"The Global Low Calorie Food Market was valued at USD 14.22 billion in 2025 and is projected to reach USD 25.63 billion by 2034, growing at a CAGR of 6.76%."

The low calorie food market consists of products that deliver reduced energy intake while maintaining satisfaction and nutritional balance ranging from meal replacements, snacks, beverages, and convenience foods to condiments, baking mixes, and frozen meals. These offerings often rely on reformulations that reduce fats, sugars, and refined carbohydrates, or feature alternative ingredients such as sugar alcohols, high-fiber bulking agents, protein enrichment, and low-glycemic sweeteners. Demand is driven by rising prevalence of overweight and obesity, increased consumer health consciousness, expanding fitness and wellness trends, and prevention-focused dietary habits. These products appeal broadly to dieters, health-conscious professionals, aging populations, and individuals managing chronic conditions like diabetes or cardiovascular risk. Retail, foodservice, and online channels contribute to market reach especially as brands highlight portion control, low-sugar/low-fat labels, and easy-to-prepare formats. Regulatory frameworks concerning nutritional claims (such as “low calorie,” “reduced sugar,” and “light”) and health certifications play an influential role in product development, positioning, and consumer trust.

Competition in the low calorie food market spans large-scale food corporations extending premium offerings and nutrition brands innovating in plant-based, functional, or minimally processed formats. Key differentiators include the sensory quality of reformulated products such as taste, mouthfeel, texture, and satiety together with clean-label ingredient portfolios and allergen-conscious positioning. Emerging trends include high-protein and fiber-rich versions that support fullness, zero-added-sugar beverages with natural sweeteners such as stevia or monk fruit, and smart packaging that guides portion size. Industry players are leveraging digital engagement via recipe platforms, calorie-tracking integrations, and personalized nutrition recommendations. Challenges include balancing flavor and texture when reducing calories, managing higher production costs for specialty ingredients, and addressing consumer skepticism of highly processed or “diet” branded products. Over the medium term, the market growth is expected to be propelled by innovations in natural sweetening systems, personalized nutrition interventions, expansion of physician- and wellness partner-endorsed products, and rising adoption of healthier convenience options across both developed and developing markets.

Key Market Insights

- The low calorie food market is growing steadily as consumers increasingly prioritize healthier dietary choices to manage weight, improve wellness, and prevent chronic diseases. Rising obesity rates, coupled with heightened nutritional awareness, are driving demand for reduced-calorie options across multiple food categories.

- Product portfolios are diversifying beyond traditional diet snacks and beverages to include full meals, sauces, frozen entrees, bakery items, and ready-to-drink products. This expansion allows consumers to integrate low calorie choices into everyday eating patterns without compromising variety.

- Advances in natural sweeteners such as stevia, monk fruit, and allulose are enabling better taste profiles in reduced-calorie products. These innovations help address long-standing consumer concerns about artificial sweeteners while delivering clean-label appeal.

- High-protein and fiber-enriched formulations are increasingly common, as they promote satiety and reduce overall calorie intake while supporting fitness and muscle maintenance goals. These attributes broaden appeal to both weight-conscious and performance-focused consumers.

- E-commerce and subscription models are gaining traction in the category, offering consumers convenience, personalized selections, and access to niche low calorie products not widely available in traditional retail channels.

- Foodservice operators are incorporating low calorie menu options and calorie transparency initiatives to meet regulatory requirements and customer demand. This is expanding consumption opportunities beyond home settings.

- Premium positioning is emerging, with low calorie products marketed as gourmet, organic, or functional foods. This strategy appeals to affluent consumers seeking health benefits along with taste and quality.

- Regulatory oversight on calorie and nutrient claims remains a key factor influencing product development and marketing. Brands must ensure accurate labeling and compliance with region-specific health claim standards to maintain credibility.

- Packaging innovation plays a growing role in consumer engagement, with portion-controlled packs, calorie-count callouts, and QR codes linking to nutrition and recipe content enhancing transparency and trust.

- The long-term growth outlook is supported by the integration of low calorie products into mainstream dietary habits, aided by technology-driven personalization tools, wellness program endorsements, and greater availability in both physical and digital marketplaces.

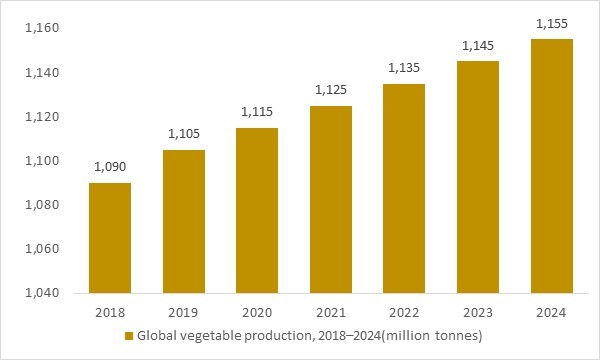

Global vegetable production, 2018–2024(million tonnes)

FFigure: Global artificial sweetener, milk and vegetable production has steadily increased between 2018 and 2024, expanding the ingredient base for low-sugar, low-fat and plant-forward formulations. Rising volumes of high-intensity sweeteners, dairy inputs and vegetables enable manufacturers to reformulate core categories such as beverages, yogurts, snacks and ready meals into reduced-calorie options without sacrificing taste or variety. OG Analysis estimates, aligned with FAO and industry benchmarks, highlight how these supply-side trends structurally support long-term growth in the global low calorie food market.

