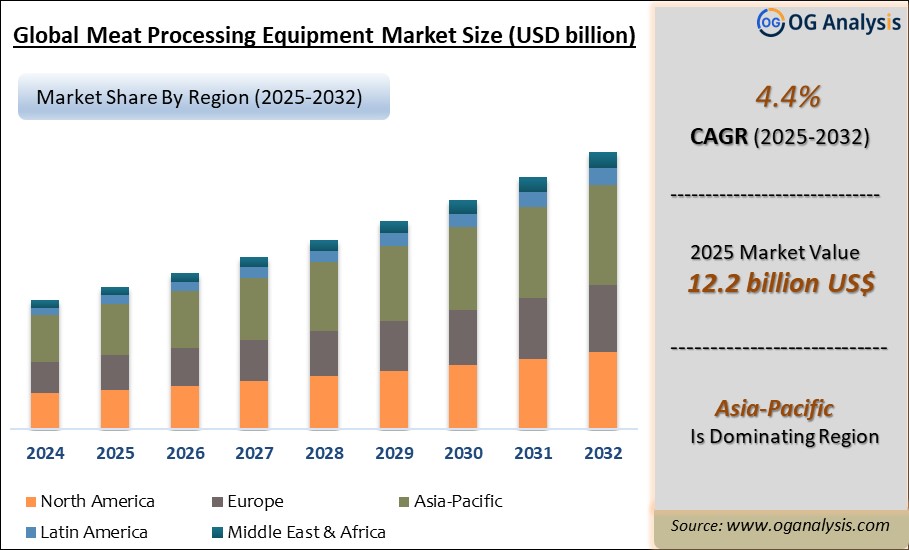

"The Global Meat Processing Equipment Market Size was valued at USD 11.8 billion in 2024 and is projected to reach USD 12.2 billion in 2025. Worldwide sales of Meat Processing Equipment are expected to grow at a significant CAGR of 4.4%, reaching USD 18.3 billion by the end of the forecast period in 2034."

The global meat processing equipment market is experiencing substantial growth driven by rising demand for processed and convenience meat products across developed and emerging economies. Meat processing equipment includes machinery used for slaughtering, cutting, deboning, grinding, blending, marinating, smoking, cooking, freezing, packaging, and other processes to produce value-added meat products efficiently and hygienically. Increasing urbanization, changing dietary habits, and the expansion of quick service restaurants, food service chains, and packaged food brands are propelling demand for advanced automated equipment that enhances productivity and ensures compliance with stringent food safety standards. Additionally, technological advancements such as IoT-enabled equipment, robotics, and high-speed processing lines are transforming operations for meat processors, leading to improved yield, reduced labour costs, and higher operational efficiency.

The market is also benefiting from growing investments in modernizing slaughterhouses and meat processing facilities to cater to rising domestic consumption as well as export-oriented processed meat production. North America and Europe hold significant market shares due to established meat processing industries and strong focus on automation, while Asia Pacific is witnessing the fastest growth led by China, India, Vietnam, and Thailand, driven by the growing middle-class population, rapid urbanization, and expanding meat consumption. However, the market faces challenges related to high initial capital costs, stringent regulatory approvals, and operational complexities associated with processing diverse meat types and cuts. Key players are focusing on developing energy-efficient, multifunctional, and compact equipment to cater to small and medium-scale processors alongside large meat processing corporations. Overall, the meat processing equipment market is expected to continue its growth trajectory as global meat demand rises, coupled with increasing adoption of efficient and sustainable technologies to meet food safety, quality, and production standards worldwide.

Cutting equipment holds the largest share in the meat processing equipment market as it is a fundamental step in meat processing operations across all product types. High demand for precise cutting, portioning, and slicing machinery with minimal wastage drives its adoption among processors to enhance yield and throughput. Advanced automated cutting lines also reduce labour costs and improve hygiene, strengthening its market dominance.

Fresh processed meat is the largest segment by meat type due to high global consumption of products like sausages, patties, and minced meat that require minimal thermal processing but extensive cutting, grinding, and blending. Rising demand for fresh meat-based ready-to-cook products in supermarkets, quick service restaurants, and meal kits supports this segment's continued dominance in the market.

