze Dried Pet Foods Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.33% during the forecast period from 2025 to 2034.

The Frozen Freeze Dried Pet Foods Market is estimated to reach USD 202 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!