- The low-calorie food market is underpinned by a rapidly expanding base of low-calorie sweeteners, dairy inputs and vegetable raw materials.Global artificial sweetener volumes rose from 143.0 thousand tons in 2018 to 183.7 thousand tons in 2024, reflecting aggressive reformulation away from sugar in beverages, dairy, bakery and snacks.Over the same period, global milk output increased from 842 to 981 million tonnes, enabling a larger portfolio of low-fat, high-protein and reduced-sugar dairy-based low-calorie foods, while global vegetable production climbed from 1,090 to 1,155 million tonnes, supporting plant-forward, naturally low-calorie meal and snack development.Together, these trends show a broad and resilient raw-material foundation that structurally supports the long-term expansion of the global low-calorie food market.

Regional Insights

Low Calorie Food Market North America

The market in North America is driven by high health literacy, transparent labeling norms, and strong adoption of fitness and weight management programs across demographics. Market dynamics favor high-protein, low-sugar, and clean-label formulations in ready-to-drink, bars, frozen meals, and condiments, with retailers expanding better-for-you assortments and private labels. Lucrative opportunities include GLP-1 companion SKUs, diabetic-friendly lines, and personalized subscription bundles that pair digital coaching with portion-controlled products. Latest trends feature allulose and stevia blends for sugar reduction, fiber enrichment for satiety, and recyclable lightweight packaging optimized for e-commerce. The forecast points to steady, premium-led growth supported by taste advances and omnichannel reach, while recent developments highlight co-manufacturing capacity additions, retailer wellness end-caps, and data-driven reformulations aligning with evolving nutrient targets.

Low Calorie Food Market Asia Pacific

Asia Pacific demand is underpinned by rapid urbanization, rising disposable incomes, and convenience-oriented eating habits, with consumers seeking lighter meals and reduced-sugar beverages tailored to local palates. Market dynamics emphasize affordable single-serve sachets, plant-based proteins, and lactose-free or low-GI options suited to regional dietary needs. Companies can capture opportunities in beauty-from-within and digestive wellness platforms, social-commerce distribution, and quick-commerce cold chains for chilled RTDs. Latest trends include monk fruit–stevia sweetener systems, hybrid protein blends (soy, pea, rice), and clean-label noodles, sauces, and bakery mixes with calorie-aware positioning. The outlook indicates robust growth from first-time adopters and repeat purchases, with recent developments focused on regional manufacturing footprints, influencer-led launches, and nutrition education tie-ups that build trust and category penetration.

Low Calorie Food Market Europe

Europe’s market is shaped by stringent nutrition and claim standards, strong sustainability expectations, and mature shopper interest in balanced, lower-sugar choices across grocery and pharmacy channels. Market dynamics favor minimally processed ingredient decks, non-GMO sourcing, and high-fiber recipes that deliver satiety without compromising taste, alongside vegan and allergen-aware variants. Attractive opportunities include circular packaging pilots, retailer health-aisle curation, and medically aligned SKUs for specific populations. Latest trends span prebiotic fiber integration, culinary-grade flavors for premiumization, and digital product passports that enhance transparency. The forecast suggests measured, compliance-anchored growth as brands optimize sensory quality and reformulate to new nutrient profiles, while recent developments highlight refill systems, workplace wellness partnerships, and cross-border co-packing that shortens lead times and supports localized flavor adaptation.

Report Scope

| Parameter | Low Calorie Food Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Low Calorie Food Market Segments Covered In The Report

By Type

- Sugar Substitutes

- Sugar Alcohol Substitutes

- Nutrient Based Substitutes

By Product

- Aspartame

- Sucralose

- Stevia

- Saccharin

- Cyclamate

By Application

- Dairy Products

- Dietary Beverages

- Bakery Products

- Snacks

- Other Applications

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Ajinomoto Co. Inc., Beneo Group, Ingredion Incorporated, Abbott Laboratories, Galam Ltd., PepsiCo Inc., Zydus Wellness Limited, Bernard Food Industries Inc., Danisco A/S, Archer Daniels Midland Company, The Coca-Cola Company, Cargill Incorporated, Groupe Danone SA, Nestlé S.A., McNeil Nutritionals LLC, Dr Pepper Snapple Group Inc., Heartland Food Products Group, Glucerna SR tablets, Kellogg Company, General Mills Inc., The Hershey Company, Mars Incorporated, Mondelez International Inc., Unilever plc, Kraft Heinz Company, Campbell Soup Company, Conagra Brands Inc., The J.M. Smucker Company, Hormel Foods Corporation, Tyson Foods Inc., Maple Leaf Foods Inc., Beyond Meat Inc., Impossible Foods Inc., Amy's Kitchen Inc., Sweetgreen Inc., Freshii Inc., Just Salad LLC, Chopt Creative Salad Company LLC, Tender Greens, Cava Group Inc., Dig Inn Hospitality Group LLC, Lemonade Restaurant Group LLC

Recent Industry Developments

- March 2025 — Kraft Heinz introduced Crystal Light Vodka Refreshers, a zero-sugar canned cocktail with just 77 calories, marking the brand's first venture into low-calorie alcoholic ready-to-drink products.

