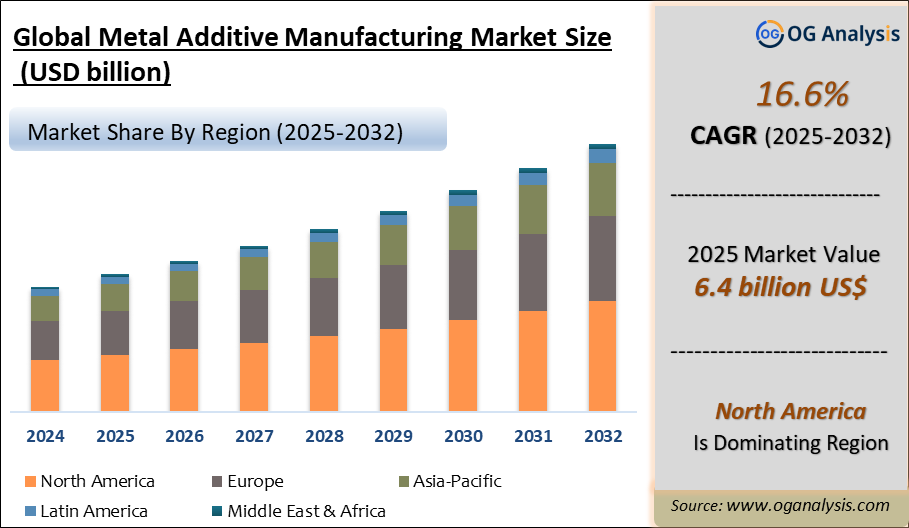

"The Global Metal Additive Manufacturing Market Size was valued at USD 5.6 billion in 2024 and is projected to reach USD 6.4 billion in 2025. Worldwide sales of Metal Additive Manufacturing are expected to grow at a significant CAGR of 16.6%, reaching USD 26.3 billion by the end of the forecast period in 2034."

The metal additive manufacturing market is experiencing rapid growth as industries increasingly adopt 3D printing technologies for producing complex metal components with improved performance, reduced weight, and optimized geometries that are challenging to achieve through traditional manufacturing. Metal additive manufacturing, also known as metal 3D printing, involves processes such as selective laser melting (SLM), electron beam melting (EBM), direct energy deposition (DED), and binder jetting to produce high-strength parts using materials like titanium, stainless steel, aluminum, and nickel alloys. Key end-user sectors include aerospace, defense, automotive, energy, and healthcare, where additive manufacturing enables lightweight designs, part consolidation, and on-demand production, significantly reducing lead times and material waste. The market growth is driven by advancements in printing technologies, expanded material availability, and increasing investments by OEMs and tier suppliers to integrate additive manufacturing into production workflows and supply chains.

Regionally, North America leads the metal additive manufacturing market, supported by strong aerospace, defense, and medical device sectors, along with early technology adoption and extensive R&D investments. Europe follows closely, driven by automotive lightweighting initiatives, aerospace component production, and advanced manufacturing research programs supported by the EU. Asia Pacific is the fastest-growing region, with rapid adoption in China, Japan, South Korea, and India due to expanding industrial manufacturing capabilities and government-supported innovation initiatives. However, challenges remain in terms of high equipment costs, process standardization, and qualification barriers for critical applications. Companies are investing in large-format printers, integrated software for generative design and process simulation, and developing qualified powder supply chains to support scalable production. As industries prioritize performance, customization, and supply chain resilience, the metal additive manufacturing market is poised for significant growth over the coming years.

Powder bed fusion is the largest segment by technology in the metal additive manufacturing market due to its extensive use in producing high-precision, high-strength components for aerospace, medical, and industrial applications, offering superior part density and dimensional accuracy. Direct energy deposition is the fastest-growing technology segment, driven by its application in repairing, refurbishing, and adding material to high-value components in aerospace and energy sectors, reducing costs and extending equipment life.

Aerospace is the largest application segment, as metal additive manufacturing is widely used for lightweight structural parts, engine components, and complex designs that improve fuel efficiency and performance while meeting stringent industry standards. Automobile is the fastest-growing application segment, fueled by the automotive industry’s focus on lightweighting, prototyping, tooling, and integration of complex metal parts to support electric vehicle production and innovative design solutions.

Trade Intelligence for metal additive manufacturing market

| Global Machines and mechanical appliances, n.e.s. Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 42,123 | 49,069 | 47,902 | 50,402 | 54,027 |

| United States of America | 4,307 | 5,216 | 5,604 | 6,438 | 7,553 |

| China | 8,327 | 9,603 | 8,429 | 7,116 | 6,880 |

| Germany | 2,940 | 3,020 | 3,199 | 3,403 | 3,425 |

| Mexico | 1,383 | 2,006 | 2,565 | 2,659 | 2,908 |

| India | 1,025 | 1,227 | 1,205 | 1,553 | 2,010 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- United States of America, China, Germany, Mexico and India are the top five countries importing 42.2% of global Machines and mechanical appliances, n.e.s. in 2024

- Global Machines and mechanical appliances, n.e.s. Imports increased by 28.3% between 2020 and 2024

- United States of America accounts for 14% of global Machines and mechanical appliances, n.e.s. trade in 2024

- China accounts for 12.7% of global Machines and mechanical appliances, n.e.s. trade in 2024

- Germany accounts for 6.3% of global Machines and mechanical appliances, n.e.s. trade in 2024

| Global Machines and mechanical appliances, n.e.s. Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Key Insights

- The metal additive manufacturing market is driven by rising demand for lightweight, complex, and high-performance metal components across aerospace, defense, automotive, and energy sectors to improve fuel efficiency, reduce emissions, and enhance product functionality.