Key Insights

-

The global meat processing equipment market is expanding steadily due to the rising consumption of processed meat products such as sausages, bacon, ham, nuggets, and ready-to-eat meat meals. This trend is driven by changing consumer lifestyles, preference for convenience foods, and the rapid expansion of retail and foodservice distribution networks globally, especially in urban areas.

-

Cutting equipment holds a significant market share as it forms the first stage of processing, involving slicing, portioning, and dicing of meat into required formats for further processing or packaging. Demand for high-precision cutting equipment with minimal wastage and higher throughput is growing among processors to enhance productivity and yield.

-

Asia Pacific is the fastest-growing regional market due to increasing meat consumption in China, India, and Southeast Asia, supported by rising disposable incomes and westernisation of diets. Governments and private players are investing in modern slaughterhouses and processing facilities to meet domestic and export requirements efficiently.

-

Automation and robotics integration in meat processing equipment are transforming operational efficiency by reducing manual handling, improving hygiene, enhancing speed, and optimising labour costs. Companies are developing IoT-enabled, sensor-based equipment with real-time monitoring and predictive maintenance capabilities to support smart manufacturing.

-

Deboning and grinding equipment are witnessing strong demand driven by the production of minced meat, sausages, patties, and processed meat products requiring uniform texture and high safety standards. Innovations focus on improved blade designs, faster throughput, and minimised contamination risks during processing.

-

Strict food safety regulations across countries are influencing meat processors to invest in advanced hygienic equipment made of stainless steel with easy-to-clean designs. Compliance with standards such as USDA, FDA, and EU regulations is essential to ensure food safety and maintain market competitiveness.

-

Packaging equipment is gaining prominence as vacuum packaging, modified atmosphere packaging, and skin packaging are widely adopted to extend shelf life, maintain freshness, and improve product appeal. This supports retailers and processors in meeting consumer preferences for hygienic, convenient, and attractively packaged meat products.

-

High capital investment remains a challenge for small and medium enterprises, limiting their adoption of advanced automated processing equipment. Equipment manufacturers are addressing this by offering compact, multifunctional, and cost-effective solutions suited to SMEs while maintaining quality and compliance standards.

-

Key market players including Marel, GEA Group, JBT Corporation, and Middleby Corporation are focusing on mergers, acquisitions, and strategic partnerships to expand their technological capabilities, product portfolios, and geographic presence in emerging meat processing markets.

-

Environmental sustainability trends are driving innovation in energy-efficient meat processing equipment, reducing water usage, emissions, and operational costs. Companies are also investing in circular economy approaches such as waste valorisation technologies to support sustainable meat processing operations globally.

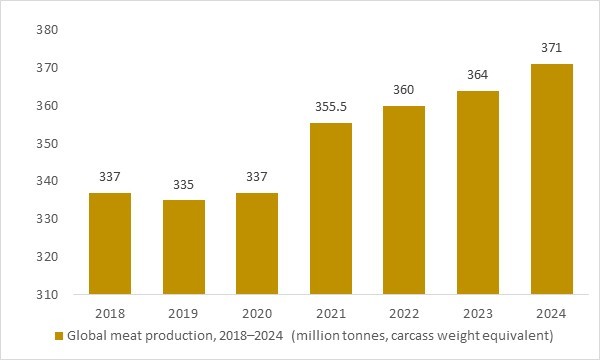

Global meat production, 2018–2024 (million tonnes, carcass weight equivalent)

Figure: Global meat production (million tonnes, carcass weight equivalent), 2018–2024. The steady rise in worldwide meat output underpins capital expenditure on slaughtering, deboning, grinding, marinating, and packaging lines, driving sustained demand for advanced meat processing equipment.

- The steady increase in global meat production from 2018 to 2024 underscores the strong underlying demand for slaughtering, cutting, deboning, grinding, marinating, and packaging lines worldwide. As processors scale up capacity to handle higher volumes while meeting stringent hygiene and efficiency requirements, investments in advanced meat processing equipment accelerate, supporting sustained growth opportunities for equipment manufacturers across primary and further-processing segments.

