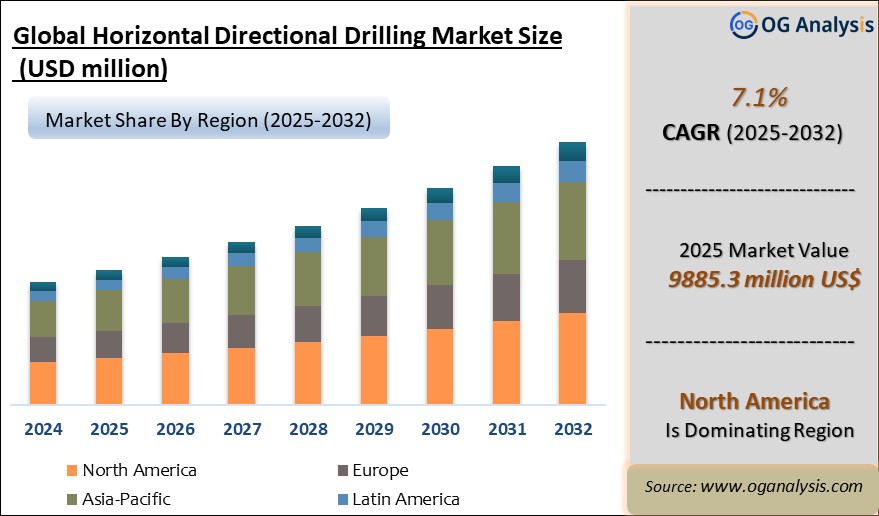

The Horizontal Directional Drilling Market is estimated at USD 8,687 million in 2023. Further, the market is expected to grow from USD 9,230 million in 2024 to USD 15,046 million in 203 at a CAGR of 7.1%.

Horizontal directional drilling (HDD) is a trenchless technology used to install underground pipelines, conduits, and cables without the need for extensive excavation. By drilling a pilot bore along a predetermined path, then enlarging the hole and pulling in piping or utilities, HDD minimises surface disruption, reduces environmental impact, and accelerates project timelines. The market for HDD equipment and services spans oil & gas pipeline installation, fiber-optic and power cable deployment, water and sewer line replacements, and renewable energy site access. Growth is driven by increasing investments in smart grid infrastructure, broadband rollouts, and the need to retrofit aging underground utilities in urban centres. Technological advances—such as steerable drill heads, real-time monitoring systems, and synthetic drilling fluids—have enhanced accuracy, reduced down-time, and expanded HDD applicability to harder rock formations and longer bore lengths.

Regionally, North America leads HDD adoption with mature oil & gas networks and large-scale broadband projects, while Europe is following suit through stringent environmental regulations favouring trenchless solutions. Asia Pacific is the fastest-growing market, propelled by urbanisation, municipal water infrastructure upgrades, and aggressive rural broadband initiatives in China and India. Manufacturers are focusing on modular drilling rigs, electrified powertrains, and integrated data analytics to optimise drilling performance and lower operating costs. However, challenges such as high initial equipment investment, operator skill requirements, and variable subsurface conditions can hinder project feasibility. Overall, the HDD market outlook remains positive as public and private stakeholders prioritise infrastructure renewal, digital connectivity, and sustainable construction methods, ensuring continued demand for trenchless technology solutions worldwide.

Conventional HDD systems are the largest segment by type due to their established reliability, lower upfront costs, and widespread availability of parts and service networks. Operators favor conventional rigs for standard bore applications where precise directional control is less critical, reinforcing their dominance in oil & gas, utilities, and telecom projects globally.

Rotary steerable systems are the fastest-growing type as they deliver enhanced precision, faster drilling rates, and reduced re-drills in complex or long-radius bores. Their ability to maintain continuous rotation while steering improves operational efficiency, making them increasingly preferred for challenging subsurface conditions and high-value infrastructure installations.

Rigs constitute the largest parts segment, accounting for the bulk of HDD equipment expenditure. High capital investment in drilling rigs—with features like increased torque, depth capacity, and automation—drives rig sales and rental revenues, as operators upgrade fleets to tackle deeper and longer bores.

Drill bits represent the fastest-growing parts segment due to their high wear rates and frequent replacement cycle. Advances in bit design and materials—such as polycrystalline diamond compact (PDC) cutters—boost performance in abrasive formations, driving robust demand for next-gen bits in HDD operations.

Key Insights

-

HDD is widely used for crossing waterways, roads, and railways without open trenching, preserving surface integrity and reducing restoration costs. This makes it essential for urban utility replacement and expansion projects.

-

Steerable drill heads and downhole instrumentation provide real-time directional control, enabling precise bore trajectories over distances exceeding 1,000 metres and through complex geology, improving first-pass success rates.

-

North America accounts for the largest share of HDD revenues due to extensive oil & gas pipeline networks and fibre-optic broadband deployments, supported by well-developed service provider ecosystems and equipment fleets.

-

Asia Pacific is the fastest-growing region as governments invest in water infrastructure upgrades, rural broadband access, and cross-border pipeline projects, driving increased HDD equipment procurement and service contracts.