- January 2025 — GOOD GOOD launched a reduced-calorie apple butter containing 85% fewer calories than traditional versions, achieved by slashing sweeteners while retaining rich, cozy flavors.

- June 2025 — Nissin Foods unveiled Kanzen Meal, a frozen, nutrient-dense option designed to support individuals using GLP-1 weight loss medications, addressing the need for high-nutrient, low-calorie selections.

Available Customizations

The standard syndicate report is designed to serve the common interests of Low Calorie Food Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Low Calorie Food Pricing and Margins Across the Supply Chain, Low Calorie Food Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Low Calorie Food market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Low Calorie Food Market Latest Trends, Drivers and Challenges, 2024 - 2034

2.1 Low Calorie Food Market Overview

2.2 Market Strategies of Leading Low Calorie Food Companies

2.3 Low Calorie Food Market Insights, 2024 - 2034

2.3.1 Leading Low Calorie Food Types, 2024 - 2034

2.3.2 Leading Low Calorie Food End-User industries, 2024 - 2034

2.3.3 Fast-Growing countries for Low Calorie Food sales, 2024 - 2034

2.4 Low Calorie Food Market Drivers and Restraints

2.4.1 Low Calorie Food Demand Drivers to 2034

2.4.2 Low Calorie Food Challenges to 2034

2.5 Low Calorie Food Market- Five Forces Analysis

2.5.1 Low Calorie Food Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Low Calorie Food Market Value, Market Share, and Forecast to 2034

3.1 Global Low Calorie Food Market Overview, 2024

3.2 Global Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

3.3 Global Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

3.4 Global Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

3.5 Global Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

3.6 Global Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

3.7 Global Low Calorie Food Market Size and Share Outlook by Region, 2024 - 2034

4. Asia Pacific Low Calorie Food Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Low Calorie Food Market Overview, 2024

4.2 Asia Pacific Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

4.3 Asia Pacific Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

4.4 Asia Pacific Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

4.5 Asia Pacific Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

4.6 Asia Pacific Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

4.7 Asia Pacific Low Calorie Food Market Size and Share Outlook by Country, 2024 - 2034

5. Europe Low Calorie Food Market Value, Market Share, and Forecast to 2034

5.1 Europe Low Calorie Food Market Overview, 2024

5.2 Europe Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

5.3 Europe Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

5.4 Europe Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

5.5 Europe Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

5.6 Europe Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

5.7 Europe Low Calorie Food Market Size and Share Outlook by Country, 2024 - 2034

6. North America Low Calorie Food Market Value, Market Share and Forecast to 2034

6.1 North America Low Calorie Food Market Overview, 2024

6.2 North America Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

6.3 North America Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

6.4 North America Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

6.5 North America Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

6.6 North America Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

6.7 North America Low Calorie Food Market Size and Share Outlook by Country, 2024 - 2034

7. South and Central America Low Calorie Food Market Value, Market Share and Forecast to 2034

7.1 South and Central America Low Calorie Food Market Overview, 2024

7.2 South and Central America Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

7.3 South and Central America Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

7.4 South and Central America Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

7.5 South and Central America Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

7.6 South and Central America Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

7.7 South and Central America Low Calorie Food Market Size and Share Outlook by Country, 2024 - 2034

8. Middle East Africa Low Calorie Food Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Low Calorie Food Market Overview, 2024

8.2 Middle East and Africa Low Calorie Food Market Revenue and Forecast, 2024 - 2034 (US$ billion)

8.3 Middle East Africa Low Calorie Food Market Size and Share Outlook By Type, 2024 - 2034

8.4 Middle East Africa Low Calorie Food Market Size and Share Outlook By Product, 2024 - 2034

8.5 Middle East Africa Low Calorie Food Market Size and Share Outlook By Application, 2024 – 2034

8.6 Middle East Africa Low Calorie Food Market Size and Share Outlook By Segment4, 2024 - 2034

8.7 Middle East Africa Low Calorie Food Market Size and Share Outlook by Country, 2024 - 2034

9. Low Calorie Food Market Structure

9.1 Key Players

9.2 Low Calorie Food Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Low Calorie Food Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Low Calorie Food Market is estimated to generate USD 14.22 billion in revenue in 2025.

The Global Low Calorie Food Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.76% during the forecast period from 2025 to 2034.

The Low Calorie Food Market is estimated to reach USD 25.63 billion by 2034.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!