Regional Insights

North America meat processing equipment market

In North America, the meat processing equipment market is driven by a large, consolidated meat and poultry industry, continuous upgrades to automation, and stringent food safety regulations. Processors are investing in high-throughput cutting, deboning, grinding, forming, marinating, smoking, cooking, chilling, and packaging lines to cope with labour shortages and rising demand for processed meat and convenience foods. Equipment with enhanced hygiene design, CIP capability, and data logging is prioritized to meet regulatory expectations and retailer audits. There is also strong interest in robotics, vision systems, and line-speed optimisation to maintain competitiveness while addressing worker safety concerns at high line speeds. Growing adoption of advanced equipment among mid-sized regional processors, not just the biggest integrators, is widening the installed base and supporting aftermarket service revenues.

Europe meat processing equipment marke

In Europe, the market is shaped by strict animal welfare, hygiene, and sustainability regulations, which drive demand for sophisticated, energy-efficient and water-efficient meat processing equipment. Many European plants have already transitioned to automated or semi-automated deboning, trimming, portioning, and packaging systems, and are now layering on software, sensors, and data analytics to improve yield and traceability. Equipment upgrades are often linked to retailer and export requirements on product consistency, labelling, and environmental performance. The region also has a strong base of equipment manufacturers, particularly in Germany, the Netherlands and the Nordics, which export lines worldwide and continuously refine solutions for pork, beef and poultry processors. Increasing interest in hybrid and alternative protein processing is leading some meat equipment suppliers to adapt slicers, mixers, and formers for plant-based and mixed-protein products as well.

Asia-Pacific meat processing equipment market

Asia-Pacific is the fastest-growing region for meat processing equipment, underpinned by expanding meat consumption, rapid urbanisation, and the modernisation of slaughterhouses and processing plants. Large integrated poultry and pig producers in China and Southeast Asia are investing in automated evisceration, chilling, cut-up, and further-processing lines to support branded chilled and frozen products. Governments and municipalities are also supporting the build-out of modern, hygienic abattoirs with imported equipment in markets such as India, to improve food safety and meet rising demand in major cities. Global suppliers are increasingly localising production and service capabilities in the region; for example, new production centres in India and upgrades to European facilities dedicated to Asia-focused exports. As convenience foods, quick-service restaurants and modern retail expand, demand for flexible lines that can handle nuggets, patties, marinated cuts and ready-to-eat meat products is accelerating.

Reort Scope

| Parameter | Meat processing equipment Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End User and By Technology |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Equipment

- Cutting

- Blending

- Tenderizing

- Grinding

- Massaging

- Filling

- Dicing

- Smoking

- Others

By Meat

- Fresh processed meat

- Raw cooked meat

- Precooked meat

- Cured meat

- Raw fermented sausages

- Dried meat

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Key Companies Covered

Marel hf, GEA Group AG, JBT Corporation, BAADER Group, Meyn Food Processing Technology B.V., Tomra Systems ASA, Heat and Control Inc., The Middleby Corporation, Handtmann Maschinenfabrik, Bettcher Industries Inc., Bühler Group, Tetra Pak International S.A., Alfa Laval AB, SPX FLOW Inc., Bayle S.A., Provisur Technologies Inc., CFS (part of GEA), Skaginn 3X, Frey Maschinenbau, Minerva Omega Group

What You Receive

• Global Meat Processing Equipment market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Meat Processing Equipment.

• Meat Processing Equipment market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Meat Processing Equipment market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Meat Processing Equipment market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Meat Processing Equipment market, Meat Processing Equipment supply chain analysis.

• Meat Processing Equipment trade analysis, Meat Processing Equipment market price analysis, Meat Processing Equipment Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Meat Processing Equipment market news and developments.

The Meat Processing Equipment Market international scenario is well established in the report with separate chapters on North America Meat Processing Equipment Market, Europe Meat Processing Equipment Market, Asia-Pacific Meat Processing Equipment Market, Middle East and Africa Meat Processing Equipment Market, and South and Central America Meat Processing Equipment Markets. These sections further fragment the regional Meat Processing Equipment market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Meat Processing Equipment market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Meat Processing Equipment market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Meat Processing Equipment market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Meat Processing Equipment business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Meat Processing Equipment Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.

However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Meat Processing Equipment Pricing and Margins Across the Supply Chain, Meat Processing Equipment Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Meat Processing Equipment market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Meat Processing Equipment Market is estimated to reach USD 16.7 billion by 2032.

The Global Meat Processing Equipment Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period from 2025 to 2032.

The Global Meat Processing Equipment Market is estimated to generate USD 11.8 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!