-

Synthetic and polymer-based drilling fluids enhance bore hole stability, minimize fluid loss, and protect sensitive aquifers, addressing both environmental compliance and operational efficiency in varied soil conditions.

-

Electric and hybrid HDD rigs are emerging to reduce fuel consumption and emissions, aligning with corporate sustainability goals and urban noise ordinances, while maintaining torque and pullback performance.

-

Service providers increasingly bundle HDD with utility mapping and subsurface utility engineering (SUE) to de-risk projects, leveraging 3D detection technologies and geophysical surveys for optimal drill planning.

-

Operators require specialised training and certification to manage sophisticated HDD rigs and fluid systems, creating a competitive advantage for contractors with skilled workforces and safety management programs.

-

Key OEMs and service firms are collaborating on digital platforms that integrate rig telemetry, drill bit wear analytics, and predictive maintenance alerts to maximize uptime and reduce unplanned service calls.

-

Government incentives for trenchless infrastructure and tight timelines for utility relocations during highway expansions continue to drive HDD adoption as a cost-effective alternative to traditional open-cut methods.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Parts, By End-Use By sales channel |

| Countries Covered |

North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Segmentation

By Type

- Conventional

- Rotary Steerable System

By Parts

- Rigs

- Pipes

- Bits

- Others

By Sales Channel

- Onshore

- Offshore

By End-Use

- Oil & Gas

- Utility

- Telecommunication

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA

Companies Mentioned

The Toro Company

Halliburton Company

Baker Hughes Co.

Schlumberger Ltd.

Ditch Witch, Ltd.

What You Receive

• Global Horizontal Directional Drilling market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Horizontal Directional Drilling.

• Horizontal Directional Drilling market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Horizontal Directional Drilling market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Horizontal Directional Drilling market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Horizontal Directional Drilling market, Horizontal Directional Drilling supply chain analysis.

• Horizontal Directional Drilling trade analysis, Horizontal Directional Drilling market price analysis, Horizontal Directional Drilling Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Horizontal Directional Drilling market news and developments.

The Horizontal Directional Drilling Market international scenario is well established in the report with separate chapters on North America Horizontal Directional Drilling Market, Europe Horizontal Directional Drilling Market, Asia-Pacific Horizontal Directional Drilling Market, Middle East and Africa Horizontal Directional Drilling Market, and South and Central America Horizontal Directional Drilling Markets. These sections further fragment the regional Horizontal Directional Drilling market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Horizontal Directional Drilling market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Horizontal Directional Drilling market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Horizontal Directional Drilling market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Horizontal Directional Drilling business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Horizontal Directional Drilling Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Horizontal Directional Drilling Pricing and Margins Across the Supply Chain, Horizontal Directional Drilling Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Horizontal Directional Drilling market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

TABLE OF CONTENTS

1. GLOBAL HORIZONTAL DIRECTIONAL DRILLING INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. HORIZONTAL DIRECTIONAL DRILLING MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023-2031

