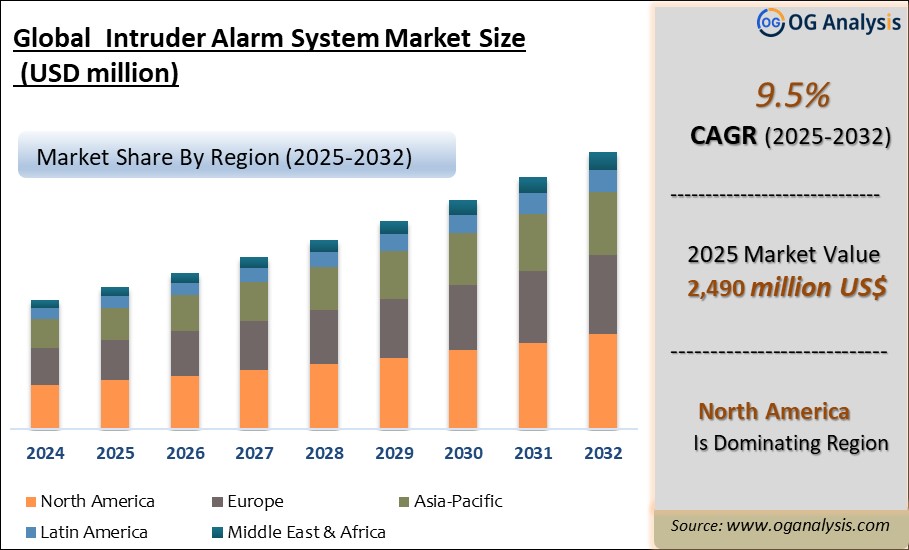

"The Global Intruder Alarm System Market Size was valued at USD 2,863 million in 2024 and is projected to reach USD 3,085 million in 2025. Worldwide sales of Intruder Alarm System are expected to grow at a significant CAGR of 9.5%, reaching USD 6,554 million by the end of the forecast period in 2034."

The global intruder alarm system market is evolving rapidly as security and surveillance technologies become increasingly vital across residential, commercial, and industrial sectors. These systems, designed to detect unauthorized entry or intrusion into properties, integrate sensors, motion detectors, and control panels to provide real-time alerts. With rising crime rates, urbanization, and heightened security awareness, the adoption of intelligent alarm systems is surging. Moreover, the integration of IoT, AI-based analytics, and wireless connectivity has transformed traditional alarm systems into smart, automated security networks. Governments and enterprises are investing heavily in advanced monitoring infrastructure to ensure safety and operational continuity, driving the market forward. The growing trend toward smart homes, coupled with technological advancements such as mobile app control and cloud-based monitoring, is expanding market accessibility and user convenience. In addition, declining hardware costs and the proliferation of connected devices are democratizing access to security solutions across emerging economies.

From a strategic standpoint, the market is witnessing consolidation and innovation, with leading manufacturers focusing on intelligent alarm panels, multi-sensor fusion technologies, and integrated command platforms. Vendors are emphasizing compatibility with broader building automation ecosystems, enabling centralized control of lighting, HVAC, and security systems. In commercial applications, retail, banking, and data centers are key adopters due to high-value asset protection needs. Industrial facilities and warehouses are leveraging these systems for perimeter security and access control integration. Meanwhile, residential customers are increasingly turning to wireless and app-based alarms due to ease of installation and remote management features. Regulatory compliance, insurance benefits, and the push toward smart city development are further catalyzing market growth. Overall, the intruder alarm system market is transitioning from reactive defense mechanisms to predictive, intelligent ecosystems that enhance both physical and digital security postures across global infrastructures.

Key Insights Of Market

- Rising urbanization and smart infrastructure investments are fueling large-scale deployment of intruder alarm systems in cities worldwide. As governments implement smart city projects, connected alarm systems are being integrated into traffic management, surveillance, and emergency response networks. This convergence of IoT and security infrastructure enhances situational awareness and enables real-time monitoring across critical zones such as airports, public spaces, and transportation hubs. The increasing emphasis on public safety and digital governance is accelerating the adoption of next-generation intrusion detection systems.