- Selective laser melting (SLM) is the largest technology segment, widely used for producing high-density, precision components in aerospace, medical implants, and tooling applications due to its superior mechanical properties and design flexibility.

- Direct energy deposition (DED) is gaining traction for repair and refurbishment of high-value components in aerospace and energy sectors, enabling cost savings, extended part life, and reduced downtime for critical equipment maintenance.

- North America dominates the market with strong adoption in aerospace, defense, and medical device manufacturing, supported by established OEM investments, robust R&D infrastructure, and specialized material suppliers driving innovation in metal AM.

- Asia Pacific is the fastest-growing region, driven by rapid industrialization, expansion of aerospace manufacturing, government initiatives supporting additive manufacturing technology, and increasing investment in advanced production capabilities in China, Japan, and South Korea.

- Automotive applications are expanding, as manufacturers leverage metal additive manufacturing for lightweight structural components, prototyping, and tooling, supporting electric vehicle development and improving manufacturing agility for design iterations.

- Material advancements, including high-strength aluminum, titanium, and nickel-based superalloys, are broadening application scopes in high-temperature and corrosion-resistant environments across aerospace engines and energy turbines.

- High equipment and operational costs remain challenges, prompting companies to focus on process optimization, powder recycling technologies, and integrated software solutions to reduce per-part production costs and improve scalability.

- Certification, standardization, and qualification remain key barriers for aerospace and defense applications, driving collaborations between OEMs, research institutes, and regulatory bodies to establish robust qualification protocols and supply chain standards.

- Strategic partnerships between metal AM equipment manufacturers, material suppliers, and end-users are increasing, facilitating technology integration, development of tailored materials, and adoption of additive manufacturing in mainstream production workflows for critical applications.

Report Scope

| Parameter | metal additive manufacturing market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Technology, By Component, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

- By Technology

- Powder Bed Fusion

- Binder Jetting

- Direct Energy Deposition

- Bound Powder Extrusion

- Other Technologies

- By Component

- Systems

- Materials

- Service and parts

- By Application

- Aerospace

- Healthcare

- Tools and mold

- Automobile

- Others

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

What You Receive

• Global Metal Additive Manufacturing market size and growth projections (CAGR), 2024- 2034

• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Metal Additive Manufacturing.

• Metal Additive Manufacturing market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Metal Additive Manufacturing market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Metal Additive Manufacturing market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Metal Additive Manufacturing market, Metal Additive Manufacturing supply chain analysis.

• Metal Additive Manufacturing trade analysis, Metal Additive Manufacturing market price analysis, Metal Additive Manufacturing Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Metal Additive Manufacturing market news and developments.

The Metal Additive Manufacturing Market international scenario is well established in the report with separate chapters on North America Metal Additive Manufacturing Market, Europe Metal Additive Manufacturing Market, Asia-Pacific Metal Additive Manufacturing Market, Middle East and Africa Metal Additive Manufacturing Market, and South and Central America Metal Additive Manufacturing Markets. These sections further fragment the regional Metal Additive Manufacturing market by type, application, end-user, and country.

Recent Developments

- Oerlikon expanded its additive manufacturing capacity by partnering with TRUMPF Additive Manufacturing, integrating multiple TruPrint systems to strengthen its metal AM production.

- Agnikul Cosmos launched a large-format additive manufacturing facility dedicated to aerospace and rocket components, enabling integrated design, production, and finishing.

- 3D Systems advanced its aerospace portfolio by securing a contract to develop a large-format metal 3D printing demonstrator designed for high-temperature flight applications.

- Outokumpu entered the aerospace additive manufacturing supply chain by delivering its first batches of stainless steel metal powders tailored for aviation needs.

- Oerlikon achieved a milestone of producing over 25,000 3D-printed suppressors utilizing its proprietary MetcoAdd™ nickel powder technology.

- HP introduced new metal additive manufacturing innovations and partnerships aimed at lowering costs and scaling adoption across automotive and industrial markets.

- FormAlloy expanded its presence with a new Application Development Center focused on Directed Energy Deposition technologies, receiving industry recognition for its advancements.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Metal Additive Manufacturing Market is estimated to generate USD 5.6 billion in revenue in 2024.

The Global Metal Additive Manufacturing Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period from 2025 to 2032.

The Metal Additive Manufacturing Market is estimated to reach USD 19.1 billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!