2.1. Horizontal Directional Drilling Market Latest Trends

2.1.1. NEW WELL DISCOVERIES & ADVANCES IN TECHNOLOGY ALLOW FOR OFFSHORE DEEPWATER DRILLING

2.1.2. AUTOMATION IN HDD

2.1.3. INCREASING FOCUS ON RENEWABLE ENERGY

2.1.4. GROWING NUMBER OF PRODUCT LAUNCHES BY KEY PLAYERS & SIGNIFICANT INVESTMENTS

2.1.5. INCREASING INVESTMENTS IN UNTAPPED OIL & GAS RESERVES

2.1.6. RECENT DEVELOPMENTS IN THE HDD MARKET

2.2. Horizontal Directional Drilling Market Insights, 2023-2031

2.2.1. Leading Horizontal Directional Drilling Type, 2023-2031

2.2.2. Dominant Horizontal Directional Drilling Parts, 2023-2031

2.2.3. Leading Horizontal Directional Drilling Application, 2023-2031

2.2.4. Dominant Horizontal Directional Drilling End-use, 2023-2031

2.2.5. Fast-Growing Geographies for Horizontal Directional Drilling, 2023-2031

2.3. Horizontal Directional Drilling Demand Drivers to 2031

2.3.1. RISING FIBER INSTALLATIONS

2.3.2. GROWTH IN HDD RIGS

2.3.3. BENEFITS OF HORIZONTAL DIRECTIONAL DRILLING

2.3.4. EVOLVING OIL & GAS SECTOR & STRONG PRODUCTION ACTIVITIES

2.3.5. RISING URBANIZATION & GROWING EMPHASIS ON ENVIRONMENT-FRIENDLY TECHNOLOGIES

2.4. Horizontal Directional Drilling Challenges to 2031

2.4.1. LACK OF SKILLED TECHNICIANS

2.4.2. HIGH COST AND RIG & EQUIPMENT SHORTAGES

2.4.3. RISKS ASSOCIATED WITH DRILLING ACTIVITIES

2.4.4. COVID-19 IMPACT ON HORIZONTAL DIRECTIONAL DRILLING MARKET

2.5. Horizontal Directional Drilling Market-Five Forces Analysis

3. GLOBAL HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE, AND FORECAST FOR 2031

3.1. Global Horizontal Directional Drilling Market Overview, 2023

3.2. Global Horizontal Directional Drilling Market Size and Share Outlook, By Type, 2023-2031

3.2.1. Conventional

3.2.2. Rotary Steerable System

3.3. Global Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

3.3.1. Rigs

3.3.2. Pipes

3.3.3. Bits

3.3.4. Others

3.4. Global Horizontal Directional Drilling Market Size and Share Outlook, By Application, 2023-2031

3.4.1. Onshore

3.4.2. Offshore

3.5. Global Horizontal Directional Drilling Market Size and Share Outlook, By End-use, 2023-2031

3.5.1. Oil & Gas

3.5.2. Utility

3.5.3. Telecommunication

3.5.4. Others

3.6. Global Horizontal Directional Drilling Market Size and Share Outlook by Region, 2023-2031

4. NORTH AMERICA HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

4.1. North America Horizontal Directional Drilling Market Overview, 2023

4.2. North America Horizontal Directional Drilling Market Size and Share Outlook by Type, 2023-2031

4.3. North America Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

4.4. North America Horizontal Directional Drilling Market Size and Share Outlook By Application, 2023-2031

4.5. North America Horizontal Directional Drilling Market Size and Share Outlook By End-use, 2023-2031

4.6. North America Horizontal Directional Drilling Market Size and Share Outlook by Country, 2023-2031

4.6.1. United States

4.6.2. Canada

4.6.3. Mexico

5. EUROPE HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE, AND FORECAST TO 2031

5.1. Europe Horizontal Directional Drilling Market Overview, 2023

5.2. Europe Horizontal Directional Drilling Market Size and Share Outlook by Type, 2023-2031

5.3. Europe Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

5.4. Europe Horizontal Directional Drilling Market Size and Share Outlook By Application, 2023-2031

5.5. Europe Horizontal Directional Drilling Market Size and Share Outlook By End-use, 2023-2031

5.6. Europe Horizontal Directional Drilling Market Size and Share Outlook by Country, 2023-2031

5.6.1. Germany

5.6.2. France

5.6.3. UK

5.6.4. Italy

5.6.5. Spain

5.6.6. Rest of Europe

6. ASIA PACIFIC HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

6.1. Asia Pacific Horizontal Directional Drilling Market Overview, 2023

6.2. Asia Pacific Horizontal Directional Drilling Market Size and Share Outlook by Type, 2023-2031

6.3. Asia Pacific Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

6.4. Asia Pacific Horizontal Directional Drilling Market Size and Share Outlook By Application, 2023-2031

6.5. Asia Pacific Horizontal Directional Drilling Market Size and Share Outlook By End-use, 2023-2031

6.6. Asia Pacific Horizontal Directional Drilling Market Size and Share Outlook by Country, 2023-2031

6.6.1. China

6.6.2. Japan

6.6.3. India

6.6.4. Rest of Asia Pacific

7. SOUTH AND CENTRAL AMERICA HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

7.1. South and Central America Horizontal Directional Drilling Market Overview, 2023

7.2. South and Central America Horizontal Directional Drilling Market Size and Share Outlook by Type, 2023-2031

7.3. South and Central America Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

7.4. South and Central America Horizontal Directional Drilling Market Size and Share Outlook By Application, 2023-2031

7.5. South and Central America Horizontal Directional Drilling Market Size and Share Outlook By End-use, 2023-2031

7.6. South and Central America Horizontal Directional Drilling Market Size and Share Outlook by Country, 2023-2031

7.6.1. Brazil

7.6.2. Argentina

7.6.3. Rest of South and Central America

8. MIDDLE EAST AFRICA HORIZONTAL DIRECTIONAL DRILLING MARKET VALUE, MARKET SHARE AND FORECAST TO 2031

8.1. Middle East Africa Horizontal Directional Drilling Market Overview, 2023

8.2. Middle East Africa Horizontal Directional Drilling Market Size and Share Outlook by Type, 2023-2031

8.3. Middle East Africa Horizontal Directional Drilling Market Size and Share Outlook, By Parts, 2023-2031

8.4. Middle East Africa Horizontal Directional Drilling Market Size and Share Outlook By Application, 2023-2031

8.5. Middle East Africa Horizontal Directional Drilling Market Size and Share Outlook By End-use, 2023-2031

8.6. Middle East Africa Horizontal Directional Drilling Market Size and Share Outlook by Country, 2023-2031

8.6.1. Middle East

8.6.2. Africa

9. OPERATIONAL DRILLING RIG DATA

9.1. Operational Drilling Rigs, by Region and Key Countries

9.2. Operational Horizontal Drilling Rigs, by Region and Key Countries

10. HORIZONTAL DIRECTIONAL DRILLING MARKET STRUCTURE

10.1. THE TORO COMPANY

10.2. HALLIBURTON COMPANY

10.3. BAKER HUGHES CO.

10.4. SCHLUMBERGER LTD.

10.5. DITCH WITCH, LTD.

11. APPENDIX

11.1. About Us

11.2. Sources

11.3. Research Methodology

11.4. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!