- Technological convergence with IoT and AI is transforming the market landscape. Traditional alarm systems are evolving into intelligent, connected ecosystems capable of learning user behavior patterns and differentiating between genuine threats and false alarms. AI-driven algorithms enhance motion detection accuracy, while IoT connectivity enables remote access, automation, and cloud-based control. This evolution toward predictive security systems is creating new opportunities for manufacturers to deliver advanced, self-learning devices that enhance both reliability and operational efficiency.

- Rising residential adoption due to smart home integration is a defining trend across developed and emerging economies. Consumers are increasingly deploying wireless intruder alarm systems compatible with voice assistants and mobile applications. Integration with smart locks, lighting, and surveillance cameras has turned home security into a comprehensive digital experience. The convenience of DIY installation, app-based notifications, and compatibility with smart ecosystems like Alexa and Google Home is driving mass adoption among tech-savvy homeowners seeking customizable protection solutions.

- Commercial and industrial sectors are driving large-scale installations, particularly in high-risk environments such as banking, logistics, and manufacturing facilities. These industries demand perimeter protection, intrusion detection, and access management systems that can integrate with centralized command centers. Companies are leveraging multi-zone monitoring and AI analytics to secure assets, warehouses, and data centers from theft and sabotage. The shift from standalone alarms to integrated enterprise-grade security platforms marks a significant transformation in commercial risk management strategies.

- Regulatory frameworks and insurance mandates are reinforcing the demand for certified alarm systems. Compliance with international standards such as EN 50131 and UL 639 ensures the reliability and interoperability of alarm components across global markets. Insurers increasingly incentivize businesses and homeowners to adopt approved security systems, linking safety compliance to premium reductions. Governments in regions such as Europe and North America are introducing stricter security regulations in critical infrastructure sectors, creating stable long-term growth prospects for certified solution providers.

- The rise of wireless and hybrid alarm systems is reshaping the market’s technical foundation. Wireless systems eliminate complex cabling requirements, offering flexibility for retrofitting in existing buildings and scalability for future expansion. Hybrid configurations combining wired sensors with wireless communication modules are addressing reliability concerns while maintaining easy installation and maintenance. These advancements are particularly beneficial in sectors requiring modular security architecture, such as education, healthcare, and small enterprises.

- Cloud connectivity and mobile control platforms are redefining user engagement in security management. Cloud-based architectures enable real-time data storage, remote monitoring, and analytics, allowing users to manage alarms, track incidents, and receive alerts through smartphones or desktops. This evolution has spurred the emergence of subscription-based service models offering software updates, video verification, and AI analytics. The shift toward cloud-native ecosystems is fostering continuous innovation and recurring revenue opportunities for vendors.

- Regional expansion in emerging markets is a key growth frontier as urbanization accelerates in Asia-Pacific, the Middle East, and Latin America. Governments are prioritizing infrastructure security and private property protection amid rising crime rates. Local manufacturing initiatives, favorable import policies, and smart city funding programs are supporting market entry for global players. Furthermore, declining component costs and increased awareness of security benefits are enabling wider adoption across mid-tier residential and SME sectors.

- Competitive consolidation and strategic alliances are shaping the market’s structure. Leading security companies are acquiring regional players and forming partnerships with telecom and IoT service providers to enhance their distribution networks. Mergers and acquisitions are strengthening technology portfolios, allowing firms to integrate AI analytics, automation, and remote management tools. This consolidation trend is promoting standardization, interoperability, and cost efficiency across end-user industries.

- Future outlook points toward predictive and autonomous security ecosystems powered by AI, cloud, and 5G. Intruder alarm systems will evolve beyond mere detection to proactive threat anticipation using behavioral analytics and cross-device communication. Integration with drones, robotic patrol units, and advanced sensor networks will redefine physical security management. As cybersecurity and physical security converge, the industry will witness a transformation toward unified, data-driven safety architectures that operate autonomously to safeguard modern infrastructures.

