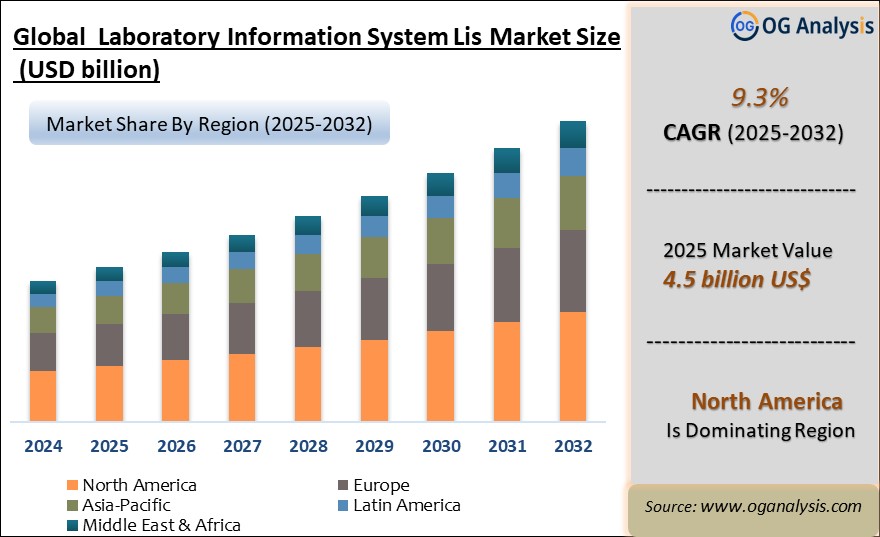

"The Global Laboratory Information System (LIS) Market Size was valued at USD 4.1 billion in 2024 and is projected to reach USD 4.5 billion in 2025. Worldwide sales of Laboratory Information System (LIS) are expected to grow at a significant CAGR of 9.3%, reaching USD 10.1 billion by the end of the forecast period in 2034."

Laboratory Information System (LIS) Market Overview

The Laboratory Information System (LIS) market is experiencing significant growth, driven by the increasing demand for laboratory automation and the need for efficient data management systems in healthcare and research settings. LIS are software systems designed to manage medical laboratory operations, data, and information more effectively. With the healthcare industry increasingly focused on precision and personalized medicine, LIS plays a critical role in enhancing the efficiency of laboratory processes by ensuring accurate data management and streamlined laboratory operations. The integration of LIS helps in managing complex data flows and supports regulatory compliance, contributing to enhanced diagnostic and research outputs.

Amidst the backdrop of a global push towards digital health solutions, LIS have become indispensable in modern medical infrastructures. They not only facilitate seamless integration of laboratory services with electronic health records (EHR) but also improve the quality and speed of laboratory testing. As laboratories face growing pressure to deliver faster and more accurate results, the adoption of LIS is expected to proliferate. The market's expansion is further propelled by the rising prevalence of chronic diseases, which necessitates regular and sophisticated testing protocols that LIS systems are uniquely equipped to handle.

North America is the leading region in the Laboratory Information System (LIS) market, powered by advanced healthcare infrastructure, increasing adoption of digital health technologies, and a strong presence of key market players.

Clinical laboratories segment is the dominating segment in the LIS market, fueled by the rising demand for efficient diagnostic workflows, growing test volumes, and the need for streamlined laboratory operations.

Laboratory Information System (LIS) Market Latest Trends, Drivers and Challenges

One of the leading trends in the LIS market is the shift towards cloud-based solutions, offering scalability, remote access, and cost efficiency. Cloud-based LIS enable laboratories to manage operations without the need for extensive on-premise IT infrastructure, thus reducing capital expenditure and maintenance costs. Furthermore, the adoption of Artificial Intelligence (AI) and machine learning technologies in LIS is gaining momentum. These technologies enhance data analysis capabilities, enabling predictive analytics that can forecast trends, automate routine tasks, and provide deeper insights into laboratory processes. Another significant trend is the integration of LIS with mobile technologies, allowing healthcare providers to access laboratory results and manage tasks directly from their smartphones or tablets, thereby improving workflow efficiency and data accessibility.

The primary drivers of the LIS market include technological advancements in healthcare IT, growing emphasis on laboratory automation, and the increasing burden of chronic diseases. As healthcare providers seek to enhance operational efficiencies and patient outcomes, the deployment of advanced LIS becomes crucial. The regulatory environment also plays a significant role in driving the adoption of LIS, as compliance with health data standards and practices is mandatory in many regions. Additionally, the surge in laboratory tests due to an aging population and the global increase in health awareness are pushing laboratories towards sophisticated systems like LIS to manage high volumes of data and improve turnaround times.

Despite the growth, the LIS market faces several challenges. High initial costs and complexities involved in implementing LIS can deter smaller laboratories and healthcare facilities from adopting the technology. Interoperability issues between different healthcare IT systems, including EHRs and LIS, pose another significant challenge, as seamless data exchange is crucial for effective operations. Data security concerns, particularly with cloud-based systems, also impede market growth, as laboratories handle sensitive patient information that must be protected against breaches. Furthermore, there is a persistent skill gap in healthcare IT, necessitating continuous training and development to effectively operate and manage advanced LIS solutions.