Report scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD million |

| Market Splits Covered | By System type, By product Type, and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

By System Type:

- Wired

- Wireless

- Hybrid

By Product Type:

- Control Panels

- Motion Detectors

- Glass Break Detectors

- Door/Window Sensors

- Others

By End User:

- Residential

- Commercial

- Industrial

- Government

By Geography:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Rest of APAC)

- The Middle East and Africa (Saudi Arabia,

- UAE, Iran, South Africa, Rest of MEA)

- South and Central America (Brazil, Argentina, Rest of SCA)

Major Players in the Intruder Alarm System Market

- NRG Energy, Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- Siemens AG

- Robert Bosch GmbH

- ADT Inc.

- United Technologies Corporation (Carrier Global Corporation)

- Securitas AB

- Tyco Security Products

- ABB Ltd.

- Assa Abloy Group

- Hikvision Digital Technology Co., Ltd.

- FLIR Systems, Inc.

- Nortek Security & Control LLC

- RISCO Group

- Ingersoll Rand Plc

Recent Developments

January 2025 – Alarm.com launched AI Deterrence (AID), an automated audio-response feature that delivers adaptive verbal warnings to intruders based on real-time detection of clothing and surroundings.

September 2025 – Alarm.com introduced its new ADC-V516 Indoor Wi-Fi Camera, enhancing indoor surveillance capability integrated with its alarm system platform.

July 2025 – Pye-Barker announced the acquisition of 13 fire and security firms across 11 U.S. states, expanding its geographic coverage in intrusion and alarm solutions.

1. TABLE OF CONTENTS

1.1. List of TABLES

1.2. LIST of FIGURES

2. GLOBAL INTRUDER ALARM SYSTEM INDUSTRY

2.1. Market Scope and Definition

2.2. Study Assumptions

3. INTRUDER ALARM SYSTEM MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2024-2034

3.1. Intruder Alarm System Market Latest Trends

3.2. Intruder Alarm System Market Insights, 2024-2034

3.2.1. Dominating Intruder Alarm System Type, 2024-2034

3.2.2. Leading Intruder Alarm System End User, 2024-2034

3.2.3. Top Intruder Alarm System Component, 2024-2034

3.2.4. Fast-Growing Geographies for Intruder Alarm System, 2024-2034

3.3. Intruder Alarm System Market Drivers to 2034

3.4. Intruder Alarm System Market Restraints

3.5. Intruder Alarm System Market-Five Forces Analysis

4. GLOBAL INTRUDER ALARM SYSTEM MARKET GROWTH

4.1. Global Intruder Alarm System Market, By System Type

4.1.1. Intruder Alarm System Market, By System Type, Wireless

4.1.2. Intruder Alarm System Market, By System Type, Hybrid

4.1.3. Intruder Alarm System Market, By System Type, Wired

4.2. Global Intruder Alarm System Market, By End User

4.2.1. Intruder Alarm System Market, By End User, Residential

4.2.2. Intruder Alarm System Market, By End User, Commercial

4.2.3. Intruder Alarm System Market, By End User, Industrial

4.2.4. Intruder Alarm System Market, By End User, Others

4.3. Global Intruder Alarm System Market, By Component

4.3.1. Intruder Alarm System Market, By Component, Detectors

4.3.2. Intruder Alarm System Market, By Component, Sensors

4.3.3. Intruder Alarm System Market, By Component, Control Panels

4.3.4. Intruder Alarm System Market, By Component, Others

4.4. Global Intruder Alarm System Market, By Region

5. ASIA-PACIFIC INTRUDER ALARM SYSTEM MARKET GROWTH

5.1. Asia-Pacific Intruder Alarm System Market, By System Type

5.2. Asia-Pacific Intruder Alarm System Market, By End User

5.3. Asia-Pacific Intruder Alarm System Market, By Component

5.4. Asia-Pacific Intruder Alarm System Market, By Country

5.4.1. South Korea Intruder Alarm System Market

5.4.2. Japan Intruder Alarm System Market

5.4.3. Rest of Asia-Pacific Intruder Alarm System Market

5.4.4. India Intruder Alarm System Market

5.4.5. Indonesia Intruder Alarm System Market

5.4.6. Vietnam Intruder Alarm System Market

5.4.7. Australia Intruder Alarm System Market

5.4.8. China Intruder Alarm System Market

5.4.9. Malaysia Intruder Alarm System Market

6. EUROPE INTRUDER ALARM SYSTEM MARKET GROWTH

6.1. Europe Intruder Alarm System Market, By System Type

6.2. Europe Intruder Alarm System Market, By End User

6.3. Europe Intruder Alarm System Market, By Component

6.4. Europe Intruder Alarm System Market, By Country

6.4.1. Spain Intruder Alarm System Market

6.4.2. United Kingdom Intruder Alarm System Market

6.4.3. France Intruder Alarm System Market

6.4.4. BeNeLux Intruder Alarm System Market

6.4.5. Italy Intruder Alarm System Market

6.4.6. Sweden Intruder Alarm System Market

6.4.7. Germany Intruder Alarm System Market

6.4.8. Finland Intruder Alarm System Market

6.4.9. Denmark Intruder Alarm System Market

6.4.10. Rest of Europe Intruder Alarm System Market

6.4.11. Russia Intruder Alarm System Market

7. MIDDLE EAST AFRICA INTRUDER ALARM SYSTEM MARKET GROWTH

7.1. Middle East Africa Intruder Alarm System Market, By System Type

7.2. Middle East Africa Intruder Alarm System Market, By End User

7.3. Middle East Africa Intruder Alarm System Market, By Component

7.4. Middle East Africa Intruder Alarm System Market, By Country

7.4.1. Saudi Arabia Intruder Alarm System Market

7.4.2. UAE Intruder Alarm System Market

7.4.3. Egypt Intruder Alarm System Market

7.4.4. Rest of MEA Intruder Alarm System Market

7.4.5. South Africa Intruder Alarm System Market

7.4.6. Iran Intruder Alarm System Market

8. NORTH AMERICA INTRUDER ALARM SYSTEM MARKET GROWTH

8.1. North America Intruder Alarm System Market, By System Type

8.2. North America Intruder Alarm System Market, By End User

8.3. North America Intruder Alarm System Market, By Component

8.4. North America Intruder Alarm System Market, By Country

8.4.1. Canada Intruder Alarm System Market

8.4.2. United States Intruder Alarm System Market

8.4.3. Mexico Intruder Alarm System Market

9. SOUTH AND CENTRAL AMERICA INTRUDER ALARM SYSTEM MARKET GROWTH

9.1. South and Central America Intruder Alarm System Market, By System Type

9.2. South and Central America Intruder Alarm System Market, By End User

9.3. South and Central America Intruder Alarm System Market, By Component

9.4. South and Central America Intruder Alarm System Market, By Country

9.4.1. Peru Intruder Alarm System Market

9.4.2. Brazil Intruder Alarm System Market

9.4.3. Chile Intruder Alarm System Market

9.4.4. Argentina Intruder Alarm System Market

9.4.5. Rest of SCA Intruder Alarm System Market

10. INTRUDER ALARM SYSTEM MARKET STRUCTURE

10.1. ADT Inc.

10.2. NRG Energy, Inc.

10.3. Honeywell International Inc.

10.4. Johnson Controls International plc

10.5. ASSA ABLOY AB (publ)

10.6. Hangzhou Hikvision Digital Technology Co., Ltd.

11. APPENDIX

11.1. About Us

11.2. Sources

11.3. Research Methodology

11.4. Research Process

11.5. Research Execution

11.6. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Intruder Alarm System Market is estimated to reach USD 4755.9 million by 2032.

The Global Intruder Alarm System Market is estimated to generate USD 2301 million in revenue in 2024.

The Global Intruder Alarm System Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period from 2025 to 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!