Major Players in the LIS Market

1. Cerner Corporation

2. McKesson Corporation

3. Sunquest Information Systems Inc.

4. Epic Systems Corporation

5. Medical Information Technology, Inc. (Meditech)

6. Compugroup Medical

7. Computer Programs and Systems, Inc. (CPSI)

8. Merge Healthcare, Inc.

9. Orchard Software Corporation

10. STARLIMS Corporation

11. Thermo Fisher Scientific Inc.

12. SCC Soft Computer

13. Sysmex Corporation

14. LabWare

15. LabVantage Solutions, Inc.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Component and By end user |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product:

- Standalone LIS

- Integrated LIS

By Component:

- Services

- Software

By End User:

- Hospitals and Clinics

- Independent Laboratories

- Others

By Geography:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Laboratory Information System Lis Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Laboratory Information System Lis Market Overview

2.2 Key Strategies of Leading Laboratory Information System Lis Companies

2.3 Laboratory Information System Lis Market Insights, 2024- 2034

2.3.1 Leading Laboratory Information System Lis Types, 2024- 2034

2.3.2 Leading Laboratory Information System Lis End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Laboratory Information System Lis sales, 2024- 2034

2.4 Laboratory Information System Lis Market Drivers and Restraints

2.4.1 Laboratory Information System Lis Demand Drivers to 2034

2.4.2 Laboratory Information System Lis Challenges to 2034

2.5 Laboratory Information System Lis Market- Five Forces Analysis

2.5.1 Laboratory Information System Lis Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Laboratory Information System Lis Market Value, Market Share, and Forecast to 2034

3.1 Global Laboratory Information System Lis Market Overview, 2024

3.2 Global Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

3.3.1 Standalone LIS

3.3.2 Integrated LIS

3.4 Global Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

3.4.1 Services

3.4.2 Software

3.5 Global Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

3.5.1 Hospitals and Clinics

3.5.2 Independent Laboratories

3.5.3 Others

3.6 Global Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

3.7 Global Laboratory Information System Lis Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Laboratory Information System Lis Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Laboratory Information System Lis Market Overview, 2024

4.2 Asia Pacific Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

4.4 Asia Pacific Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

4.5 Asia Pacific Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

4.6 Asia Pacific Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

4.7 Asia Pacific Laboratory Information System Lis Market Size and Share Outlook by Country, 2024- 2034

4.8 Key Companies in Asia Pacific Laboratory Information System Lis Market

5. Europe Laboratory Information System Lis Market Value, Market Share, and Forecast to 2034

5.1 Europe Laboratory Information System Lis Market Overview, 2024

5.2 Europe Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

5.4 Europe Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

5.5 Europe Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

5.6 Europe Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

5.7 Europe Laboratory Information System Lis Market Size and Share Outlook by Country, 2024- 2034

5.8 Key Companies in Europe Laboratory Information System Lis Market

6. North America Laboratory Information System Lis Market Value, Market Share and Forecast to 2034

6.1 North America Laboratory Information System Lis Market Overview, 2024

6.2 North America Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

6.4 North America Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

6.5 North America Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

6.6 North America Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

6.7 North America Laboratory Information System Lis Market Size and Share Outlook by Country, 2024- 2034

6.8 Key Companies in North America Laboratory Information System Lis Market

7. South and Central America Laboratory Information System Lis Market Value, Market Share and Forecast to 2034

7.1 South and Central America Laboratory Information System Lis Market Overview, 2024

7.2 South and Central America Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

7.4 South and Central America Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

7.5 South and Central America Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

7.6 South and Central America Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

7.7 South and Central America Laboratory Information System Lis Market Size and Share Outlook by Country, 2024- 2034

7.8 Key Companies in South and Central America Laboratory Information System Lis Market

8. Middle East Africa Laboratory Information System Lis Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Laboratory Information System Lis Market Overview, 2024

8.2 Middle East and Africa Laboratory Information System Lis Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Laboratory Information System Lis Market Size and Share Outlook By Product, 2024- 2034

8.4 Middle East Africa Laboratory Information System Lis Market Size and Share Outlook By Component, 2024- 2034

8.5 Middle East Africa Laboratory Information System Lis Market Size and Share Outlook By End User, 2024- 2034

8.6 Middle East Africa Laboratory Information System Lis Market Size and Share Outlook 0, 2024- 2034

8.7 Middle East Africa Laboratory Information System Lis Market Size and Share Outlook by Country, 2024- 2034

8.8 Key Companies in Middle East Africa Laboratory Information System Lis Market

9. Laboratory Information System Lis Market Structure

9.1 Key Players

9.2 Laboratory Information System Lis Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Laboratory Information System Lis Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Laboratory Information System (LIS) Market is estimated to reach USD 8.4 billion by 2032.

The Global Laboratory Information System (LIS) Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period from 2025 to 2032.

The Global Laboratory Information System (LIS) Market is estimated to generate USD 4.1 billion in revenue in 2024.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!